Spot the scam: Be cautious of job listings offering above-average salaries or generous sign-on bonuses, and application processes that require you to first send money or complete suspicious online forms.

LinkedIn, like any other social media platform, is used by some scammers as a channel to reach potential victims. In the first half of 2024 alone, LinkedIn detected over 86 million fake profiles and more than 142 million spam or scam incidents.

Cybercriminals targeting job seekers and business professionals with LinkedIn scams aim to get access to sensitive information, account credentials, or details that they can use in financial fraud. To help keep yourself safe from these schemes, you need to be able to recognize them.

Here are eight of the most common LinkedIn scams and tips that can help you spot them.

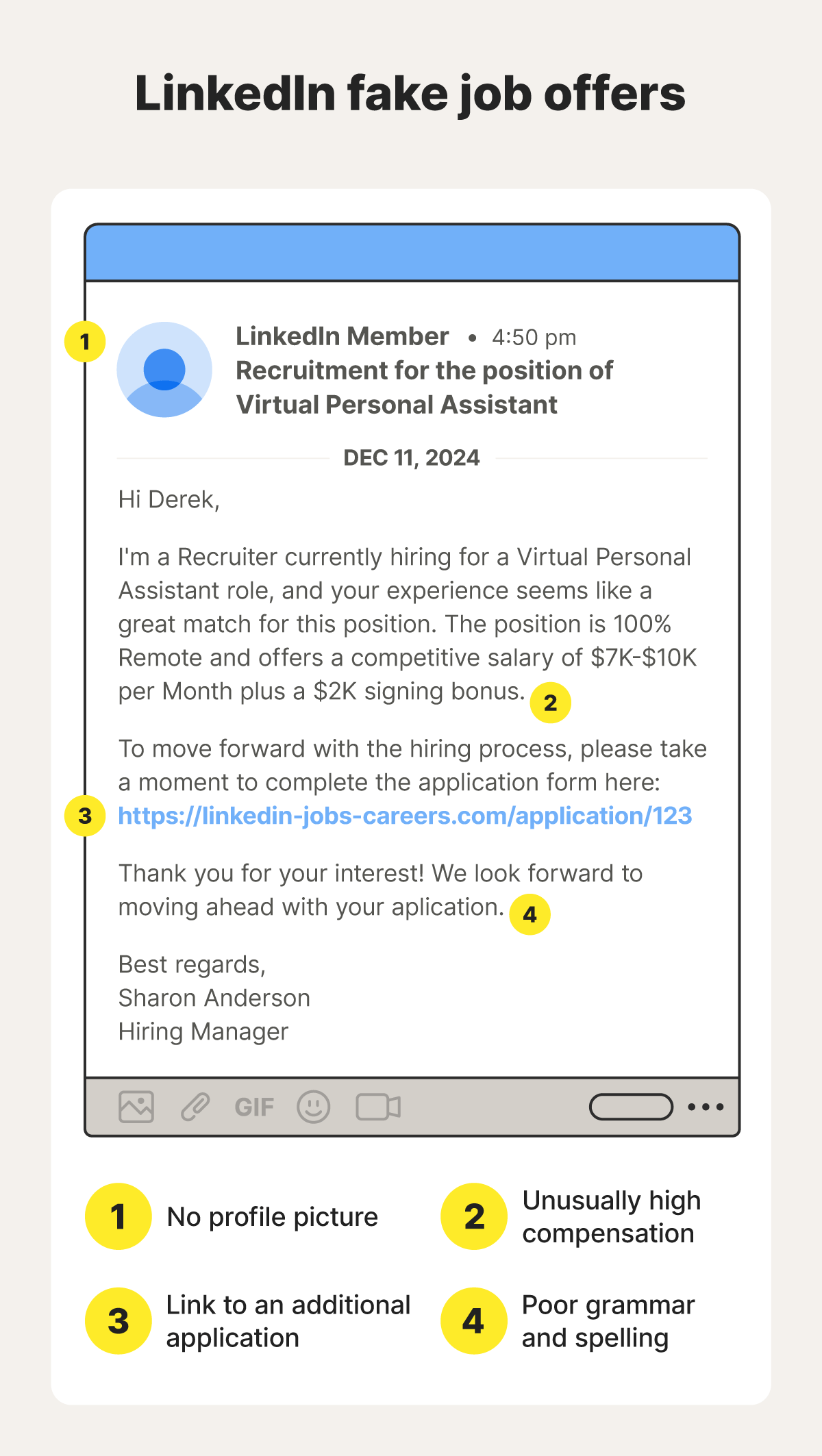

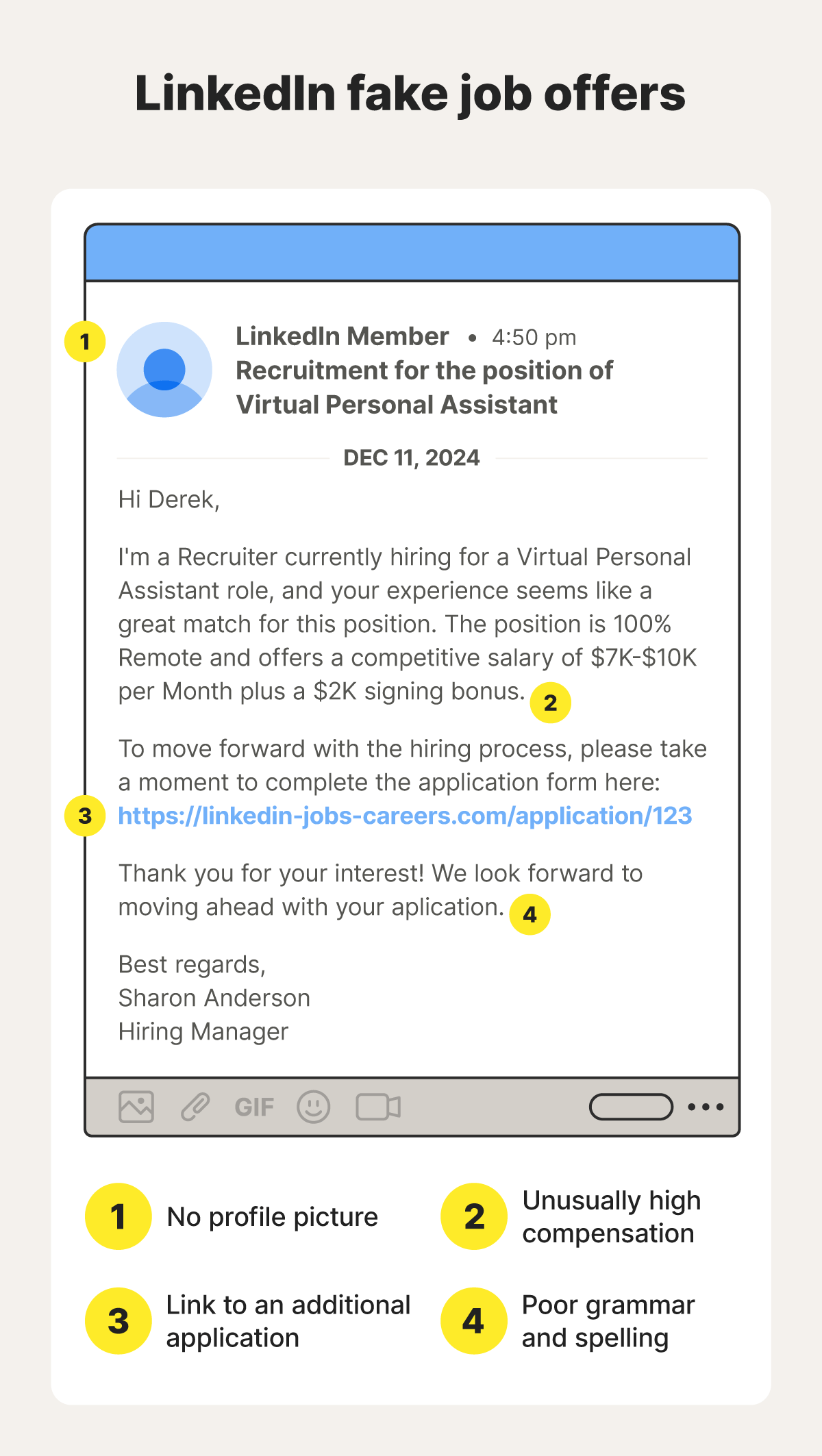

1. Fake job offers

Some LinkedIn scammers pose as recruiters or hiring managers and try to lure victims into their scheme by offering a high-paying job that requires minimal effort. They commonly advertise remote roles like personal assistants, admin clerks, or mystery shoppers.

