Trustpilot ratings are accurate as of December 2025. Feature availability is based on information provided on each company’s official website and is accurate as of December 2025. Read more about our methodology.

LifeLock vs. Aura: Overview

The main difference between LifeLock and Aura is that LifeLock focuses on identity protection with the option to add additional cybersecurity features if needed. Aura, by contrast, bundles cybersecurity features directly into its identity products.

LifeLock’s highest tier of identity theft protection, available in LifeLock Ultimate Plus, provides monitoring features that Aura doesn’t, like social media and phone takeover monitoring. And, if you ever become the victim of identity theft, LifeLock offers up to $3 million per adult in reimbursement coverage and no limit on the number of claims, compared to $1 million per adult with Aura and an apparent limit of one claim every 12 months.

But Aura’s built-in VPN and antivirus features can come in handy if you need them. You can get those security tools and more with LifeLock by adding the cybersecurity package from Norton 360.

Here’s an overview of each solution’s key features so you can compare them head-to-head:

LifeLock Ultimate Plus |

Aura |

|

|---|---|---|

Identity monitoring |

|

|

Dark web monitoring§ |

|

|

Credit monitoring4 |

Equifax |

Equifax |

Maximum reimbursement limit |

$3 million per adult††† |

$1 million per adult |

Financial accounts monitored |

Checking, savings, investment, credit, and 401(k) accounts |

Checking, savings, investment, credit, and 401(k) accounts |

Credit report and score access |

Daily (1 bureau)†† |

Monthly (1 bureau) |

Credit lock |

|

|

Payday loan lock |

|

|

Social media account monitoring |

|

|

Phone takeover monitoring |

|

|

Buy-now-pay-later monitoring |

|

|

Cybersecurity tools |

Available in Norton 360 with LifeLock plans |

|

Court record monitoring |

|

|

Family plans |

|

|

Trustpilot rating |

LifeLock at a glance

LifeLock was founded in 2005, making it one of the longest-running providers of identity theft protection. It offers a combination of identity monitoring, restoration support, and reimbursement coverage.

Identity and credit monitoring are the bedrock of LifeLock’s protection, scanning for signs of your Social Security number, name, address, birth date, or other personally identifiable information (PII) being used in fraudulent applications, and sending alerts if suspicious activity is detected.

If identity theft does occur, LifeLock’s U.S.-based identity restoration specialists are available to help members work through the recovery process. And, depending on the plan, LifeLock provides up to $3 million in reimbursement3 and no limit on the number of claims you can file to help cover financial losses or expenses following identity theft.

Other key features include dark web monitoring, notifications of large-scale data breaches, and a suite of additional alerts covering financial accounts, court records, social media accounts, and home titles.

LifeLock is available for individuals, couples, or families of two adults and up to five children. It can also be paired with Norton’s device protection and online privacy tools, giving members the flexibility to get all-in-one cybersecurity and identity theft protection across multiple devices.

Pros |

Cons |

|---|---|

30-day free trial available |

Free trial requires credit card pre-authorization |

Up to $3m in identity theft reimbursement |

Reimbursement and monitoring coverage vary by plan |

No limit on the number of claims |

Premium plans may not fit every budget |

U.S.-based identity theft restoration support |

|

Identity and credit monitoring tools |

|

Wide selection of additional alerts, including financial accounts |

|

Integrates easily with Norton’s security tools |

Aura at a glance

Founded in 2017, Aura is a newer entrant to the identity theft protection space but has quickly built a name for itself. It combines identity monitoring with a broader set of cybersecurity tools, aiming to deliver an all-in-one solution.

Aura only has one plan tier, which includes identity theft monitoring, restoration support, up to $1m in identity theft insurance per adult, financial account alerts, antivirus protection, a basic VPN, a password manager, and a digital vault for storing sensitive files.

It’s available for individuals or in a family plan that covers up to five adults and unlimited children. Aura’s family plan also includes parental controls, allowing parents to set screen time limits or content filters, for example.

