When it comes to how many credit cards each person should have, there’s no universal answer. The ideal number depends on your particular financial situation, how you manage your existing credit, and how much more you’re willing to take on.

However, some guidelines can help you decide how many credit cards are the right number for you. Read on to discover the benefits and drawbacks of multiple credit cards as well as the potential effects on your credit.

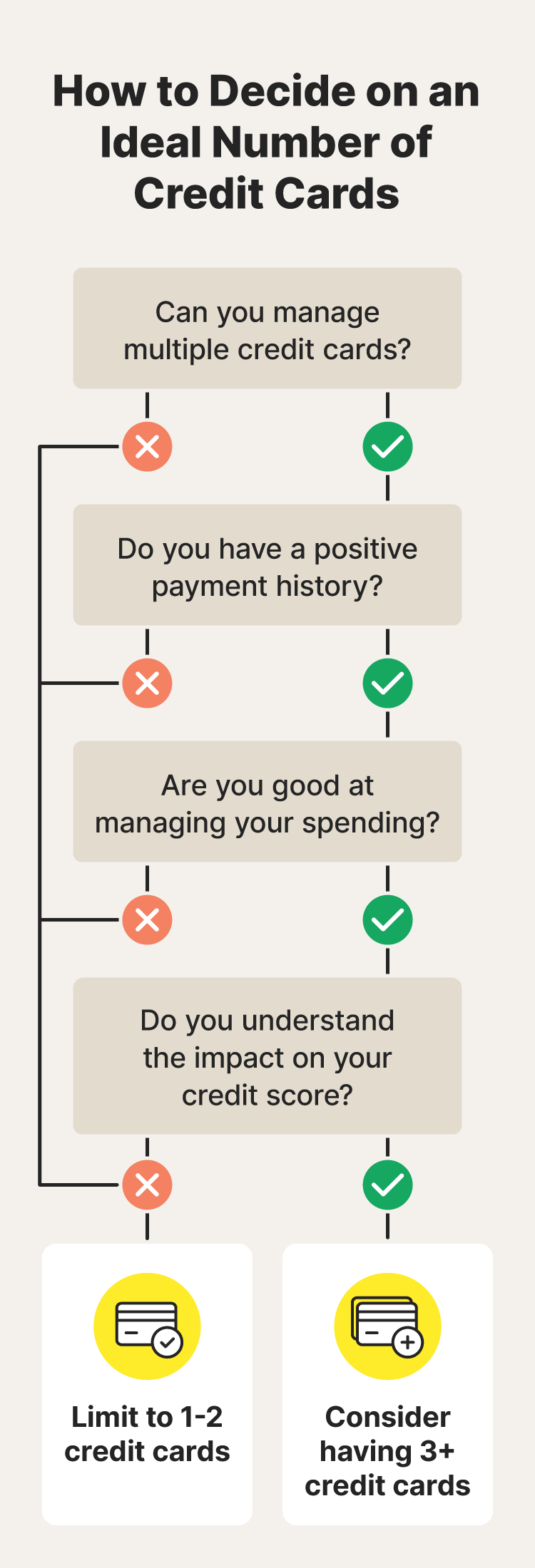

How to decide how many credit cards you should have

Your personal financial habits should determine the optimal number of credit cards you should have. According to Experian, the average American consumer has between three and four credit cards, but you may prefer to have more or fewer depending on how you handle debt.

Here are a few actions to help you decide how many credit cards to have:

- Assess your ability to manage credit cards: More credit cards means more due dates to keep track of and bills to pay. If this reality sounds too stressful or unrealistic, it’s best to stick to 1-2 credit cards you know you can manage.

- Be honest about your payment history: If you know you’re at risk of forgetting payments, limit the number of credit cards you have. On the other hand, if you always pay your monthly credit card bill on time and in full, you may be able to manage additional credit cards with no problem.

- Evaluate your spending habits: If you’ve had trouble managing your spending in the past, having more available credit could worsen your financial situation.

- Consider the impact on your credit score: While credit cards can help you build credit, mismanaging them or the debt you accrue can harm your score. Make sure to weigh the benefits and risks to your credit score before applying for another card.

