After finally paying off all your credit card debt, you go to check your credit score expecting a big jump. But… nothing’s changed. That’s because credit scores don’t update right away after your financial situation changes.

In this guide, we’ll explain when credit scores update, why they fluctuate, and how to check your most recent score.

When do credit scores update?

Credit scores typically update on a monthly cadence, but the updates can show more frequently if you have multiple credit lenders. There’s no set date for when updates happen. Instead, your credit score is refreshed when each lender reports your activity to the three credit bureaus: Equifax, Experian, and TransUnion.

Most lenders that report do so monthly. Credit card companies, for example, will usually report your activity to the bureaus shortly after your billing cycle ends. Because updates from different lenders come in at different times, your score can even change multiple times each month.

Once the bureaus receive data about your activity from a lender, they’ll add it to your credit report. And, soon after your credit report updates, credit scoring models like FICO® and VantageScore® can access the new data to recalculate your latest score.

However, since credit reporting is voluntary and not all lenders report to all three bureaus, it’s important to remember that not every bit of credit activity will result in an updated score. If one of your lenders doesn’t report to Equifax, for example, you might not see your Equifax credit score reflect new activity.

What day of the month does your credit score update?

Although your credit score typically updates at least once a month, there’s no specific day you can put in your calendar to check it. The timing of each update varies based on when your lenders submit new information to the credit bureaus. Some may report at the beginning of the month, others in the middle or at the end, and some may not report at all.

How often can I check my credit score?

You can check your credit score as often as you'd like without lowering it. Checking your own credit score is considered a soft inquiry (or soft check), which differs from a hard inquiry, which happens when lenders check your credit during a loan or credit card application.

The main difference between a soft and hard inquiry is that the latter may lower your score slightly. Although this drop is usually less than five points, repeated hard inquiries can cause larger drops.

Although there’s no downside to checking your own credit score every day, you’re unlikely to see your score change on a daily basis. However, some credit score monitoring services do allow you to at least check for new credit score updates daily, meaning you’ll see updates as soon as they come through. That includes:

- Credit Karma: Checks for updates to your VantageScore 3.0 from Equifax and TransUnion daily.

- Credit Sesame: Checks for updates to your TransUnion VantageScore 3.0 daily when you log into your account.

- LifeLock Total: Offers daily credit report updates and checks for updates to your VantageScore 3.0 from one bureau daily, and all three annually. LifeLock Total also offers three-bureau credit monitoring, alerting you to credit report changes that might indicate fraud.

Why do credit scores fluctuate?

