Note: The VantageScore model generally requires less credit history than the FICO model to generate a score, and you may even get your first VantageScore within a month of activity. Keep in mind that VantageScore and FICO use slightly different scoring criteria and weighting, so your scores may vary a little.

If you’re just getting started with credit, you might wonder what your first score should be. You may think zero makes sense, or maybe the highest possible score, 850. But the truth is, you don’t have a credit score at all until months after you first begin using credit.

A credit score is a three-digit number, typically ranging from 300 to 850, that indicates how likely you are to repay borrowed money. Lenders use it to determine whether to approve you for credit cards, loans, or even apartment rentals. But, until you’ve got a history of credit, there’s nothing for credit bureaus to score.

In fact, nearly 20% of American adults don’t have a credit score, meaning they’re considered “credit invisible,” according to consulting firm Oliver Wyman.

Once you start building credit, your initial score will depend on your financial behavior and credit habits. Read on to learn when you get a credit score and how to build a strong one from the start.

When do you get a credit score?

It can take up to six months to get a credit score after you start using credit. The process starts when you first open a credit account, like when you get a credit card or take out a loan. But even after your credit activity begins, the three major credit bureaus need time to collect data on your usage.

Your creditor will report your early credit activity to the bureaus every month. After enough data has been collected, a starting credit score can be generated by scoring models like FICO® and VantageScore.

It’s also possible to start building a credit score without opening an account yourself. For example, if a parent or guardian adds you as an authorized user on their credit card, that account’s history may appear on your credit report.

What factors determine your starting credit score?

Once you begin using credit, the information in your credit report determines your starting credit score. Key factors include how consistently you pay your credit accounts, how much of your available credit you use, and how long you’ve had credit.

According to the FICO scoring model, here’s how each factor affects your credit score:

- Payment history (35%): Do you pay your bills on time? Even one missed or late payment early on can hurt your score, so consistent on-time payments are crucial from the start.

- Amounts owed (30%): Also known as your credit utilization rate, this refers to how much credit you’re using compared to your total available credit. For example, if you get a credit card with a $1,000 limit and carry a $500 balance, your utilization is 50%.

- Length of credit history (15%): When you’re new to credit, your credit history will be short, but over time, keeping accounts open and in good standing can help boost your score.

- Credit mix (10%): Lenders like to see that you can manage different types of credit, such as credit cards, student loans, and auto loans. It’s normal to start with just one type and slowly add variety over time.

- New credit (10%): Applying for several credit accounts in a short time can be a red flag to lenders. It’s best to open accounts gradually and only when needed.

Because these factors generally favor longer, more established credit histories, initial credit scores tend to be lower. When you’re just starting, you haven’t had time to build a solid track record, making it harder to get a high score immediately.

What is a good starting credit score?

A good credit score is considered anything above 670 on the FICO scale and 661 in the VantageScore model. However, it’s unlikely that your very first credit score will be this high, since building credit takes time as you practice responsible credit use.

