| Credit bureau | Mailing address | Phone number | Online dispute page |

| Equifax | Equifax Information Services, LLC P.O. Box 740256 Atlanta, GA 30374-0256 |

(888) 378-4329 | Equifax’s website |

| Experian | Experian P.O. Box 4500 Allen, TX 75013 |

(888) 397-3742 | Experian’s website |

| TransUnion | TransUnion Consumer Solutions P.O. Box 2000 Chester, PA 19016 |

(800) 916-8800 | TransUnion’s website |

A hard credit inquiry, also called a “hard credit check” or “hard pull,” happens when you apply for new credit. If someone steals your identity and applies for credit in your name, unauthorized hard inquiries may appear on your report.

Can you remove hard inquiries from your credit report?

Yes, you can (and should) dispute unauthorized or fraudulent hard inquiries on your credit report to get them removed. Legitimate hard inquiries should never be removed from your credit report—disputing legitimate hard inquiries can signal that you’re trying to hide your credit history and can raise red flags to the credit bureaus or lenders.

There are services that claim to be able to remove legitimate hard inquiries from your credit report in an attempt to raise your credit score, but you shouldn’t trust them—they’re likely fraudulent services or doing something shady behind the scenes.

Legitimate hard inquiries include any situation when you personally applied for financing, like a new credit card, car loan, or mortgage application.

The good news is that hard inquiries usually don't have a long-term impact on your credit score. Especially if you’re rate shopping—when you apply for the same loan type from multiple lenders to try to find the best interest rate before making a decision—several hard pulls within a short timespan are generally combined into a single hard pull, which ultimately has less of an impact on your credit score.

A legitimate hard credit inquiry can lower your score by up to 10 points, though it often impacts it by five points or fewer. And while inquiries stay on your report for two years, only those from the past 12 months usually affect your FICO score.

