When you ask your lender to raise your credit limit, you may notice a minor drop in your credit score. This is likely a temporary dip brought about by a hard credit check — a routine inquiry lenders make to review your full credit report when assessing your creditworthiness.

Sometimes, a credit limit increase only requires a soft credit check, which won’t impact your credit score at all. This is often the case for automatic or pre-approved credit limit increases. Check with your creditor to see how they handle credit increase requests and how this will affect your credit score.

Either way, the impact of requesting a credit limit increase is usually minor and temporary. In fact, raising your credit limit can improve your credit score in the long term, provided you don’t also increase your credit spending.

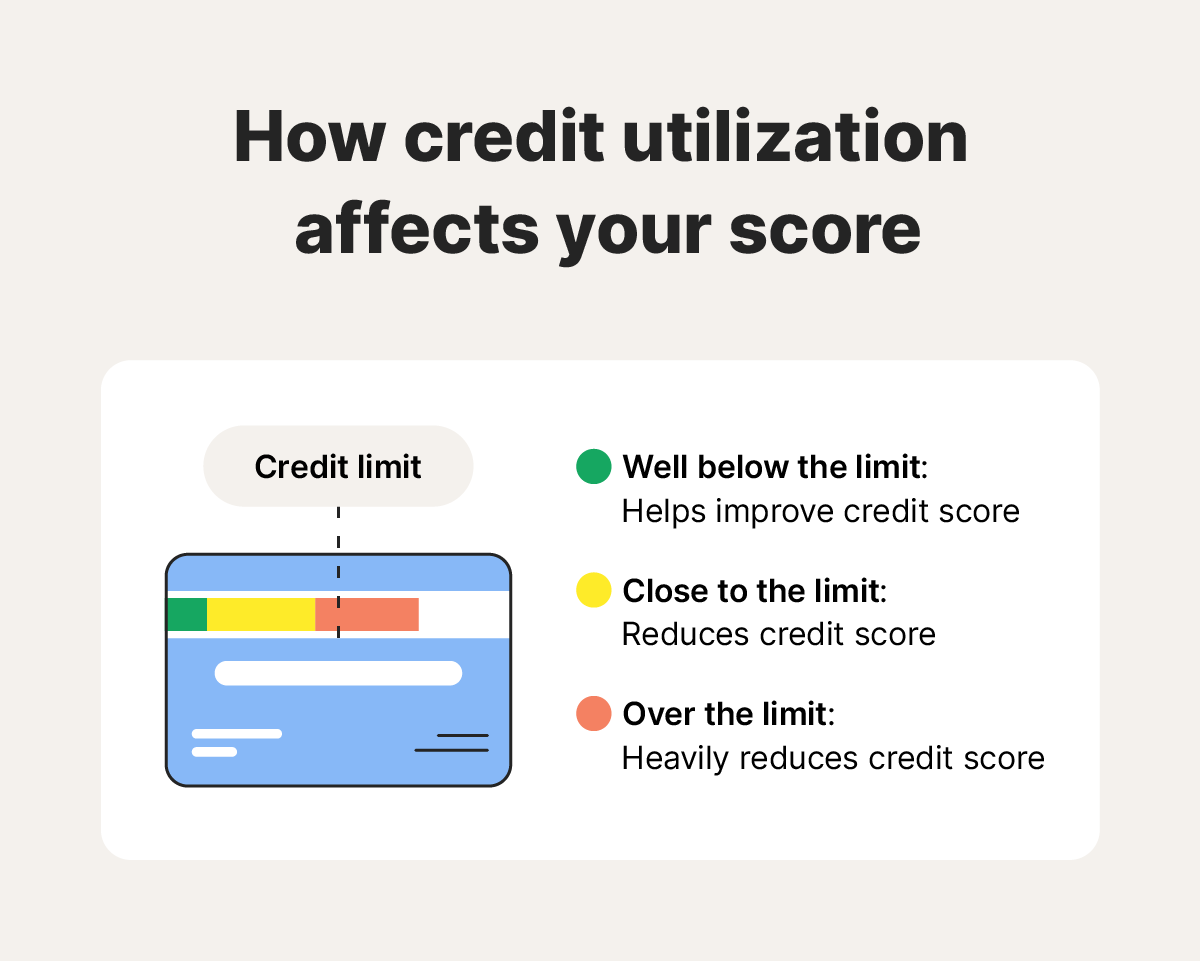

This is because a credit limit increase could result in a lower (i.e., better) credit utilization rate, which is a measure of the percentage of your total available credit that you’re currently using. Credit utilization is a major factor in your credit score in popular models, including FICO Score and VantageScore.

How credit limits work

Credit limits represent the maximum amount you’re allowed to borrow on revolving credit accounts like credit cards and home equity lines of credit (HELOCs). These limits don’t apply to installment loans such as auto loans or mortgages.

When deciding whether or not to increase your credit limit, creditors consider your risk profile, as reflected in your credit score and credit reports. Here are some of the factors that could impact their decision:

- Credit utilization: Lenders typically calculate your credit utilization by dividing your total balances by your total credit limits across all revolving accounts. A high utilization rate — typically above 30% — can signal that you’re overextended, which may lead lenders to deny your request or approve only a small increase.

- Existing debt: Other types of existing debt, such as mortgages or auto loans, can be a factor in determining how ready you are to handle higher limits. Applying only for loans you can realistically afford shows creditors that you’re a responsible borrower and lowers your perceived risk.

- Income: A higher income suggests you’re better positioned to manage larger credit limits and repay what you borrow. Lenders consider your ability to handle monthly payments and pay off balances when approving credit limit increase requests.

- Credit history: A history of missed payments and accounts in collections signals a higher risk to creditors. Establishing a good payment history will help you unlock higher credit limits.

- Credit age: A long credit history will help you seem more reliable to creditors. Keeping your oldest credit accounts around as long as possible can provide strong evidence that you handle credit responsibly.

Lenders may increase or decrease your credit limit in response to your financial situation. If you improve your credit profile, start earning more money, or reduce your outstanding debts, you could be rewarded with a higher credit limit. These increases can happen either automatically or upon your request.

