Scammers have grown more sophisticated in their efforts to deceive their victims, with one of their common tactics being fake bank text messages designed to trick people into sharing sensitive personal information. We’ll show you how to recognize fake bank scam messages and help protect yourself from fraud.

How fake bank text messages work

Cybercriminals use malicious text messages to masquerade as legitimate financial institutions and deceive unsuspecting targets into revealing personal information, leaving them vulnerable to identity theft.

Here’s how bank phishing scams work:

- Targeting: A scammer identifies potential victims through data breaches, public records, or social media profiles.

- Crafting the message: The scammer creates a convincing and urgent text message that appears to be from a legitimate bank.

- Sending the message: The scammer sends the fake text message to a targeted victim.

- Tricking the victim: The victim falls for the scam and takes the requested action.

- Data theft: Once the victim taps a malicious link or provides personal information, the scammer can steal their data for fraudulent purposes.

- Exploiting the stolen information: The scammer uses the information to piece together their identity and commits identity theft, financial fraud, or other crimes.

Will a bank ever send you a text message?

Yes, banks may send security alerts, account updates, and transaction notification text messages to customers. However, they will never require you to confirm your account details or request other personal information via text.

In any case, it's important to be cautious and verify the authenticity of an SMS before interacting with any messages purportedly from your bank.

7 Warning signs of bank phishing

The best way to avoid being tricked by a fake bank phishing scam is to know the red flags to look out for. Whenever you suspect a text from your bank might be fake, keep these fake bank text message warning signs in mind:

