Tip: Taking a proactive approach to your rental search and providing potential landlords with a credit score you've pulled yourself, which is considered a soft inquiry and won't impact your score, may help you bypass a hard inquiry that can lower your credit score.

Passing a rental credit check is one of the final steps toward securing a rental property. Landlords use credit checks to review your credit history and score, evaluating your ability to pay rent on time. You likely won't run into any challenges if you have a good credit score, but a poor credit score can make it more difficult to secure a rental.

The good news is that, even if you have poor credit, there are additional steps you can take to boost your potential landlord’s confidence in your ability to pay rent on time. Here are six of the best ways to increase the chance that you pass a rental credit check.

1. Check your credit score

Before starting your rental search, you should investigate your current credit performance to get an idea of whether you’ll face issues with rental credit checks. There are several ways to check your credit score:

- Use your bank or credit card provider: Many credit card companies provide credit score information as part of their service for cardholders. Your credit score may also appear on bank statements, depending on what banking institution you use.

- Check the credit bureaus: The three major credit bureaus (Equifax, Experian, and TransUnion) offer limited access to credit reports and credit score updates if you create an online account.

- Use a credit monitoring service: LifeLock Total includes credit score monitoring, with daily VantageScore 3.0 updates based on Equifax data, meaning you can check your latest credit score whenever you want.

