† LifeLock does not monitor all transactions at all businesses.

How long it takes to rebuild your credit score depends on what you’re rebuilding from. It’s relatively easy to recover from a small drop caused by a hard credit check or past-due balance, for example, but much harder to recover from the impact of a home foreclosure.

While the specifics vary depending on a variety of factors like your specific credit history and your current score, here’s a more detailed look at how some situations may impact your credit and how long it might take to rebuild your score:

- Late payments: Although payment history is one of the most important credit score factors, a single late payment should only have a minor impact on your credit score, which may take a few months to recover from. However, repeatedly missing payments will cause more serious damage and may take longer to rebuild from.

- Collections and charge-offs: Collections and credit card charge-offs, often the result of several consecutive late payments, can have a major impact on your credit. It may take several months to a few years to recover, depending on the size of the balance that went to collections or was written off.

- High credit utilization: Credit utilization, or the percentage of your total credit limit that you’re currently using, is a major credit factor in most credit scoring models. High utilization may have a significant impact on your score, and decreasing it may take anywhere from a few months to years, depending on how much credit you’re using.

- Foreclosures: Losing your home due to missed mortgage payments or other issues can have a huge negative impact on your credit score. Since payment history is a major factor in credit score calculations, it will usually take years to recover from foreclosure events.

- Bankruptcies: A bankruptcy might seem like an easy way to “reset” your financial situation and get out of debt, but it can cost thousands of dollars in administrative and legal fees and significantly damage your credit score. Depending on the scale, the credit damage caused by a bankruptcy event may take years to fully recover from.

Apart from the specific situation that caused your credit score drop, the main thing that affects how long it will take to rebuild your score is how well you optimize your credit usage.

Credit scoring models like the FICO Score and VantageScore consider several factors to generate your score, including your payment record, credit utilization, credit mix, length of credit history, and amount of new credit. By sticking to credit best practices, like making payments on time and keeping your credit utilization low, you can improve how these factors contribute to your overall score.

How long does it take for bad marks to fall off my credit report?

Most of the factors that damage your credit score, like late payments and accounts that have gone to collection, are visible on your credit report as “derogatory marks.” These marks will generally stay on your report for seven years. However, there are a few exceptions, like hard inquiries being removed after two years and Chapter 7 bankruptcies taking 10 years to disappear unless you can get them removed sooner.

However, the derogatory mark is just a signifier of the event that caused your credit score to drop — you can rebuild your credit even while you have marks on your report. For example, if one of your credit accounts is sent to collections, you’ll see it reflected on your credit report and in a decreased score. But paying off the debt should mean your score recovers a little bit, even though the derogatory mark will remain for seven years.

Here’s a breakdown of how long some of the main derogatory marks you may see on your credit report take to fall off:

Derogatory mark |

The time it takes to fall off |

|---|---|

Late payments, collections, and charge-offs |

7 years |

Repossessions and foreclosures |

7 years |

Bankruptcies |

7 to 10 years |

Hard inquiries |

2 years |

Student loan defaults |

7 years |

Fraud |

7 years |

Tax liens |

7 years (if paid)* |

* Tax liens stay on your credit indefinitely until paid off.

It’s also worth noting that not all credit activities will create a derogatory mark on your credit report. For example, unlike hard credit checks, soft checks allow creditors to screen your eligibility for debt without leaving a mark. Checking your score doesn’t lower it either, and is considered a soft check.

Factors that affect rebuilding your credit

While different credit scoring models use slightly different factors, payment history and credit utilization are generally the credit factors that affect your score most. Other important factors include your credit history length, your credit profile diversity, your total debt balance, and your record of new credit applications.

Here’s a breakdown of the key factors that affect your FICO Score and how they’re weighted in the overall credit score calculation:

Factors |

FICO impact |

|---|---|

Payment history |

35% |

Credit utilization |

30% |

Credit history |

15% |

Credit mix |

10% |

New credit |

10% |

While largely similar, the VantageScore model features a few unique factors, uses slightly different names, and measures weighting differently:

Factors |

VantageScore impact |

|---|---|

Payment history |

40% |

Depth of credit |

21% |

Credit utilization |

20% |

Balances |

11% |

Recent credit |

5% |

Available credit |

3% |

These factors sometimes overlap, meaning you can improve your credit usage, and your score, in multiple ways at once. Paying off accounts that have gone to collections, for example, will decrease your total balance, reduce your utilization, and positively impact your payment history.