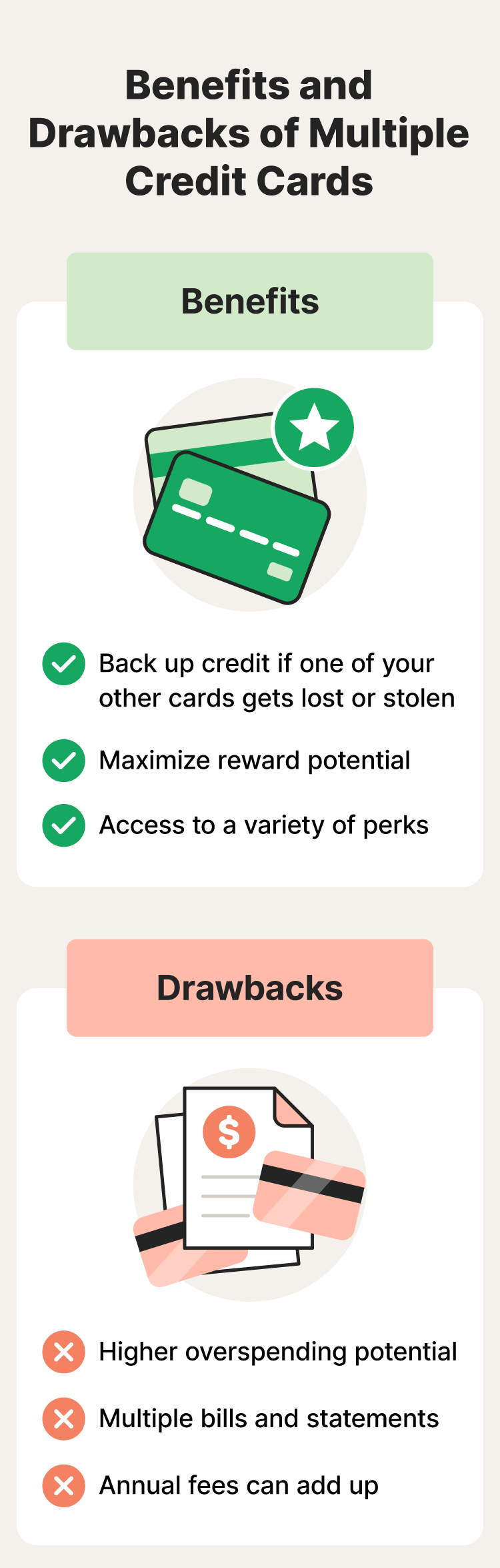

What are the benefits of multiple credit cards?

There are several benefits to having multiple credit cards, including:

- Backup credit: If your wallet gets lost or stolen, having multiple credit cards can allow you to maintain access to credit while you wait for replacement cards, provided they weren’t all in your wallet at the same time.

- Rewards and perks: Credit cards offer rewards such as cashback, miles, and exclusive access to entertainment or specific types of insurance. Multiple credit cards can increase these rewards.

- Flexibility: Having multiple credit cards allows you to take advantage of better benefits or interest rates for specific purchases. For example, one card may give you a higher percentage of cashback on food- or travel-related expenses.

Potential drawbacks of having multiple credit cards

While there are several benefits of having multiple credit cards, you should be aware of the following drawbacks:

- Overspending: Having multiple credit cards means that you have more available credit, which could lead to the temptation to overspend.

- Multiple bills: Keeping track of multiple bills and their corresponding due dates can get overwhelming and potentially cause you to miss a payment. To help mitigate this, set up automatic payments whenever possible.

- Annual fees: Many credit cards charge annual fees—the average being $157 for the largest issuers in the United States, although cards can cost up to $500 or more. Having multiple credit cards can lead to fees adding up to hundreds or even thousands of dollars.

- Higher chance of lost cards: Having more credit cards makes them harder to track, making it easier to have them lost or stolen. With enough cards, you might not even realize your card is missing.

