| Sign of a credit repair agency scam | How do you know? |

| They require you to pay a fee upfront. | Under the Credit Repair Organizations Act, it’s illegal for credit repair agencies to ask for fees before services are completed. |

| They promise to get you a higher credit score fast. | This can’t be guaranteed and is therefore unrealistic. |

| They tell you not to contact credit bureaus yourself. | You have the right to make inquiries about your credit reports. Checking your credit score yourself does not lower it. |

| They don’t provide a written contract for their services. | Legitimate credit repair agencies will provide you with proper terms and conditions, even in urgent cases. |

| They offer a strategy called “piggybacking.” | Piggybacking involves adding you as a user to a stranger’s credit card account to artificially boost your credit score. |

| They ask you to use false information to build a new credit identity. | Using fake information alongside your own is called synthetic identity theft, and it’s illegal. |

When identity theft wreaks havoc on your credit, the consequences can be severe—making it difficult to secure a loan, raising credit card interest rates, and even affecting job or rental prospects. It also takes an emotional toll, with a lost sense of security and the draining process of disputing fraudulent charges and dealing with creditors.

If common signs of identity theft have set your alarm bell ringing, read on to learn how to secure your identity, dispute fraudulent charges quickly, and start to repair your credit.

How to repair your credit after identity theft

Perhaps you’ve started receiving bills, late notices, or collection calls for accounts you didn’t open, or maybe you’ve been denied credit you should qualify for. Take immediate steps to protect yourself by filing an identity theft report and collecting copies of your credit report.

Then follow along with the rest of our detailed guide to help reduce the impact of identity theft and start repairing your credit.

1. Secure your identity as quickly as possible

As soon as you notice any signs of identity theft, the first and most important action is to secure your identity against further theft. This will also help stop further damage to your credit and limit your liability for the fraudulent activity.

Here’s how to secure your identity quickly:

- Report the theft and freeze your credit with all three credit bureaus: Contact the national credit bureaus (Experian, Equifax, and TransUnion) to report the identity theft and initiate a fraud alert on your credit reports. At the same time, request a credit freeze to prevent creditors or lenders from accessing your credit and stop identity thieves from opening new accounts in your name.

- Gather evidence and documentation: Collect any statements, past-due notices, or other written communication that shows fraudulent transactions. You’ll need this information to prove and help dispute the fraud.

- File an identity theft report with the Federal Trade Commission (FTC): Visit the FTC’s IdentityTheft.gov page and click the “Get Started” button. Their website will guide you through filing an identity theft affidavit. You’ll need this official report to help prove the theft and start repairing your credit.

- Contact your bank for new account and card numbers: Your bank will help you secure your accounts, which may include changing your account numbers to prevent fraudsters from regaining access and replacing your debit and credit cards.

- Update your passwords, and enable 2FA on your online accounts: Do a thorough audit of your accounts by creating new, strong and unique passwords for each one. Using a password manager can help with this process. For added protection, set up two-factor authentication (2FA) using an authenticator app for all your online accounts where possible.

- File a police report: Go to your local police department with your FTC identity theft affidavit and any other documents listing the fraudulent activity to report the identity theft. Obtain a copy of the police report to help support the identity theft credit repair process when you’re disputing purchases or fake accounts created in your name.

2. Contact the provider of your identity theft protection service

Your identity theft insurance or identity theft protection provider can help you report the identity theft and assist you throughout the credit score recovery process. The sooner you contact them, the more benefit you’ll gain from their expertise.

Some identity theft protection services, such as LifeLock, offer assistance and reimbursement for stolen funds in the event you have money stolen due to identity theft. With LifeLock, you’ll also get financial coverage for lawyers and experts to help resolve your case, as well as access to U.S.-based restoration specialists to personally handle your case and handle the identity theft restoration process.

3. Get copies of your credit reports

Your credit reports are crucial for identifying and disputing fraudulent activity. Fortunately, you can get free copies of your credit reports from all three credit bureaus through the Annual Credit Report website. You're entitled to one free report from each bureau every 12 months. Additionally, if you place a fraud alert on your credit file, you can continue to access your reports for free.

Carefully reviewing your credit reports is key to spotting and disputing fraudulent activity. Since each of the three major bureaus—Experian, TransUnion, and Equifax—may have different information, it's important to check all of them for errors. If you find inaccuracies or suspicious activity, contact the credit bureaus right away to correct these issues and begin repairing your credit.

4. Check your bank and credit card statements for fraud

Examine every charge on your bank and credit card statements for signs of credit card fraud, paying close attention to any unfamiliar transactions, regardless of the amount. If a vendor name seems unfamiliar, a quick Google search can help clarify it, as vendors often use different billing names.