Because Aura’s service includes cybersecurity tools, members may not need additional subscriptions. However, that model means that Aura doesn’t currently offer identity protection as a standalone service.

Additionally, when reviewing Aura’s security features, PCMag found that the “security components didn’t all do well” and that Aura has “no scores from independent antivirus labs,” which security providers usually seek to secure from independent labs to benchmark their antivirus and anti-malware capabilities.

Pros |

Cons |

|---|---|

14-day free trial available |

All-in-one plans offer little choice over which features you want |

All-in-one identity theft and cybersecurity |

Limited antivirus and VPN capabilities |

Parental controls available on family plans |

Anti-malware tools are unavailable on iOS devices |

Digital vault for storing sensitive files |

Identity theft reimbursement is capped at $1m per adult |

Three-bureau credit monitoring on all plans |

Limit of one claim every 12 months |

LifeLock vs. Aura: Third-party reviews

Both LifeLock and Aura receive favorable reviews from third-party experts and real customers. They consistently appear in lists of the best identity theft protection tools, and have ratings of 4.8 stars and 4.3 stars on Trustpilot, respectively (as of December 2025).

PCMag called LifeLock's identity theft protection “comprehensive and time-tested” in their review, giving an Editors’ Choice badge to the Norton and LifeLock bundled product. This all-in-one package was also named Best Overall Identity Protection in PCMag’s summary of the best identity theft protection tools for 2025.

Tom’s Guide also named LifeLock “Best identity theft protection overall” in its review of the best identity theft protection services. And Security.org gave it a score of 9.7/10, calling out that alerts were received “within 60 seconds of an event.”

For its part, Aura was given five stars by Forbes, received praise from Security.org who described it as “robust and comprehensive,” and ranked on the Tom’s Guide list of best identity theft protection services, with its “concierge services” called out as a key strength.

However, PC Mag’s expert on security, privacy, and identity protection, Neil J. Rubenking, said in his review of Aura that the local device protection element of Aura’s combined suite of security and identity tools “doesn’t make the grade.”

Here's a breakdown of how LifeLock and Aura compare in customer ratings on third-party sites and app stores:

LifeLock |

Aura |

|

|---|---|---|

Trustpilot |

4.8 (11K+ ratings) |

4.3 (800+ ratings) |

Apple App Store |

4.8 stars (170K+ ratings) |

4.7 stars (70K ratings) |

Google Play |

5M+ downloads |

500K+ downloads |

Google Play downloads, Apple App Store ratings, and Trustpilot ratings are accurate as of December 2025.

LifeLock vs. Aura: Features

While both LifeLock and Aura offer strong identity theft protection solutions and there are many similarities between the feature sets, there are also some key differences. The main one is that LifeLock is primarily focused on identity theft monitoring, alerts, and restoration features, while Aura aims to provide an all-in-one experience with bundled cybersecurity tools.

In other words, LifeLock specializes in identity theft protection and financial monitoring, with higher maximum reimbursement limits and some alerts Aura doesn’t offer, while Aura has a more general approach that covers device security and online privacy, too.

Here’s a closer look at how LifeLock and Aura compare when it comes to features:

Identity monitoring

Both LifeLock and Aura include monitoring capabilities that act as the foundation of the identity theft protection offering. Each option offers similar standard tools, like identity alerts and dark web monitoring, but LifeLock offers some additional features on the more expensive LifeLock Ultimate Plus plan, like social media and phone takeover monitoring.

Here’s a summary of the identity monitoring features available through LifeLock Ultimate Plus:

- Identity and Social Security alerts: Notifies you if your Social Security number (SSN), name, address, or date of birth (DOB) are detected in applications for credit or services. This is a patented feature that sends alerts via text, phone, email, or through the mobile app.

- Privacy monitor: Scans common public people-search websites that collect your personal information and guides you through the process of removing it or opting out.

- Dark web monitoring§: Scans the dark web and notifies you if it finds your personal information — such as your email, name, DOB, address, SSN, or credit card numbers.

- Data breach notifications: Sends notifications of large-scale data breaches that are unfolding, which may have exposed your sensitive information and left you vulnerable to fraud or identity theft.

