“100% worth the money. My information was on the dark web and someone stole my Social Security number. Immediately LifeLock responded and took care of the situation at ease. With cyber attacks, trust me when I say you want to get LifeLock.” — Google Play review

LifeLock is a service that provides professional identity theft protection and restoration support should you ever fall victim. Millions of customers trust LifeLock to help protect their identities, with Tom’s Guide giving it the top spot in its list of best identity theft protection products and PCMag calling it the “Best Identity Protection Overall” in 2025.

To know why LifeLock is worth it, you need to know how the service works, what features it offers, and what real LifeLock members say. Read more about our methodology below.

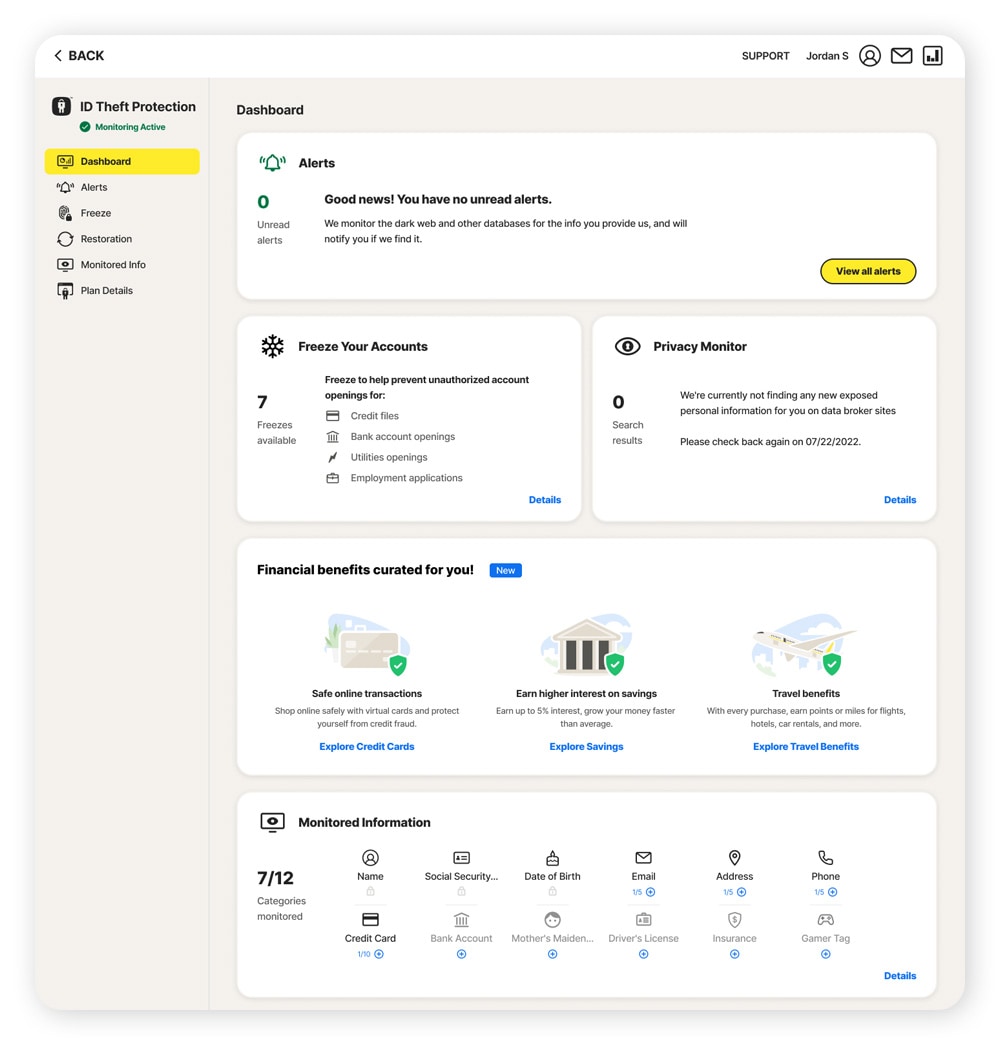

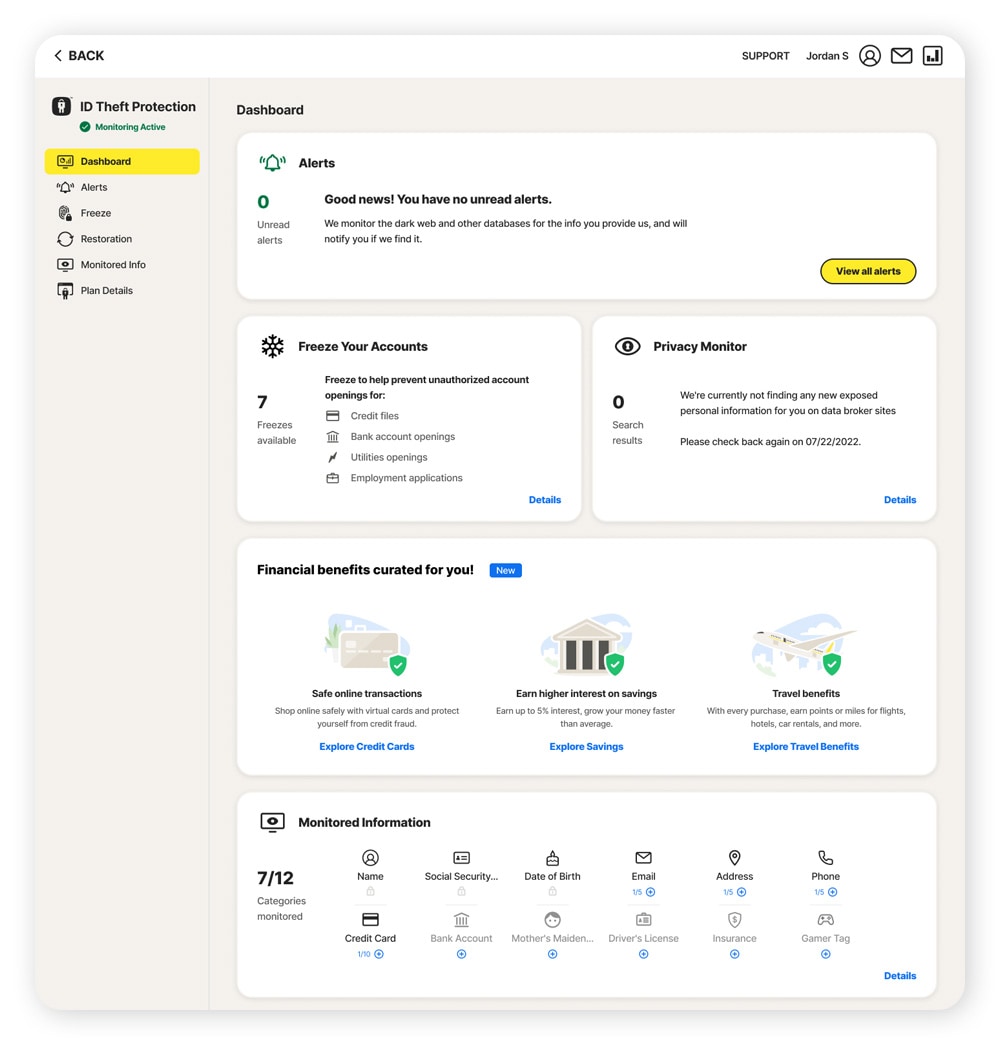

How does LifeLock work?

LifeLock monitors tons of data sources to detect potential threats to your identity. It looks out for your name, address, date of birth, Social Security number (SSN), financial details, and more across the internet, dark web, and in applications for credit and other financial services.2

If it finds suspicious activity, LifeLock provides the information you need to help protect yourself, with 24/7 live member support.Δ And, if the worst happens and your identity is stolen, you’ll get expert guidance and support from a U.S.-based personal restoration specialist, plus up to $3 million in reimbursement coverage for financial losses and incurred costs, depending on your plan.3

Aside from active monitoring for identity theft risks, LifeLock also offers credit monitoring†† to help you spot key changes to your credit report that may indicate fraud, with three-bureau credit monitoring available. Plus, you’ll get timely alerts of large-scale data breaches that might impact your privacy.

