* Experian’s free credit monitoring service used as an example for illustrative purposes only.

††† Up to $1 million for coverage for Lawyers and Experts included on all plans. Reimbursement and expense compensation varies according to plan—up to $1 million each for LifeLock Total. Insurance benefits are issued by third parties. See us.norton.com/legal for policy info.

What is a credit monitoring service?

A credit monitoring service tracks your credit reports from one or more bureaus and alerts you to changes, such as new accounts, inquiries, or unusual activity. These services act as a safeguard for your financial health, notifying you of any significant alterations to your credit profile that may signal fraud or identity theft.

Since credit card fraud is one of the most commonly reported types of identity theft, with over 449,000 reports to the FTC in 2024, monitoring your credit is one of the most powerful steps you can take to help protect your identity and, by extension, your finances.

How does credit monitoring work?

Credit monitoring services continually scan your credit reports from one or more bureaus for changes. They’re typically configured to detect new accounts, credit inquiries, late payments, and unusual patterns, flagging anything that could indicate someone is making credit applications or changes in your name.

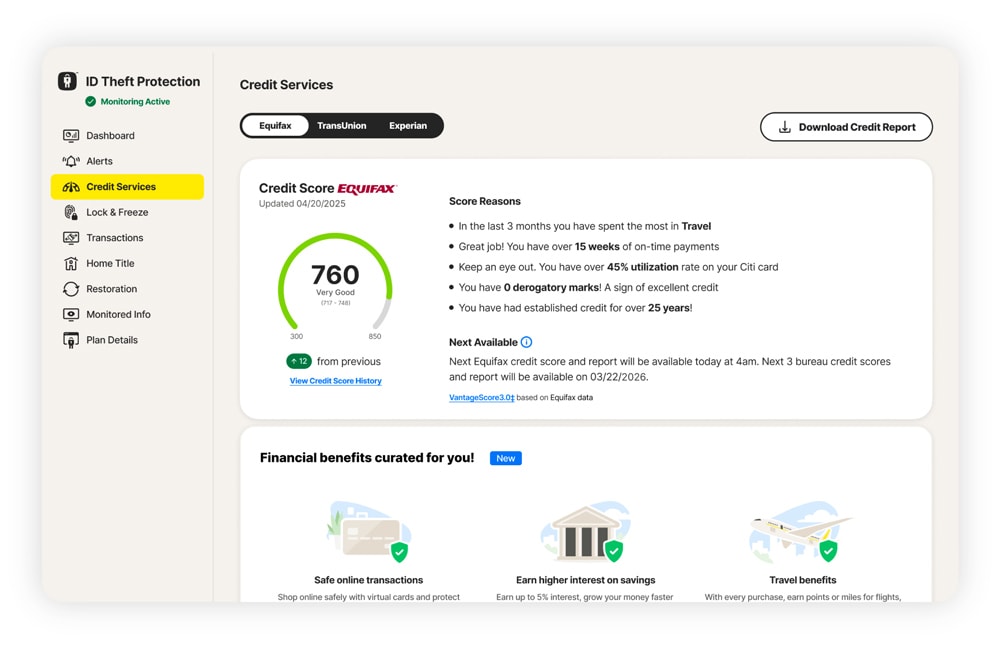

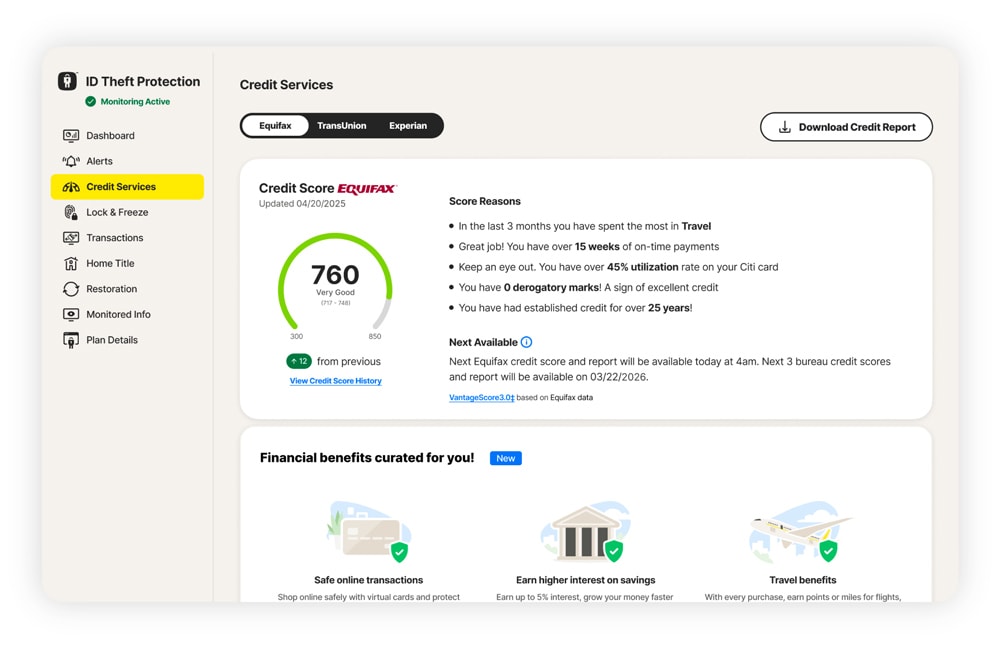

The most comprehensive credit monitoring tools aggregate data from all three major credit bureaus (Equifax, Experian, and TransUnion) in real time and use algorithms to quickly identify suspicious activity. If anything unusual is detected, you’ll get an alert via email, the app, or text, prompting you to review the activity immediately and take action to protect your credit.

For example, imagine someone who stole your Social Security number (SSN) applies for a new credit card in your name without your knowledge. With a credit monitoring service set up, you would receive an alert as soon as the credit inquiry is detected, as opposed to only seeing it when you next open a credit report (or missing it altogether).

