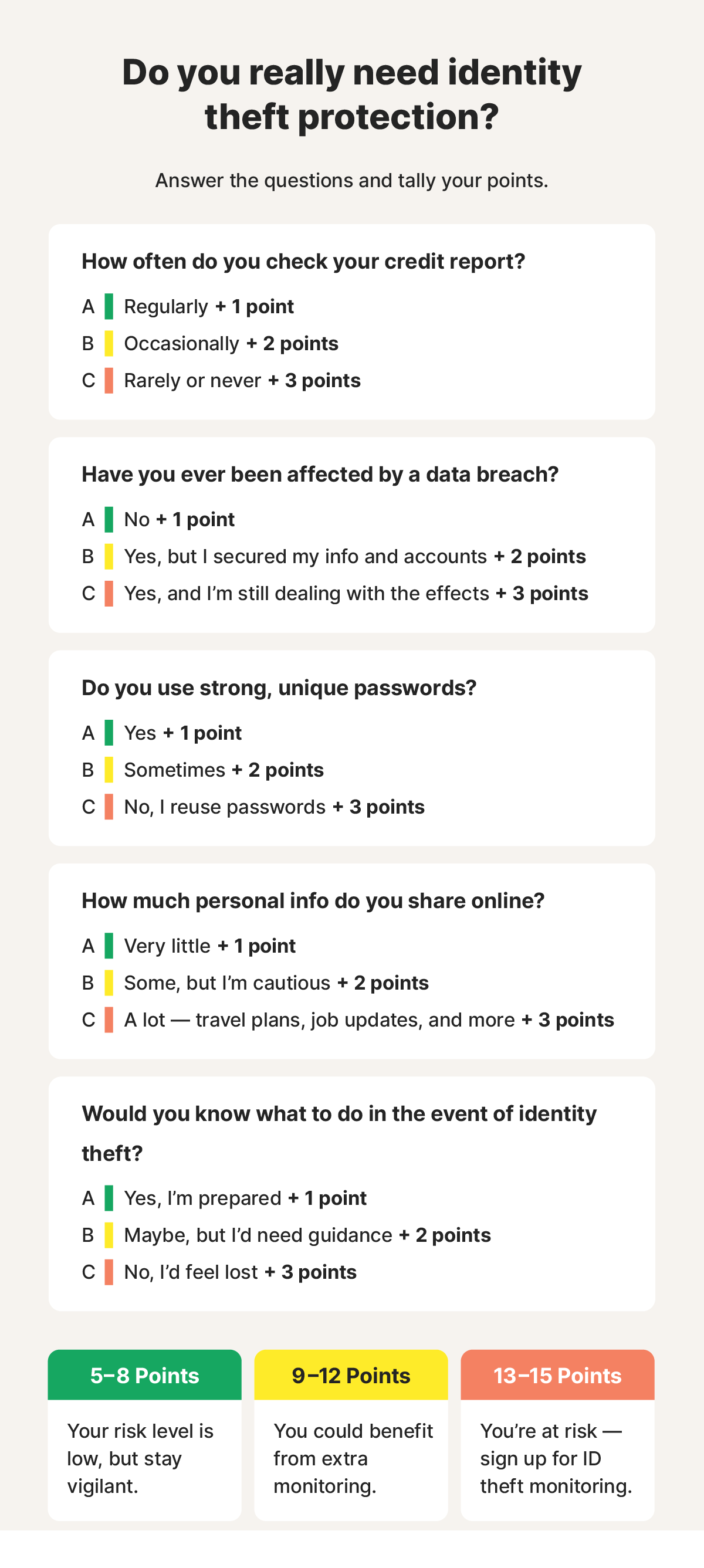

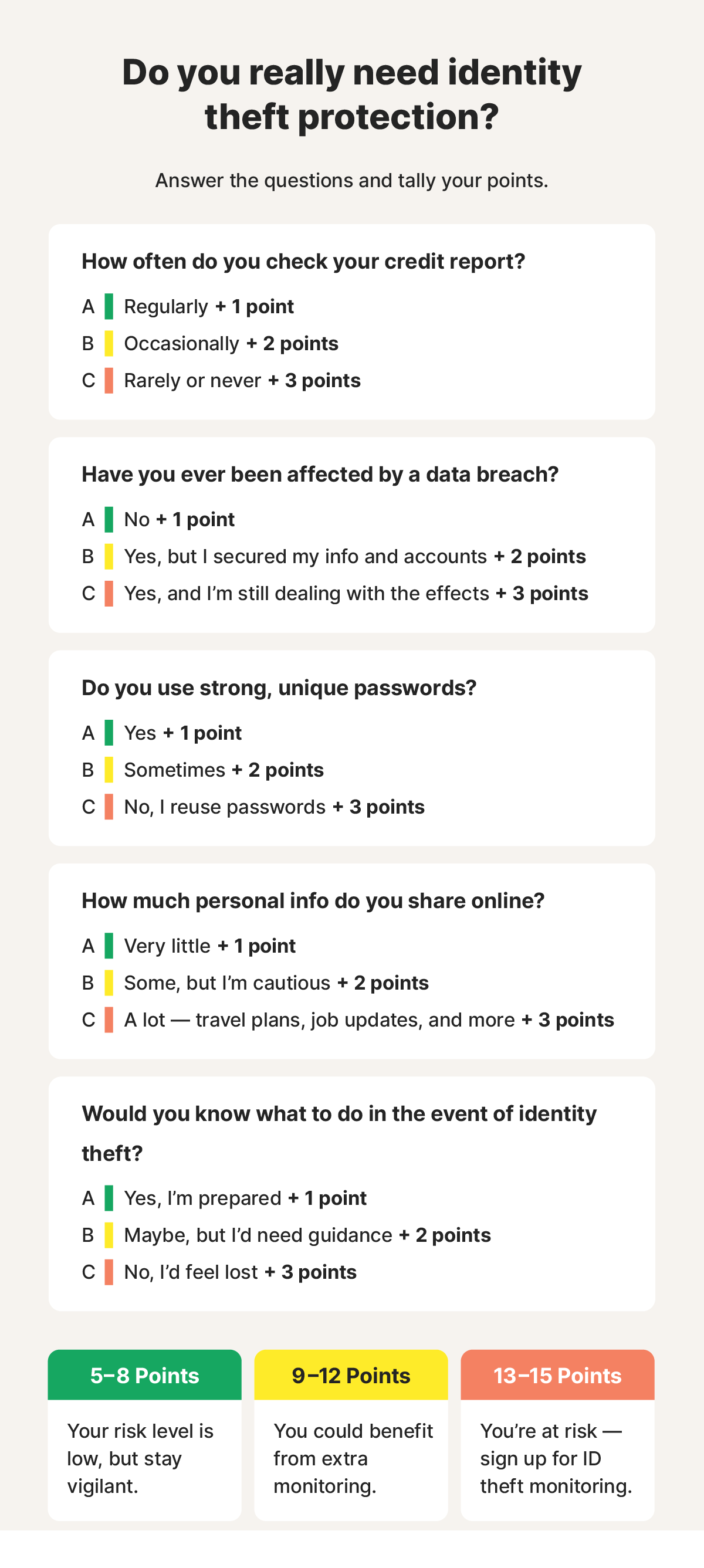

Do you regularly check your credit reports, track data breaches, and proactively monitor your accounts? Are you confident in your ability to recover from fraud? If so, you may feel that the added reassurance and enhanced benefits of identity theft protection are not worth it.

But for most people living busy, complex lives, it’s just not possible to keep up with all the potential identity risks, making identity theft protection tools a worthwhile investment. They offer a simple solution for maximum peace of mind, with a fraction of the effort.

Keep reading for a breakdown of what these services offer and how you can help protect yourself.

What does identity theft protection do?

Identity theft protection services monitor for threats, alert users to possible fraudulent activity, and help them secure themselves against identity theft. Quality ID theft protection services may also offer financial and restoration support to help victims recover their stolen identity and financial losses.

Here’s a closer look at the three main ways identity theft protection can help:

- Monitoring: ID theft protection tools automatically scan places like your credit report, people search sites, and the dark web for signs of personal data exposure and misuse.

- Alerts: After detecting a threat, such as a data breach or fraudulent use of your personal information, identity theft protection tools send alerts to notify users, allowing them to take swift corrective actions.

- Recovery: If your identity is stolen, ID theft protection services can connect you with experts to assist with the restoration process. Some also offer identity theft insurance, which may reimburse you for fraud-related financial losses.