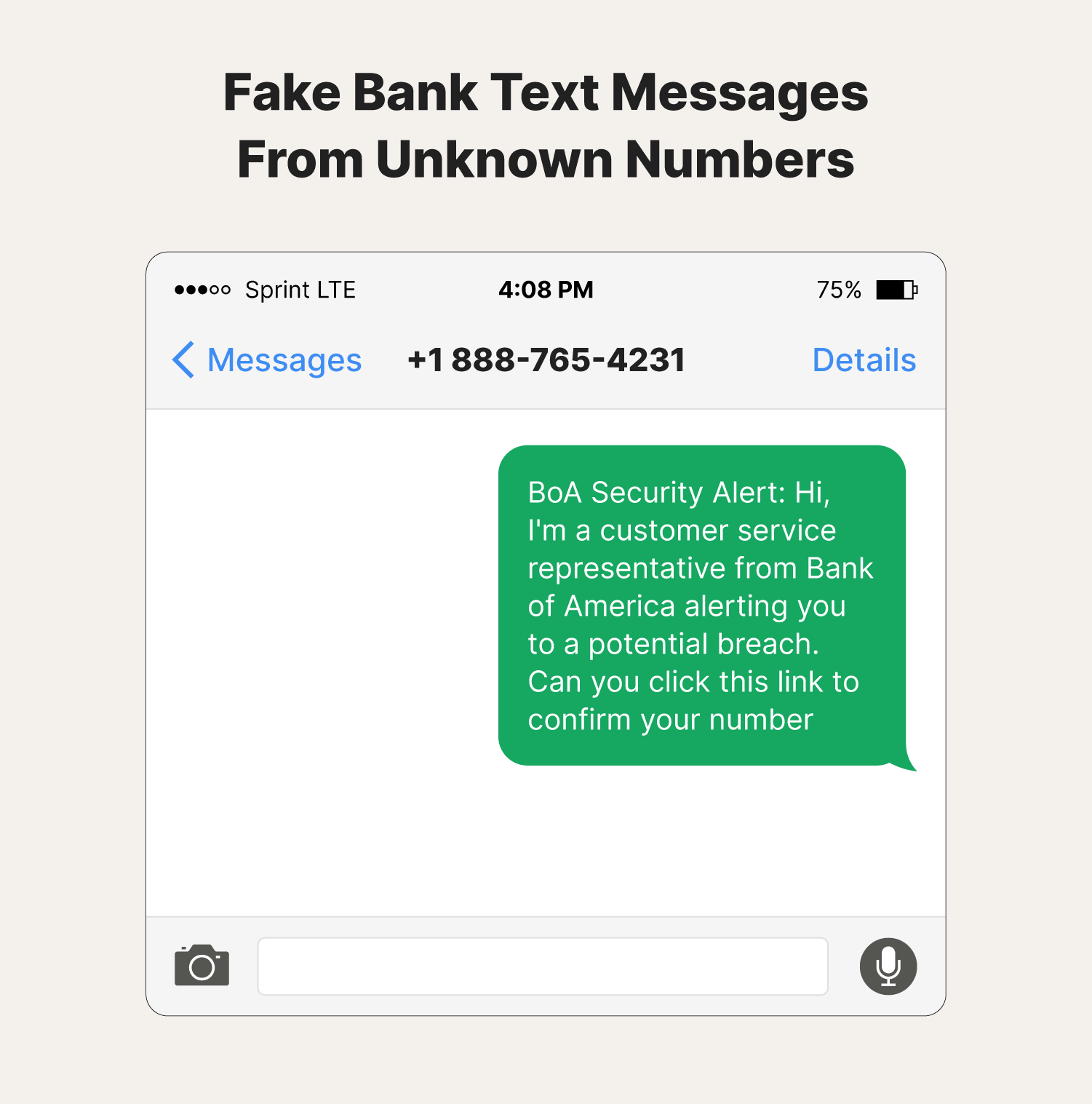

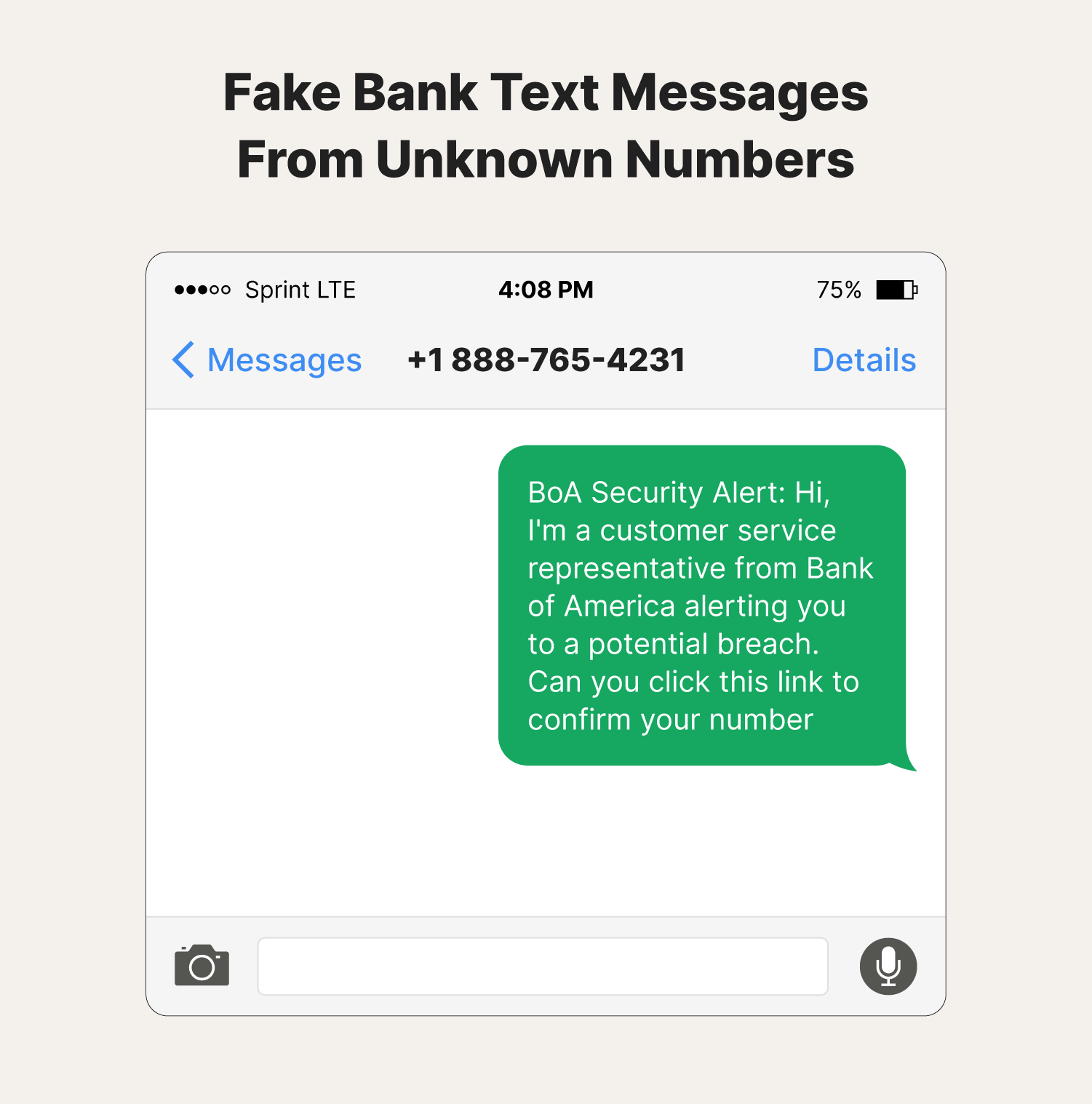

1. Unknown number

Be cautious of text messages from unfamiliar numbers, as legitimate banks almost always use their official contact information when communicating with customers. If you're unsure whether a number is from your bank, contact their customer service directly to verify it.

2. Tempting links

Avoid tapping on links in text messages that appear suspicious or unusual—they could lead to phishing websites designed to steal your personal information. Instead of tapping the link, you can manually type the bank's website address into your browser to access your account.