If you submit an application for a fake job on LinkedIn, the scammer may ask you to send money via check, wire transfer, or prepaid gift card. In other cases, they may try to send you to a webpage containing an “application form” designed to steal sensitive information. Both scams might position these requests as prerequisites for an interview or job offer.

One Reddit user reported that they accidentally applied for a scam job on LinkedIn and then received a suspicious email with a link asking them to submit their credit score.

2. Tech support scams

Some scammers impersonate technical or customer support representatives to convince targets that their account has an urgent issue requiring immediate attention. They may contact you via LinkedIn’s built-in messaging platform or over the phone with an offer to “resolve” the issue, by “fixing your settings,” for example.

This is a trick that aims to get you to grant access to your account. Once they get in, they can reset your password and steal personal information which they may then be able to use to commit identity theft.

Spot the scam: Remember that LinkedIn doesn’t have a phone number for customer support and will never ask for access to your account, through direct messages, emails, or any other communication channel.

3. Phishing

LinkedIn phishing scams involve bad actors pretending to be someone trustworthy to trick targets into revealing their personally identifiable information or exposing their devices to malware.

Fraudsters may pose as recruiters or business professionals, sending messages with links they claim lead to their website, a Google Doc, or a background check form. However, these links may instead lead to malicious sites designed to steal sensitive information or install malware on your device.

Falling victim to a phishing scam, whether it leads to a loss of information or a hacker getting access to your device through malware, can lead to serious consequences, including identity theft and financial losses.

Spot the scam: Be cautious of unsolicited messages that include links, especially if they ask for sensitive information like your Social Security number, passport number, or bank account information. To verify the legitimacy of a link, hover over it to check the URL you’ll be sent to. If it looks suspicious, don’t click.