Here’s what to expect when you join LifeLock:

- You’ll be asked to verify your identity by providing your SSN or other personal details to help us protect you against fraudulent signups. Providing this data also allows us to monitor it for fraudulent use.

- You can then provide other personal information that you want to be monitored, from your name and address to your banking details.

- Dark web monitoring will be activated automatically, so right when you sign up you’ll get an immediate report about your personal information on the dark web.

- You’ll also get automatic access to our restoration support services upon signup, and you can choose to activate any other features included in your plan.

- LifeLock will start monitoring your information across the internet, dark web, and applications for credit and services, sending you alerts whenever a potential threat is detected.

Is LifeLock worth the cost?

LifeLock plans start at $12.49 monthly or $124.99 annually for the first year. You’ll get access to a suite of identity theft protection, fraud detection, and financial monitoring tools, along with 24/7 member support. And, depending on your plan, you’ll get access to up to $3 million in potential coverage per member for losses and costs following identity theft.

Whether LifeLock is worth it depends on your specific situation and the level of identity protection you feel you need. If you’re looking for no limit on claims, up to $3 million dollars in reimbursement support, and a dedicated US-based restoration team with decades of experience resolving complex identity theft cases, then LifeLock is the service you need. The potential costs of identity theft are simply too high to stay unprotected.

Did you know? The latest FTC data shows there were over 1.1 million reports of identity theft in 2024 and over 2.6 million fraud reports in total — altogether responsible for over $12.5 billion in consumer losses.

Joining LifeLock can help reduce your exposure to identity theft or fraud by spotting early warning signs, alerting you to potential threats, and providing reimbursement for qualifying losses in the worst-case scenario.

Here’s a full summary of the price of the three best-selling individual LifeLock plans, so you can decide which level of coverage suits you best.

Plan |

First year price |

Notes |

|---|---|---|

$12.49 monthly |

Up to $1 million in coverage in case you need it.††† |

|

$19.99 monthly |

Up to $1.2 million in coverage in case you need it. |

|

$34.99 monthly |

Up to $3 million in coverage in case you need it. |

LifeLock also offers family plans, with the same suite of identity theft protection tools, which cover up to two adults and five children in one simple package. LifeLock family plans start at $149.87 for the first year for two adults, and $221.87 for two adults and up to five children.

What users and experts say

It’s one thing for us to claim that LifeLock is worth it. But to help prove it, we’ll show you what current LifeLock members say about our identity theft protection, and what independent experts report in their reviews.

“I've been a customer for many years. Excellent service, and the partnership…is outstanding. Any time I've opened an account, I receive notice to be sure it's valid. Communication about breaches is timely. I love the variety of plans, and the cost is reasonable. Thank you for having our backs!” — Trustpilot review

“Lifelock is one of the oldest identity theft protection providers, and it offers some of the most comprehensive coverage around. During testing, we were impressed by its features: you get everything from credit monitoring and alerts to dark web monitoring, scam protection and a large amount of insurance.” — Tom’s Guide

“My grandma swears by Lifelock. A few years ago she was hacked before hacking was cool and they got her straightened out and continue monitoring her and anything that comes close. She…has peace of mind and an account rep who calls anytime something is in question.” — Reddit review

LifeLock features and capabilities

LifeLock offers an identity theft protection toolkit full of features that can help you reduce exposure of your personal information, detect potential threats, and protect yourself in the worst-case situation.

Identity theft protection

The foundation of all LifeLock plans, identity theft protection features are designed to help you safeguard your personal information and detect signs that your identity might be at risk. Tools available across all plans include:

- Identity and Social Security alerts: LifeLock sends alerts if it detects your name, address, date of birth, SSN, or other personal details in applications for credit or services.

- Privacy monitoring: Regular scans of public people-search and data broker websites can help you find where your sensitive personal information is exposed and improve your online privacy.

- Dark web monitoring: LifeLock continuously monitors the dark web and sends notifications if traces of your personal or financial information are detected on hidden websites or marketplaces.

- Data breach notifications: You’ll get notifications about large-scale data breaches that may have impacted your online privacy or security, so you can take steps to protect yourself.

