FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Is a FICO score the same as a credit score?

“Credit score” is a general term — there isn’t one universal credit score, but multiple scores calculated using different scoring models. The FICO Score, created by the Fair Isaac Corporation in 1989, is one type of credit score that lenders use to assess credit risk. Other credit scores, like VantageScore®, are also widely used by lenders.

What is a credit score?

A credit score is a three-digit number that represents how likely you are to repay debts on time. It’s based on the information in your credit reports, which are compiled by the three major credit bureaus: Equifax, Experian, and TransUnion.

Lenders use credit scores to evaluate your creditworthiness, or how risky it might be to lend you money. Generally, a lower credit score signals higher risk, while a higher score suggests you’re a more reliable borrower.

Your credit score not only influences whether you’re approved for credit, but it can also affect the terms of the loan or credit card, including your interest rate and borrowing limit.

Third parties like landlords, insurers, or employers may also use your credit score in rental credit checks, to determine insurance rates, or to assess your financial responsibility during a job application.

What is a FICO score?

FICO Score is a type of credit score developed by the Fair Isaac Corporation, which introduced the first credit scoring algorithm in 1989. While other scoring models have emerged since, the FICO Score remains the most common, with 90% of lenders referencing it when making lending decisions.

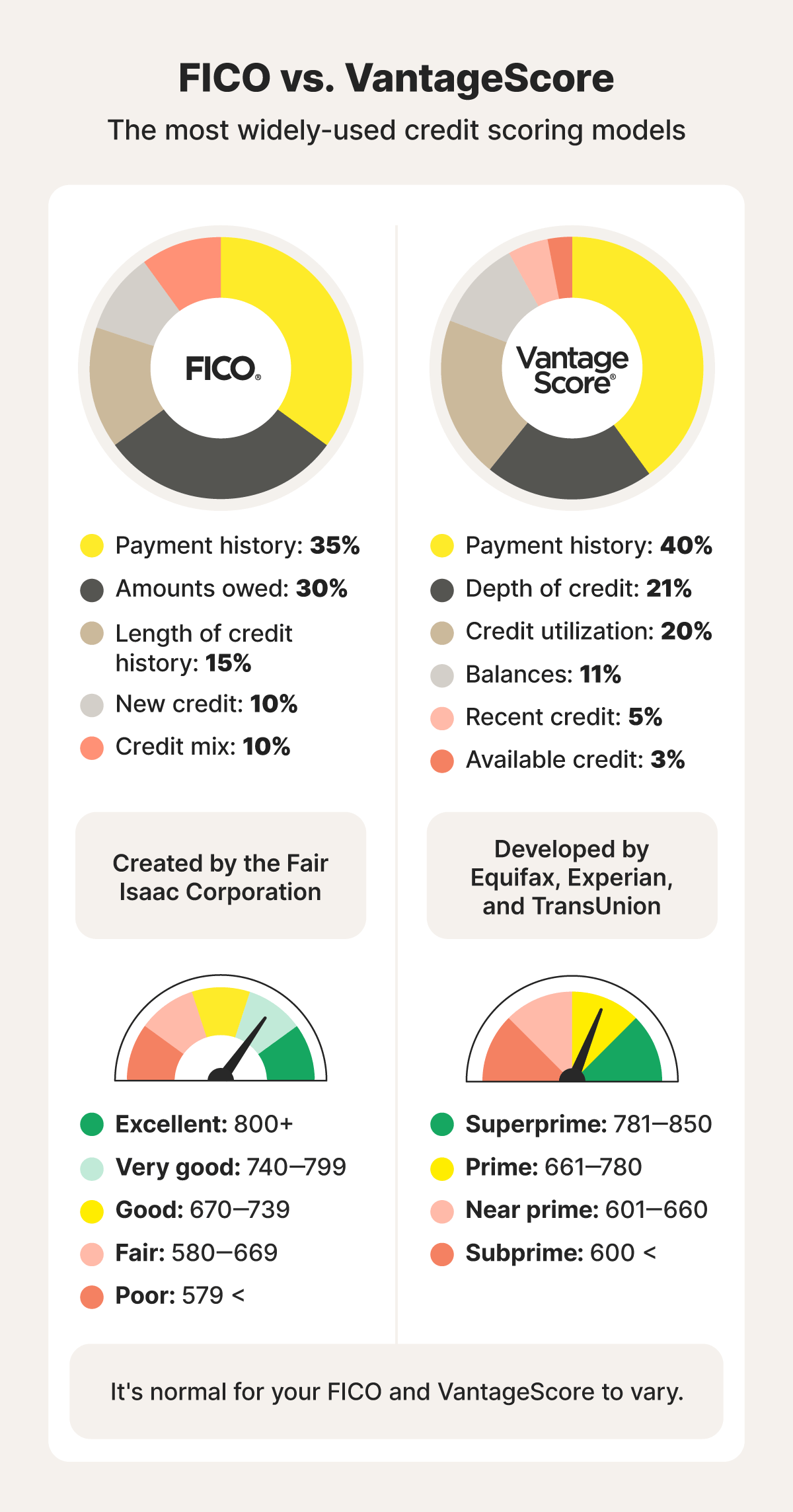

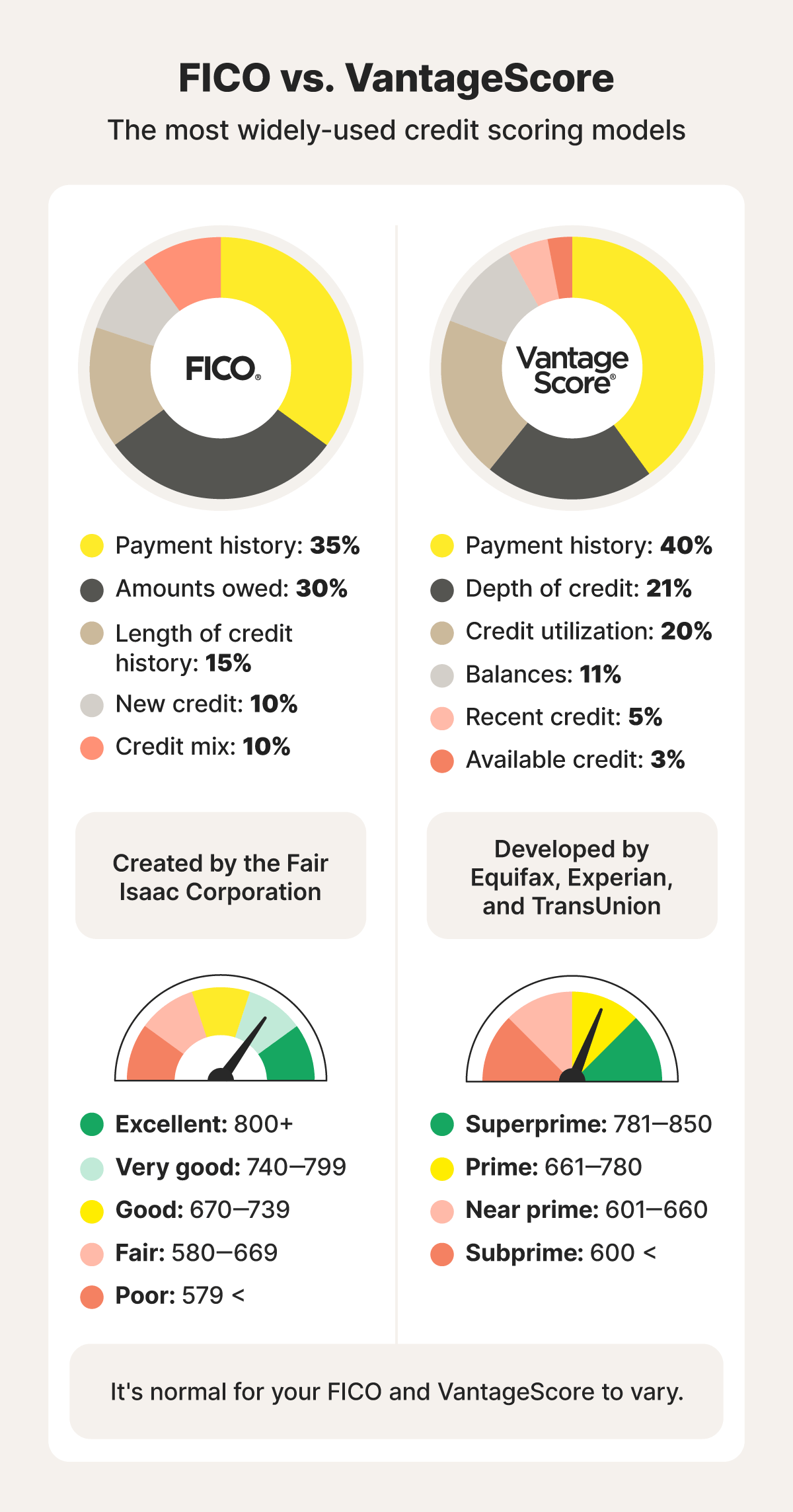

FICO calculates your score using data from your credit report and divides it into five categories, each one affecting your credit score to varying degrees:

- Payment history (35%): Your track record of paying past credit accounts on time and in full.

- Amounts owed (30%): How much of your total available credit you’re currently using, sometimes known as your credit utilization.

- Length of credit history (15%): How long your credit accounts have been open, including the average age of all your accounts.

- Credit mix (10%): The variety of credit types you have, such as credit cards, installment loans, and mortgages.

- New credit (10%): The number of credit accounts you’ve recently opened.

Based on these factors, your score will fall between 300 and 850. Here's what each credit score range means according to the most widely used FICO score version, FICO Score 8:

- Exceptional: 800+

- Very Good: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Poor: 579 and below

Why is my FICO score different from my credit score?

Your FICO score might differ from other credit scores because it’s just one of several scoring models. Other models may use different criteria or weighting systems, resulting in a different score.

