Good to know: Some states have a cap on the amount tenants can legally pay as a security deposit. Check your state’s security deposit limit to ensure that offering a larger deposit doesn’t take you over the legal amount.

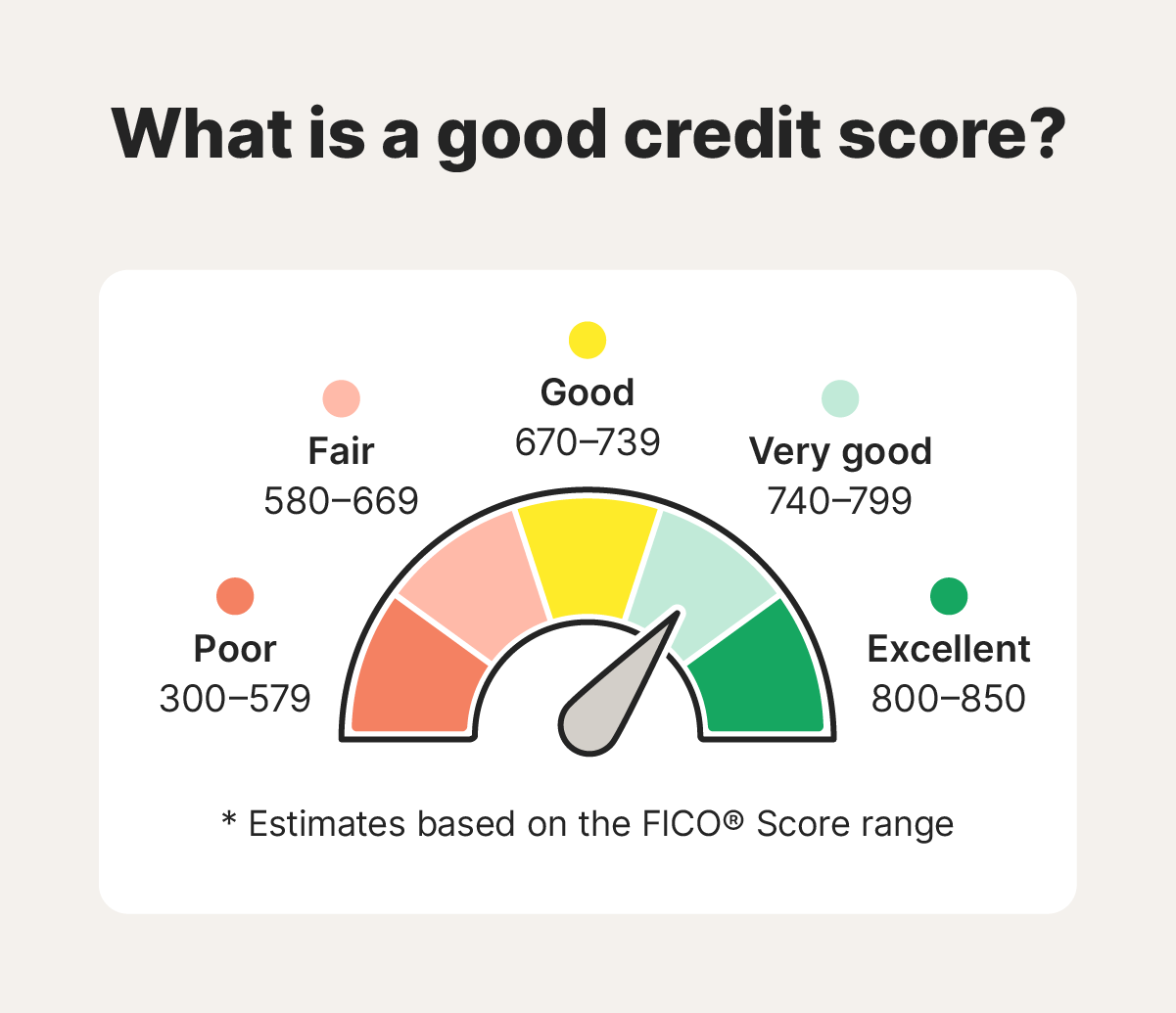

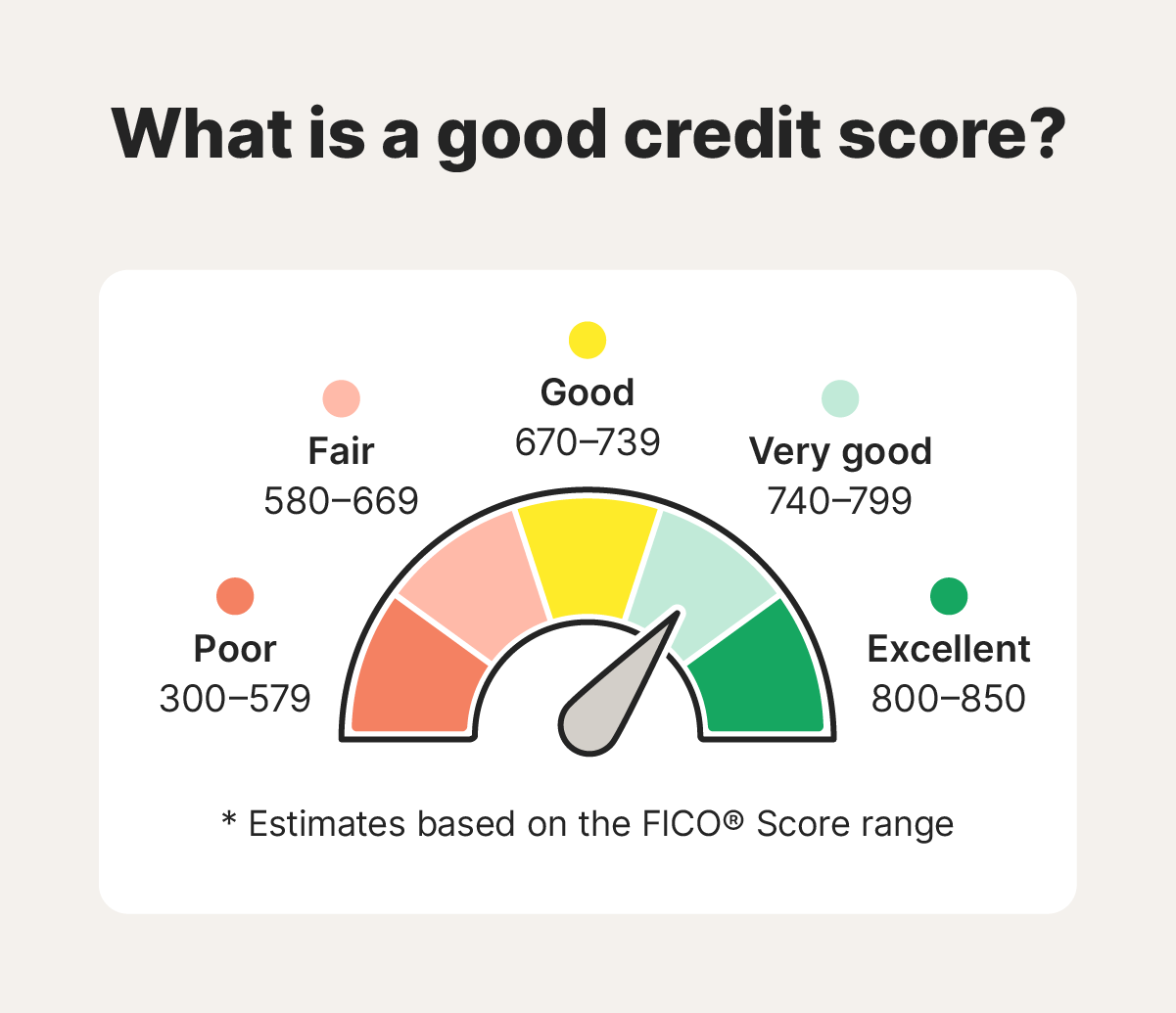

Struggling with bad credit? You're not alone. Nearly 30% of U.S. consumers have credit scores that sit below the “Good” threshold according to the FICO model. If you fall into this category and are applying to rent an apartment, you might be worried about your chances of getting approved. The good news is that renting with bad credit is still possible.