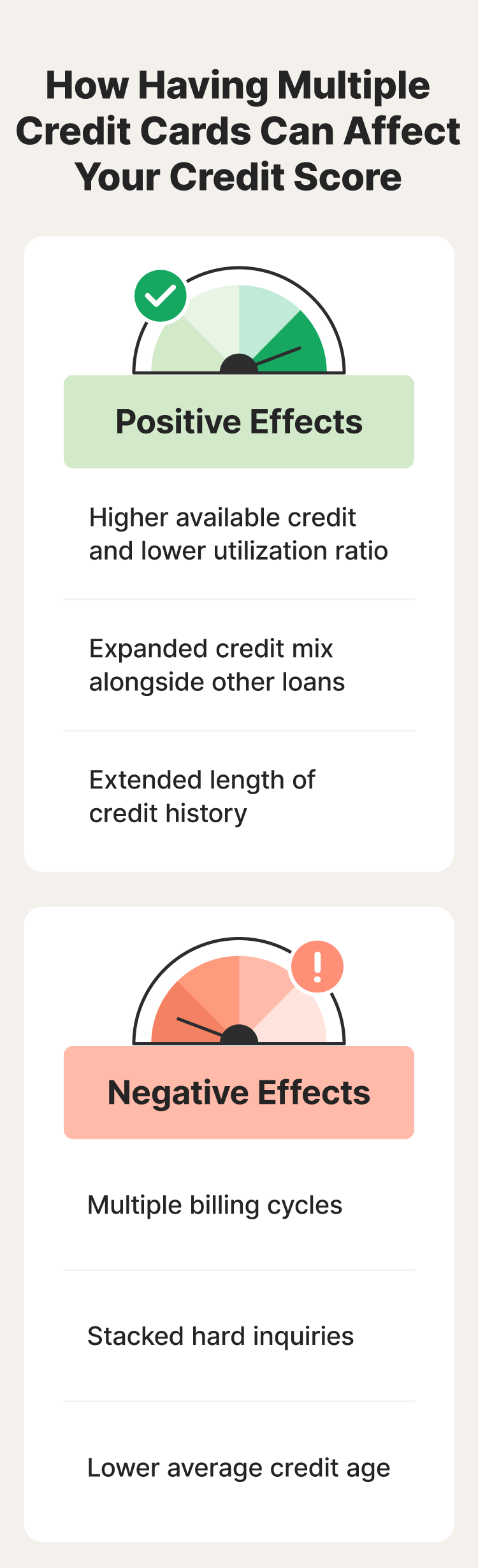

How does having multiple credit cards affect your credit score?

Having multiple credit cards can help or hurt your credit, depending on how you manage them. Here’s how multiple credit cards can impact the different factors that determine your credit score.

Payment history

Payment history is the most important factor in achieving a good credit score. Juggling multiple credit cards can increase the risk of late or missed payments, which can significantly harm your score. However, paying credit card bills on time and in full can help fix your credit score if you're in the process of repairing it.

Credit utilization

Credit utilization is the percentage of your available credit that you’re actively using. It’s generally recommended to keep your credit utilization ratio under 30 percent. For example, if your total approved credit limit is $30,000, you should aim to have spent no more than $10,000 across all purchases at any given time.

When you take out multiple credit cards, you increase the total credit available to you, which can decrease your credit utilization as long as you maintain your spending levels.

Length of credit history

A longer credit history is beneficial for your credit score. So, opening multiple new credit cards in a short period can be detrimental by decreasing the average age of your accounts. On the flip side, you should generally avoid closing old credit card accounts since doing so will shorten your average credit history.

Credit mix

Your credit mix is the variety of credit you have access to. Having multiple credit cards and other types of credit can improve your credit score because it demonstrates to lenders your ability to manage several different kinds of credit. Some debt is referred to as “good debt” because it’s an investment that helps you build wealth over time—as long as you stay on top of your payments.

In addition to credit cards, here are a few other credit types to consider utilizing:

- Mortgages

- Auto loans

- Small business loans

- Student loans

- Personal loans

New credit

Applying for new credit causes a hard inquiry on your credit report, which can temporarily affect your credit score. Therefore, if you plan on getting multiple credit cards, try to space out the applications by at least six months in order to minimize the impact on your credit.

How to manage multiple credit cards

Managing multiple credit cards can be tricky, but here are some tips to help you stay on track with your credit:

- Enable automatic payments: Set up automatic payments to ensure you never miss a payment. And ensure you have enough money in your bank account so you don’t incur an overdraft fee.

- Set up reminders: If you prefer not to set up automatic payments, consider setting reminders on your phone for each credit card’s due date. Or, pay the bill immediately once you receive it.

- Adjust your due dates: Most credit card issuers allow you to change your statement due date and schedule your card payments together to avoid juggling multiple due dates per month.

- Stick to a budget: Multiple credit cards may tempt you to overextend your finances by offering credit limit increases, so create a budget and stick to it. Consider using a budgeting app that allows you to sync all of your credit card transactions for a consolidated view of your spending.

- Regularly check your credit report: Check your credit report regularly or invest in a credit monitoring service that grants you regular access to your credit report and alerts you to key changes.

- Know when to close an account: If you’re having trouble keeping track of payments or are paying hefty annual fees, it may be best to close one (or more) of your accounts.

Help protect against credit card fraud

Whether you have one credit card or ten, it’s important to keep track of your cards to protect against fraud. With LifeLock, you’ll get bank and credit card activity alerts that notify you of large cash withdrawals, balance transfers, or large purchases.

Plus, if your wallet is ever stolen, LifeLock will help you cancel and replace your credit cards as well as your driver’s license, Social Security card, and more. And if you ever become the victim of identity theft, LifeLock’s dedicated U.S.-based Restoration Specialists will be there with the support you need to help restore your identity.

FAQs about multiple credit cards

Still unsure how many credit cards are right for you? Read on for answers to common credit card questions.

How many credit cards are too many?

There’s no set rule about the number of credit cards that’s considered too many, since each person’s ability to manage credit differs. If you notice that you’re missing deadlines or stressing about multiple payments, you may have more credit cards than you can comfortably handle, and you should consider closing one of your accounts.

Is it bad to have a lot of credit cards with zero balances?

While it’s not necessarily bad to have multiple credit cards with zero balances, your credit card issuers may close the account due to inactivity. This could potentially shorten your average length of credit history and negatively impact your credit score.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- How to decide how many credit cards you should have

- What are the benefits of multiple credit cards?

- Potential drawbacks of having multiple credit cards

- How does having multiple credit cards affect your credit score?

- How to manage multiple credit cards

- Help protect against credit card fraud

- FAQs about multiple credit cards

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.