Highlight or make a list of all the unauthorized transactions you find and any unusual account activity. You’ll need the date of each suspicious charge, the amount, and the vendor name to report the fraud and dispute the transactions.

5. Check public records for fraud

Public records are government documents accessible to anyone, sometimes free of charge or for a small fee. Since the 2017 National Consumer Assistance Plan (NCAP), bankruptcy is typically the only public record on credit reports. However, you should still check for other fraud in your name, like unexplained tax liens, property ownership, civil judgments, criminal records, and employment-related fraud.

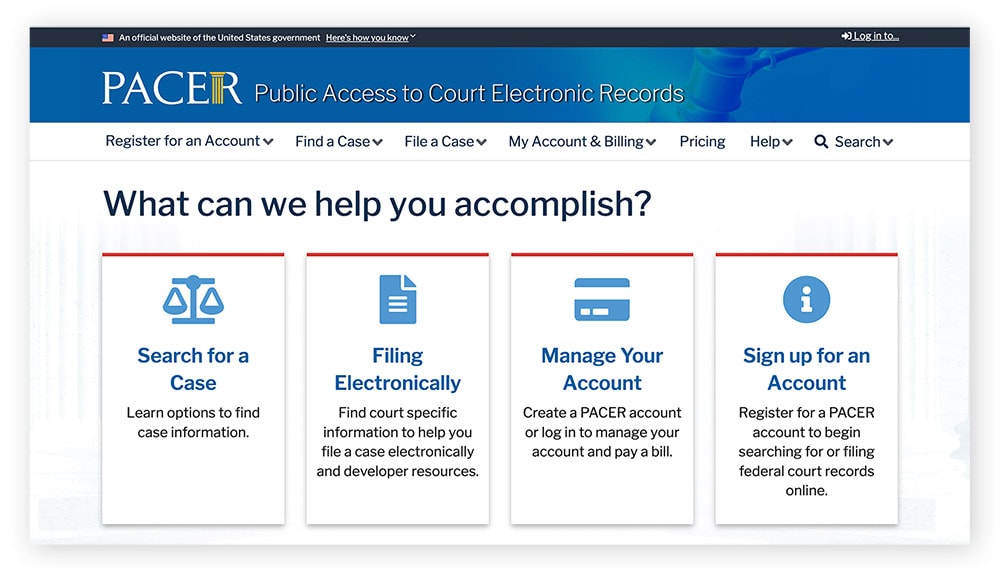

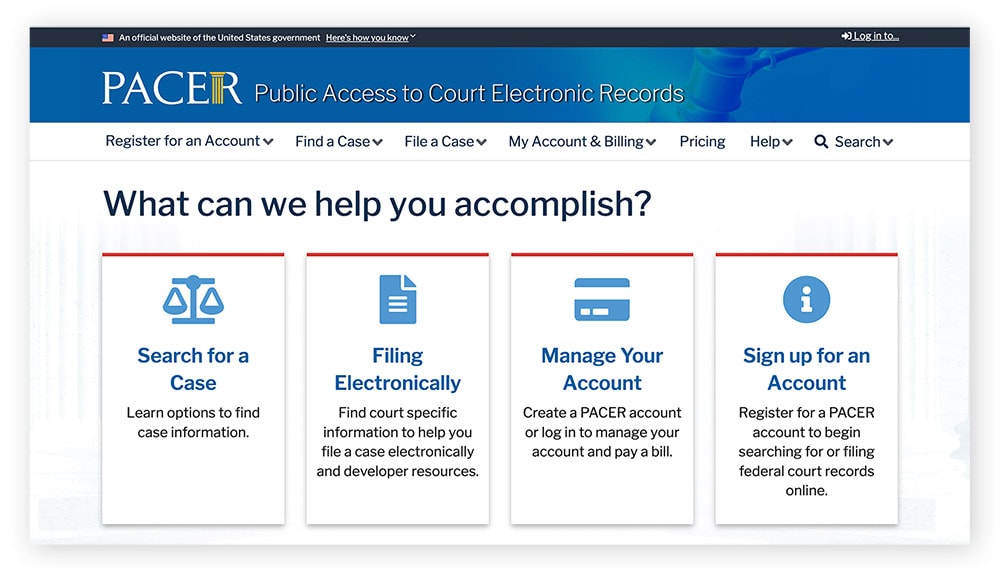

To make sure the public record is accurate, start by checking court records for your name. You can do this either by searching PACER, the official court records website of the U.S. government, or by checking in person through a public access terminal at your county courthouse.