7 tips to help rebuild or fix your credit score

While there’s no one way to fix your credit score, you can work toward improving it over time by adopting good financial habits like creating a budget, maintaining a record of on-time payments, decreasing your credit utilization, and building a longer credit history.

Here are more details on practical steps you can take to help rebuild your credit score after a drop.

1. Create a budget

The first step to establishing credit goals is understanding what you can realistically afford. This means breaking down your needs, wants, and savings goals into a budget that gets you closer to achieving a good credit score.

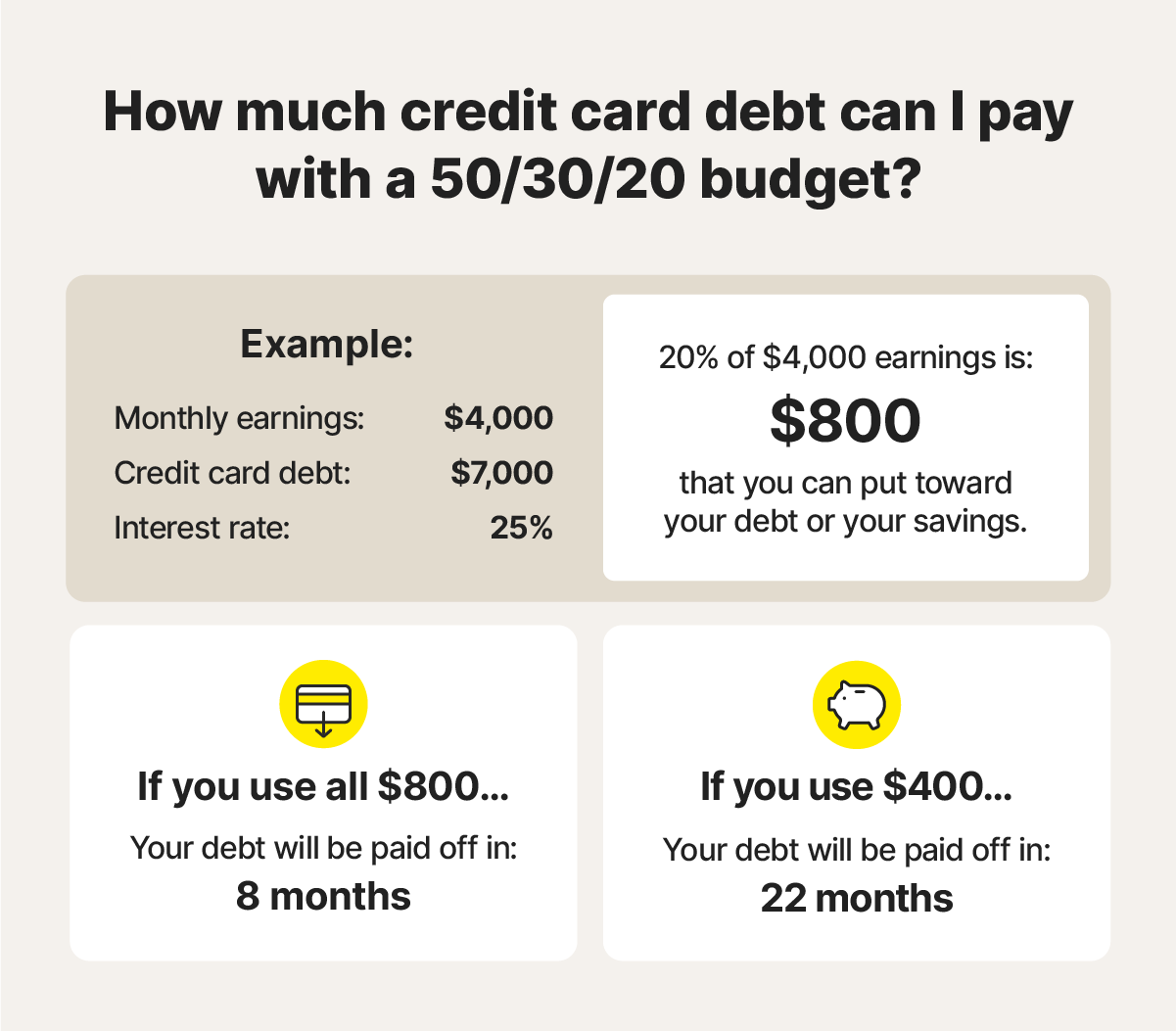

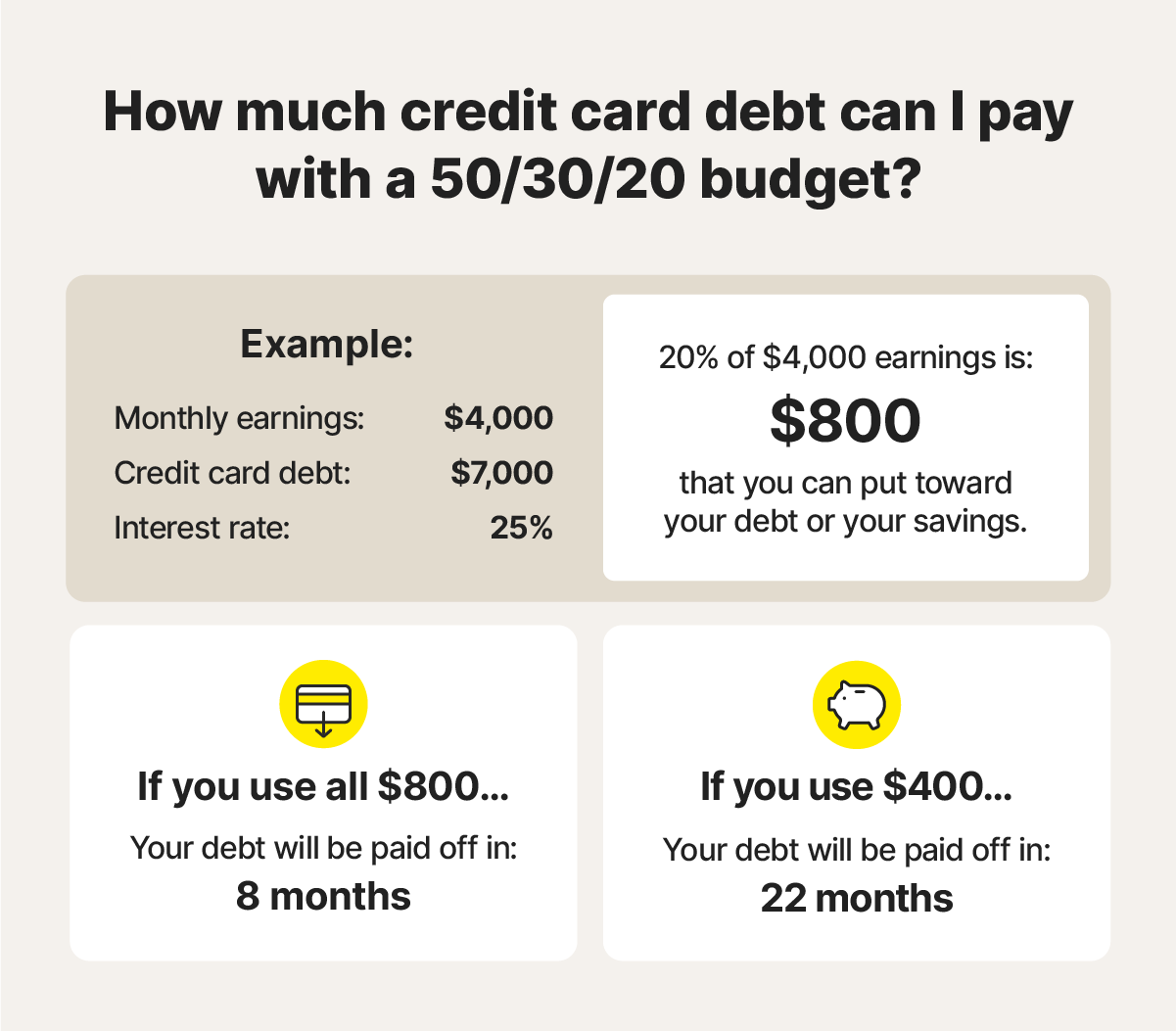

You can use a specific budgeting method, like the 50/30/20 rule, to help organize your finances and stay on track. Here’s how it suggests you should split your income:

- 50% to your needs: Things that you cannot live without, such as food, housing, and transportation.