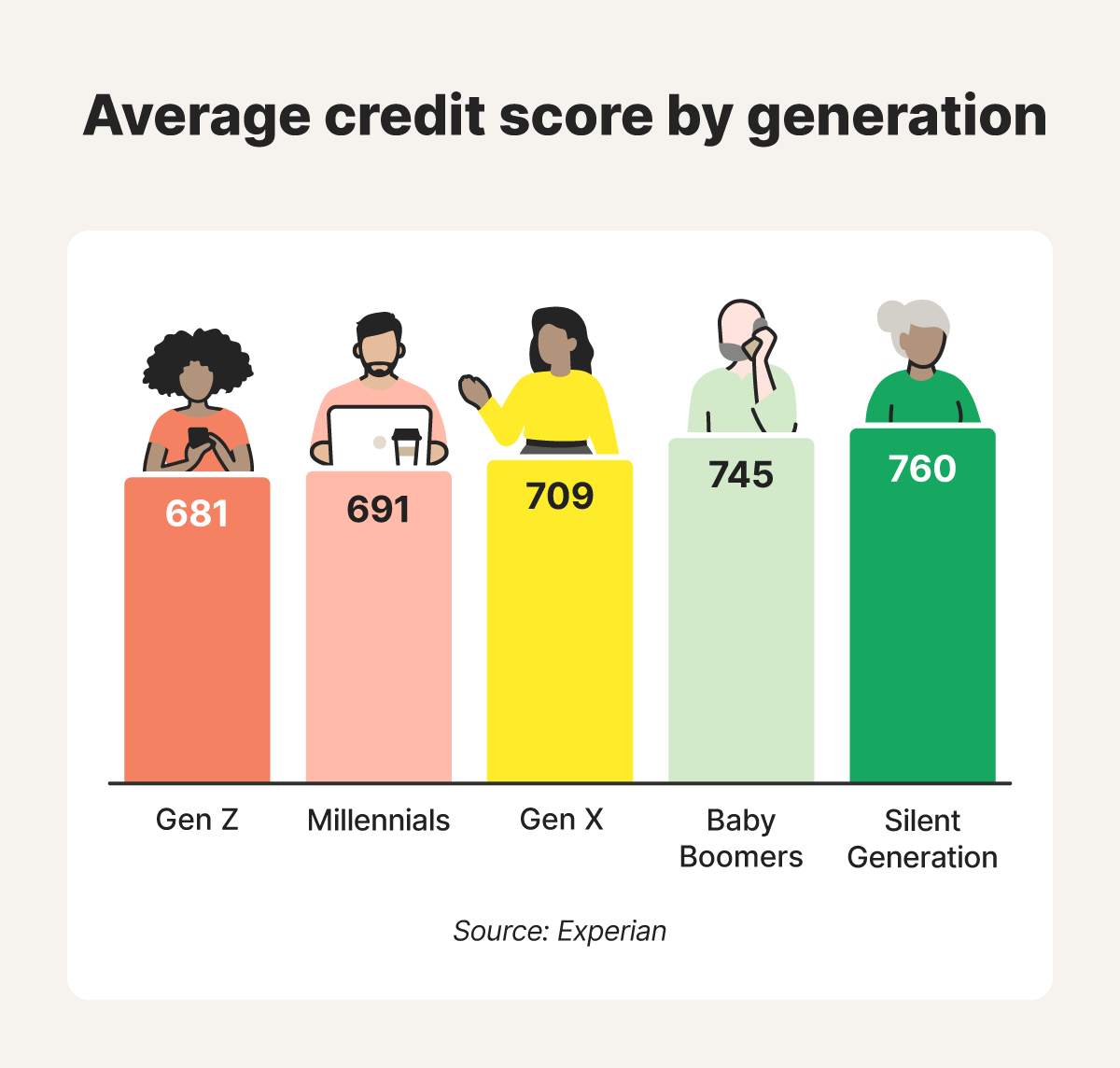

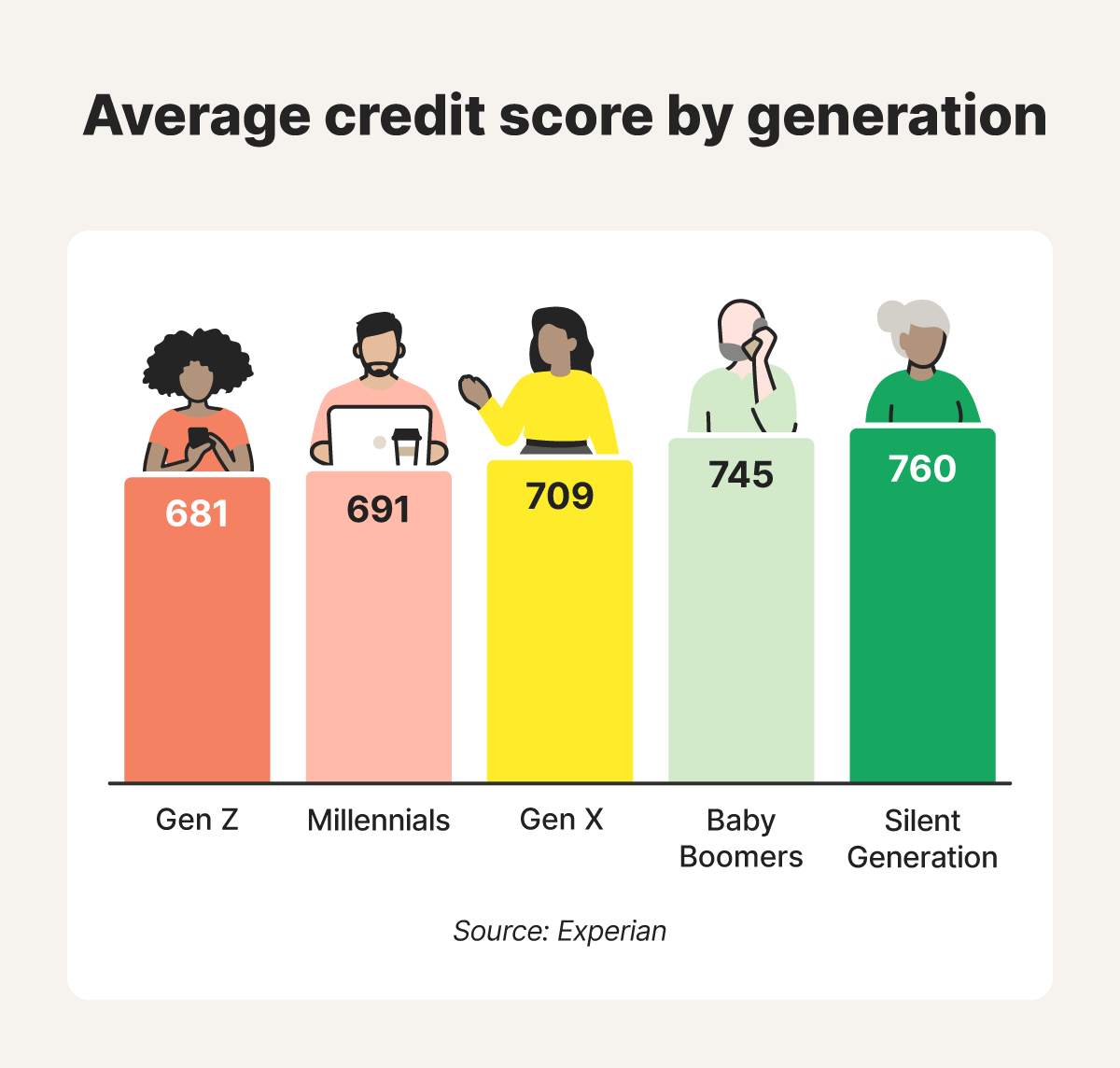

Because of this, credit scores tend to improve with age and experience. Experian data shows that average credit scores steadily increase across generations, with the youngest credit users averaging 681 and the oldest averaging 760.