- Social media monitoring: Monitors your accounts across platforms like Facebook, Instagram, Twitter, and LinkedIn and alerts you if it detects suspicious activity that may indicate an account takeover attack.

- Phone takeover monitoring: Sends alerts if an attempt to port your number to another carrier is detected. This can help you spot “SIM swap” attacks, which can leave you vulnerable to follow-up fraud.

- Alerts for crimes committed in your name: Scans for court records containing your personal information to help you detect association with crimes you didn’t commit, which may be the result of criminal identity theft.

And here are the key monitoring features included with an Aura membership:

- SSN and personal information monitoring: Notifies you if your email address, SSN, passport numbers, or other personal data are found on the dark web. A notification can be an indication that you should check if someone is using your identity.

- Identity verification monitoring: Monitors for signs that your identity or SSN are being used for high-risk transactions, like payday loan applications.

- Account breach monitoring: Sends alerts if your online accounts are breached, or if the associated login credentials are detected on the dark web, helping notify you of potential account takeover risks.

- Online data removal: Helps you identify and remove your personal information from public data broker websites, including people-search sites and junk mail lists.

- Court records monitoring: Notifies you if it detects that your identity has been used by a criminal, by scanning court records.

Financial account monitoring

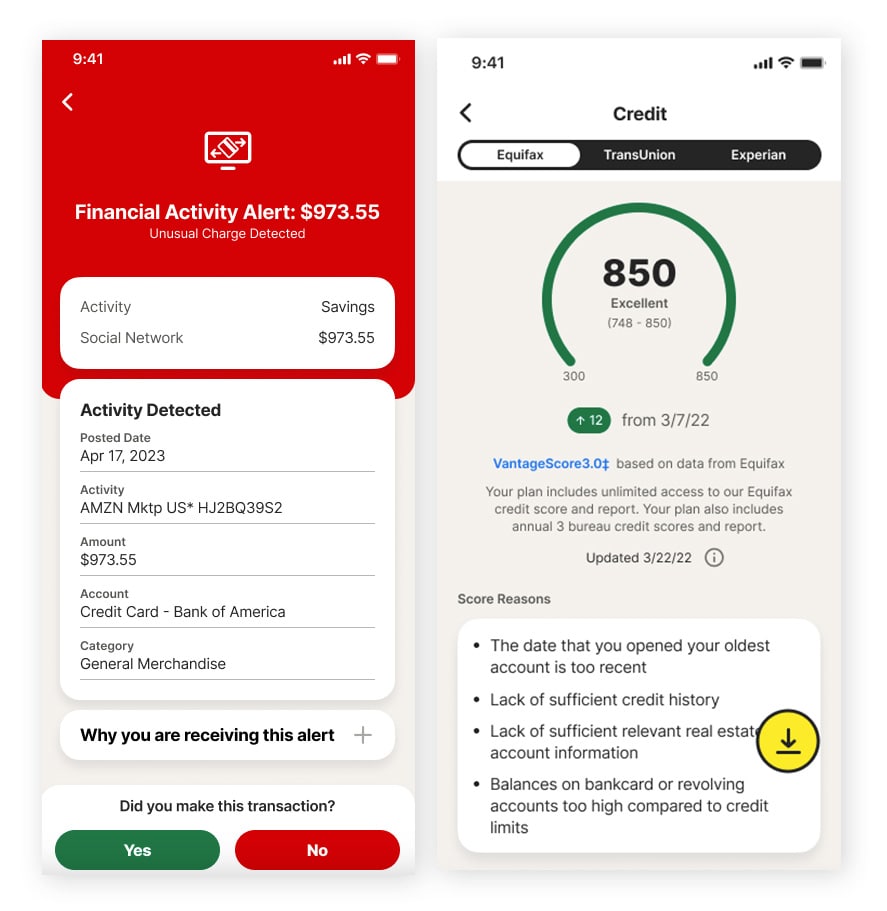

LifeLock and Aura both offer financial account monitoring features, helping members detect unusual activity across their bank, credit, and investment accounts.