There are lots of other ways to show landlords you’re a reliable tenant, like offering a larger deposit or demonstrating steady income. Keep reading to learn how to get an apartment with bad credit. Need answers fast? Get a summary in ChatGPT.

Can you get an apartment with bad credit?

Yes, you can rent an apartment with bad credit — it may just require proactive steps to reassure the landlord that you’re not a risk. Landlords often review applicants' credit to gauge their financial reliability, and a bad score might make passing the credit check more challenging.

Many landlords understand that credit scores don’t always tell the full story, but they’ll still want reassurance that you’re not a risk. Providing other evidence of reliability, like proof of consistent income, a larger security deposit, or a cosigner, can help offset a poor credit score and help you secure an apartment.

6 steps to help get an apartment with bad credit

Here are six tips that can help you get an apartment, even if your credit score or history isn’t great:

1. Save for a larger deposit

A security deposit is an upfront payment made to a landlord to cover any potential damages or unpaid rent during your tenancy. Typically, security deposits are equivalent to one month's rent. However, if you have a poor credit score or no credit, offering a larger deposit, like two to three months' rent, may increase your chances of securing the apartment.

By providing a larger deposit, you demonstrate to the landlord that you have money saved and are financially responsible, which can provide them with a sense of security. If you pay rent on time and keep the apartment in good condition, the landlord should return the deposit when you move out.

2. Provide proof of income

Providing proof of income helps show landlords that you can meet the financial responsibilities of the lease, even if your credit report is less than ideal. Examples of proof of income landlords may accept include:

- Pay stubs

- Bank statements

- Tax returns

- Direct deposit records

- Employment verification letter

Bear in mind that many landlords look specifically for proof of consistent, long-term income. That means it can be difficult to secure a rental with bad credit if you've only recently started a new job. However, a steady job history of a year or more can work in your favor.