- 30% to your wants: Things that aren’t required to live, such as streaming subscriptions, gym memberships, and eating out.

- 20% to your savings & debts: Funding activities like paying down debts and saving toward retirement.

For example, if you have $7,000 in credit card debt at 25% interest and make $4,000 a month, sticking to the 50/30/20 budget would mean 20% of your income ($800) will go toward your savings and debts. That would mean you could clear that debt in under a year.

This budgeting method can help ensure that you’re always working on paying off debts and improving your financial stability.

2. Establish a history of on-time payments

Your payment history, which represents how often you make credit repayments on time, has the highest impact on your credit score in most major models. Building a better history by committing to covering your credit card or loan repayments in full every month should help you recover from drops, showing credit bureaus you’re a responsible borrower.

Here are some tips if you’re struggling with on-time payments:

- Turn on autopay: Automatic payment features let you schedule payments on due dates, so you don’t have to make them manually. As long as funds are available in your account, this will prevent you from forgetting to settle your credit payments.

- Set calendar reminders: If you prefer to make your payments manually, you can set calendar reminders on payment due dates using your phone’s built-in calendar app.

- Review your budget: If you’re missing payments due to a lack of funds, review and adjust your budget to see if you can reduce your spending elsewhere to help make your payments.

On-time payments can be a challenge to manage on a limited budget. If you’re struggling to make payments, reach out to your creditors and ask them about the possibility of reducing your monthly payments. You can also explore debt consolidation plans to minimize the total interest you pay.

If you’re hoping to improve your credit score, it’s also important that you try to prevent credit card charge-offs or repossessions. These often stem from continuous missed payments and can severely damage your credit.

3. Reduce credit utilization

Credit utilization is the percentage of your total available credit across all your revolving credit accounts (such as credit cards) that you’re using. Using a high percentage of your available credit can hurt your credit score. Keeping your credit utilization low — ideally somewhere between 1% and 30% — can help reassure creditors that you’re less of a risk.

Here are some practical methods to help reduce your credit utilization:

- Pay above the minimum: Covering only your minimum payments can extend debt repayment for years, while paying extra reduces your balance faster.

- Pay twice per month: Paying twice monthly is an effective way to pay above the minimum, if you can afford it. If you get bonuses from work or other cash windfalls, see if you can fit a double credit card payment into your budget.

- Avoid further credit spending: Avoiding new purchases on credit can keep your balance from increasing and lower your utilization faster.

If you have debt on a high-interest credit card that’s hindering your ability to keep up with monthly payments, consider whether a balance transfer card could help you reduce your overall interest rate. Just be sure to pay off the balance before the promotional rate ends to avoid higher interest later.

4. Increase your credit limit

Increasing your total credit limit can improve your credit score by decreasing your credit utilization, assuming you don’t increase your spending proportionately. When increasing your limit, start by contacting your existing creditors. Increasing the limits on cards you already have saves you from having to make a new hard inquiry and manage another account.

Here are some tips to help increase your odds of raising your credit limit:

- Have a good payment history: A consistent record of on-time payments will help demonstrate to creditors you’ll be able to handle potentially higher monthly payments. Creditors are more likely to grant increases to those with a good history.

- Increase your earnings: Request credit limit increases when your income rises. This shows that you can pay down these balances with greater ease. Higher earners are generally better equipped to handle higher credit limits.

- Reduce your expenses: Explain that you’ve reduced your monthly expenses to allow for higher payments toward credit. Reducing your credit utilization ratio can improve your chances of securing limit increases.