- USPS address change verification: LifeLock notifies you if a change is made or a new address reported to the United States Postal Service (USPS) in your name.

Certain LifeLock family plans, as well as the LifeLock Junior plan, offer the same robust identity theft protection for minors, who may be at risk of child identity theft.

With a LifeLock Advanced or LifeLock Total subscription, you’ll get access to additional identity theft protection features that can help you detect even more risks to keep your identity and finances safer:

- Social media monitoring: Scan for signs of unusual activity like suspicious login attempts, account takeovers, or inappropriate content tied to your name across Facebook, Instagram, Twitter, and LinkedIn.

- Phone takeover monitoring: Get alerts if LifeLock detects an attempt to port your number to another carrier — a common tactic involved in “SIM swap” attacks that can leave you vulnerable to follow-up fraud.

- Buy Now, Pay Later monitoring: Monitor for account applications made in your name with services like Klarna, Affirm, and Afterpay to help spot potential fraudulent activity that could harm your credit.

- Utility account monitoring: Monitor for signs that a fraudster has opened a new utility account in your name, with coverage of gas, electric, water, cable, and internet services.

- Home title monitoring: Get notified if LifeLock detects changes to your home title, including alterations to the record of ownership or financing details, to help protect against title theft and other forms of fraud.

- Alerts for crimes committed in your name: Search for falsified court records that contain your personal information, a potential sign of criminal identity theft that could leave a lasting mark on your record.

Together, these identity theft monitoring and protection features provide coverage across the visible web, the dark web, social media, and much more, helping you protect against possible identity threats that other services can miss.

Credit monitoring

LifeLock’s credit monitoring feature helps you spot key changes to your credit report that could indicate fraud. You’ll receive alerts about new hard credit inquiries, accounts opened, or lines of credit drawn in your name as they appear.

Early warnings about suspicious activity give you the information you need to take swift action to protect your finances by disputing errors or freezing your credit.

All LifeLock plans include credit monitoring coverage so you can keep track of key changes to your credit and get alerts to help detect potentially fraudulent activity. And LifeLock Total allows you to monitor your credit at all three major credit bureaus.

As a LifeLock Total member, you’ll also get access to daily credit reports and score updates from one bureau, helping you track your credit journey or find evidence of fraud.

Restoration and reimbursement

All LifeLock members get access to 24/7 live support and, if your identity is compromised, a U.S.-based personal restoration specialist will be standing by to help you recover.

We’re so confident in our experts’ ability to help, we offer a 100% restoration guarantee: if we can’t reinstate your identity to good standing, we’ll reimburse you for up to twelve months of your subscription cost.4

Like some identity theft insurance plans, LifeLock also includes coverage for stolen funds, costs associated with legal support, and personal expenses following identity theft. Plans range from over $1 million in potential coverage to up to $3 million with LifeLock Total.†††

Stolen wallet protection also means that you’ll get support canceling or replacing lost credit cards, driver’s licenses, Social Security cards, insurance cards, and more.

Financial monitoring

On top of the identity theft protection, credit monitoring, and restoration features, LifeLock Total offers a range of financial monitoring tools that can help you detect signs of fraud as they appear. That includes always-on monitoring of your checking, savings, and 401(k) and investment accounts.

You can customize your settings to be notified of withdrawals, balance transfers, large purchases, and more — all potential signs that someone has gained access to your financial accounts. You’ll also get alerts of new bank account applications made in your name.

LifeLock pros and cons

LifeLock is one of the best-known names in identity theft protection for a reason. If you’re weighing up whether it’s worth it for you, consider these pros and cons:

Pros |

Cons |

|---|---|

30-day free trial available to all new members. |

Requires pre-authorization with a valid payment card. |

4.8 out of 5 stars on Trustpilot.* |

Alerts may pop up on your device, but you can disable this in settings. |

A wide range of identity and financial alerts. |

The most comprehensive level of protection may not fit every budget. |

Over $3 million in potential reimbursement coverage if your identity is stolen.3 |

|

No limit on the number of reimbursement claims made. |

|

24/7 customer support for all members. |

|

U.S.-based personal restoration specialists to handle identity theft cases. |

|

100% restoration guarantee. If we can’t restore your identity, you get up to 12 months of subscription payments back.4 |

|

A user-friendly interface designed to make it easy to spot threats. |

|

Additional device security features like an antivirus and VPN available with Norton bundles. |

* Trustpilot ratings are accurate as of January 2026.