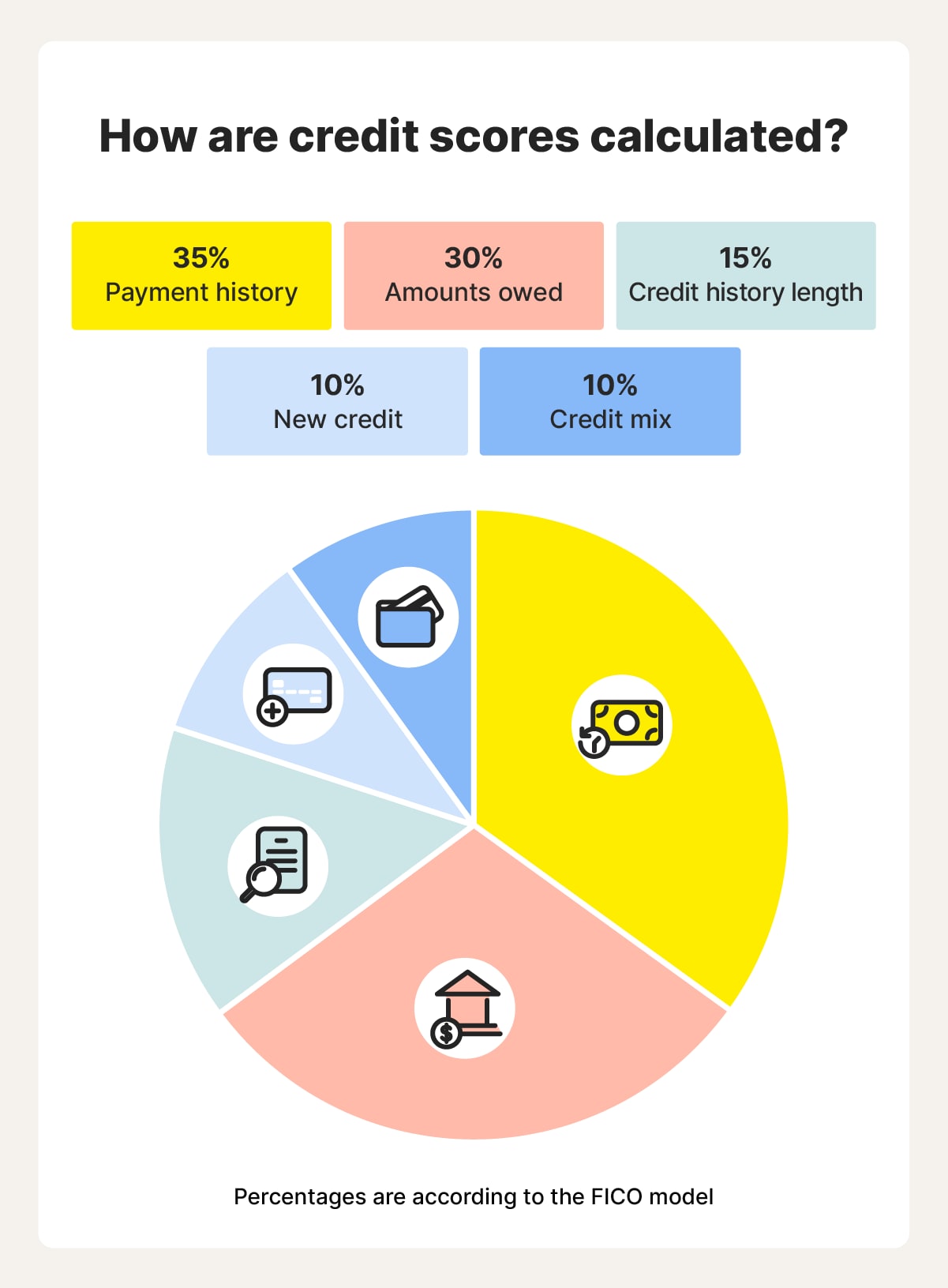

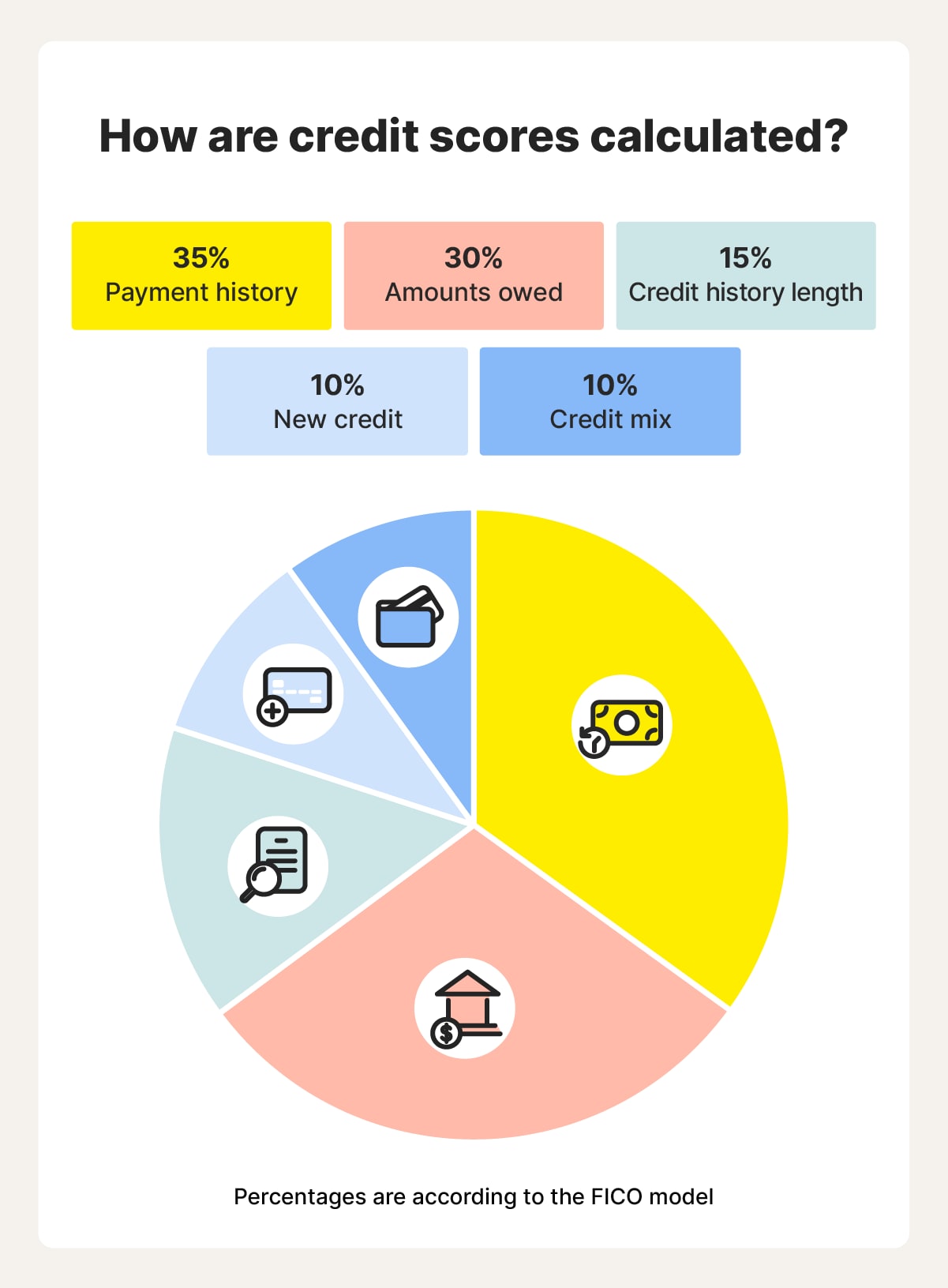

Your credit score fluctuates as new information is added to your credit report. Each time a lender updates your account activity, credit scoring models recalculate your score based on five key factors:

- Payment history: Your track record of making credit repayments on time and in full. A solid history of on-time repayments will drive credit score growth.

- Credit utilization: Also known as “amounts owed” in the FICO model, this measures how much of your total available credit you’re using across all of your credit accounts. Generally, lower credit utilization is better for your credit score.

- Length of credit history: How long you’ve had credit accounts, factoring in your oldest account and your average account age. A longer history of credit should improve your score.

- Credit mix: The variety of different credit types you manage, like credit cards, loans, and mortgages. Greater credit diversity is a positive influence on your credit score.

- New credit: How recently you’ve applied for or opened new credit accounts. A high proportion of new credit accounts might negatively impact your score.

These factors aggregate lots of small actions relating to your credit file into a single credit score — both big and small changes to the way you use credit can affect that score. Here are a few common reasons your score might fluctuate:

- You opened a new account: Applying for new credit requires a hard inquiry which will cause a small, temporary dip in your score. However, it may also reduce your credit utilization, which could balance out the impact.

- Your credit card balance changed: An increase or decrease in your balance (on any credit cards, loans, or mortgages) directly affects your credit utilization, a major scoring factor.

- You missed a payment: Since payment history carries the most weight, a missed or late payment can lead to a significant drop in your credit score.

- You closed an old account: Closing an older credit card can shorten your credit history and increase your credit utilization, both of which may lower your score.

- You paid off a loan: While paying off debt is a positive move, it can sometimes cause a short-term score dip, especially if it reduces your credit mix or overall credit history.