The FICO score model breaks credit scores into five distinct categories, with the following ranges:

- 300-579: Poor.

- 580-669: Fair.

- 670-739: Good.

- 740-799: Very good.

- 800-850: Exceptional.

Another popular credit scoring model, VantageScore, has slightly different score categories and ranges:

- 300-600: Subprime.

- 601-660: Near prime.

- 661-780: Prime.

- 781-850: Superprime.

As you build credit, focus on moving from your starting position, which may be in the Fair or Near prime category, into Good or Prime. From there, you can look towards getting an even better credit score.

Your score may fluctuate every now and again, but with responsible credit use, it should trend upwards over time.

Why does your credit score matter? A good credit score makes it easier to qualify for loans and may help you secure better interest rates, higher limits, and more favorable terms. It can save you hundreds or even thousands of dollars in the long run.

How to build a good starting credit score

Building a solid credit score starts with how you manage credit in your first six months, as this is when scoring models collect the data that will shape your initial score.

The tips below can help you make the most of that crucial window and set a strong foundation for your score. They’re also smart habits to carry with you as you continue improving your credit score over time.

- Become an authorized user: If you’re new to credit or not yet approved for your own account, consider asking a trusted family member or friend with strong credit to add you as an authorized user on their credit card.

- Apply for a secured credit card: A secured credit card works like a regular credit card but requires a refundable security deposit. It’s typically easier to qualify for and can help you start building credit.

- Repay debts on time: Timely payments are one of the biggest factors affecting your credit score. Set up automatic payments or reminders to ensure you never miss a due date.

- Keep balances low: Aim to keep your credit utilization ratio between 1% and 30%, especially early on. Consider using your card for essentials like gas or groceries and paying it off in full each month.

- Space out credit applications: Applying for multiple credit accounts in a short period can signal risk to lenders and cause a credit score drop. As a general guideline, wait at least six months between applications.

- Report rent or utilities: Some services, like RentReporters and Boom, allow you to report rent or utility payments to credit bureaus, helping you build credit without traditional loans or cards.

- Take out a credit-builder loan: These loans are designed to help people with no or low credit. The lender holds the borrowed funds in a secure account while you make monthly payments, which are then reported to the credit bureaus, helping to establish a credit history.

- Monitor your credit: Once you begin building credit, it’s important to keep an eye on your credit reports and scores, looking out for errors or signs of identity theft that could harm your score. A credit monitoring service can help by automatically alerting you to key changes to your credit file.

How to check your first credit score

Once you’ve opened a line of credit, you can usually check your credit score for free through your bank or credit card issuer’s website or mobile app.

You can also check your score through credit bureaus or credit monitoring services, though some may charge a fee. FICO also offers a free plan that lets you check your FICO Score at no cost.

Whichever method you choose, you can check your score as often as you’d like. It won’t hurt your credit, since these checks are considered soft inquiries and don’t lower your score.

Monitor changes to your credit file

As you work to establish credit, staying on top of changes to your credit file is key. Responsible credit use is important — but so is protecting your progress. Identity thieves can set your credit back in seconds.

LifeLock Standard includes a credit monitoring feature that provides automatic alerts of changes to your credit file that could signal fraud. And if identity theft happens, we can help you resolve it.

FAQs

What credit score do you start with at 18?

You don’t start with a specific credit score at 18. If you’ve never taken out credit before, you likely won’t have a score at all.

Does your credit score start at 0?

No, your credit score doesn’t start at zero. You don’t have a score until you start using credit, and even then, the lowest possible score is 300.

How long does it take to establish your first credit score?

Once you start using credit, it can take up to six months to establish your first credit score. While FICO says that “you should meet the minimum scoring criteria in six months,” you may be able to get a VantageScore more quickly.

Can you have a credit score without a credit card?

Yes, you can have a credit score without a credit card. Other types of credit can contribute to your score, such as installment loans or being an authorized user on someone else’s credit card.

At what age does your credit score start?

While Americans are eligible to apply for credit at 18, their credit score doesn’t automatically start at that age. You won’t receive a credit score until you open a line of credit.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

Copyright © 2025 Gen Digital Inc. All rights reserved. All trademarks, service marks, and tradenames (collectively, the "Marks") are trademarks or registered trademarks of Gen Digital Inc. or its affiliates ("Gen") or other respective owners that have granted Gen the right to use such Marks. For a list of Gen Marks please see GenDigital.com/trademarks.