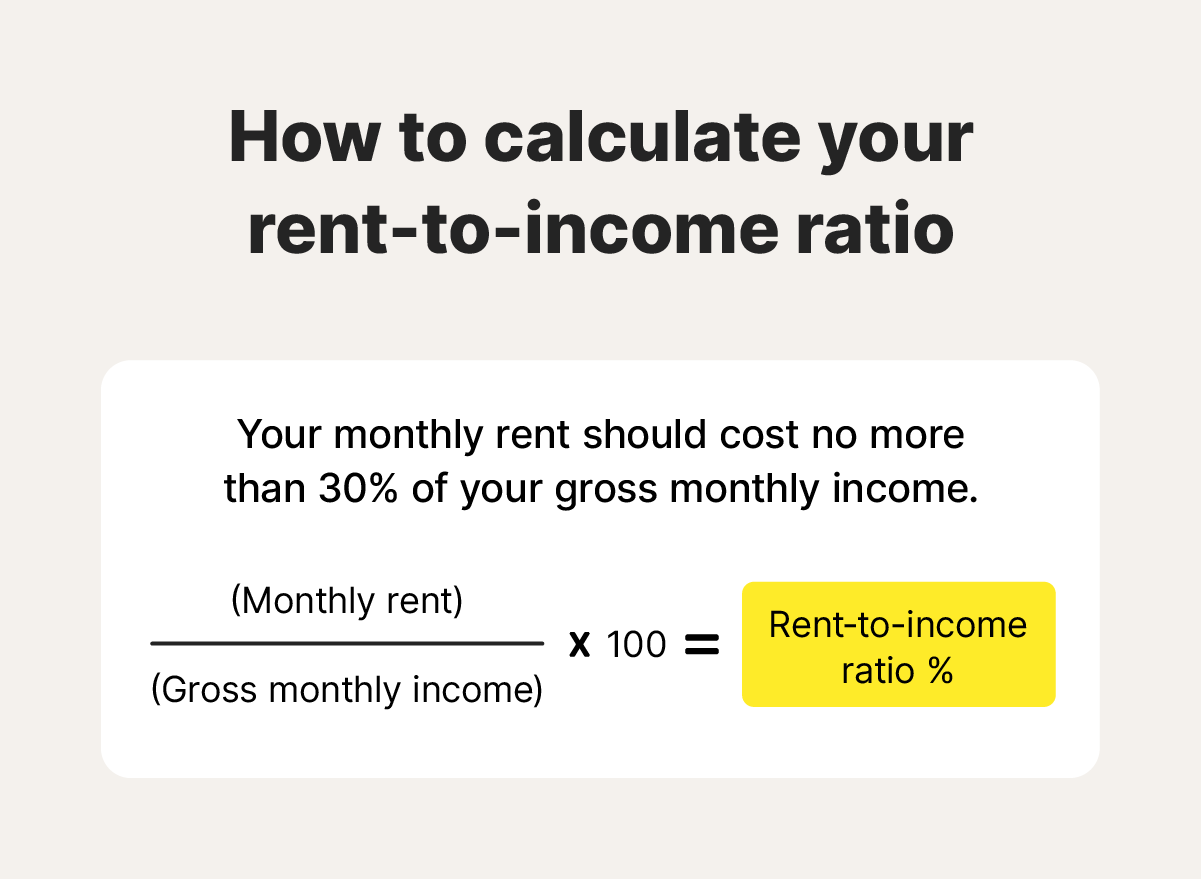

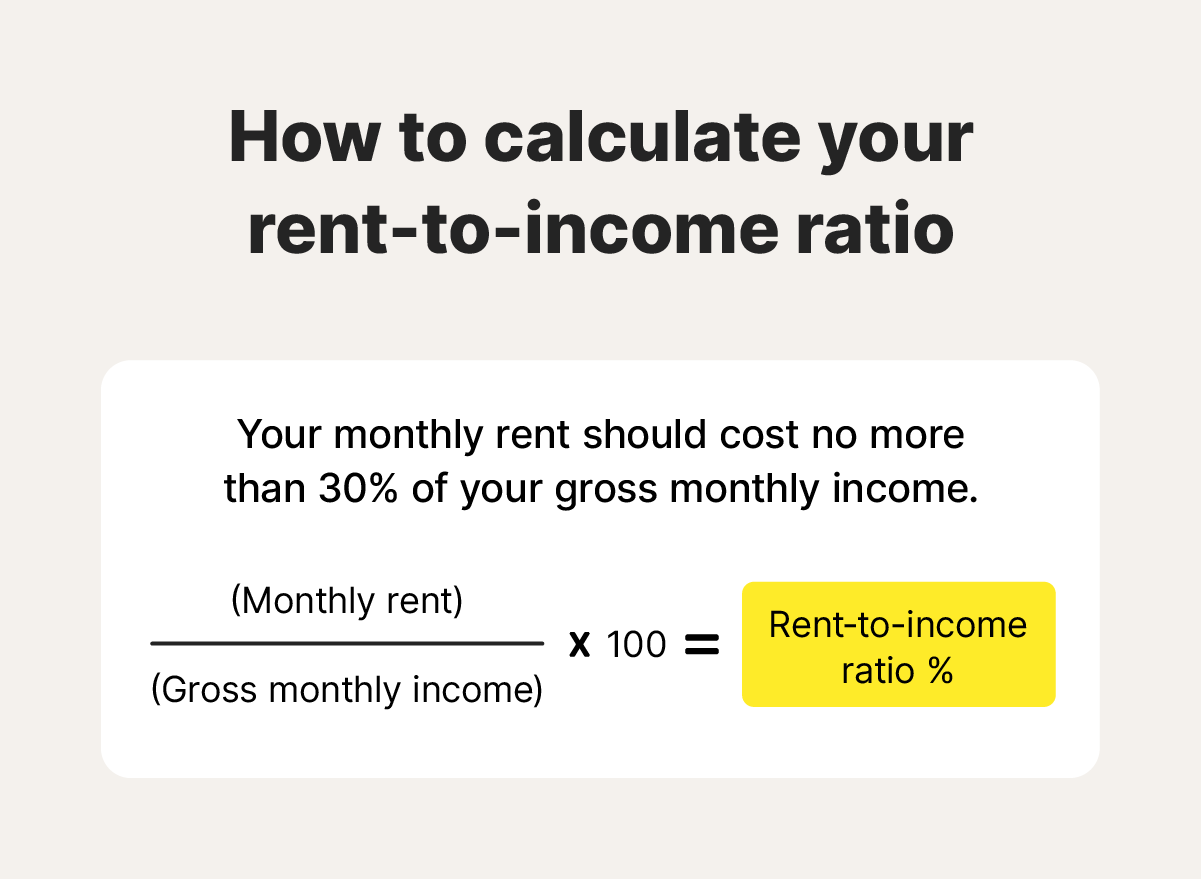

Also, remember that your likelihood of passing a rental application relies on your income being enough to afford the rent. Landlords often use the rent-to-income ratio to assess your suitability for a rental. This ratio measures the percentage of your income the rental amount represents, calculated by dividing the monthly rent amount by your gross monthly income.

While there’s no set rent-to-income ratio that guarantees you an apartment, 30% is a popular benchmark. This means your monthly rent should be less than 30% of your gross monthly income. For example, if you earn $3,000 a month, your rent should be no more than $900.

3. Find a cosigner

A cosigner is a trusted friend or family member, preferably with a good credit score, who agrees to take legal responsibility for the lease if you’re unable to meet the rent payments.

Having a cosigner provides the landlord with an additional layer of security, which could increase your chances of getting an apartment. With a cosigner, the landlord can feel more confident that rent will get paid on time, reducing the risk of renting to you even if your credit score isn’t ideal.

Before letting someone agree to be your cosigner, it's important to discuss the responsibilities of that agreement. The cosigner is legally obligated to pay the rent if you don't, so make sure they are fully aware of, and comfortable with, the commitment.

Good to know: If you can’t find a cosigner, a rental reference from a previous landlord who can vouch for your reliability may strengthen your application. This extra step can help prove that you’re a trustworthy renter.

4. Look for private landlords

A private landlord is an individual property owner who leases their property directly to tenants without the involvement of a property management company. They may be more flexible with rent requirements, making them an option worth exploring if you’re trying to rent with bad credit.