While LifeLock Standard only has limited financial monitoring capabilities, LifeLock Ultimate Plus offers broad coverage with checking, savings, credit, 401(k), and investment account monitoring all available. It sends alerts if suspicious withdrawals, transfers, or new account openings are detected, helping members catch signs of potential fraud.

Additional financial monitoring features offered by LifeLock’s upper tier include buy-now-pay-later (BNPL) and utility account application alerts. And the service also provides stolen wallet assistance, helping members cancel or replace key documents if their wallet is lost or stolen.

Aura provides roughly similar coverage, allowing members to monitor most of the same financial account types and receive alerts when suspicious activity or transactions are detected. It also offers a lost wallet remediation service designed to help members recover and protect themselves if their wallet is lost or stolen. However, it doesn’t include buy-now-pay-later alerts.

Here’s a table comparing the financial monitoring features of LifeLock and Aura:

LifeLock Ultimate Plus |

Aura |

|

|---|---|---|

Account |

Bank, credit, investment, 401(k), buy-now-pay-later, and utility accounts |

Bank, credit, investment, 401(k), and utility accounts |

Stolen wallet assistance |

Helps you cancel or replace payment cards, IDs, insurance cards, and Social Security cards |

Offers remediation plans via customer support in case of a lost wallet |

Transaction monitoring2 |

Monitors for unusual activity across bank accounts, credit cards, and investment accounts |

Monitors credit card transactions, bank accounts, and investment accounts from a central dashboard |

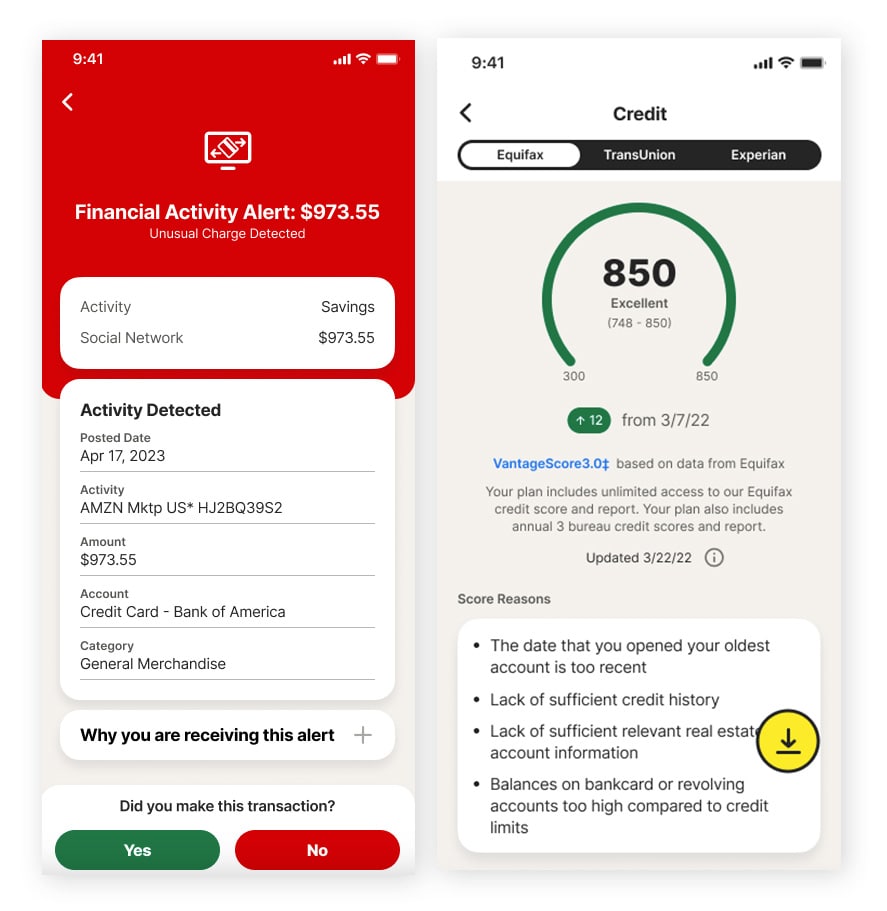

Credit monitoring

Both LifeLock and Aura offer credit monitoring that covers all three major credit bureaus — Equifax, Experian, and TransUnion. This feature helps members detect unusual credit activity like new accounts, hard inquiries, or changes to credit limits that might indicate fraud.