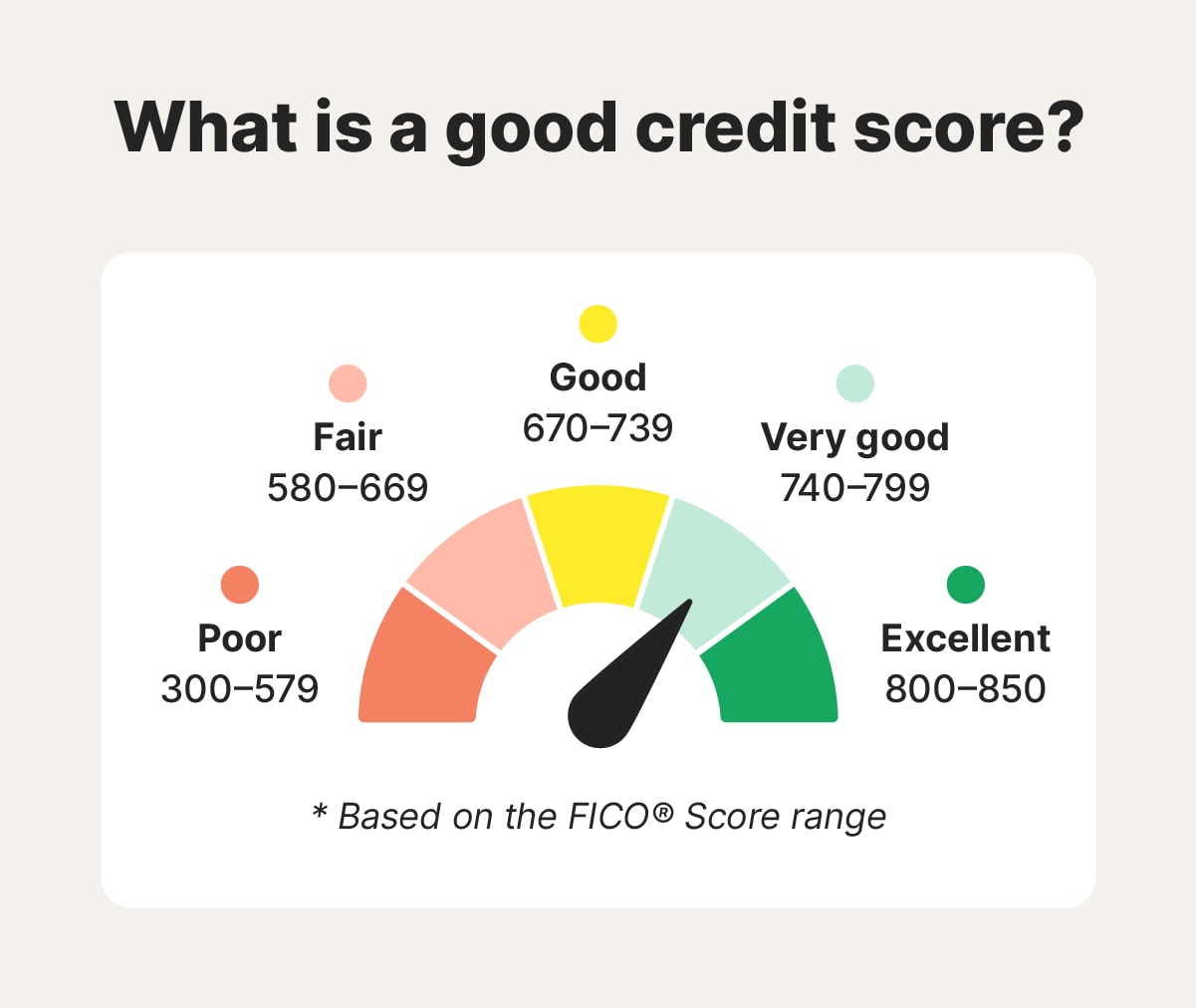

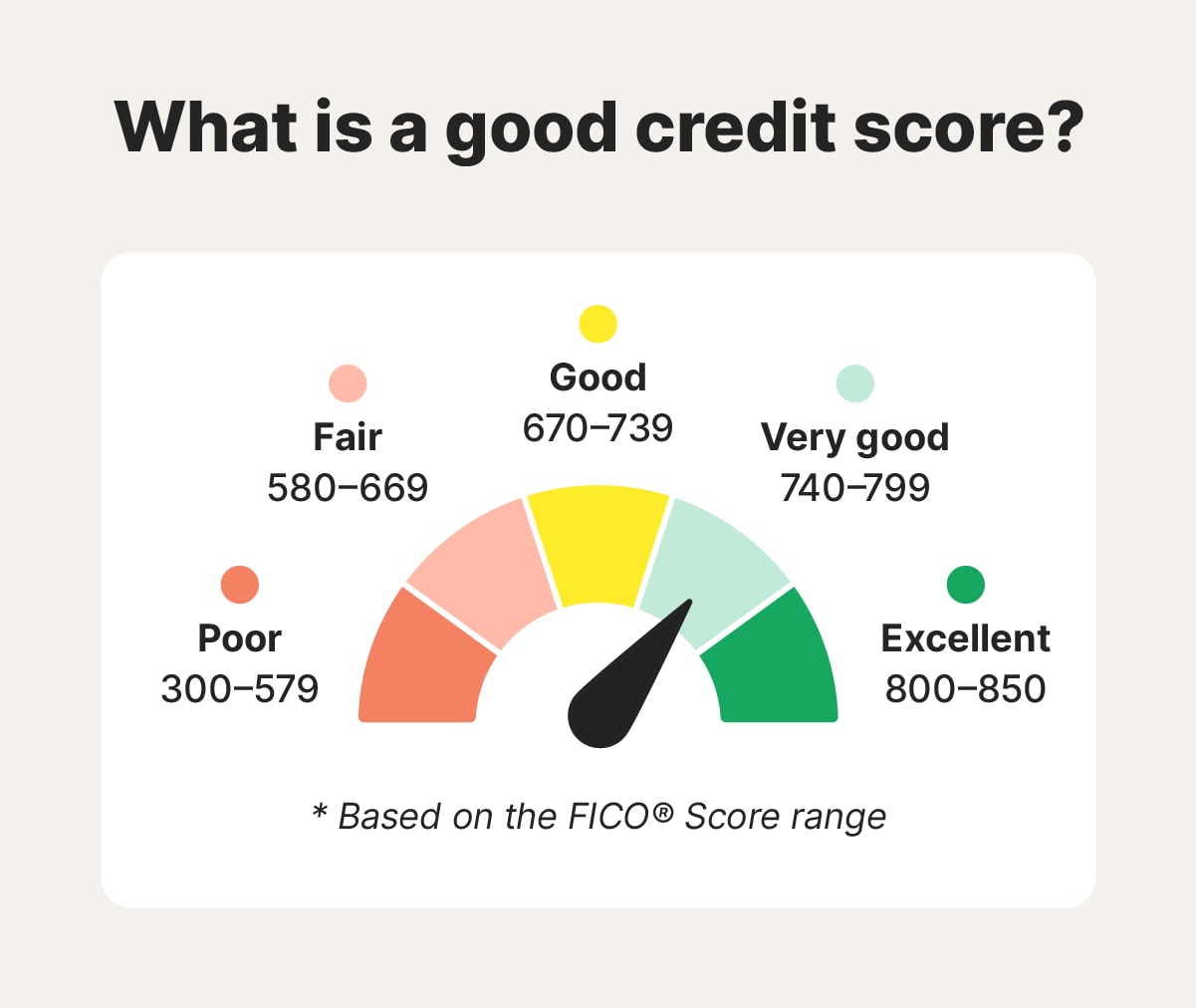

What constitutes a good credit score for renting varies depending on the landlord’s policies and the rental value. However, a score of 670 or above puts you in the “Good” and “Prime” categories in the FICO and VantageScore models, respectively. While it doesn’t guarantee anything, this should help your chances of passing a rental credit check.

2. Dispute credit report errors

If your credit score is lower than anticipated, reviewing your credit report might help you identify potential causes. For example, errors on your credit report can negatively impact your score, so checking for and disputing credit report inaccuracies could help you find opportunities for a quick credit score increase.

You can go to AnnualCreditReport.com to get a free weekly copy of your credit report from each of the major credit bureaus.

For more frequent access, get LifeLock Total. With LifeLock Total, you’ll also benefit from our automatic credit monitoring feature, which alerts you to potentially fraudulent changes to your credit report, and a suite of identity theft protection tools.

To dispute an issue you find on your credit report, contact the major credit bureaus online, by phone, or by mail.

Equifax |

Experian |

TransUnion |

|---|---|---|

(888) 378-4329 |

(888) 397-3742 |

(800) 916-8800 |

Equifax Information Services LLC |

Experian |

TransUnion Consumer Solutions |

They have 30 days to investigate and respond to your dispute. If they agree on an error, they’ll correct it, reversing any negative impact the inaccuracy had on your credit score.

3. Provide proof of income

Many landlords ask for proof of income in addition to a credit check. This helps them confirm that the rental amount doesn’t represent too large a portion of your total monthly income, which provides reassurance that you can comfortably afford the payment.

While the required rent-to-income ratio for a specific rental depends on multiple factors, many landlords work off a general rule of thumb that it should be no more than 30%. In other words, your total monthly income should be at least three times greater than the monthly rent amount.