That warning would prompt you to take steps to recover and protect yourself against additional fraud, like contacting the credit issuer to explain that the application is fraudulent and freezing your credit to help prevent further issues.

Benefits of credit monitoring

The key benefit of a credit monitoring service is that it helps you stay informed by automatically tracking new accounts, credit score updates, and potential issues, including signs of identity theft, meaning you don’t have to constantly check your credit reports manually.

Here’s how it can help you protect your finances and simplify managing your credit:

- Fraud detection: Alerts you to suspicious activity like credit applications or new accounts as they’re detected, so you can act quickly and potentially protect against identity theft before it harms your credit.

- Up to three-bureau coverage: Credit monitoring services are typically tiered based on how many bureaus are monitored, with three-bureau monitoring representing the most comprehensive service. Three-bureau monitoring makes it easy to track signs of fraud across your Equifax, Experian, and TransUnion reports with one tool, as opposed to requesting reports from each bureau separately.

- Access to credit reports and scores: Some services, like LifeLock Total, offer daily credit reports and credit score updates, giving you a clearer view of your credit health and helping you build toward financial goals.

- Peace of mind: Knowing your credit is monitored can help you feel more secure about your financial health, rather than constantly worrying about the threat of fraud going unnoticed.

- May include additional protections: Some services that provide credit monitoring also include other identity theft protection features, expert identity restoration services, stolen wallet assistance, and other safeguards, like dark web monitoring and home title theft detection, that add an extra layer of protection.