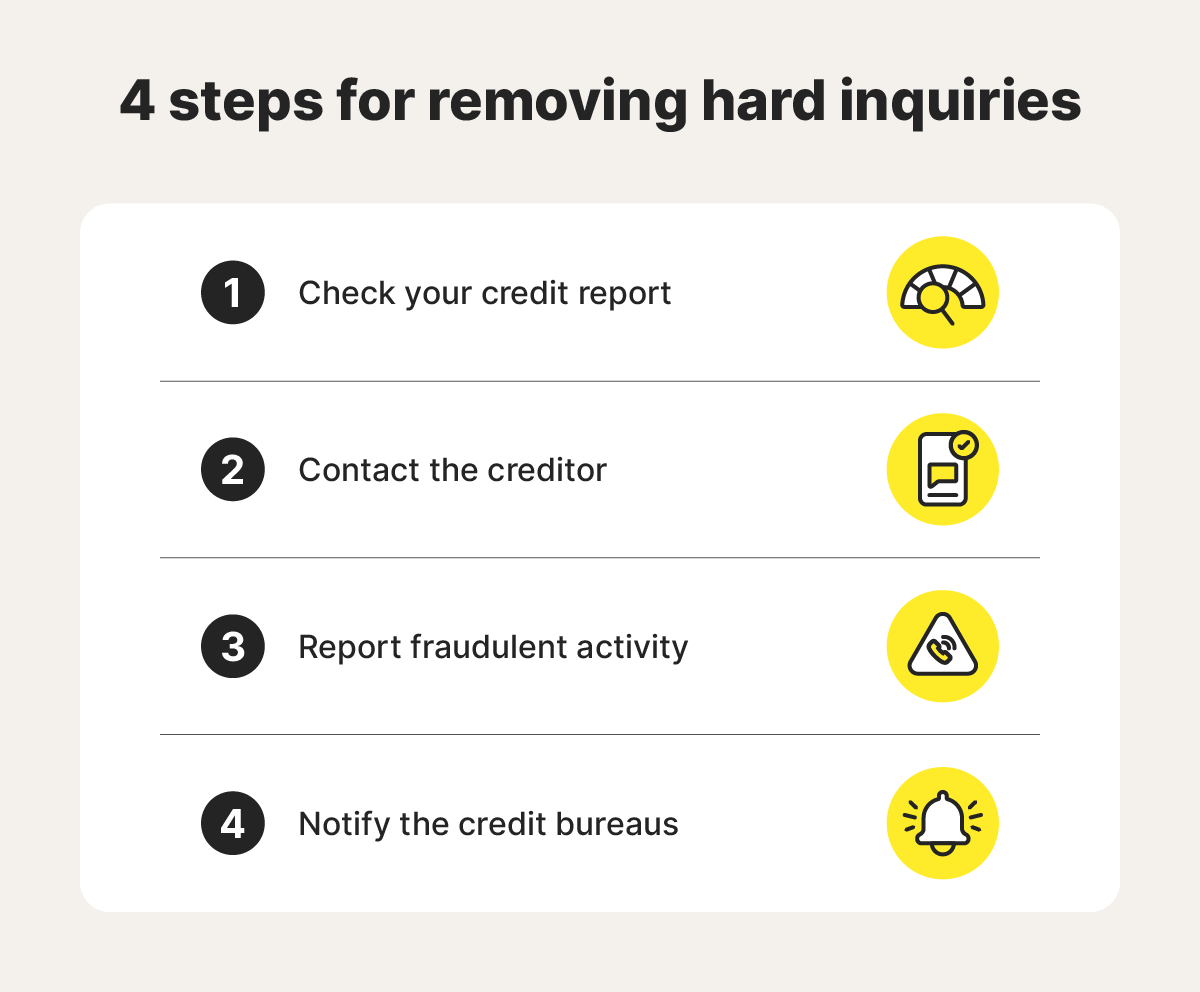

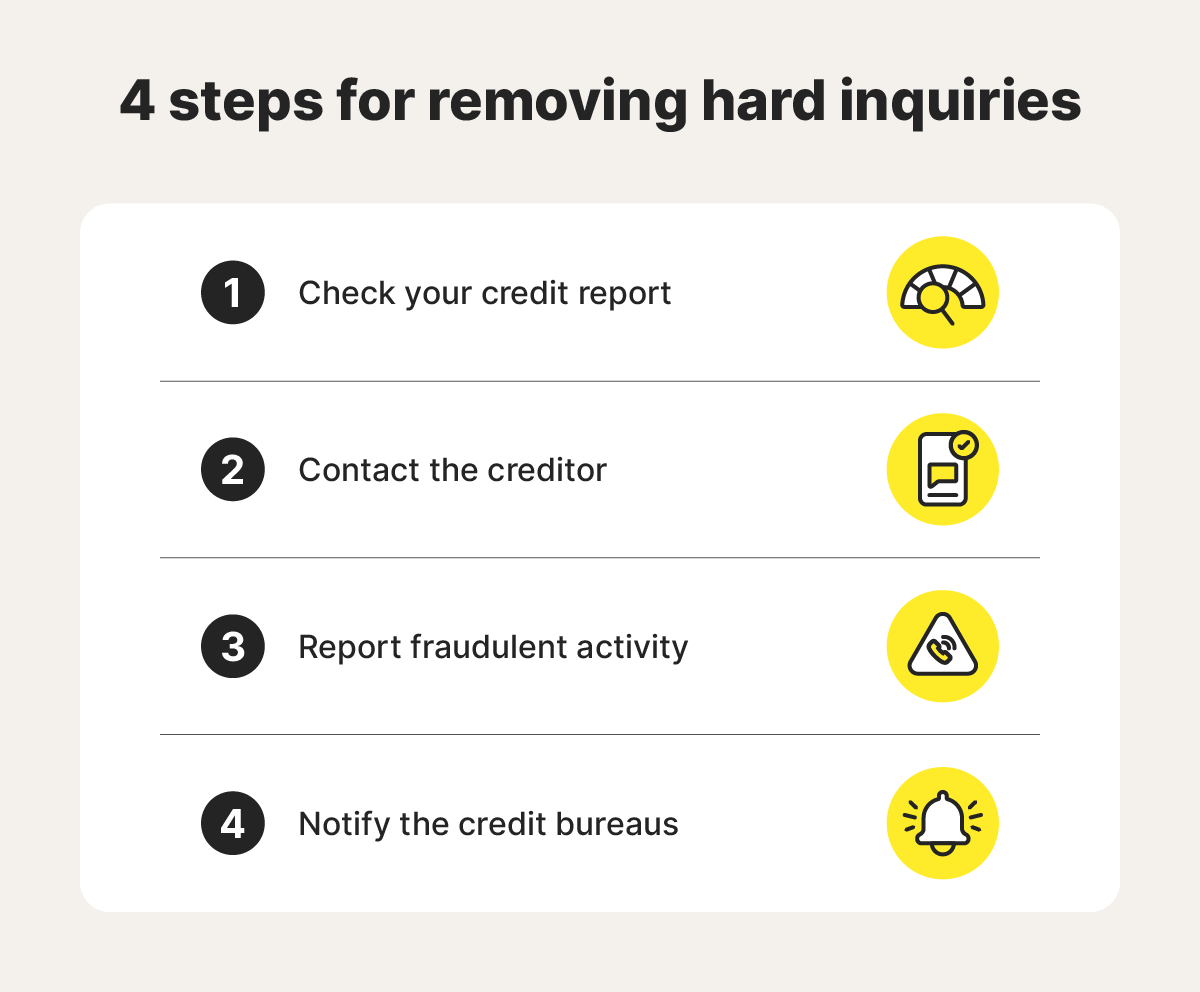

4 steps for fraudulent hard inquiry removal

If you spot a hard inquiry you don't recognize on your credit report, that's a red flag. Fraudulent hard inquiries can happen for many reasons, ranging from simple mistakes to outright identity theft. In these cases, you can remove hard inquiries by contacting the creditor who issued the inquiry as well as all three credit bureaus: Equifax, Experian, and TransUnion.

So, think you may have a fraudulent hard inquiry on your credit report? Use the following steps to have it removed:

1. Check your credit report

Checking your credit report is the best way to discover unauthorized hard inquiries. With a LifeLock Total subscription, you get unlimited credit score1 checks and annual credit reports from all three credit bureaus.2 We’ll monitor key changes to your credit file and provide you with a detailed overview of your credit history to help you detect fraud.

2. Contact the creditor that made the inquiry

There's a chance that a fraudster isn't to blame for the hard credit inquiry, and it's just a mistake made by the creditor. Use the company's contact information on the credit report to dispute the report error directly, then ask them to verify the account details and the inquiry.

If they can't confirm the account or acknowledge it was an error, request that they send a letter to each credit reporting agency to remove it from your report.

3. Report fraudulent activity

If you discover that someone fraudulently made a hard inquiry, contact the Federal Trade Commission (FTC) to report it. Filing a report with the FTC creates an official record of the fraud, which can be useful in disputing the inquiry with creditors and credit bureaus. You should also report the identity theft to the police and your bank—you may be able to recover stolen funds this way, and the police may be able to help protect others from similar fraud.

4. Notify the credit bureaus

In addition to contacting the FTC, you should also notify each of the three credit bureaus. Send a letter and a copy of your FTC Identity Theft Report to each credit reporting agency asking to remove the hard inquiry. You can also dispute your credit report by contacting each bureau through their website.

Here’s a breakdown of each credit bureau’s contact information:

How to protect your credit if you suspect fraud

If you suspect someone has stolen your identity and is trying to apply for credit, open accounts, or make purchases in your name, take these precautions to help protect your financial health:

- Freeze your credit: Freezing your credit prevents creditors from accessing your credit report, making it harder for identity thieves to open new accounts in your name.

- Place a fraud alert: Contacting the bureaus to place a fraud alert on your credit report means creditors need to take extra steps to verify your identity before approving credit. That adds an extra layer of protection against unauthorized transactions.

- Invest in credit monitoring services: Credit monitoring and identity theft protection tools like LifeLock Total help protect your finances by monitoring hundreds of millions of data points per second to help catch fraudulent use of your personal information.

Prevent unauthorized inquiries on your credit report

Discovering a fraudulent hard inquiry on your credit report can feel alarming, but you can take steps to have it removed. For added security and peace of mind, get LifeLock Total to help detect and alert you to changes to your credit report that may impact your credit score.

Plus, LifeLock will notify you in the event of potentially fraudulent use of your bank account or credit card. And if you do ever become a victim of identity fraud, LifeLock’s dedicated U.S.-based restoration specialists will work with you every step of the way to help you recover.

FAQs about removing hard inquiries

Still have questions about removing hard inquiries? Here’s everything you need to know.

How long do hard inquiries impact your credit report?

Hard inquiries stay on your credit report for a maximum of two years and impact your FICO credit score for the first 12 months.

How long does it take to remove a hard inquiry from your credit report?

After submitting your dispute, it typically takes 30 days for credit bureaus to investigate the inquiry and process the dispute. If they find the inquiry resulted from identity theft, they will remove it from your credit report.

What’s the difference between a hard and soft inquiry?

Hard inquiries occur when a lender reviews your credit for a loan or credit application, causing a temporary dip in your score. Soft inquiries occur when you check your own credit or a company checks it for pre-approval, neither of which affect your score. Additionally, lenders can see hard inquiries, but soft inquiries are visible only to you.

1 The credit score provided is a VantageScore 3.0 credit score based on Equifax data. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness.

2 Credit features require successful setup, identity verification, and sufficient credit history by the appropriate credit bureau. Credit monitoring features may take several days to activate after enrollment.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.