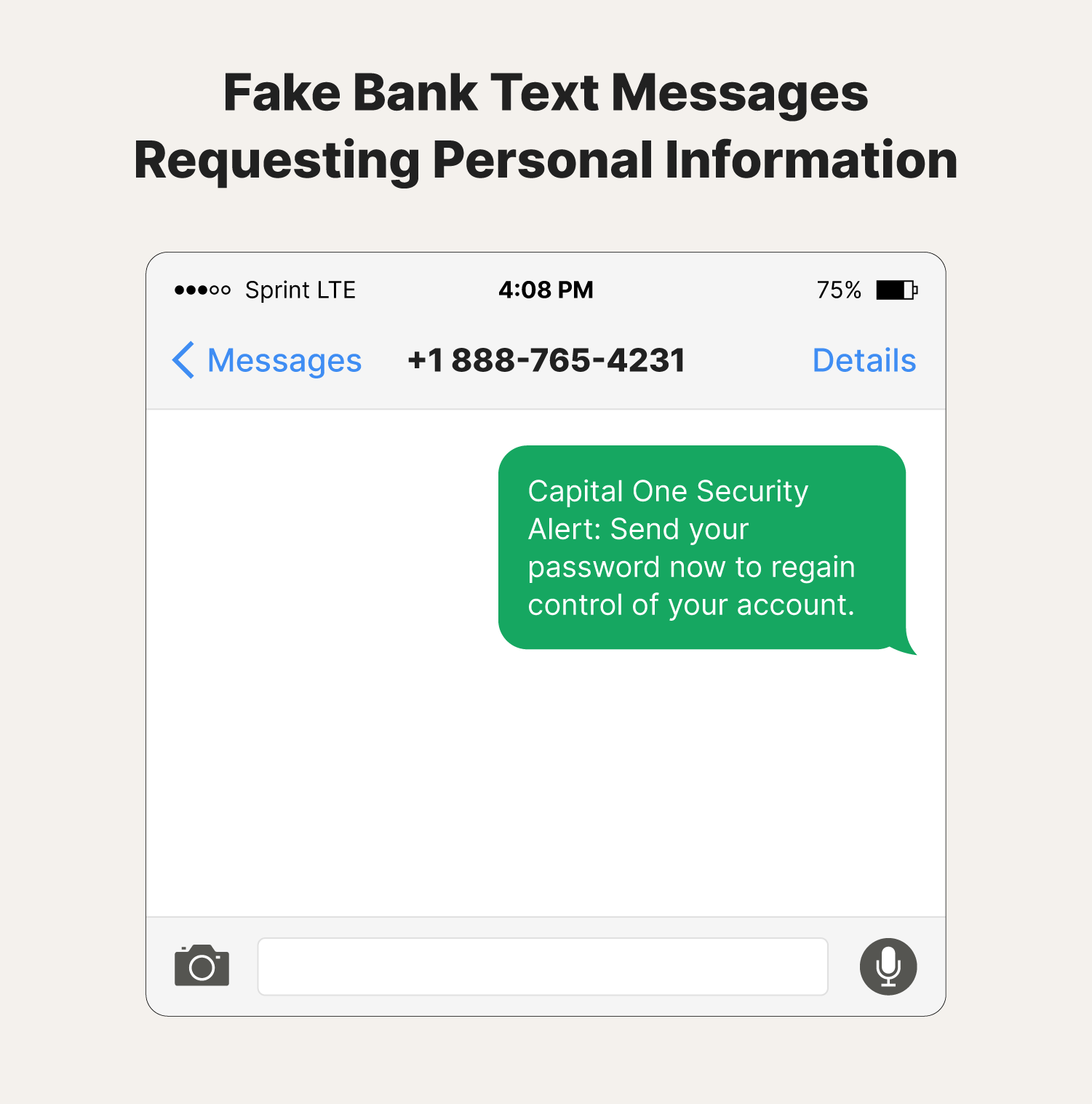

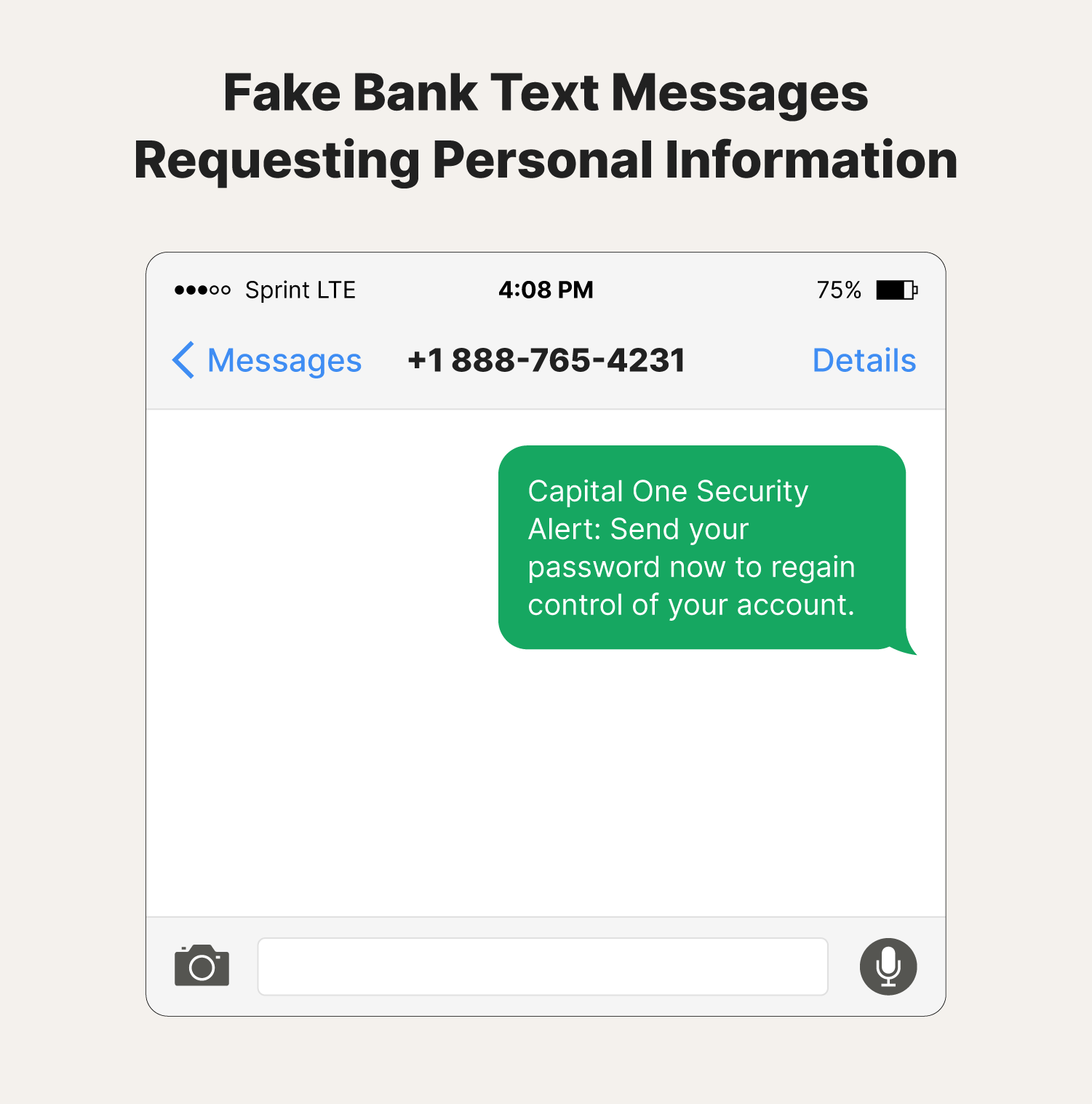

3. Personal information requests

Never share sensitive information like your account number, password, or PIN in response to a text message. Legitimate banks will never ask for this information via text. If you ever receive a message requesting such information, it's a scam.