LifeLock’s credit monitoring capabilities are dependent on which plan you choose. LifeLock Standard offers one-bureau monitoring, while LifeLock Ultimate Plus provides full three-bureau monitoring with daily credit report and score updates from one bureau. It also includes an Identity Lock feature, which allows members to quickly lock and unlock their TransUnion credit file and helps prevent unauthorized payday loan applications.

Aura, on the other hand, provides three-bureau credit monitoring and a credit lock feature that allows members to lock and unlock their Experian credit file as standard on all plans. However, it offers less frequent credit report and score updates than LifeLock Ultimate Plus, with just one update available monthly.

Here’s an overview of LifeLock and Aura’s credit monitoring4 features:

LifeLock Ultimate Plus |

Aura |

|

|---|---|---|

Credit bureaus monitored |

3 bureaus |

3 bureaus |

Credit report and score updates |

Daily (1 bureau), |

Monthly (1 bureau), |

Credit lock |

Instant TransUnion and payday loan locks |

Instant Experian credit lock |

Identity theft reimbursement

Reimbursement coverage is an essential part of identity theft protection, giving members financial support that can help them recover from the losses and costs they experience during identity theft. LifeLock and Aura both offer reimbursement packages, but the way they work is slightly different.

LifeLock provides dollar-for-dollar expense and loss reimbursement for each covered family member in the case of qualifying identity theft. There are no out-of-pocket expenses for lawyers and no limit on the number of annual claims — with a reimbursement total of up to $3 million3 in the LifeLock Ultimate Plus plan.

Here’s a breakdown of how the $3 million is split:

- Up to $1 million reimbursement for lawyers and experts that were consulted during the identity theft recovery process.

- Up to $1 million reimbursement for stolen funds that were lost due to identity theft.

- Up to $1 million compensation for personal expenses incurred during the identity theft recovery process.

Aura plans provide general identity theft insurance of between $1 million and $5 million, but this allowance is split between the members covered by the plan, and there’s a maximum reimbursement allowance of $1 million per adult. The $5 million insurance offered on the family plan, for example, provides $1 million in coverage for five adults, and can’t be used in full by one adult who suffers identity theft.

There are also some limits to Aura’s identity theft insurance, outlined in their summary of benefits. The Cash Recovery Aggregate benefit is apparently capped at one claim per 12 consecutive months, meaning members can only be reimbursed for a single covered loss event (like funds lost in credit card fraud) within that period. The policy also imposes a $350 per hour cap on costs for legal experts.

Here’s a summary of how LifeLock and Aura’s reimbursement packages compare in key areas:

LifeLock Ultimate Plus |

Aura |

|

|---|---|---|

Type of coverage |

Coverage for lawyers and experts, |

Expense reimbursement, |

Maximum reimbursement limit |

$3 million per adult |

$1 million per adult |

Claim limits |

No limit on the number of claims you can file |

One claim per 12-month period |

LifeLock vs. Aura: Plans and pricing

LifeLock offers three identity theft protection plans to choose from, each one available for individuals, couples, or families. LifeLock Standard provides foundational protection, including identity and Social Security alerts, one-bureau credit monitoring, dark web monitoring, and up to $1 million in reimbursement.

Upgrading to LifeLock Advantage adds features like phone takeover monitoring, buy-now-pay-later alerts, and Identity Lock, which allows you to lock your credit with TransUnion in case of fraudulent activity. LifeLock Ultimate Plus, the top tier plan, includes all of those features plus three-bureau credit monitoring, more frequent credit report updates, up to $3 million in reimbursement, and additional tools like 401(k) alerts, home title monitoring, and social media monitoring.