If you fall victim to identity theft, LifeLock Standard not only provides access to U.S.-based Personal Restoration Specialists, but also coverage for lawyers and experts to help resolve fraud-related issues, and up to $25,000 in Stolen Funds Reimbursement.

What identity theft protection doesn’t do

While identity theft protection can monitor for and alert you to risks, it can’t protect your data, prevent identity theft, or mitigate all issues that stem from it. For example, ID theft protection services can’t:

- Prevent data breaches.

- Resecure your sensitive information following a data leak.

- Prevent fraudulent transactions from being made in your name.

- Stop your information from being sold on dark web forums.

- Monitor every kind of account for potential risks.

- Prevent criminals from using your identity to commit crimes.

- Stop fraudsters from taking out lines of credit in your name.

Does identity theft protection work?

Identity theft protection services excel at detecting suspicious activity, alerting users to potential threats, and assisting with recovery. While they can’t completely prevent identity theft, they help subscribers take swift action to mitigate risks and reduce the impact of fraud — nearly 50% of people whose identity was stolen found out through a monitoring alert.

Some people are skeptical of identity theft protection services due to misunderstandings about their capabilities. But ID theft protection services from reputable providers offer essential benefits like early threat detection and expert restoration assistance, which are well worth considering, especially if you’re concerned about the growing risks of identity theft.

Do I need identity theft protection? 4 reasons to consider it

Identity protection is especially valuable if you have risk factors such as data breach exposure, frequent travel, a large digital footprint, or a history of identity theft. It can also be beneficial if you have high-risk dependents or simply lack the time to regularly monitor your credit and statements and take other precautions.

If you fall within any of the following four categories, you should consider investing in the benefits of identity theft protection:

1. You’re at a high risk of identity theft

You may be at higher risk of identity theft if your information was compromised in a data breach, you fell for a scam, or you connect to unsecured networks or use weak or recycled passwords. Attackers can exploit these vulnerabilities to access sensitive personal information, such as Social Security numbers (SSNs), banking details, or login credentials.

Children under your care may also be at risk. Malicious individuals sometimes steal kids’ Social Security numbers to open loans, credit cards, utility accounts, and even commit tax fraud. This type of identity theft can go unnoticed for years, making it all the more difficult to deal with the repercussions later on.

2. You have a big digital footprint

Having a large digital footprint — whether you’re sharing casual updates with friends and family or pursuing an influencer lifestyle — can increase your vulnerability to identity theft. Every post, photo, or personal detail you share online provides attackers with valuable clues about your identity, which they could exploit.

Excitedly sharing a job offer letter with your network? You might expose your full name, city, employer, job title, and pay — information that could be used to take out loans or open lines of credit in your name. Even seemingly harmless details, like your birthday, pet’s name, or vacation plans, can pose a risk if they are used to guess passwords or answer security questions.

3. Your identity was stolen in the past

If someone stole your identity in the past, one of the lasting consequences is that you’re at a heightened risk of repeat offenses. Once your personal information is exposed, it can circulate on the dark web indefinitely, making it easier for multiple parties to exploit your identity for financial gain.

Strong account security and credit freezes can help protect you, but you may still be vulnerable if you need to temporarily lift a credit freeze to apply for a loan or new account. The same goes if attackers use verification code phishing scams, SIM swapping, or malware to intercept two-factor authentication (2FA) codes.

4. You don’t have time to monitor your own identity

Checking your credit report, bank and credit card statements, social media, and emails, as well as monitoring the news for data breach reports, can be time-consuming. While it might not seem like much initially, it can quickly become a regular, hours-long task if you have multiple accounts to keep track of.

Even then, you might miss key warning signs. Identity thieves often begin with small, inconspicuous transactions or open new accounts, like utility accounts, cell phone plans, or store credit cards, which you might not think to check.

Can you protect yourself without ID theft protection?

You can take steps to protect yourself from ID theft and monitor for threats without a protection service. Start by taking preventive measures like freezing your credit, securing online accounts, and keeping sensitive information off the web. Additionally, regularly review your credit reports and bank statements to spot potential fraud early.

Here’s a more detailed look at how you can help protect your identity:

- Freeze your credit: A credit freeze protects you from identity theft by restricting access to your credit report. This prevents thieves from opening new accounts in your name.

- Secure online accounts: Strengthen your online accounts with unique, complex passwords and enable 2FA for extra protection, even if your login credentials are exposed.