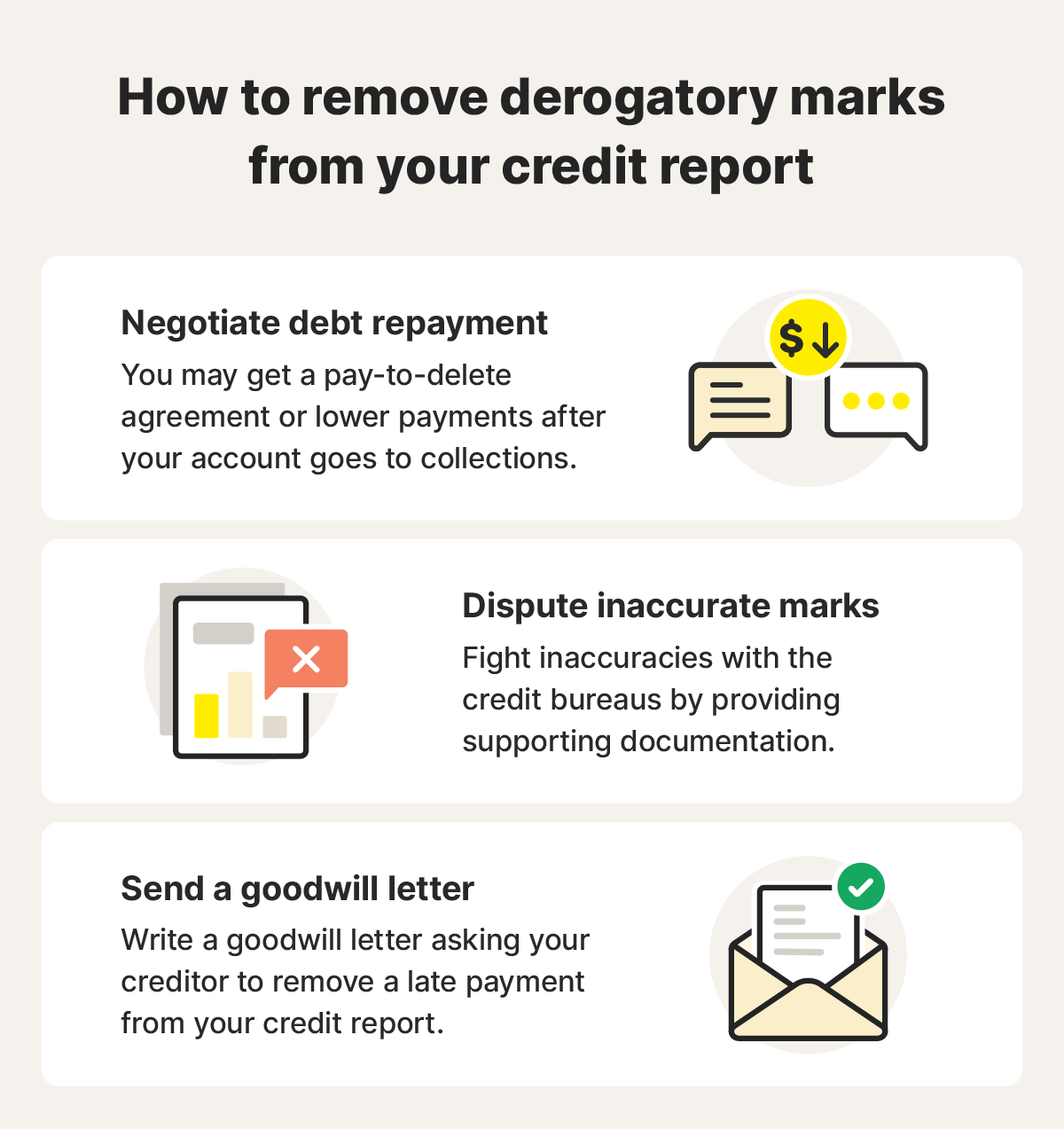

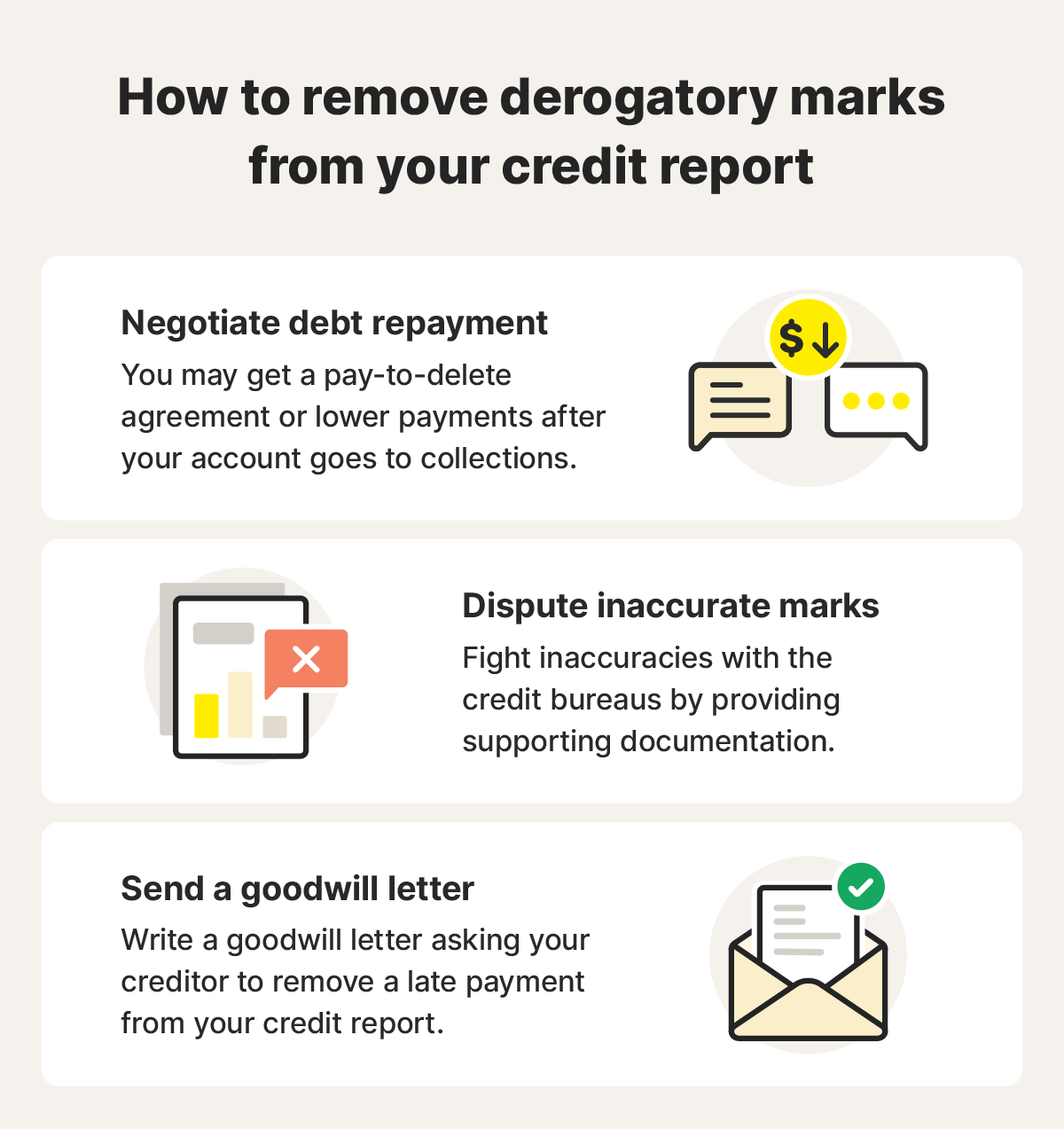

- You corrected and removed a mistake: Successfully disputing an error on your credit report, like an inaccurate late payment, can help boost your score.

- Old information dropped off: Most negative marks on your credit report, like late payments or collections, eventually drop off, helping your score improve.

Can you speed up a credit score update?

Without intervention, your credit score will only update after lenders report new information to the credit bureaus. But you can speed up the process in certain situations by requesting a rapid rescore. This prompts lenders to report information to the bureaus immediately so they can update your credit report with recent changes.

You might want to pursue a rapid rescore if you’ve just paid down debt or corrected an error and need an accurate, up-to-date picture of your credit score before the usual update cycle allows, perhaps because you’re planning a new credit application.

Here’s how the process works:

- Wait for payments to clear: Don’t rush into a rescore right after making a credit repayment. You’ll need to wait until the payment has actually been processed or it won’t help your score.

- Work with a lender to request it: Rapid rescores aren’t available to consumers directly. You’ll need to work with a lender, often during a mortgage application, who can request one and pay the fee on your behalf to help you qualify for better loan terms.

- The credit bureau issues the updated report: Once the lender submits the request, the credit bureau processes the new information and updates your credit report. It’s a quick turnaround, usually only taking a couple of days.

While a rapid rescore can ensure that recent improvements to your credit health are reflected in your score a little earlier, it isn’t a magic fix. It won’t automatically boost your score — it simply updates your report to reflect recent changes.