Aura has just one plan tier, available for individuals, couples, or families. With each plan, you get a collection of identity protection features alongside bundled cybersecurity tools, like a VPN, antivirus, and password manager. The family plan also adds parental control features including content filtering and screen time limit tools.

Here’s how LifeLock and Aura compare in terms of plan options and reimbursement coverage:

Individual plans

Plan |

Adults |

First year price |

Reimbursement limits |

|---|---|---|---|

LifeLock Standard |

1 |

$11.99 monthly |

Up to $1 million in coverage in case you need it††† |

LifeLock Advantage |

1 |

$22.99 monthly |

Up to $1.2 million in coverage in case you need it |

LifeLock Ultimate Plus |

1 |

$34.99 monthly |

Up to $3 million in coverage in case you need it |

Aura Individual |

1 |

$15 monthly |

Includes $1 million in identity theft insurance |

Two-person plans

Plan |

Adults |

First year price |

Reimbursement limits |

|---|---|---|---|

LifeLock Standard |

2 |

$23.99 monthly |

Up to $1 million in coverage per adult, in case you need it |

LifeLock Advantage |

2 |

$45.99 monthly |

Up to $1.2 million in coverage per adult, in case you need it |

LifeLock Ultimate Plus |

2 |

$69.99 monthly |

Up to $3 million in coverage per adult, in case you need it |

Aura Couple |

2 |

$22 monthly |

Includes $2 million in identity theft insurance per couple |

Family plans

Plan |

Adults |

Kids |

First year price |

Reimbursement limits |

|---|---|---|---|---|

LifeLock Standard |

2 |

Up to 5 |

$35.99 monthly |

Up to $1 million in coverage per family member |

LifeLock Advantage |

2 |

Up to 5 |

$57.99 monthly |

Up to $1.2 million in coverage per adult and up to $1 million in coverage per child |

LifeLock Ultimate Plus |

2 |

Up to 5 |

$79.99 monthly |

Up to $3 million in coverage per adult and up to $1 million in coverage per child |

Aura Family |

Up to 5 |

Unlimited |

$50 monthly |

Includes $5 million identity theft insurance per family |

All pricing accurate as of December 2025.

LifeLock vs. Aura: Ease of use

LifeLock and Aura are both designed to be simple to use, offering a central identity protection dashboard accessible through a web interface or mobile app.

LifeLock guides new members through setup in a few steps, like enabling the different identity, credit, and financial monitoring features, running initial scans to look for exposed information on the dark web, and choosing how alerts should be delivered (options include via email, text, phone, or app notifications).

Aura also provides a unified dashboard, which integrates cybersecurity tools and identity protection features into a single app. Notifications are available across all linked devices, and the settings allow users to prioritize the information or features they’re most interested in.

LifeLock vs. Aura: Customer support

Both LifeLock and Aura have an online help center where you can troubleshoot product activation and read about common support topics. Each company provides multiple ways for customers to get in touch with customer support representatives beyond that, including email, phone, and live chat — you may just need to be a subscriber to initiate contact.

When it comes to restoration support, LifeLock members can get help from a U.S.-based restoration specialist who will handle their case from start to finish, helping with all of the most important steps to take after identity theft occurs. Plus, LifeLock offers a Restoration Guarantee that provides a 100% refund of up to 12 months of subscription costs if a restoration specialist can’t restore your identity.

Aura also provides U.S-based restoration support, delivered by a team that guides users through the process of restoring their identity and resolving fraudulent accounts. However, it doesn’t advertise a restoration guarantee.

Customers report satisfaction with both services on Trustpilot, with LifeLock holding a 4.8 star rating and Aura having 4.3 stars, as of December 2025.

Protect your identity with LifeLock

LifeLock and Aura are two of the best-rated identity theft protection services for a reason, but which one is right for you depends on what you’re looking for. LifeLock offers broader monitoring and higher reimbursement limits on some plans, while Aura bundles cybersecurity tools like a VPN and antivirus.