- Limit access to personal information: Avoid oversharing both online and offline. Shred sensitive documents, use a VPN to secure your internet data, and carefully consider where you enter personal data.

- Monitor credit reports: Regularly check your credit reports for unfamiliar accounts or activity. You can access your free weekly credit report at AnnualCreditReport.com.

- Review bank statements: Scan your bank and credit card statements for unauthorized transactions or withdrawals. Look for unfamiliar merchants or amounts that could signal identity theft.

Pros and cons of identity theft protection

Identity theft protection offers a range of benefits, including identity monitoring, fraud notifications, and recovery assistance. However, some people hesitate to invest in these services, questioning the value of spending money on protection for a potential threat that can’t be completely prevented.

Let’s dig into some specific pros and cons that apply to the top ID theft protection services:

Pros

- Monitors credit reports and financial accounts automatically.

- Provides notifications and alerts to users when threats are detected.

- Covers a portion of identity theft-related expenses, including legal fees.

- Offers access to specialists who can answer questions and provide assistance during the recovery process.

- Scans the dark web for your personal information.

- Offers family plans that include monitoring for children.

Cons

- Can’t prevent identity theft.

- Can be costly, especially if you need extra coverage for family members.

- Protection and restoration assistance varies significantly between providers.

- Alerts may flag legitimate activity as suspicious.

- Fraudulent activity alerts may not be immediate.

- Personal details shared with the service could be exposed in a data breach.

If the drawbacks are making you hesitant, keep in mind that prevention usually costs less than the financial losses associated with identity theft, and reputable services use robust industry-standard security measures to help ensure your data remains secure.

How to choose the best identity theft protection services

The best identity theft protection service for you depends on your risk level, budget, coverage needs, and preferred capabilities. Here’s what to look for when weighing up your options:

- Monitoring: Select a service that tracks credit reports, financial accounts, and public records, and monitors the dark web for unauthorized use of your personal information.

- Alerts: Look for a service that sends reliable notifications about suspicious activity, such as new accounts, credit inquiries, or leaked data.

- Recovery: Choose a provider that offers expert assistance and financial reimbursement for identity theft-related expenses.

- Price: Find the best price-feature balance between basic options focused on credit monitoring and higher-tier plans, including dark web monitoring, identity restoration, and fraud-related expense reimbursement.

- Coverage: Check if the plan allows you to add family members affordably, as some services charge extra per person.

Identity theft detection and restoration

Want to invest in peace of mind with comprehensive protection against identity fraud? LifeLock Standard can help you stay ahead of potential threats.

With advanced features like Dark Web Monitoring, credit monitoring, and Stolen Wallet Protection, LifeLock actively scans for your data and alerts you if it’s found in risky places. And, if it comes to it, LifeLock’s dedicated restoration specialists are always on hand to provide expert guidance and support to help you recover quickly.

FAQ

How much do identity theft protection services cost?

Identity protection services typically cost between $10 and $40 per month for individual plans, depending on the level of protection and included features. Family plans are available at higher price points, offering coverage for multiple members.

Can identity theft protection help if your identity has already been stolen?

Most services that offer identity restoration will only be able to help if somebody steals your identity while you’re already a subscriber. However, ID theft protection can help you scan for ongoing or new threats if you’re worried about recurring identity theft.

Should I get identity theft protection?

Everyone can benefit from the extra reassurance of identity theft protection, but it’s especially valuable if you’re at high risk due to factors like a recent data breach, a large digital footprint, or previous identity theft.

Is it worth paying for identity theft protection?

Whether ID theft protection like LifeLock is worth it depends on your circumstances and risk tolerance, but identity theft protection services can save you time, stress, and money if your personal information is compromised. If you prefer a hands-off approach to securing your identity, the added protection may be well worth the cost.

Why is it so important to have restoration services with your ID theft protection?

Restoration services are important because even the best identity theft protection can’t fully prevent identity theft. However, with restoration assistance, they help you navigate the complex process of recovering your identity and repairing the damage after a theft. Monitoring alerts you to the issue, but restoration helps you resolve it.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- What does identity theft protection do?

- What identity theft protection doesn’t do

- Does identity theft protection work?

- Do I need identity theft protection? 4 reasons to consider it

- Can you protect yourself without ID theft protection?

- Pros and cons of identity theft protection

- How to choose the best identity theft protection services

- Identity theft detection and restoration

- FAQ

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2025 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.