Providing proof of income can help you mitigate issues caused by a poor credit score. A long track record of stable income that puts you above the recommended rent-to-income ratio threshold may prove that you can afford the rent, even if your credit history isn't perfect.

To check your income, a landlord might request:

- Pay stubs

- W-2s

- Tax returns

- Employment verification letters

- Bank statements

4. Offer advanced payments or a higher deposit

While many rental agreements already require a security deposit, if you have a poor credit score, you may need to offer a rent advance as well. This involves paying several months' rent in a lump sum before moving in.

Alternatively, you could offer a higher security deposit. While there are maximum deposit limits imposed on landlords on a state-by-state basis, if the deposit they request is below this threshold, providing a larger upfront payment could help you secure the rental.

Both of these options can help demonstrate you’re financially responsible and capable of meeting rental payments, while also giving the landlord more security.

5. Get a co-signer

A co-signer is a trusted family member or friend with good credit who signs the rental lease with you and agrees to cover rent payments if you can't, reducing the risk of non-payment for the landlord.

It’s important to note that if you fail to pay rent, the co-signer will legally be obligated to cover the payments, which could impact their financial situation. Since this is a significant responsibility, discuss the terms clearly with your co-signer to avoid any misunderstandings.

6. Use a reference

A reference is someone who can vouch for your character and reliability. If you have poor credit, providing a reference can help reassure landlords that you're a responsible tenant despite your credit history. Before sharing a reference's name and contact information with a potential landlord, discuss the situation and confirm they’re willing to speak on your behalf.

When thinking about a strong reference, consider reaching out to your:

- Previous landlord

- Neighbor

- Employer

- Colleague

- Professor

Be clear about what the landlord might want to know when asking a reference to provide a recommendation. Your reference could highlight traits that landlords look for, such as reliability, strong communication skills, and neighborly behavior.