There are also online public records directories such as Netronline for real estate and tax inquiries, and you can contact the Social Security Administration to ask about any suspicious activity related to your Social Security number.

6. Dispute fraudulent public records

If your public records search reveals incorrect information, disputing those records is your next step. Schedule an appointment at your local public records office and bring your FTC identity theft affidavit, police report, proof of identity, and any other documents that support your case.

7. Inform debt holders that your identity was stolen

Contact the fraud department of each business where you have debt in your name—this includes both real accounts and fraudulent accounts. Inform them that your identity was stolen and ask them to close or freeze the fraudulent accounts.

Reporting identity theft to debt collectors can stop companies from trying to collect fraudulent debts and help prevent further damage to your credit report from these illegitimate debts being reported to the credit bureaus. To do so, you’ll need to provide proof of your identity and your FTC identity theft affidavit, along with any other evidence you have, such as a police report.

The U.S. Justice Department provides examples of draft letters you can use when contacting businesses and other agencies about identity theft. Here’s their example of how to inform a debt collector via email or letter that your identity was stolen—insert your own information into the text in brackets:

Draft email to a debt collector

[Date]

[Your Name]

[Your Address]

[Your City, State, Zip Code]

[Name of Credit Collection Company]

[Company Address]

[City, State, Zip Code]

[RE: Your Account Number (if known)]

I am a victim of identity theft. An identity thief used my personal information without my permission to make purchases with [name of business where account was opened]. This debt is not mine. I have enclosed proof of my identity and a copy of my Identity Theft Report.

In accordance with the Fair Debt Collection Practices Act, I am asking you to immediately stop all collection activities about this debt, and stop reporting it to credit bureaus. I also ask that you tell the business where the account was opened that this debt is the result of identity theft.

I have enclosed a copy of the Notice to Furnishers of Information. It explains your responsibilities under the Fair Credit Reporting Act (FCRA). The FCRA requires that debt collectors give an identity theft victim documents related to an account if the victim asks. Please send me copies of all records relating to the account, including:

- Account applications made on paper, online, or by telephone

- Account statements or invoices

- Records of payment or charge slips

- Delivery addresses associated with the account

- Records of phone numbers used to activate or access the account

- Signatures on applications and accounts

- Investigator's report

Please send me a letter explaining what you have done to:

- Inform the business where the account was opened that the debt is the result of identity theft

- Stop collection activities against me

- Stop reporting information about the debt to credit bureaus

- If you've already reported the debt to credit bureaus, notify them that the debt is the result of identity theft

- Provide me with the records I request

Thank you for your cooperation.

Sincerely,

[Your Name]

Enclosures: [List what you are enclosing]

- Proof of Identity [a copy of your driver's license or state ID]

- Identity Theft Report

- Notice to Furnishers of Information

Source: Justice.gov

8. Dispute fraudulent charges and credit accounts

After identifying the fraudulent charges and accounts, it's time to dispute fraud on your credit report. A credit dispute involves providing evidence to support your claim that these charges were due to identity theft. You can initiate this process with the lenders where the charges occurred or directly with the three credit bureaus.

For each fraudulent account or transaction, gather the account number, transaction dates, amounts, and any supporting documentation. Include a copy of your FTC identity theft affidavit, the police report, and proof of your identity, like a driver's license. This information is crucial for building a strong case when disputing fraudulent activity.

When contacting lenders, ask them to respond to you in writing with confirmation that they have removed the fraudulent charges and any associated fees. Filing disputes with the credit bureaus can be done online, by phone, or by certified letter.

9. Have fraudulent hard credit inquiries removed

Hard credit inquiries are registered on your credit report whenever your identity is used to apply for credit, take out a loan, or open a new account. These inquiries impact your credit score (unlike a soft inquiry when you check your credit score by yourself) and can remain on your credit report for up to two years.

Even if the fraudulent accounts have been removed from your credit report, multiple hard credit inquiries can seriously lower your credit score.

To get hard credit inquiries removed from your credit report, you have two options:

- Dispute the hard inquiry with the creditor: Begin by contacting the creditor who initiated the credit inquiry. Write a letter explaining why the inquiry is fraudulent, and include copies of your evidence, such as the FTC identity theft affidavit and the police report.

- File an official dispute with each of the credit bureaus: If the creditor doesn’t cooperate, you’ll need to open a dispute with all three of the major bureaus: Experian, Equifax, and TransUnion.