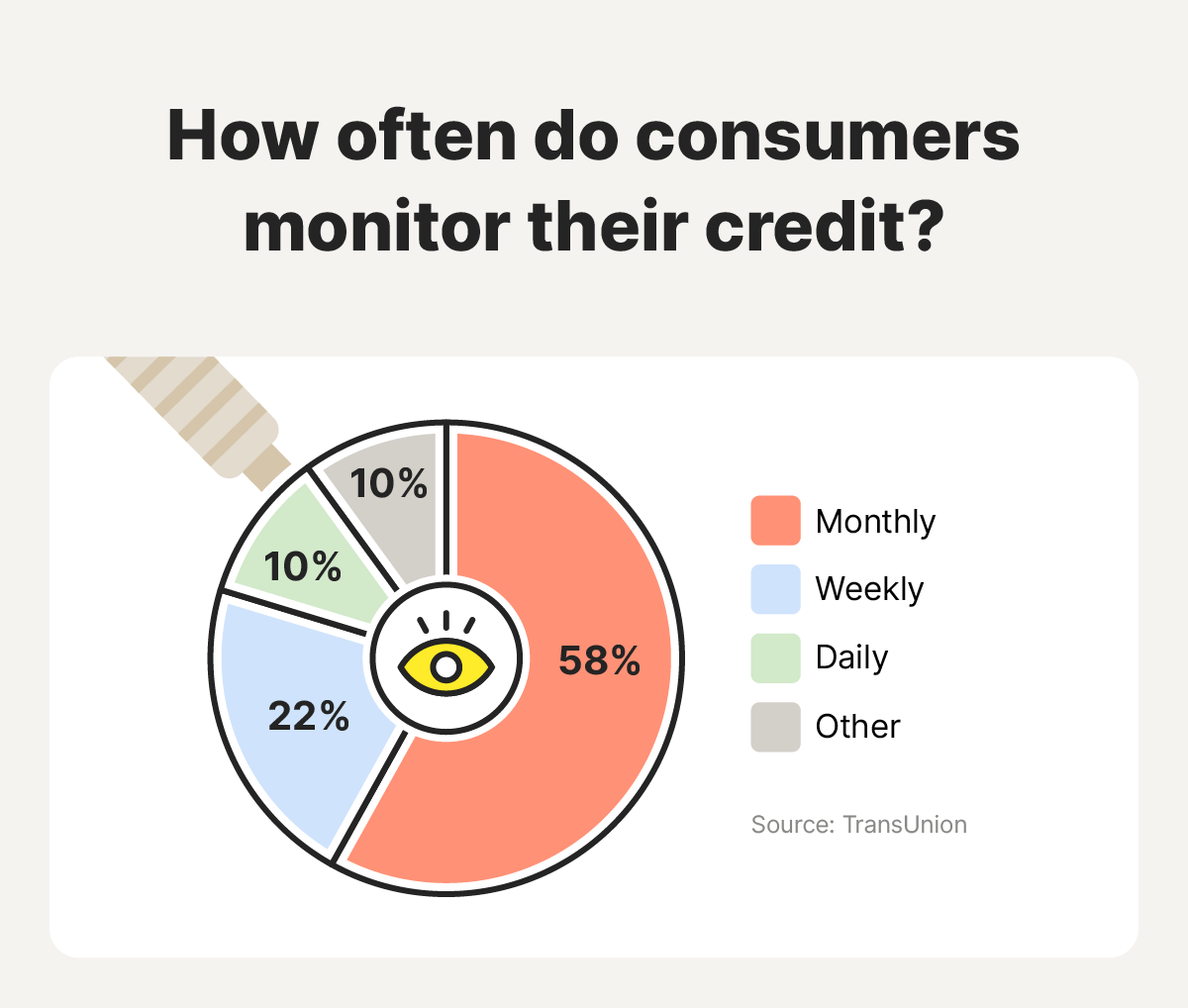

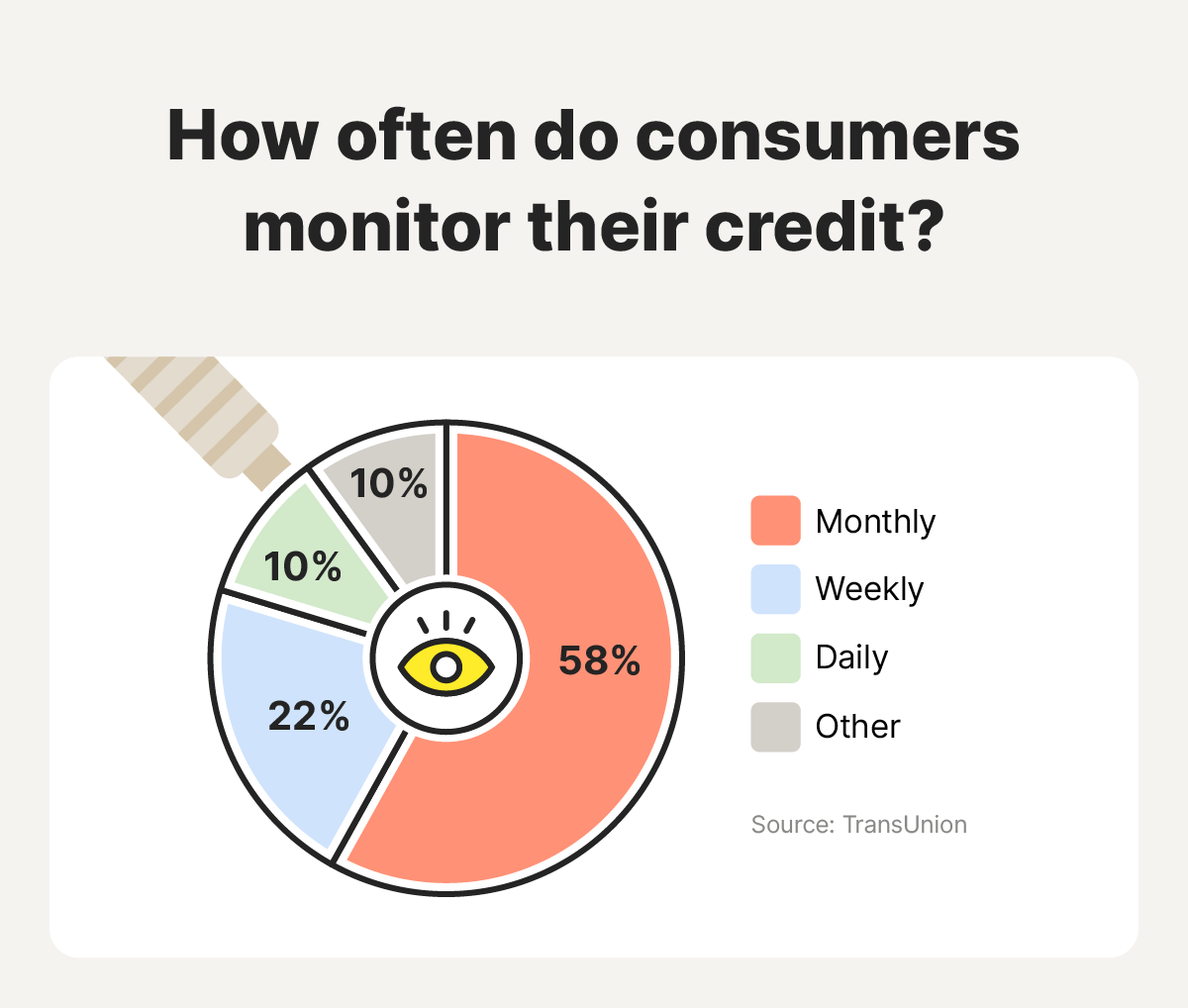

It’s generally recommended that you check your credit report at least once a year, but more frequent checks improve your chances of catching signs of fraud early. Using a credit monitoring service can stop you from having to check your reports at all, relying on automatic detection of unusual activity instead.

Limitations of credit monitoring

While credit monitoring is a valuable tool for overseeing risks, no service can prevent all identity theft. Credit monitoring services alert you after suspicious activity appears on your credit report, which means certain threats can go undetected until they’ve already caused harm.

However, the counterpoint to this limitation is that it’s still better to catch these threats as early as possible, which credit monitoring can help with.

Another argument against investing in a credit monitoring service is that you can monitor your credit manually, largely for free. This would involve requesting credit reports from the major bureaus on a regular basis, tracking your score using a free credit score tool, and potentially placing proactive protections, like a credit freeze or fraud alert.

But the manual approach has downsides: it’s time-consuming, doesn’t offer real-time alerts of potentially fraudulent events, and relies on you being able to spot an issue on your credit report.

It may also leave you blind to other threats like tax fraud or medical identity theft, which services like LifeLock provide visibility over by combining credit monitoring with broader identity theft protection. This includes continuously scanning for other risks like your SSN being used in an application or your information being exposed in a data breach.

Even with these protections, practicing good cybersecurity habits, such as using strong and unique passwords, minimizing exposure of your information online, and staying alert to common phishing strategies, is important for protecting your personal data.

When credit monitoring is worth it

Credit monitoring is worth considering if you’re worried that fraudsters may have access to your personal information or you simply want to keep tabs on your credit activity. It’s especially important after a data breach involving your information, in the lead up to making major financial applications, or if you’re concerned about identity theft.

Here’s a closer look at situations that might prompt you to think about investing in a credit monitoring service.