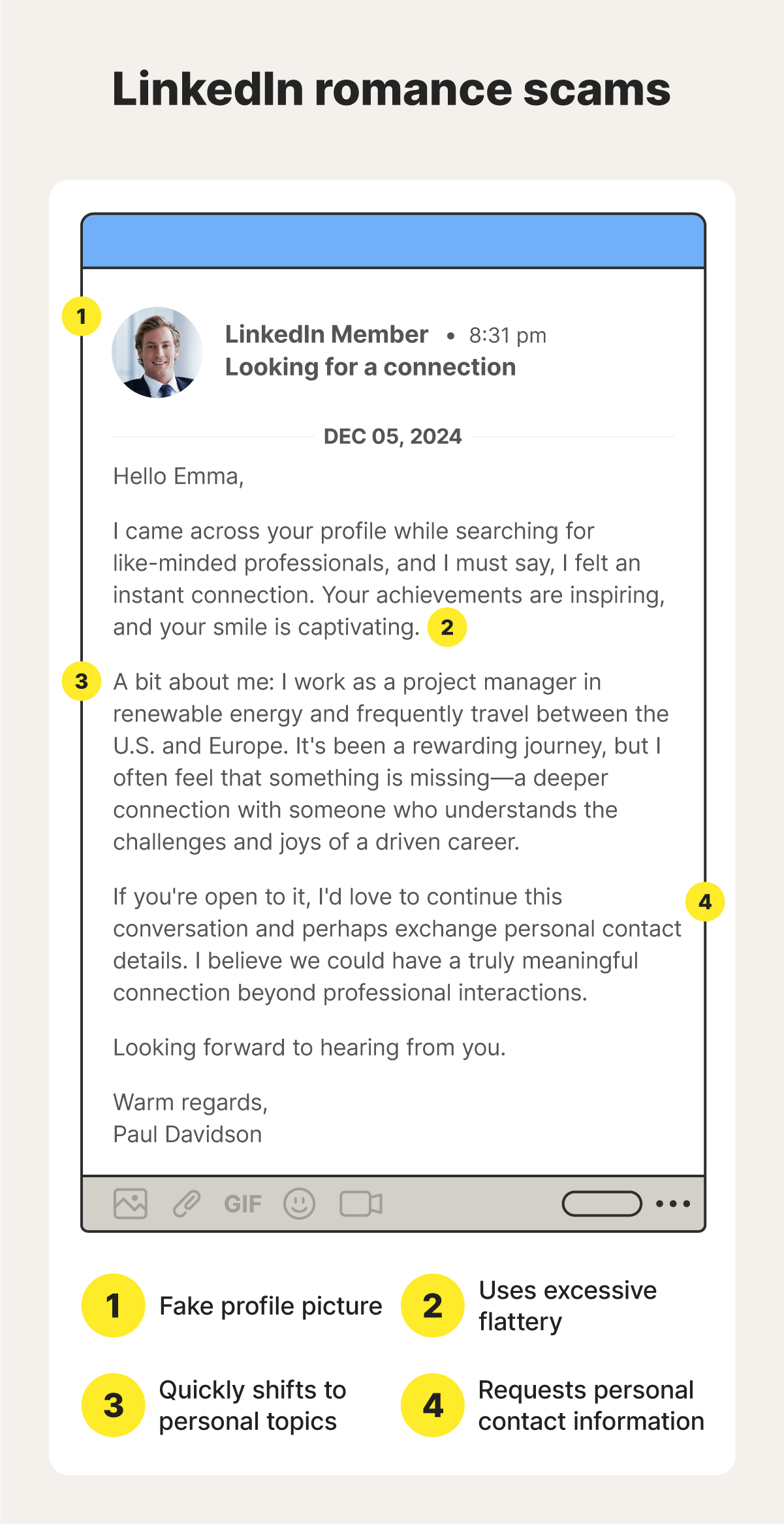

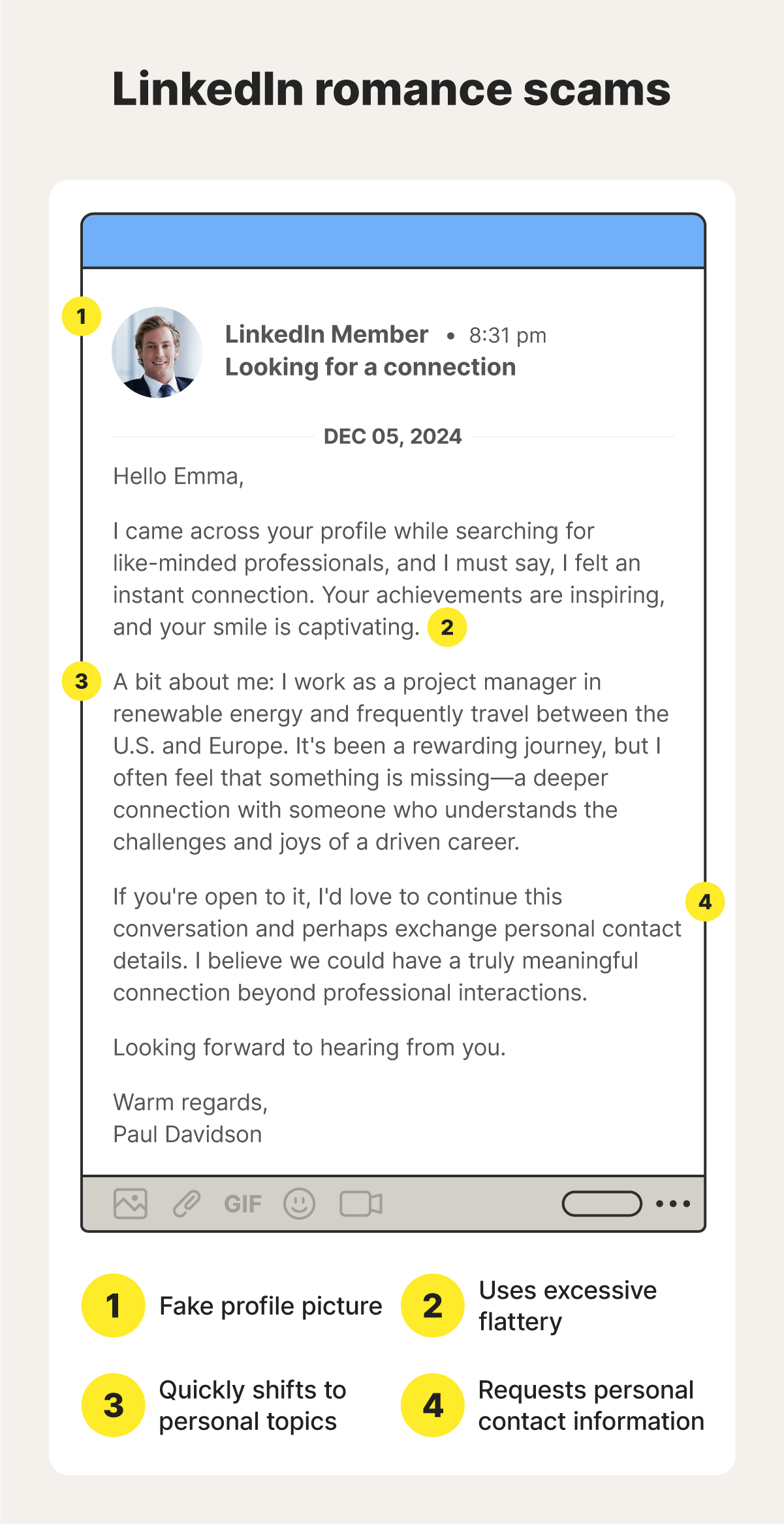

4. LinkedIn romance scams

Despite being a professional networking website, LinkedIn is sometimes used by scammers running romance schemes. In these scams, a fraudster might message you expressing romantic interest and attempting to build a relationship. After chatting and gaining your trust, the scammer may ask for money, claiming it’s for an urgent emergency or investment opportunity.

The Wall Street Journal reported on an elderly man who lost his life savings to a LinkedIn romance scam. The scammer communicated with the victim over several months, eventually transferring the conversation to WhatsApp where they persuaded him to put a significant amount of money into a fraudulent investment platform.

Spot the scam: Be wary of individuals who initiate romantic conversations on LinkedIn. Sudden, unsolicited romantic interest that’s followed by requests for money or personal information is a clear red flag of a scam.

5. Advanced fee and inheritance scams

Advanced fee scams involve a fraudster reaching out claiming that you’re set to receive a large sum of money, typically from an inheritance or prize. The catch is that the scammer will ask you to first send an advanced fee to receive the payout. If you send the money, the scammer can block you and disappear with your funds.

Advanced fee scams may be rolled into fake job offers. Scammers may claim that they’d like to employ you but require you to send a processing fee for a background check.

Spot the scam: A notification that you’re due an inheritance payout will never be delivered over LinkedIn. Any request for an advance fee sent via a LinkedIn message is likely to be a scam, especially if you haven’t entered a competition or applied for a job.