Safeguard your credit and identity

Tracking your credit score regularly can help you understand what’s working in your favor and what might be dragging it down. The more you know, the better choices you can make to move it in the right direction.

As a member of LifeLock Total, not only will you be able to access your up-to-date credit score and report daily, you’ll also get three-bureau credit monitoring that alerts you to potentially suspicious activity on your credit file. That can help you catch potential identity theft threats, so you can address issues before they do serious damage to your credit health.

FAQs

How long does it take to get your first credit score?

If you don’t have any credit history, it can take up to six months to get your starting credit score. To build a good credit score, start slowly by opening a single line of credit and paying it off consistently. Consider a secured credit card, a credit-builder loan, or becoming an authorized user on someone else’s card.

Can my credit score change daily?

Yes, although unlikely, your credit score can theoretically change daily. If multiple creditors report updates to the credit bureaus on the same day, your score might even change several times throughout the day.

How long does it take for a credit score to update after I make a payment?

Credit scores typically update within a month after you make a payment. Still, the exact timing can vary based on when creditors report to the credit bureaus and when they update their records.

How often should you check your credit score?

You should check your credit score at least once a year, and more frequently in certain cases, such as before applying for new credit or if you’re actively trying to fix your score. Regularly checking your score can also help you spot signs of identity theft so you can act quickly to minimize potential damage.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.