4. Urgent demands

Be cautious of messages that create a sense of urgency and pressure you into making hasty decisions. If you receive a message demanding immediate action, take a step back and assess the situation carefully. It's important to avoid making impulsive decisions when dealing with suspicious messages.

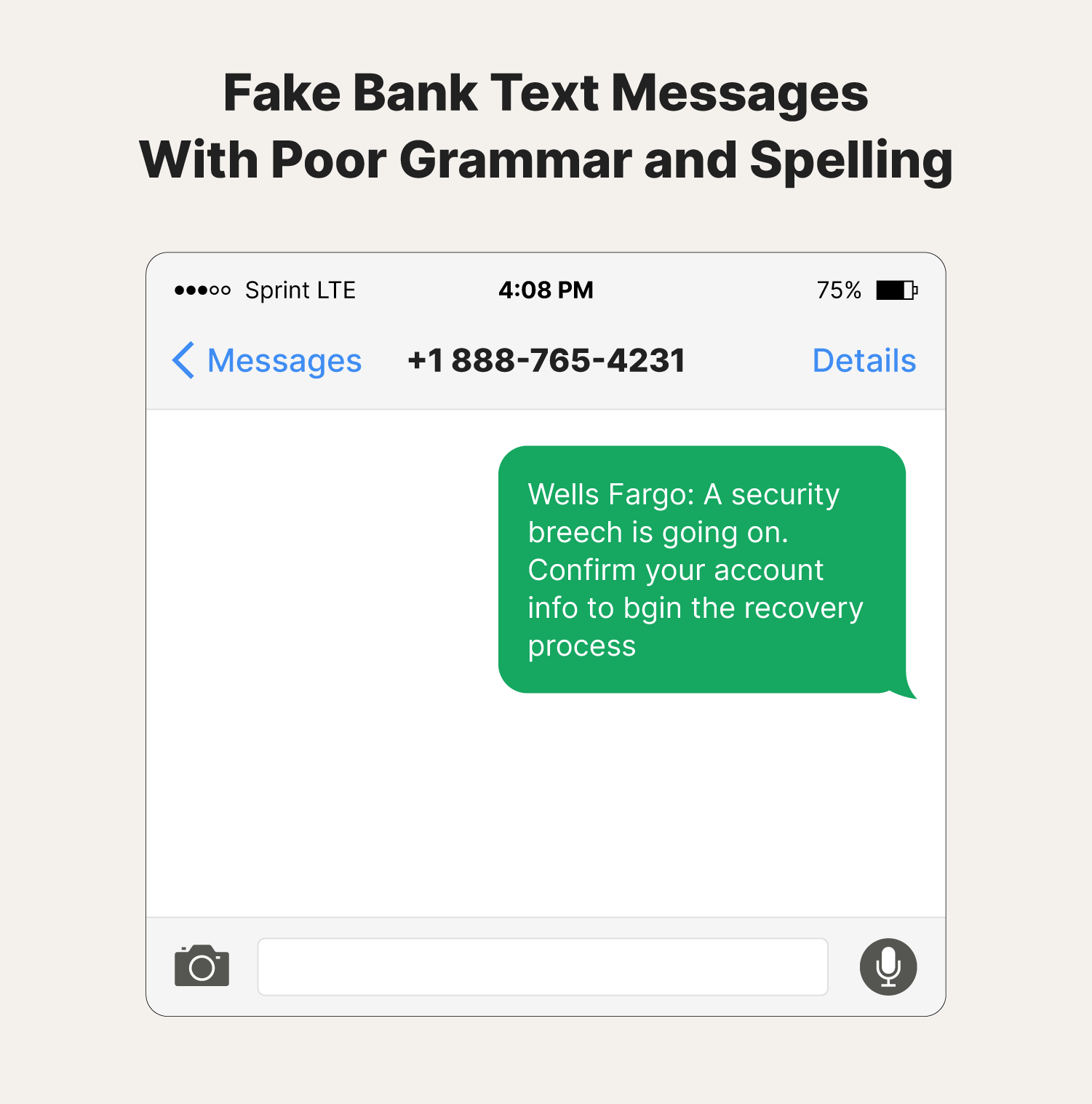

5. Poor grammar and spelling

If the text message contains grammatical errors or misspelled words, it might indicate a scam. Legitimate banks typically maintain high communication standards, so if you notice any inconsistencies in the message, treat it as a red flag.