Why do landlords require rental credit checks?

Landlords want tenants who consistently pay rent on time. Credit checks help them evaluate your financial responsibility by quantifying your track record of on-time payments and debt management.

A high credit score and strong credit report with no missed payments indicate that you’re likely to manage your finances well and prioritize rent payments, making you appealing to a landlord.

Rental credit check red flags that may cause a landlord to take pause include:

- Missed or late payments

- A high debt-to-income ratio

- Bankruptcies

- Accounts in collections

- A low credit score

What’s included in a credit check?

Credit checks provide potential landlords with a summary of your credit history, and they’re only conducted with your explicit permission. Here's what credit checks typically include:

- Credit score

- Payment history

- Information about all open and closed credit accounts

- Public records

- List of recent credit checks

Although your debt-to-income ratio isn’t usually included in a credit report, it can often be inferred from other information, like payment history and open or closed credit accounts. Landlords typically prioritize factors like credit score and payment history over other information like recent credit checks.

What credit score do I need to rent an apartment?

There’s no universal rule for what credit score you need to rent an apartment, but landlords may favor tenants with a credit score of 670 or above, which represents a “Good” or “Prime” score in the FICO® and VantageScore® models, respectively.

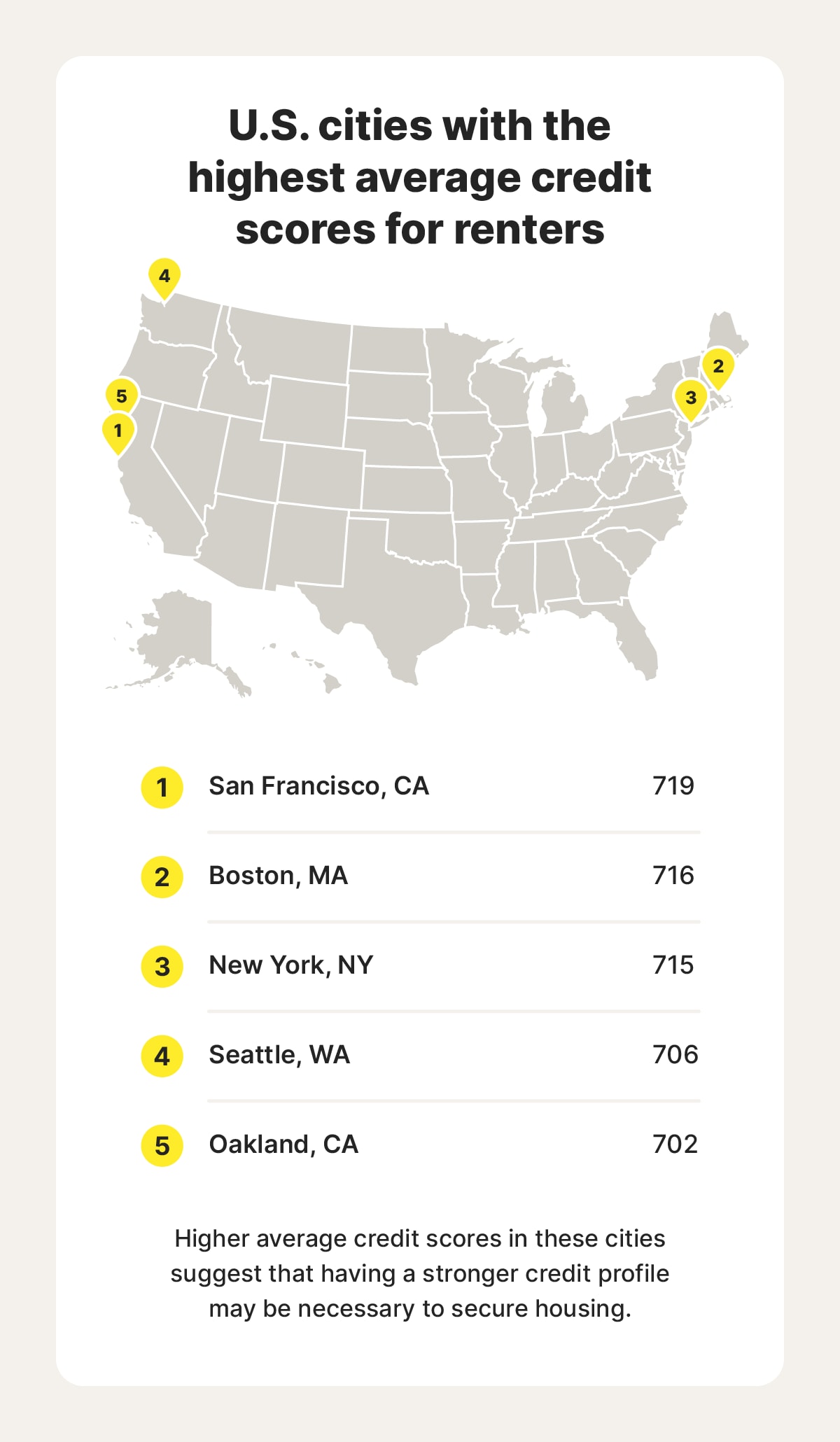

However, an analysis by RentCafe shows that the average credit score for U.S. renters is 638, demonstrating that many landlords are open to renting to tenants with lower scores. What credit score will get your rental application approved depends on factors like the type of apartment you’re applying for, the local rental market, your income, and the rental price.