After a data breach

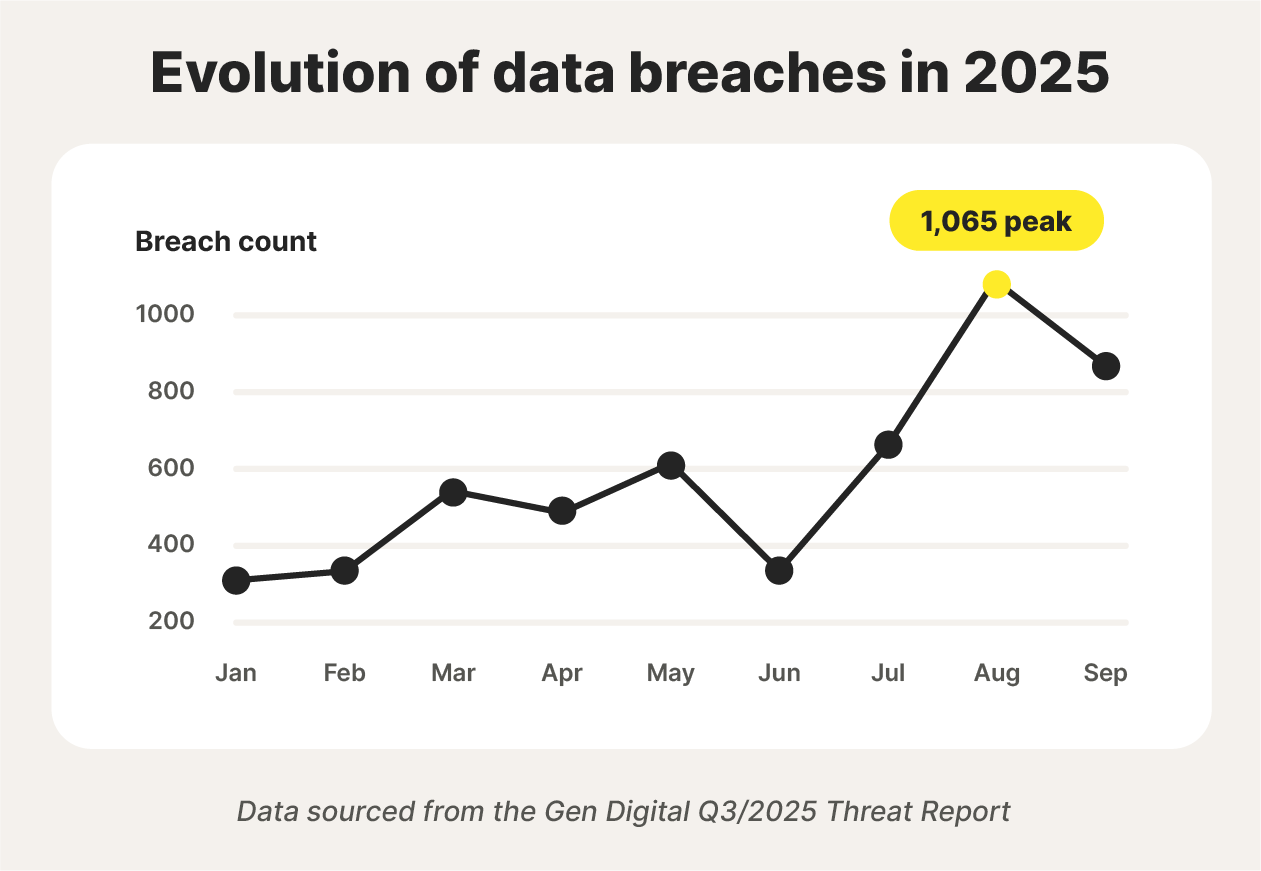

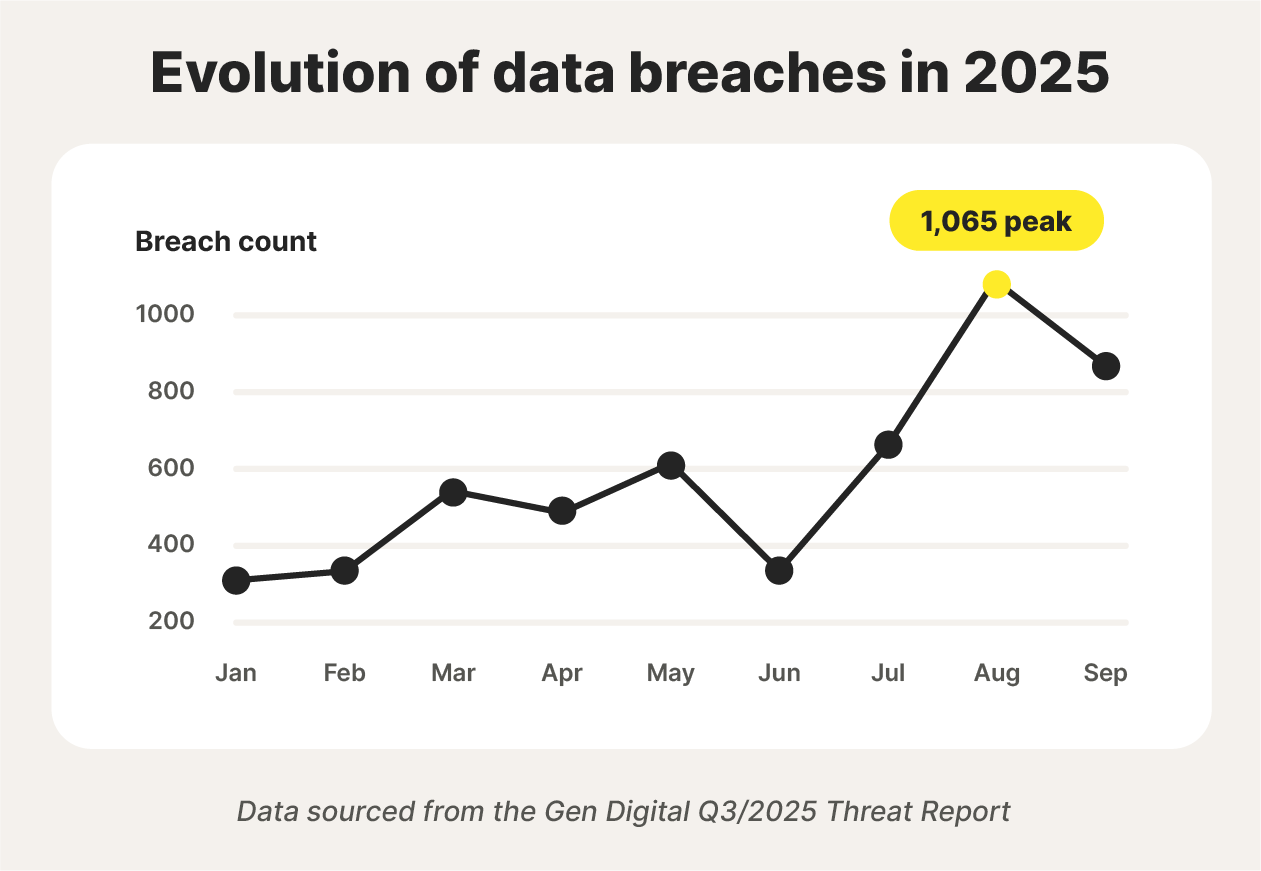

Data breaches are a near-constant risk. The Gen Digital Q3/2025 Threat Report noted that the third quarter of 2025 saw the greatest number of breach events in the year, increasing by 76% compared to the previous quarter. And each breach exposes sensitive information like SSNs, financial account details, and login credentials, all valuable to fraudsters and identity thieves.

When your information is compromised in a data breach, it can be used directly by criminals, who may open new accounts in your name, get access to your bank account, or commit other forms of identity theft. Alternatively, it might be sold to other criminals on the dark web, leaving you vulnerable to fraud in the future.

Signing up for a credit monitoring service after a breach gives you an immediate advantage. These services track changes to your credit reports and alert you to suspicious activity found, so that you can respond to potential threats as they appear. And, given the frequency of breaches, setting up credit monitoring is a smart precaution, even if your information hasn’t been compromised yet.

When preparing for major financial applications

Applying for a mortgage, car loan, or new credit card puts your credit under scrutiny, and any unexpected issues can delay approval or affect your interest rates. Credit monitoring services can give you a clear, up-to-date view of your credit reports and scores, allowing you to spot and dispute errors or unfamiliar accounts before they become a problem.

By catching discrepancies early, you can resolve issues and present your best financial profile to lenders.

If you’re concerned about identity theft

Certain demographics — such as older adults, frequent online shoppers, and victims of a previous data breach — may benefit from credit monitoring alerts to help them catch fraud or identity theft before it spirals out of control.

Here’s an overview of some groups who could be most at risk of identity theft, and could therefore benefit most from credit monitoring:

- Older adults: Scams often target older adults, assuming they are less familiar with online security and more likely to fall for phishing attacks and fraud attempts. According to data from Bureau of Justice Statistics (BJS), nearly one in 10 adults 65 and older experienced identity theft in 2021.

- Frequent online shoppers: A habit of online shopping could increase your exposure to various risks, like data breaches and scams designed to steal your personal or financial information.

- People who reuse passwords: Reusing the same passwords across different online accounts is a critical security flaw. It means that if one of your passwords is breached, several of your accounts may be compromised at once.

- Previous breach victims: As opposed to running scams to find new targets, identity thieves sometimes target people whose personal information has already been exposed and may be available on the dark web.