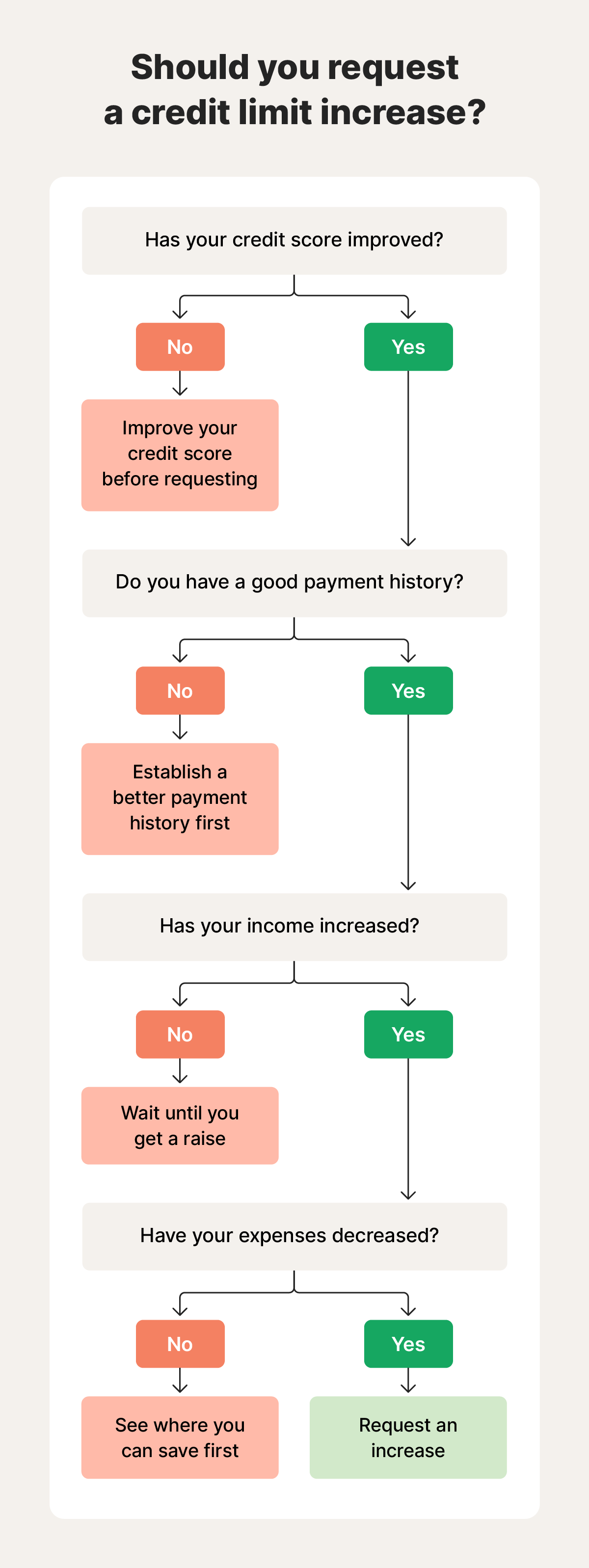

When is it a good time to request a credit limit increase?

The best time to request a credit limit increase is after you improve your financial situation, like when you get a raise, reduce your debt, or lower your household expenses. Financial gains that improve your credit score, like paying off credit card debt, often get the best results. Knowing your credit score before requesting an increase can help you determine whether it’s a good time.

Here are some good times to request a credit limit increase:

- You’re earning more: Earning more income puts you in a better position to handle higher credit limits. If you’re earning more because of a new job, wait until you’re certain it’s a good fit before applying for a credit increase.

- You’ve reduced your expenses: Cutting back on spending can lower your credit utilization ratio, which may boost your credit score. This makes you a more appealing candidate for a credit limit increase, especially if you continue to manage your spending responsibly.

- You’ve paid off debts: Paying off debts will reduce your bills and free up your disposable income. Wait until the debt falls off your credit report, which could take up to one month, before requesting a higher credit limit.

- You have a good credit history: Higher credit limits are a major perk of having a solid credit history. Establishing a good payment history can take a few years, but it helps prove your responsibility. Conversely, late payments can stay on your report for seven years.

- Your credit score is good or excellent: A good credit score is 670 or higher in the FICO model, while an excellent one is 740 or more. Checking your FICO score to see if you’re in this bracket will help you determine the right time for a credit increase.

If your credit limit increase is declined, it’s best to wait until your financial situation improves before trying again. Making too many requests can negatively affect your credit score due to the hard inquiries this process entails.

If your request is approved, but you want an even bigger increase, it’s best to wait six months before raising your credit limit again. Check with your creditor to understand their terms on the frequency of increases.

When to avoid requesting a credit limit increase

It’s wise to hold off on requesting a credit limit increase if your credit score is low or your finances are under strain. Lenders are less likely to approve your request if you’re consistently carrying high balances or have a history of missed or late payments.

Here are some reasons you might want to put off requesting a credit limit increase:

- You have a low credit score: A “fair” credit score in the FICO Score model is defined as being below 670, while a bad one is below 580. Work on fixing your credit score before applying for a limit increase, as people in the lower ranges are more likely to be declined.

- You’re carrying a high credit balance: If you regularly max out your credit cards and only make minimum payments, lenders may see you as a higher-risk borrower. This pattern suggests you may be relying too heavily on credit and could struggle to repay additional debt.

- You plan to use it for a large purchase: If you’re considering a credit limit increase to fund a big purchase, like a down payment on a home, it’s usually better to save up instead. Using a credit card for large expenses can lead to high-interest debt, especially if you can’t pay it off quickly.

- You want to use it as an emergency fund: Using credit cards as an emergency fund can leave you with large amounts of interest to pay off. By creating an emergency fund in your savings account, you can stay secure while avoiding interest.