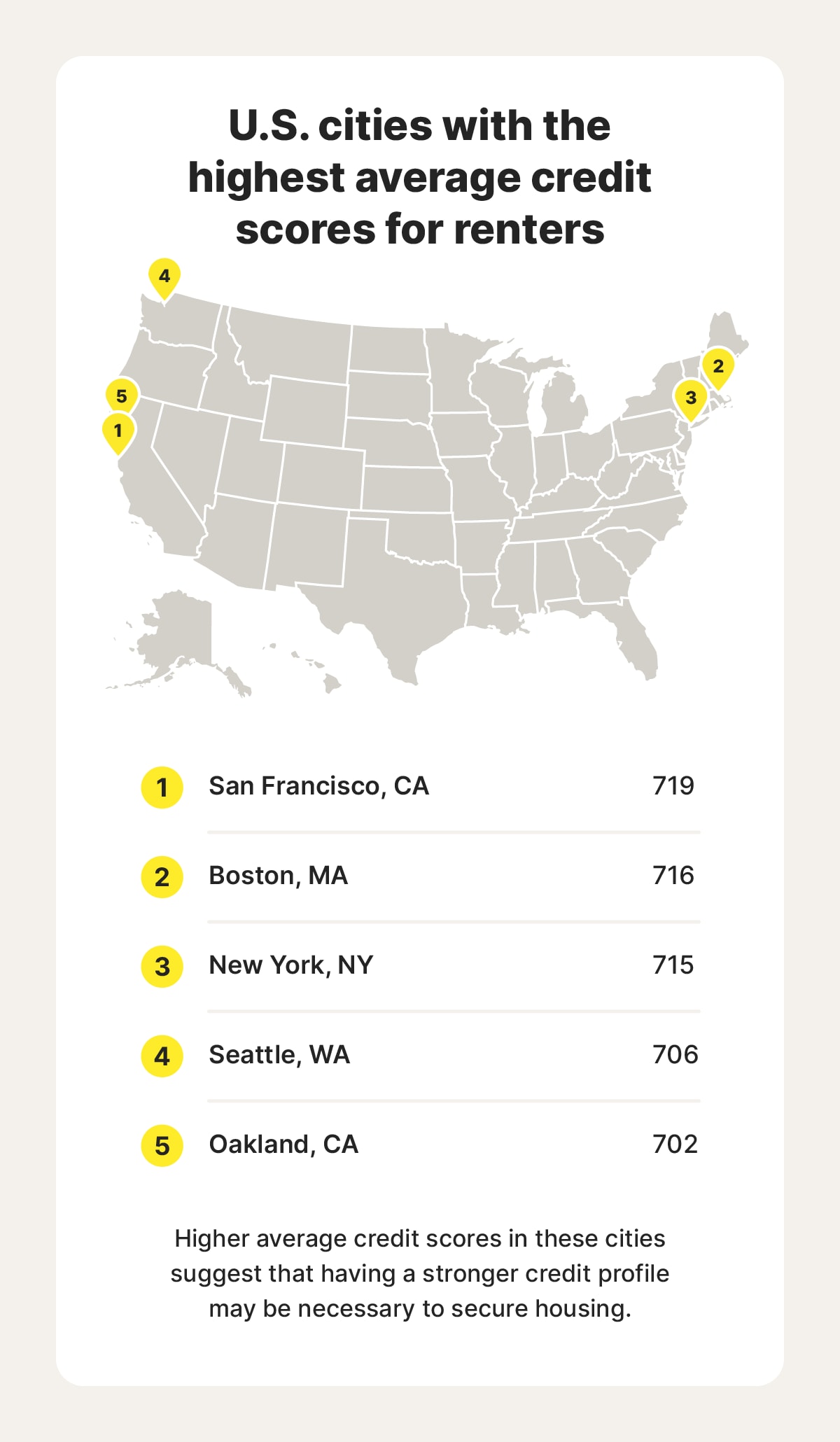

Locations with higher average renter credit scores — often more expensive or densely populated areas — might have higher average thresholds for approval, for example.

A higher credit score may improve your chances of securing housing in these more competitive markets, but remember that it’s not the only factor landlords consider.

Your credit score doesn’t take your income into account, but you may be able to prove that you’re a trustworthy renter by providing proof of income — even with a credit score below the ideal threshold.

How to improve your credit score

A poor credit score doesn't mean you're destined to live in your parents’ or a friend’s home forever. There are steps you can take to improve your credit, potentially strengthening your chances of securing a rental property.

Use the following strategies to start improving your credit if you’re hoping to secure a rental of your own:

- Invest in credit monitoring: Services that offer credit monitoring features, like LifeLock Total, can detect key changes to your credit file, helping you identify potential fraud and protect your credit score from the consequences of identity theft.

- Pay bills on time: A positive payment history is the most important factor in most credit score models. Consistently making payments in full by their due dates should help increase your score over time.

- Reduce credit card balances: To demonstrate responsible credit management, aim to keep your credit utilization below 30% of your available credit, but above 0%.

- Avoid opening too many accounts: Every time a hard credit check is made on your file, your score will take a slight hit. These checks are made when you apply for new credit, so only submit applications when necessary and check your own credit score beforehand to assess the likelihood you’ll be approved.

- Dispute errors on your credit report: Regularly review your credit reports for inaccuracies and report any errors to the credit bureaus.

- Establish a positive credit history: If you’re new to credit, start with just one credit card, get a secured credit card, or become an authorized user on someone else’s account to build credit responsibly.