10. Update recurring accounts with new credit and account numbers

If you have new credit cards or account numbers, you’ll need to update all your recurring payments such as utility bills, loans, credit cards, and other debts. It’s vital to keep paying your real bills on time because a consistent payment history is the most important factor in determining your credit score.

The easiest way to ensure you don’t miss any repayments is to set up automatic payments. So long as there’s money in your account, you’ll never miss a due date.

How long will it be before your credit is fixed?

Identity theft credit repair can be a long process. Exactly how long it takes to fix your credit after identity theft depends on factors such as how many fraudulent charges you have to dispute and if there are new accounts or loans in your name.

Credit agencies are required to complete an investigation into your dispute within 30 days, so you can expect it to take at least a month or more if you need to dispute charges with more than one agency.

The good news is that credit bureaus usually update credit scores monthly. Once fraudulent charges and accounts are removed, your credit score should start improving relatively quickly. Although identity theft recovery can be challenging and have lasting effects, rebuilding your credit and improving your score is achievable with time and effort.

Should you use a credit repair agency?

It’s possible to repair your credit on your own without needing a credit repair agency. But if you want to save time and avoid hassle, enlisting a reputable credit repair agency is a great option.

Credit repair agencies work on your behalf to address inaccuracies on your credit reports and improve your credit score. While many agencies provide legitimate services, beware of scams aiming to access your personal information.

Here are some of the warning signs that a credit repair agency may be a scam:

Tips for protecting your credit and identity against thieves

It can be quite distressing to discover that it doesn’t take a lot of personally identifiable information (PII) for a thief to steal your identity. Reducing the likelihood of identity theft may sound challenging, but there are steps you can take to safeguard your credit and personal information.

Here are some tips to help protect your identity and credit against thieves:

- Sign up for identity theft protection: Typically these services include credit monitoring to alert you of any suspicious activity or new accounts opened in your name. Other benefits can include privacy alerts if your personal information is leaked or shared online, and support from identity restoration specialists if your identity is stolen.

- Freeze or lock your credit preemptively: Locking or freezing your credit through the main credit bureaus is a quick way to prevent identity thieves from applying for new credit accounts in your name. A credit lock is faster than a credit freeze, letting you lock and unlock access to your credit report more flexibly.

- Request credit reports annually: When you regularly check your credit reports, it’s easier to identify any strange activity that might indicate someone else has been using your credit. This will help you find identity theft sooner and take action more quickly.

- Remove PII from the web: The more you share about your life online, the easier it is for cybercriminals to piece together your identity. Becoming more mindful of what you post, reviewing your privacy settings, and reducing your online footprint is a great way to protect your and your family’s personal information.

- Use a VPN, especially in public: VPNs conceal your online activity, making it difficult for data brokers and hackers to access your information. Using a VPN is especially important on public Wi-Fi, where your data is vulnerable to interception by anyone monitoring the network.

- Set and follow strict security practices: Regularly update your passwords and use unique ones for each account. A secure password manager can help you generate and store these passwords, and adding 2FA provides an extra layer of security to reduce the risk of identity theft.

- Learn how to spot a phishing attack: Staying vigilant and knowing how to identify a phishing scam can help you avoid being tricked by identity thieves trying to steal your personal information.

Reduce the risk of identity theft

To help protect against identity theft and recover from credit fraud, you need a reliable identity theft protection service that will help you keep track of your financial information and provide you with the support you need to recover if the worst ever happens.

LifeLock is a comprehensive identity theft protection service that helps you monitor your credit and alerts you to potentially fraudulent use of your personal information in applications for credit and other services. And if you do suffer from identity theft, LifeLock’s U.S.-based restoration specialists are standing by to help you recover.

FAQs about identity theft credit repair

What is an identity theft alert?

An identity theft alert (also called a fraud alert) is a note on your credit report that tells potential creditors they should verify your identity before extending credit in your name.

Identity theft or privacy monitoring services, such as those provided by LifeLock, also offer identity theft alerts that notify you directly when your personal information is found in new credit applications or when businesses try to verify your identity.

How do I remove identity theft alerts from my credit report?

Identity theft alerts automatically expire after one year unless extended. To remove an alert early, contact each credit bureau where it was placed and provide documentation to verify your identity.

How long does it take to get identity theft off of my credit report?

Removing fraudulent information connected to identity theft from your credit report can take a month or more. When you file a dispute, the credit bureau must respond within 30 days with the results of their investigation. Depending on the outcome, they will verify, correct, or remove the disputed information.

How do I check to see if someone is using my Social Security number?

You can check to see if someone is using your Social Security number by reviewing the earnings posted in your Social Security statement, which is available online at My Social Security.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.