Aside from applying for limit increases on your existing credit cards, you can also apply for a new credit card to increase your overall credit limit. However, multiple credit cards can make your finances more difficult to track, which may leave you more vulnerable to credit card fraud that goes unnoticed.

5. Maintain older accounts

The length of your credit history is a major factor in your credit score, constituting several metrics like the age of your oldest account and the average age of all your accounts. Accordingly, keeping accounts open as long as possible can improve your credit score.

If you're new to credit, take extra care to maintain your accounts as long as possible. Keeping your credit cards and loans in good standing will benefit you by establishing a strong, early history. Only apply for new credit when you need it and can afford the repayments.

If you’re considering closing an account, ask yourself whether the cons outweigh the pros. For example, if you have too many credit cards, consider closing cards with annual fees or high interest rates. But, where possible, keep old accounts open by using them every now and then to avoid them being canceled.

6. Dispute credit errors

Inaccuracies, errors, or fraud on your credit report can negatively impact your score. Dispute incorrect information with the credit bureaus to have it removed from your report, potentially resulting in a quick increase in your credit score.

Even removing minor issues, like a single inaccurate record of a late payment, can improve your credit score. Remember to check your credit report after submitting your dispute to confirm that the change has been made.

Here’s what you can dispute on a credit report:

Inaccurate details |

Errors |

Fraud |

|---|---|---|

Incorrect personal details |

Incorrect balances or limits |

Loans opened in your name |

Employment history |

Closed accounts listed as open |

Credit cards you don’t recognize |

Duplicate accounts |

Open accounts listed as closed |

Collections accounts that aren’t yours |

Accounts you don’t own |

Late payments that were on time |

Suspicious activity |

The fastest way to dispute your credit report is to submit your evidence through online forms provided by the three credit bureaus, or by calling them directly:

Credit bureau |

Contact information |

|---|---|

1-888-397-3742 |

|

1-888-378-4329 |

|

1-800-916-8800 |

7. Monitor your credit report

Monitoring your credit report helps you track your credit rebuilding progress, identify errors or signs of fraud, and make more informed decisions. This can make all the difference when working on improving your credit score, giving you the information you need to make sure your efforts pay off.

Here are some specific issues to look out for when you monitor your credit report:

- Fraud attempts: If someone tries to open accounts in your name, credit monitoring can help you catch on early so you can avoid fraud harming your credit score. Freezing your credit can also help stop further fraud attempts.

- Late payments: Credit reports can reveal late payments you might have missed. It’s best to catch these early, and monitoring provides a safety net to catch any that could lead to collections.

- Inaccurate information: Credit monitoring services can offer real-time notifications to help you identify and dispute errors on your report faster.

Monitor your credit as you rebuild your score

The last thing you need when working hard to rebuild your credit is to be set back by fraud that harms your score. Join LifeLock Total for a range of features that can help you protect against credit fraud, including credit monitoring and credit card activity alerts† that can potentially detect fraud more quickly.

Plus, you’ll get 401(k) monitoring and access to daily credit reports and scores to help protect your finances and track your credit rebuilding progress step by step.

FAQs

How long do credit repair services take?

Credit repair services can take anywhere from 45 days to six months to repair most credit issues. Depending on the depth of the credit issues, some may take up to a year. Each situation differs in how long it takes to repair.

What’s the number one factor that impacts your credit score?

Payment history is the number one factor that impacts your credit score, making up 35% to 40% of the major credit scoring models.

Can you raise your credit score by 100 points in 30 days?

While it’s technically possible to raise your credit score by 100 points in 30 days, it’s highly unlikely in most circumstances. However, you can usually see some credit score improvement within 30 days, which you can build on for long-term growth.

What’s the fastest way to raise your credit score?

While it depends on your specific situation, settling late and delinquent accounts is often the fastest way to increase your credit score. Other factors that can make a quick impact include fixing errors on your credit report and raising your credit limit.

What is the 7-year rule for bad credit?

The seven-year rule for bad credit suggests that derogatory marks on your credit report, like charged-off credit accounts, take seven years to fall off. However, some derogatory marks are removed quicker, and others take longer to disappear. But you don’t have to wait for marks to fall off before improving your credit score — you can still see credit score growth in the interim by following good credit practices.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.