When choosing between them, read customer reviews to see what real users think and consider what features you’re most interested in. And, if you want hands-on experience to help make your mind up, get a free trial of LifeLock Ultimate Plus and enjoy powerful free identity protection for 30 days before you commit.

Methodology

To create this comparison, we evaluated LifeLock and Aura using publicly available, independently verifiable information. We reviewed each provider’s website and documentation for details on monitoring features, credit tools, financial protections, reimbursement terms, pricing, usability, and customer support.

We supplemented this with analysis from independent publishers such as PCMag and Tom’s Guide, as well as customer feedback and aggregate ratings from platforms including Trustpilot, Apple’s App Store, and Google Play.

By relying on public resources and applying the same review standards to both products, we aim to provide readers with an objective comparison they can trust. All information was checked and reviewed at the time of publication, and the analysis reflects the author’s independent evaluation and does not necessarily represent the views of LifeLock or its parent company.

FAQs

Is Aura legit?

Yes. Aura is a legitimate service that aims to provide all-in-one protection through a combination of identity monitoring, alerts, and reimbursement features alongside basic cybersecurity tools.

Is LifeLock or Aura better?

Which option is better depends on your specific needs. Both offer similar features and receive strong reviews from third-party experts and customers, with LifeLock rated at 4.8 on Trustpilot and Aura holding a 4.3 star score. LifeLock might be a better choice if you want more alerts and higher reimbursement coverage, while Aura could make more sense if you want cybersecurity tools.

How can I choose the right identity theft protection service for me?

To find the right identity protection service for your needs, consider which plans offer the features you’re most interested in. Features like SSN monitoring, credit monitoring, identity theft reimbursement, dark web monitoring, and data breach notifications provide a solid baseline of protection. Additional features like social media monitoring or credit locks can help you add extra layers to your defense.

Disclosures

2 We do not monitor all transactions at all businesses. No one can prevent all cybercrime or identity theft.

3 $3 million coverage in our Ultimate Plus plan consists of up to $1 million each for Reimbursement, Expense Compensation, and Lawyers and Experts. Total coverage and category limits vary depending on plan chosen. Benefits under the Master Policy are issued and covered by United Specialty Insurance Company (State National Insurance Company, Inc. for NY State members). Policy terms, conditions and exclusions at: LifeLock.com/legal.

4 If your plan includes credit reports, scores, and/or credit monitoring features ("Credit Features"), two requirements must be met to receive said features: (i) your identity must be successfully verified with Equifax; and (ii) Equifax must be able to locate your credit file and it must contain sufficient credit history information. IF EITHER OF THE FOREGOING REQUIREMENTS ARE NOT MET YOU WILL NOT RECEIVE CREDIT FEATURES FROM ANY BUREAU. If your plan also includes Credit Features from Experian and/or TransUnion, the above verification process must also be successfully completed with Experian and/or TransUnion, as applicable. If verification is successfully completed with Equifax, but not with Experian and/or TransUnion, as applicable, you will not receive Credit Features from such bureau(s) until the verification process is successfully completed and until then you will only receive Credit Features from Equifax. Any credit monitoring from Experian and TransUnion will take several days to begin after your successful plan enrollment.

†† Credit reports, scores and credit monitoring may require an additional verification process and credit services will be withheld until such process is complete.

††† Up to $1 million for coverage for Lawyers and Experts included on all plans, plus reimbursement and expense compensation up to $25,000 each with Standard, $100,000 each with Advantage, and $1 million each with Ultimate Plus. Insurance benefits are issued by third parties. See GenDigital.com/legal for policy info.

Δ LifeLock/Norton 24/7 Support is available in English only. See https://www.norton.com/globalsupport.

§ Dark Web Monitoring is not available in all countries. Monitored information varies based on country of residence or choice of plan. It defaults to monitor your email address and begins immediately. Sign in to your account to enter more information for monitoring.

6 Identity Lock cannot prevent all account takeovers, unauthorized account openings, or stop all credit file inquiries. The credit lock on your TransUnion credit file and the Payday Loan Lock will be unlocked if your subscription is downgraded or canceled.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2025 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.