6. Unexpected deals

Be skeptical of unsolicited offers that seem too good to be true. Legitimate banks will typically communicate promotions or deals through more official channels, such as email or their website. If you receive an unexpected offer via text, it's best to verify it with the bank directly.

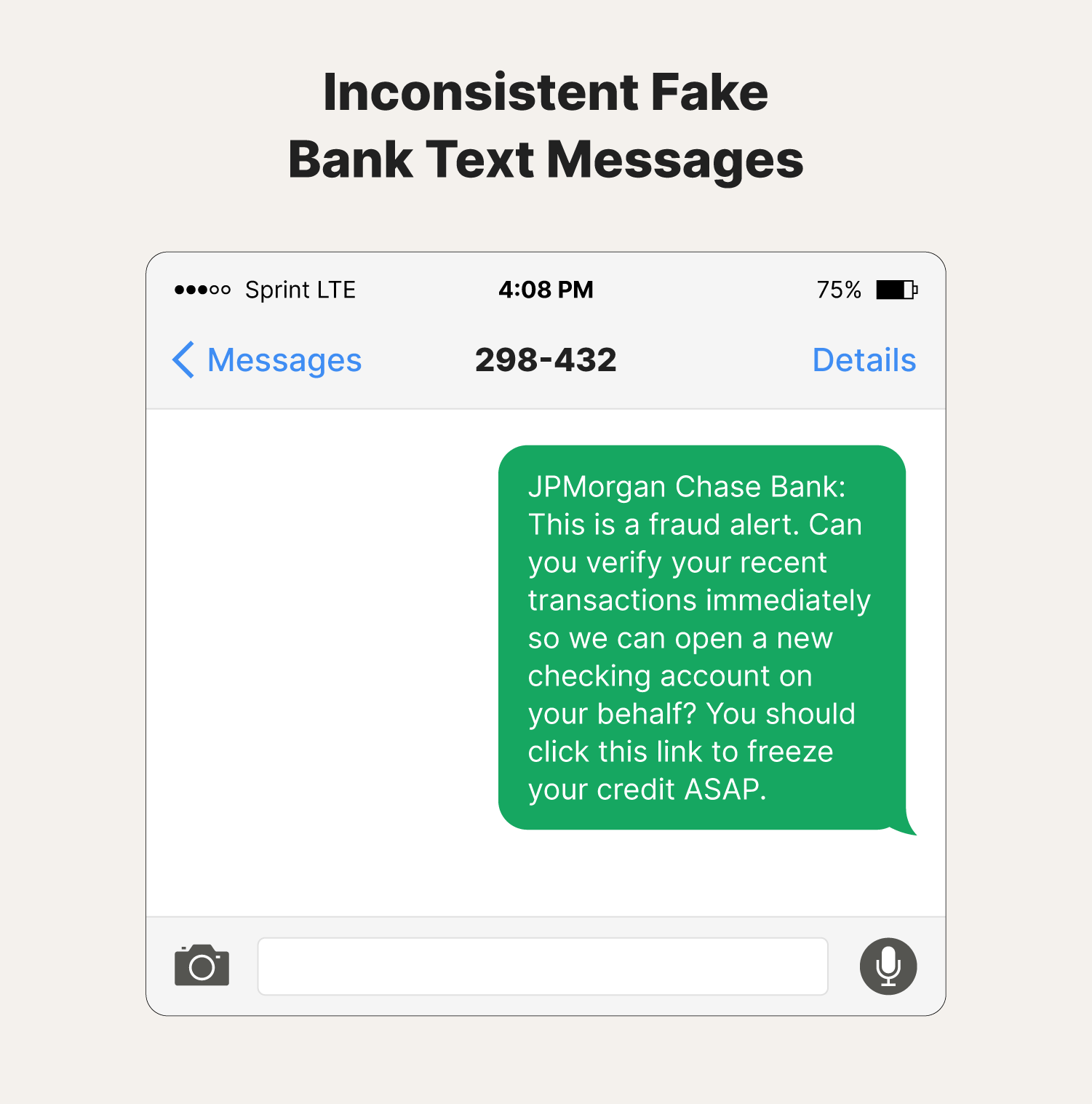

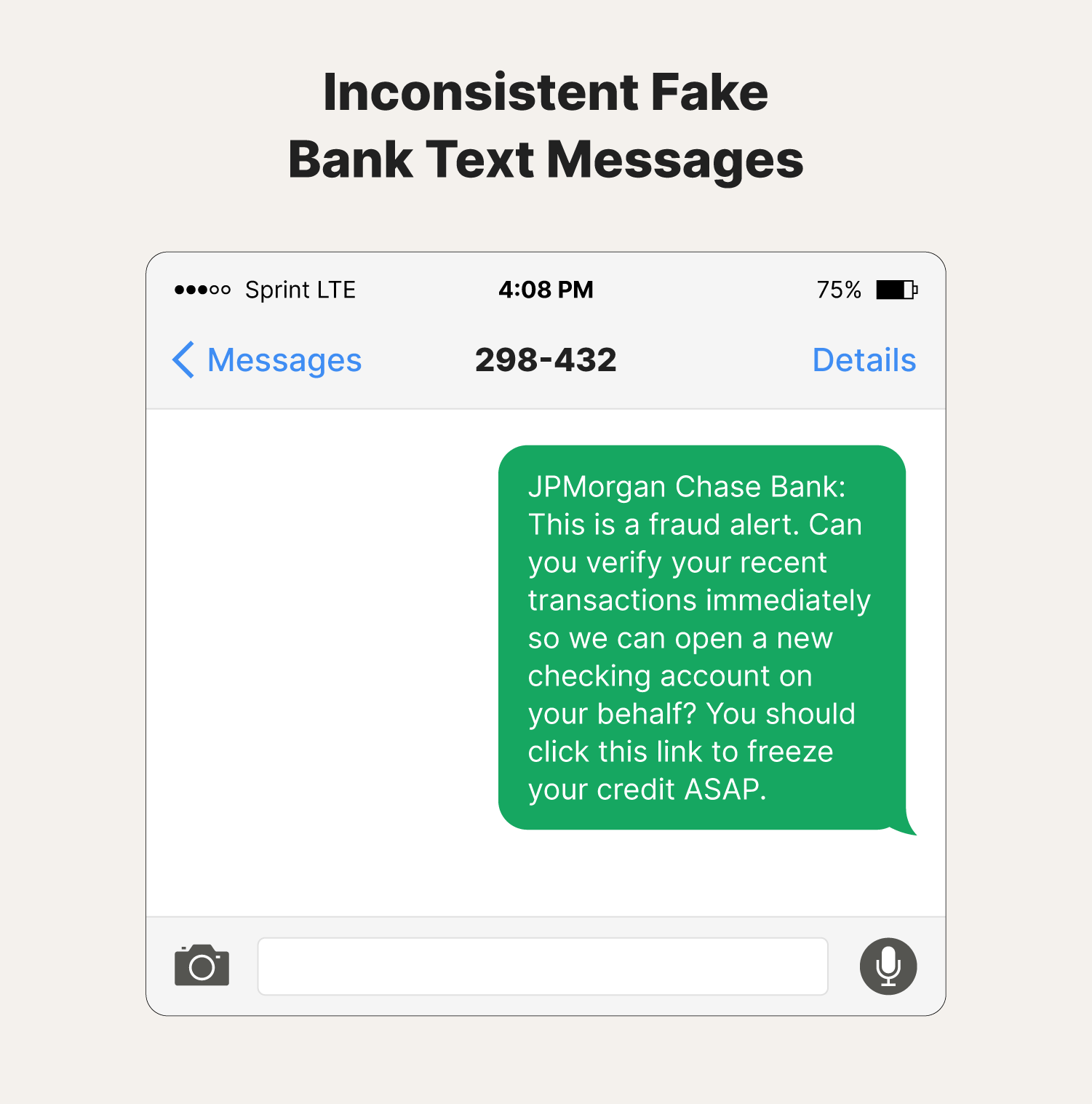

7. Inconsistent information

If the text message contains conflicting or inaccurate information about your account, it’s very likely a sign of a scam. Legitimate banks will nearly always provide accurate and consistent information. Some inconsistencies you may notice include:

- Fake emails and phone numbers: Scammers often use addresses and numbers that closely resemble the bank’s legitimate contact details but with minor alterations.

- Inconsistent logos or branding: Fake messages may contain poorly designed logos or branding that doesn’t match the bank’s usual style.

- Missing or incorrect bank name: Some messages may use vague phrases like “your bank” instead of naming the specific institution you use.