- High-net-worth individuals: Some thieves pursue high-net-worth individuals to gain larger financial rewards through scams and fraud. According to a 2021 report by BJS, households with an annual income of $200,000 had the highest prevalence of identity theft compared to other income groups.

- Young adults: Fraudsters often exploit people with underdeveloped credit histories or habits, potentially assuming that fraud may go undetected longer. According to the 2024 Consumer Sentinel Network Data Book, 44% of people aged 20 to 29 reported losing money to fraud.

Even if you haven’t been targeted yet, proactive monitoring gives you an early warning system to help protect your financial well-being.

When you want extra peace of mind

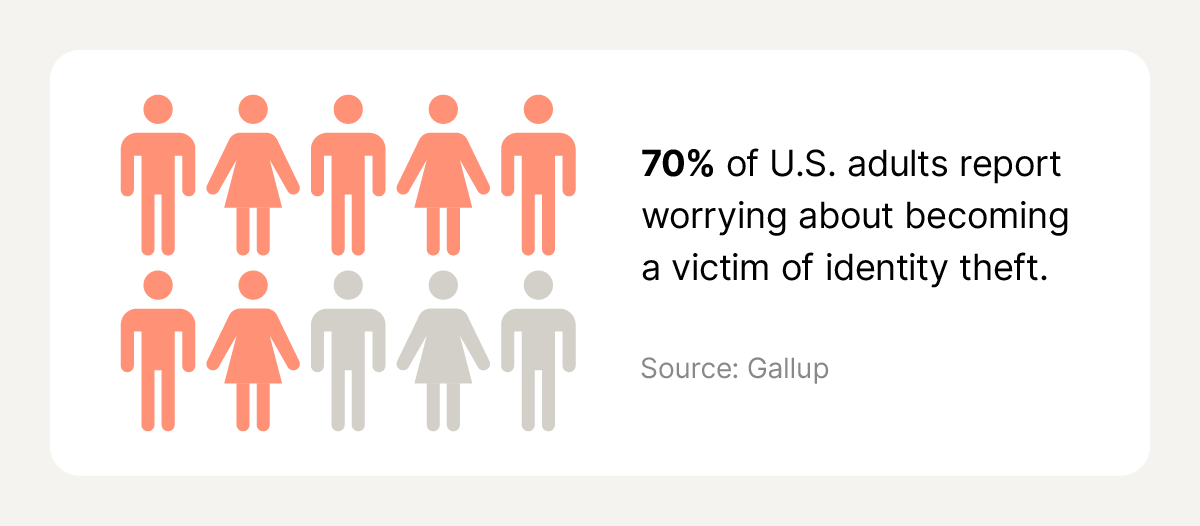

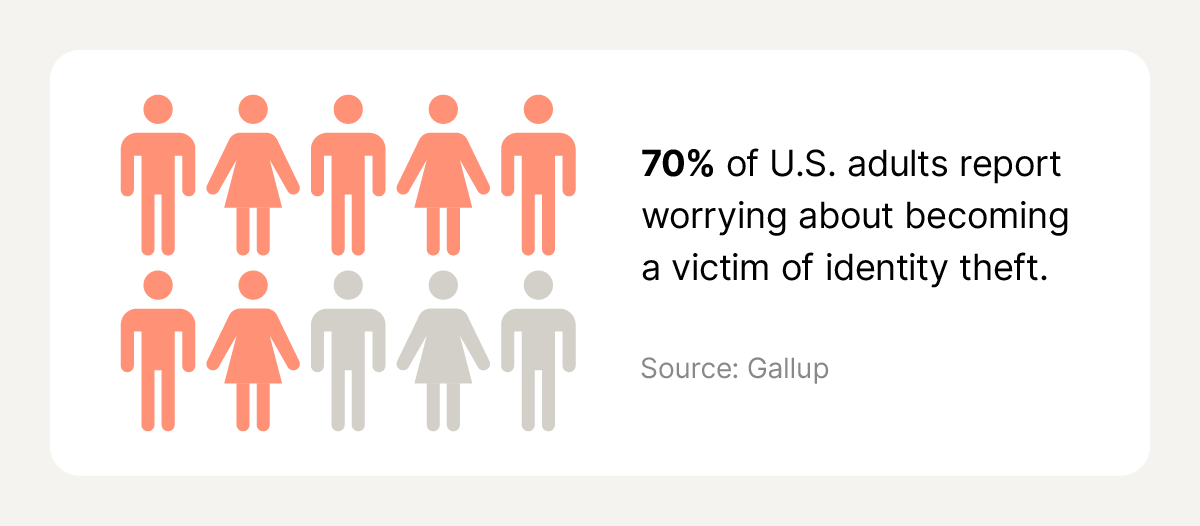

More than 70% of U.S. adults report worrying about becoming a victim of identity theft. If you fall into this category, credit monitoring can help provide some peace of mind. While it doesn’t proactively prevent identity theft, it can help you detect threats as they appear on your credit reports, keeping you informed without requiring manual effort.