Some private landlords even offer rentals without credit checks. These rental agreements often come with stricter terms to compensate for the lack of a credit screening, but they’re worth considering if you can’t find a suitable apartment elsewhere.

To find apartments owned by private landlords, check online rental listings, local classifieds like Craigslist (though be on the lookout for Craigslist scams) or websites dedicated to connecting tenants with property owners, like Zillow. You can also join local rental groups on Facebook and other social media, where landlords can advertise newly-available properties.

It’s worth noting that, along with having a more flexible attitude towards credit scores, private landlords may also have fewer standardized processes when it comes to maintenance or lease renewal.

While they still have to adhere to the law, this could mean you get a less consistent rental experience than you would renting from an established company. You should also exercise caution in your search, staying aware of the risks of rental scams.

5. Consider living with a roommate

Having a roommate may make it easier to secure an apartment when you have bad credit. Some landlords feel more confident renting to a group if at least one of the applicants has strong credit or steady income to help meet financial obligations.

Sharing rent with roommates also makes apartments more affordable, which is especially valuable in areas with a particularly high cost of living, like New York City. Splitting costs like utilities and rent can significantly reduce financial strain, while allowing you to live in a desirable location.

6. Be transparent

Finally, don't try to hide or downplay your credit score to trick landlords. Instead, be upfront about your credit situation and how you're working on improving your score. This can help build trust and show responsibility.