How LifeLock compares to alternatives

While LifeLock is a popular identity theft protection option, there are other services available on the market, including Aura, Identity Guard, and IdentityForce by TransUnion.

Most offer basic protection features, including credit monitoring, dark web monitoring, and alerts for signs of identity theft or data breaches. However, some of these other services fall short of the additional monitoring coverage LifeLock offers, lacking phone takeover monitoring or robust social media account monitoring, for example.

These other services may also offer lower reimbursement limits, increasing your risk of being left out of pocket in the event of identity theft. And, unlike LifeLock, most don’t advertise a restoration guarantee that offers up to 12 months of subscription payments back if they fail to restore your identity.

When it comes to evidence of customer satisfaction, LifeLock had a strong 4.8 star customer rating on Trustpilot as of January 2026, higher than competitors like Aura with 4.2 stars and Identity Guard with 3.6 stars.

Here’s a summary of how LifeLock stacks up against other identity theft protection services:

* Trustpilot and Apple App Store ratings are accurate as of January 2026.

Do you need LifeLock?

You need LifeLock if you’re concerned about the risk of identity theft or fraud, want to monitor your online exposure to help protect your privacy, or want peace of mind that you’ll have reliable resolution support and strong reimbursement coverage to help bounce back from losses or expenses caused by identity theft.

It’s designed to help you stay more alert to threats so you can protect yourself and your finances. And, should the worst happen and your identity get stolen, you’ll rest more easily with our U.S.-based personal restoration specialists on your side, along with up to $3 million in reimbursement coverage for each individual on your plan.

Join the millions of customers who trust us to help protect their identities

Identity theft is more common than you might think, and its impacts can be life-altering. LifeLock helps protect you against the risks of becoming a victim with powerful proactive monitoring, expert restoration support, and up to $3 million in reimbursement coverage. Invest in peace of mind today to safeguard your identity and financial future.

Methodology

To create this article, we evaluated LifeLock using publicly available, independently verifiable information and corroborated that with LifeLock product managers, who are the real subject matter experts. We also reviewed documentation on monitoring features, credit tools, financial protections, reimbursement terms, pricing, usability, and customer support.

We supplemented this with analysis from independent publishers such as PCMag and Tom’s Guide, as well as customer feedback and aggregate ratings from platforms including Trustpilot, Apple’s App Store, and Google Play.

By relying on public resources and LifeLock subject-matter experts, we aim to provide readers with a review they can trust. All information was checked and reviewed before publication and is subject to change. The analysis reflects the author’s independent evaluation and does not necessarily represent the views of LifeLock or its parent company.

2 We do not monitor all transactions at all businesses. No one can prevent all cybercrime or identity theft.

3 $3 million coverage in our Total plan consists of up to $1 million each for Reimbursement, Expense Compensation, and Lawyers and Experts. Total coverage and category limits vary depending on the plan chosen. Benefits under the Master Policy are issued and covered by United Specialty Insurance Company (State National Insurance Company, Inc. for NY State members). Policy terms, conditions and exclusions at: LifeLock.com/legal.

4 Restrictions apply. Automatically renewing subscription required. If you are a victim of identity theft and not satisfied with our resolution, you may receive a refund for the current term of your subscription. See Lifelock.com/Guarantee for complete details.

†† Credit reports, scores and credit monitoring may require an additional verification process and credit services will be withheld until such process is complete.

††† Up to $1 million for coverage for Lawyers and Experts included on all plans, plus reimbursement and expense compensation up to $25,000 each with Core, $100,000 each with Advanced, and $1 million each with Total. Insurance benefits are issued by third parties. See GenDigital.com/legal for policy info.

Δ LifeLock/Norton 24/7 Support is available in English only. See https://www.norton.com/globalsupport.

§ Dark Web Monitoring is not available in all countries. Monitored information varies based on country of residence or choice of plan. It defaults to monitor your email address and begins immediately. Sign in to your account to enter more information for monitoring.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.