- Avoid closing old accounts: Older accounts contribute to the length of your credit history, which is a factor in most credit score models. Avoid them being closed automatically, by using them to make small payments every now and then, where possible.

- Focus on paying off debt: Prioritize paying down high-interest debts to improve your debt-to-income ratio and free up financial resources.

Protect your credit from harm

Having a low credit score doesn't have to prevent you from securing your next rental property. Following the steps listed above can increase your chances of getting approved, even if your credit isn't perfect.

To help protect your credit in the process, join LifeLock Total. As a member, you’ll get alerts of suspicious activity that could impact your credit score. You’ll also benefit from daily credit score and credit report updates, helping you track your credit score improvement journey so you can work on landing the rental of your dreams.

FAQs

Can you rent with a credit score of 500?

A credit score of 500 is considered poor, which may make it more challenging to find a rental. However, you may still be able to secure a rental if you’re able to provide proof of sufficient income, offer advance payments or a high deposit, get a co-signer, or use a reliable reference.

Do all apartments check credit?

Most, but not all, apartments require a credit check. If you're searching for a rental property that doesn't conduct a credit check, you may have better luck with a private landlord than an established, centrally-managed apartment complex.

How long does it take to hear back from a rental application?

How long it’ll take to hear back following a rental application varies depending on who you’ve made the application to. However, you can generally expect to get a response from most rental companies and landlords within a week of applying.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- 1. Check your credit score

- 2. Dispute credit report errors

- 3. Provide proof of income

- 4. Offer advanced payments or a higher deposit

- 5. Get a co-signer

- 6. Use a reference

- Why do landlords require rental credit checks?

- What’s included in a credit check?

- What credit score do I need to rent an apartment?

- How to improve your credit score

- Protect your credit from harm

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.