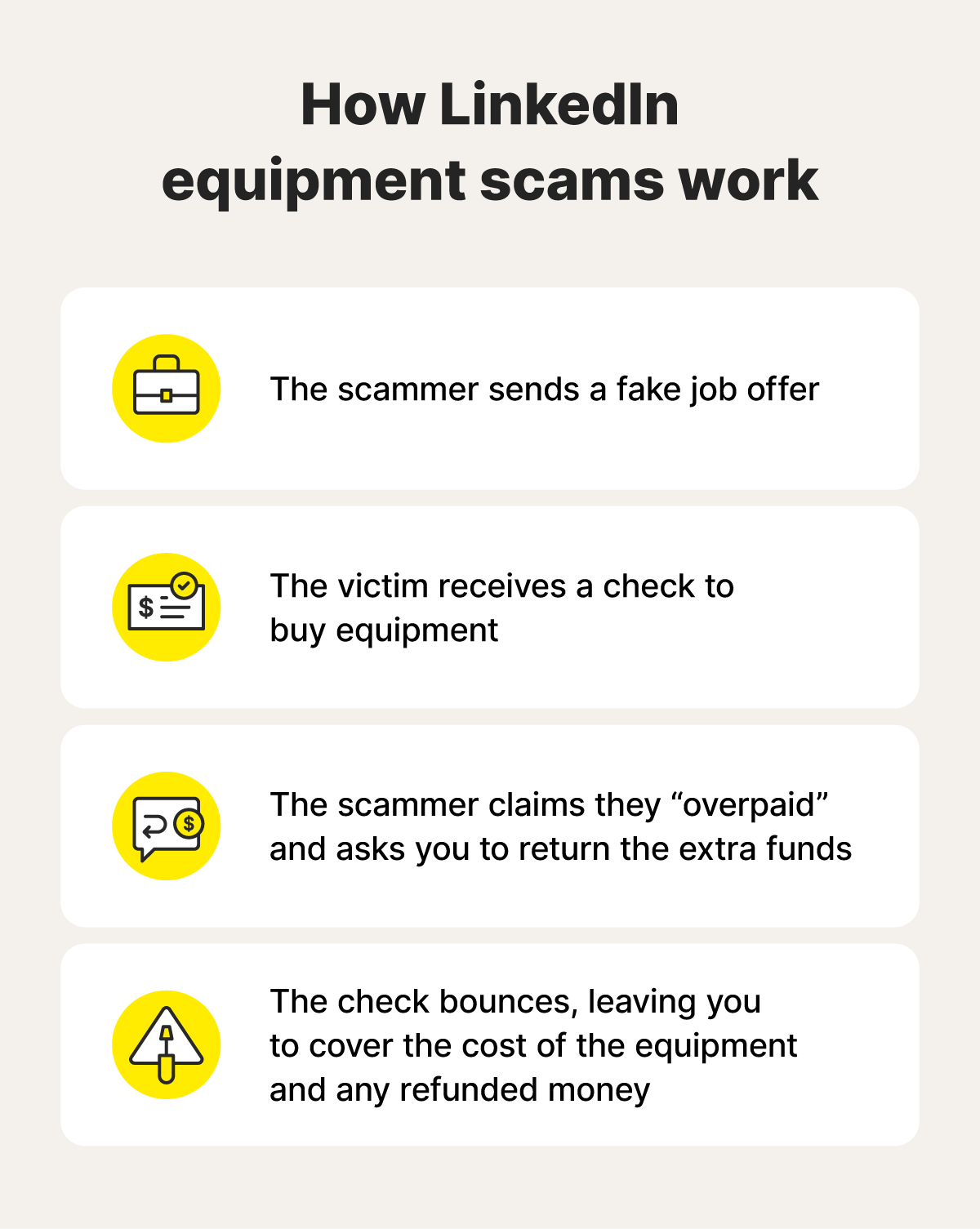

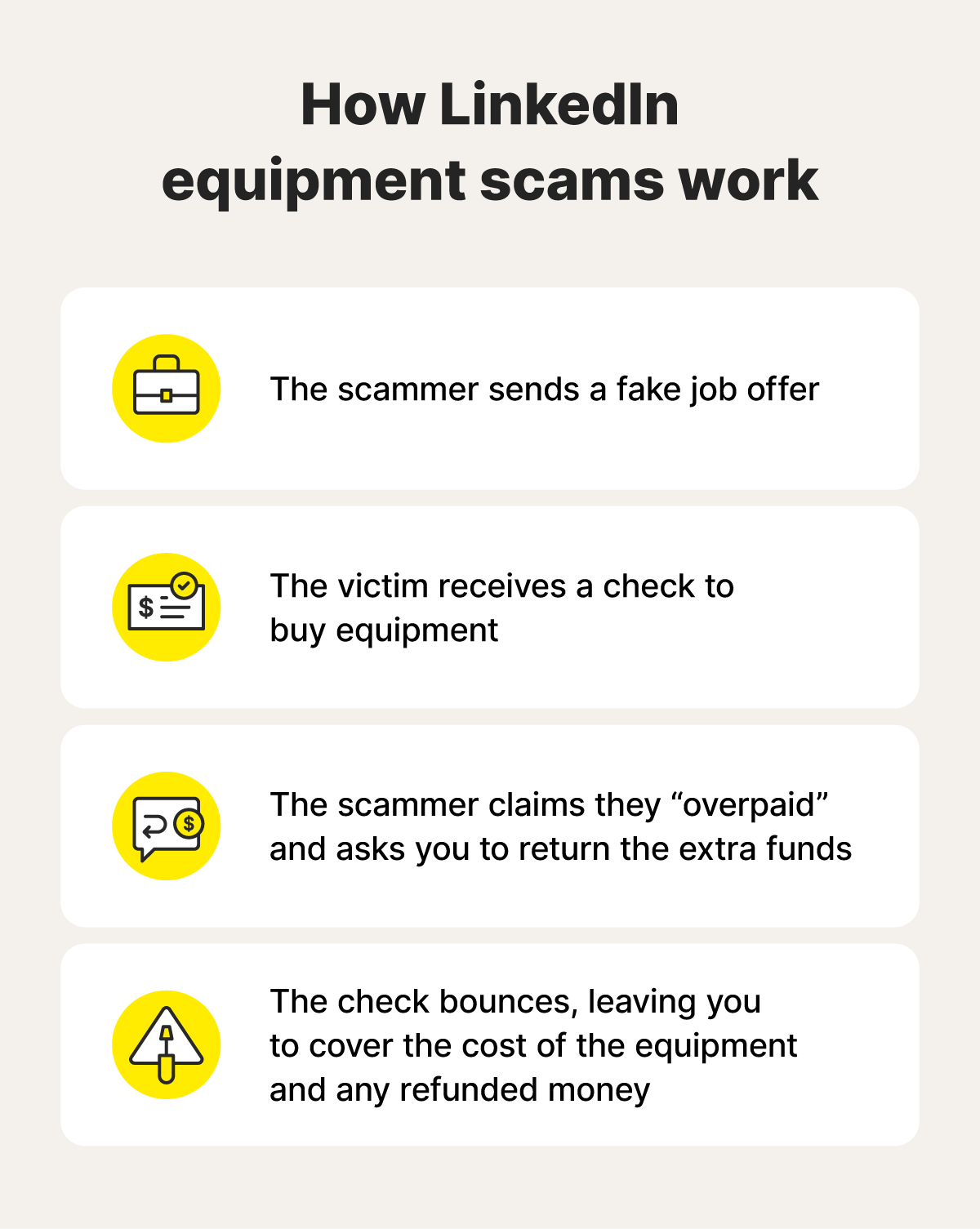

6. Work-from-home equipment scams

Equipment scams occur when a fraudster offers you a fake job via LinkedIn and sends a check for you to purchase work-from-home equipment, like a computer or monitor. Afterward, they claim to have accidentally overpaid and ask you to return the extra money. The original check then bounces, leaving you to swallow the cost of both the equipment and any money you sent back to the scammer.

One Reddit user encountered this scam when a “hiring manager” instructed them to purchase a MacBook Pro and software for orientation, supposedly funded by the company. Luckily, the potential target recognized the scam after looking up the real company’s website and realizing the scammer’s email address had a slightly different domain name.

Spot the scam: Be wary if a company requests that you buy your own equipment, such as a computer or phone. This is a major red flag you’re being targeted by a scam.

7. Investment scams

Some LinkedIn scams revolve around “investment opportunities,” with scammers claiming they can guarantee you high returns on an initial investment. You might hear from an existing connection whose account has been hacked or a new fake account that’s tailored to look like it’s owned by an authentic investor.

They’ll typically reach out in a LinkedIn message and may claim that they have insider information about a stock or cryptocurrency token that’s going to rise in price. If you fall for it and send them money to invest on your behalf, they can block you and disappear with your funds.

Spot the scam: Be cautious of anybody who reaches out to you directly about an investment opportunity, especially if their account or message seems suspicious. Do your own research and never send money to someone else to invest on your behalf.

8. Account takeover attack

An account takeover attack involves a fraudster trying to gain access to your LinkedIn account, typically using information they’ve stolen through a phishing scheme or following a data breach.

If they get access, they can lock you out by changing your password and use your account to scam your connections. That leaves you with the challenging task of reclaiming your LinkedIn identity, and facing potential damage to your professional image.

Spot the scam: Look out for emails from LinkedIn flagging an unusual login attempt or suspicious changes to your account details or settings. Both can be warning signs that someone’s trying to take over your account.