Be prepared to explain any issues that have impacted your credit, like medical bills or job loss. And, highlight the steps you're taking to improve it, like paying down debt or proactively monitoring your credit. This helps demonstrate your commitment to being a reliable tenant and can improve your chances of securing the rental.

Good to know: While some landlords may prefer to run their own credit check, try taking a proactive approach by providing a copy of your credit report that you’ve pulled yourself. This may help avoid a hard inquiry, which usually leads to a temporary dip in your credit score.

What credit score do I need to rent an apartment?

There’s no set credit score you need to rent an apartment. What credit score makes you a suitable tenant depends on your income, the landlord, the cost and location of the apartment, and the rental terms. While many landlords prefer tenants with good scores because they indicate financial responsibility, what each landlord considers “good” will vary.

According to most credit scoring models, including FICO Score and VantageScore, a “good” credit score tends to start at around 670. Generally speaking, a score of 670 or higher shows that you manage credit well and are likely to pay bills on time, both of which are appealing qualities in a renter.

And, of course, a score that puts you in the “very good” or “excellent” categories in the FICO Score model, for example, will only help your chances.

To better understand how your credit score might impact your chances of success in a rental application, check your FICO score before applying for a lease.

How to improve your credit score

While the steps above could help you secure an apartment with the credit score you already have, improving your credit score can open the door to more rental opportunities. Here are a few steps you can take to improve your score:

- Establish a positive credit history: Building a solid credit history takes time. Start by opening credit accounts, and use them consistently and responsibly to show you can handle credit effectively.

- Pay bills on time: Making your monthly credit payments on time is one of the most significant factors that affects your credit score. Consistently paying off your credit card or loan balances demonstrates financial responsibility and helps build a positive credit history.

- Keep credit utilization low: Where possible, aim to use less than 30% of your total available credit. High credit utilization can signal financial strain and lower your credit score, whereas keeping it low shows you manage credit wisely.

- Prioritize paying off debt: Paying down debt reduces your overall credit utilization and improves your score. Focusing on high-interest debt first can also save you money in the long run.

- Monitor your credit: Keeping an eye on your credit report helps you spot any changes, discrepancies, or errors that may signal credit fraud or identity theft. Use LifeLock Total for automatic alerts of key changes to your credit file, so you can take action to help protect your credit score.

- Dispute credit errors: Disputing errors or inaccuracies on your credit report by contacting the three credit bureaus may help get them removed from your file, potentially improving your score and providing a more accurate reflection of your credit history.

Protect your credit with LifeLock Total

Securing an apartment with bad credit might seem daunting, but with the right steps, you can still make a strong case for yourself as a reliable tenant.

Join LifeLock Total for support building your credit as you prepare for a future application. You’ll benefit from powerful credit monitoring features that can help you detect potential fraud along with daily credit score and credit report updates that make tracking your progress easier.

FAQs

Can you get an apartment with bad credit but good income?

Yes, it’s possible to secure an apartment with bad credit but good income. While a good credit score can help, landlords often consider your rent-to-income ratio a key factor in determining whether you can afford the rent.

Ideally, your rent should be no more than 30% of your gross monthly income, which shows you can comfortably manage the cost alongside your other expenses.

Can you rent an apartment if your partner has bad credit?

Yes, you can still rent an apartment if your partner has bad credit, especially if you have good credit and meet the landlord’s requirements. If you have good credit, you can act as a cosigner for your partner, strengthening your application.

Can you get an apartment with no credit?

Yes, you can get an apartment with no credit. However, your apartment search will likely be more complicated than someone with good credit, and may involve prioritizing apartments available through private landlords or with no credit check needed.

In the process, watch out for too-good-to-be-true listings. Some scammers may create fake, no credit check apartment listings to trick you into providing them with your personal information.

How can I pass a rental credit check?

To pass a rental credit check, ensure your credit score is healthy by paying bills on time, reducing debt, and checking your credit report for errors. Provide proof of steady income, savings, or a cosigner if your credit is low. Be upfront about any issues and offer additional security, like a larger deposit or pre-paid rent, to reassure the landlord.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.