- Missing or incorrect account information: A legitimate text will typically contain accurate account information (e.g., the last four digits of your account number). Scammers might leave out these details or make errors.

- Generic or short codes: Banks usually send texts from easily recognizable short codes or branded names. If the number looks like a personal phone number or a generic short code, it could be fake.

What to do if you receive fake bank text messages

Receiving a fake bank text message can be a distressing experience. However, understanding the appropriate steps to take can help mitigate potential damage and prevent further scams. By following these guidelines, you can protect your personal information and safeguard your financial security:

- Do not respond: Never reply to suspicious text messages or tap any links they contain.

- Verify the sender: Contact your bank using a known phone number or website to confirm the message's authenticity.

- Report the scam: Notify your bank about the scam and provide them with details about the message using a verified channel.

- Change your passwords: If you believe your personal information may have been compromised, change your passwords for your bank account and other online services.

- Monitor your accounts: Keep a close eye on your bank and credit card statements for unauthorized activity.

- Educate yourself: Learn about common scam tactics and how to identify them.

- Be cautious of unsolicited offers: Be wary of unexpected deals or promotions that seem too good to be true.

Remember, if you ever suspect a message is fraudulent, always contact your bank directly through verified channels to verify its authenticity.

| Bank | Phone | |

| Bank of America | abuse@bankofamerica.com | 800-432-1000 |

| Capital One | abuse@capitalone.com | 800-227-4825 |

| Citigroup | spoof@citi.com | 800-248-4226 |

| Fifth Third Bank | 53investigation@security.53.com | 800‑972‑3030 |

| JPMorgan Chase Bank | phishing@chase.com | 800–935–9935 |

| PNC | abuse@pnc.com | 800-762-2035 |

| Truist | emailabuse@truist.com | 844-487-8478 |

| U.S. Bank | fraud_help@usbank.com | 877-595-6256 |

| USAA | abuse@usaa.com | 877-762-7256 |

| Wells Fargo | reportphish@wellsfargo.com | 866-867-5568 |

Tips for protecting your bank information

Knowing what to do when you get an online banking text alert that turns out to be malicious is important. But taking preventive measures to help safeguard your banking information is even better.

Here’s how you can help protect your finances from scammers, hackers, and other cybercriminals:

- Use strong passwords: Create strong passwords that are difficult to crack.

- Enable two-factor authentication: Add an extra layer of security to your accounts by using two-factor authentication.

- Be cautious of public Wi-Fi: Avoid conducting sensitive banking activities on unsecured public Wi-Fi networks.

- Keep your software updated: Ensure your system and software are always updated with the latest security patches.

- Be mindful of phishing scams: Be aware of common phishing tactics and avoid tapping on suspicious links or downloading attachments from unknown sources.

- Monitor your accounts regularly: Review your bank and credit card statements for any unusual activity.

- Shred sensitive documents: Properly dispose of documents containing personal information.

- Be cautious when sharing personal information online: Avoid sharing personal information on social media or other public platforms.

- Use caution when using ATMs: Be aware of your surroundings and check for signs of ATM skimming before using one.

- Report suspicious activity: If you suspect your bank account has been compromised, report it to your bank immediately.

It’s also good to stay informed about the latest scams, like Cash App scams. Knowing how these ploys work can also help you recognize new patterns and protect yourself better against fake SMS bank message alerts.

Protect yourself against bank text scams

No matter how careful you are, it only takes one scam text allegedly from your bank to slip past your guard to put your finances at risk. That’s why you need LifeLock, a comprehensive identity theft protection service with strong financial protection features.

LifeLock will monitor key changes to your credit file and help you if your wallet is ever stolen. And it will alert you if it detects fraudulent use of your personal information. Plus, if you ever become the victim of identity theft, LifeLock’s U.S.-based dedicated restoration specialists are standing by to help you restore your identity.

FAQs about fake bank text messages

Still have questions about fake bank text messages? We've got answers.

How can I tell if a text message from my bank is legit?

To determine if a text message from your bank is legitimate, verify the sender's information and contact your bank directly to confirm the message's authenticity. A bank will never send a text asking for personal information.

How do I stop fake bank texts?

To help stop fake bank texts, block and report scam numbers, enable spam filters on your phone, and consider registering for Do Not Disturb (DND) services to reduce unwanted messages.

Can a scammer steal your info through text?

Yes, scammers can steal your personal information through text messages by tricking you into tapping malicious links or providing sensitive data. Be cautious of any unsolicited messages that request personal information.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.