How to tell if someone is scamming you on LinkedIn

Knowing how to spot the warning signs of a scam on LinkedIn can help you take steps to protect yourself. Here are some key red flags to look out for:

- Strange profile: Although receiving contact from a stranger isn’t unheard of on LinkedIn, be on guard if you hear from someone with whom you don’t share any mutual connections. Also look out for profiles with no profile pictures, incomplete employment history, and few connections, which may have been hastily set up by a scammer.

- Grammatical errors and misspellings: User profiles, messages, or job listings that are full of spelling and grammar mistakes may also be an indication of a scam.

- Suspicious links: While you should act with caution whenever you’re prompted to click a link on LinkedIn, be particularly careful if the URL you’re being sent to looks suspicious. If it contains strange characters or is slightly different from the official website you’re told it’ll send you to, it may be part of a phishing or account takeover scam.

- Pressure to move quickly: Scammers often pressure targets to make a quick decision, claiming a job offer or investment opportunity is only available for a brief period of time, for example.

- Above-average compensation: Scammers who post fake job adverts on LinkedIn often aim to lure targets in with unusually high pay. Be especially wary if the job posting emphasizes advance payments or large signing bonuses.

- Job offer without an interview: If a recruiter offers you a job without first conducting an interview, it’s a major red flag of a potential scam.

- Requests to communicate on a different platform: Be cautious if somebody who reaches out to you on LinkedIn requests to move the conversation to another platform like WhatsApp, where they can scam you without fear of LinkedIn monitoring their activity.

Tips to avoid LinkedIn scams

Scammers often use sophisticated approaches that involve social engineering to trick vulnerable users. While there’s no guarantee you’ll be able to identify every scam you’re targeted by, there are some general best practices to follow that can help you avoid falling victim to them:

- Don’t give out personal information: Make sure to protect your personal information while using LinkedIn. Don’t share your Social Security number, bank account number, or driver’s license number with anybody.

- Verify LinkedIn profile details: If somebody contacts you on LinkedIn claiming to be from a specific company, try to verify if they’re telling the truth. Check if they’re connected with other employees and ensure their job history aligns with their claims.

- Use strong passwords and two-factor authentication: Choose a strong and unique password for your LinkedIn account, and consider a password manager to help you remember it without compromising your security. Enable two-factor authentication for an extra layer of protection against potential hackers.

- Never send payments: Legitimate companies will never ask for you to pay them over LinkedIn, and any other advanced fee requests, whether they’re related to an “investment opportunity,” “inheritance payout,” or something else, are likely to be a scam.

What to do if somebody scammed you on LinkedIn

Sometimes, even if you take all the right precautions, a scammer may be able to trick you. The next best thing after knowing how to protect yourself is knowing what to do if you get scammed on LinkedIn.

If you suspect you’ve fallen for a LinkedIn scam, here are some key steps to take:

- Fill out LinkedIn’s Reporting a Possible Scam Form with a link to the scammer’s profile, the message you received, and any other relevant details.

- If you provided sensitive personal details that may have compromised your accounts on LinkedIn or other sites, update your passwords and enable 2FA to protect against account takeover attacks.

- If you revealed financial information, consider setting up a fraud alert or freezing your credit to help prevent identity theft leading to financial losses or credit score damage.

- If you sent money to the scammer, report it to the Federal Trade Commission (FTC) at reportfraud.ftc.gov. You’ll get guidance on the next steps to take, and your report may help the FTC build a bank of evidence on the scammer.

Stay safe as you network on LinkedIn

Scammers are constantly developing new approaches to target victims on social media platforms like LinkedIn. While learning how common scams work and what you can do to avoid them is useful, investing in identity theft protection can help add an extra layer of defense.

LifeLock offers a range of features that can help you safeguard your personal data and recover your identity if it’s ever stolen. That includes alerts† for potentially fraudulent use of your Social Security number, credit monitoring, and identity restoration support from a U.S.-based specialist.

† LifeLock does not monitor all transactions at all businesses.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- 1. Fake job offers

- 2. Tech support scams

- 3. Phishing

- 4. LinkedIn romance scams

- 5. Advanced fee and inheritance scams

- 6. Work-from-home equipment scams

- 7. Investment scams

- 8. Account takeover attack

- How to tell if someone is scamming you on LinkedIn

- Tips to avoid LinkedIn scams

- What to do if somebody scammed you on LinkedIn

- Stay safe as you network on LinkedIn

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.