Free vs. paid credit monitoring

The main difference between free credit monitoring services, like the one offered by Experian, and paid services, like LifeLock, is that free options generally have a narrower scope. They may only monitor your reports from one bureau, for example, and don’t tend to offer additional features like Social Security number alerts, data breach notifications, and identity theft reimbursement packages.

Feature |

Free credit monitoring* |

LifeLock Total |

|---|---|---|

Credit bureaus monitored |

1 bureau |

All 3 major bureaus |

Identity monitoring |

No |

Yes |

Identity theft reimbursement |

Not included |

Up to $3 million††† |

Identity theft restoration support |

No |

Yes |

In other words, free credit monitoring services don’t offer much more than what you can do yourself by manually checking your credit reports. They’re useful for basic awareness but won’t provide much support beyond alerting you to potential fraud.

On the other hand, paid credit monitoring services often include broad coverage across all three bureaus and additional features like restoration support and reimbursement if you fall victim to identity theft, making them a better choice for those who want more comprehensive protection.

Key features to look for in a credit monitoring service

When selecting a credit monitoring service, look for features that provide comprehensive coverage, monitoring of other threats, and support in the event that your identity is stolen.

Here’s a closer look at the features you should consider:

- Three-bureau monitoring: Three-bureau monitoring provides near-comprehensive coverage that makes it more likely you’ll be alerted to potential signs of fraud on your credit reports, as they appear.

- Bank account activity alerts: Many identity theft protection services allow you to centralize financial account alerts, notifying you of unusual transactions or other activity across linked accounts so you can take action.

- Dark web monitoring: Scanning the dark web for your personal information, such as Social Security numbers or login credentials, may allow you to address potential vulnerabilities before criminals exploit them.

- Home title monitoring: Home title monitoring alerts you if someone tries to change or transfer ownership of your property, giving you a warning that you might be getting targeted with home title theft.

- Identity theft reimbursement: Reimbursement coverage can help you recoup certain financial losses caused by identity theft, like legal costs or stolen money, giving you a financial safety net if your identity is stolen.

- Restoration support: Identity theft protection services often provide access to restoration experts who can help guide you through the recovery process if your identity is stolen, resolving issues caused by fraud.

Protect your financial future with credit monitoring

If you’re concerned about the risk of credit fraud or identity theft, a credit monitoring service may be worth it. Investing in one is a proactive step that can help you catch threats before they spiral out of control. LifeLock Total goes beyond standard monitoring, with three-bureau coverage and identity theft protection features, including expert restoration support.

FAQs

How much does credit monitoring cost?

The cost of credit monitoring varies. Free services typically track one bureau and typically have slower alerts, while paid plans range from $10–$40 per month and may include additional features such as extra monitoring capabilities, reimbursement coverage, and identity theft restoration support.

What is the best credit monitoring service?

Different credit monitoring services have different strengths and weaknesses, and the best one for you will depend on what, specifically, you’re looking for. However, choosing LifeLock or a similar option that includes additional identity theft protection features like dark web monitoring, SSN alerts, and stolen funds reimbursement provides extra protection versus services that only monitor credit.

Does credit monitoring hurt your score?

No, credit monitoring does not hurt your credit score. Monitoring services simply track changes to your credit reports and alert you to activity. They do not involve credit inquiries that affect your score. Checking your own credit through these services is considered a “soft inquiry,” which has no impact on your credit.

Should I sign up for credit monitoring?

While the decision will depend on your unique situation, signing up for credit monitoring can help you stay alert to suspicious activity, catch potential identity theft early, and protect your financial health. It’s especially valuable after a data breach, when applying for major credit, or if you want extra peace of mind.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- What is a credit monitoring service?

- How does credit monitoring work?

- Benefits of credit monitoring

- Limitations of credit monitoring

- When credit monitoring is worth it

- Free vs. paid credit monitoring

- Key features to look for in a credit monitoring service

- Protect your financial future with credit monitoring

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.