- You’re making less money: Creditors aren’t likely to approve a credit limit increase if you’re making less money than you were before. Wait until you can improve your financial situation before applying.

If a creditor declines a limit increase, it might be tempting to apply for a new credit card. While this technically increases your overall credit limit, be careful. Having a lot of credit cards can be hard to manage and increase your risk of identity theft.

How to ask for a credit increase

You can increase your credit limit by requesting it on your creditor’s website, mobile application, or by calling their customer service line.

Take these steps whenever asking for a credit increase:

- Collect information: To increase your credit limit, you need to provide evidence that you can handle the new limit responsibly. This can include billing statements showing reduced utilities or pay stubs showing increased income.

- Contact your creditor: Contact the creditor or submit the credit increase request online. Calling the creditor directly could potentially give you an advantage, as some creditors are willing to hear personal situations rather than rely solely on financial data.

- Know the impact: Before committing to a credit increase, ask your creditor whether the application involves a hard inquiry, which could temporarily drop your credit score by a few points. If you see a hard inquiry that you didn’t make on your credit report, you can request to remove it.

- State your case: Creditors will ask you a few questions to check your ability to handle new credit. Providing them with accurate information on increased income, reduced bills, or a good credit history will improve your chances of an increase.

- Accept their offer: If your credit limit increase is approved, your creditor will usually send a confirmation by email or through your online account. Before accepting, carefully review the terms to ensure there are no unexpected changes like a higher interest rate, added fees, or revised repayment conditions.

Even with a great credit history, approval for a credit limit increase is ultimately at the discretion of your creditor. If they deny your request, don’t despair. Instead, try to figure out why you were rejected so you can take action to improve your chances next time.

How long does a credit limit increase take?

Credit limit increases are usually approved or declined immediately, as eligibility is typically standardized and checked automatically after a request is made. However, it could take a few weeks before this increase appears on your account. Ask your creditor for specific details about their process.

Help monitor and protect your credit

Keeping a close eye on your credit is crucial, as a bad credit score can undermine your borrowing power and wreak havoc on your financial well-being.

LifeLock can bring you peace of mind, with credit monitoring alerts that notify you of key changes to your credit file. This can help you spot potential signs of identity theft or fraud, meaning you can act quickly to protect your finances and minimize the impact on your credit score.

FAQs

Does requesting an increase always trigger a hard inquiry?

Not always. Whether a credit limit increase request results in a hard inquiry depends on the issuer and how the request is made. User-initiated requests often involve a hard credit check, which can slightly impact your credit score. However, some issuers may use a soft inquiry instead, especially for pre-approved or automatic increases. It’s best to ask your creditor how they handle credit limit requests before applying.

How much will a hard inquiry drop my score?

A hard inquiry typically lowers your credit score by five points or less, and the impact is usually temporary. The exact effect depends on your overall credit profile — those with shorter credit histories or few accounts may see a slightly bigger dip. Hard inquiries remain on your credit report for two years, but usually stop affecting your score after a few months.

Can creditors reduce your limit?

Yes, creditors have the right to lower credit card limits if they believe a borrower’s financial position has worsened. If your limit is reduced and your current balance exceeds the new limit, you typically won’t be charged over-the-limit fees. However, you won’t be able to make new purchases with the card until your balance falls below the new limit.

How much of a credit increase should I ask for?

A typical credit limit increase ranges from 10% to 25%. Asking for more could be feasible in certain circumstances, like if you get a raise or a higher-paying job. If you are denied, you can sometimes counteroffer for a lower increase.

Should I request a new card or a credit limit increase?

You should request a credit limit increase if you can’t see yourself benefiting from having a new card. A new card may offer benefits, but it could also come with additional fees and more management. Ask yourself what you need when deciding between a new card or a credit increase.

Will applying for a credit limit increase hurt my credit score if I’m denied?

Requesting a credit limit increase may temporarily hurt your credit score, regardless of whether you’re approved or denied, as it may incur a hard inquiry.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.