For example, another scoring model might weigh your payment history more heavily or consider additional factors that FICO doesn't, such as your total available credit. Even small differences in weighting can result in varying scores across models.

Other credit scoring models

After the FICO Score, the second most commonly used credit scoring model is VantageScore. It was created in 2006 as a joint venture between Equifax, Experian, and TransUnion. The use of VantageScore is widespread and growing, with eight out of the top 10 banks in the U.S. using the VantageScore model.

While the factors that make up your VantageScore are similar to FICO, they are weighted slightly differently. Here’s how your credit score is calculated based on the VantageScore 3.0 model:

- Payment history: 40%

- Depth of credit: 21%

- Credit utilization: 20%

- Balances: 11%

- Recent credit: 5%

- Available credit: 3%

Additionally, VantageScore organizes the credit score ranges differently, with unique names for each score category:

- Superprime: 781 to 850

- Prime: 661 to 780

- Near prime: 601 to 660

- Subprime: 600 and below

While FICO and VantageScore are the most commonly used credit scoring models, other models are available. For example, the three major credit bureaus offer proprietary scores, such as the Equifax Credit Score, Experian’s National Equivalency Score, and TransUnion’s TransRisk Score.

However, these scores don’t tend to get used in as many lending decisions as FICO and VantageScore models. You’re most likely to see them when you check your credit score with one of the bureaus.

Which credit score is most accurate?

No single credit score is considered the most accurate. One lender might prefer VantageScore, while another only looks at your FICO Score, but that doesn’t mean one is a better representation of your creditworthiness. Both are reliable and accurate within the context of their own scoring criteria.

Which credit score do lenders use?

Lenders can use different credit scores or even multiple scores when reviewing loan applications. Each credit score model also has multiple versions, with newer versions typically reflecting changes in consumer behavior. Currently, the most widely used versions are FICO Score 8 and VantageScore 3.0.

The type of loan you’re applying for may also determine which score the lender checks. For example, FICO offers industry-specific scoring models like the FICO Auto Score for auto loans and the FICO Bankcard Score for credit card lending. These scores weigh factors slightly differently when assessing credit risk for the specific loan product.

When it comes to buying a house, most lenders still rely on older FICO versions for mortgages: FICO Score 2 (Experian), FICO Score 4 (TransUnion), and FICO Score 5 (Equifax), in line with federal guidelines. However, lenders plan to transition to using the newer FICO 10T and VantageScore 4.0 scores at some point soon.

How to check your credit scores

Regularly checking your credit score can help you understand how your actions impact your perceived creditworthiness. It’s also a useful way of understanding how different scores compare. Here are three of the best ways to check your credit scores:

- myFICO website: You can check your FICO Score from Equifax with a free myFICO plan or access all three bureaus’ scores with a paid plan.

- Credit card or bank: Many financial institutions offer credit score tools to bank account or credit card holders. Depending on the institution, this might be a FICO score or a VantageScore.

- Credit monitoring: These services track your credit activity for suspicious activity that might indicate fraud, but also often include credit score information. For example, a LifeLock Ultimate Plus membership offers credit monitoring alongside a free credit report weekly and access to your VantageScore 3.0 credit score.

Protect your credit and identity

Your credit score isn’t just a key part of your financial health — it can also be one of the first warning signs of identity theft. A sudden drop in your score might indicate fraudulent activity.

Rather than manually checking your credit all the time, join LifeLock Ultimate Plus for daily credit score updates, credit reports, and reliable credit monitoring that can help you spot the signs of fraud. You’ll also benefit from a range of tools that can help you protect your finances, like alerts for suspicious activity on your bank accounts, investment accounts, and credit cards.

FAQs

What’s a good FICO score?

According to the FICO model, a good credit score falls between 670 and 739, while scores ranging from 740 to 799 are considered very good.

Why is my FICO score higher than my credit score?

Each credit scoring model calculates scores slightly differently, so they can vary. Additionally, the timing of when each score updates can create discrepancies between them. For example, if your FICO Score was calculated right after you paid your credit card bill, but your VantageScore was calculated earlier, your FICO Score may be higher due to lower credit utilization.

Why is my FICO score different on different sites?

Your FICO score can differ across sites because each one may use data from different credit bureaus. And not all lenders report to all three bureaus, so the information in your credit report might vary. For example, if a lender only reports a late payment to Experian, your FICO score from Experian could be lower than the scores you receive from Equifax or TransUnion, which may not have that information.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- Is a FICO score the same as a credit score?

- What is a credit score?

- What is a FICO score?

- Why is my FICO score different from my credit score?

- Other credit scoring models

- Which credit score is most accurate?

- Which credit score do lenders use?

- How to check your credit scores

- Protect your credit and identity

- FAQs

Start your protection,

enroll in minutes.

Copyright © 2025 Gen Digital Inc. All rights reserved. All trademarks, service marks, and tradenames (collectively, the "Marks") are trademarks or registered trademarks of Gen Digital Inc. or its affiliates ("Gen") or other respective owners that have granted Gen the right to use such Marks. For a list of Gen Marks please see GenDigital.com/trademarks.