Tip: Consider keeping a credit freeze active until you’re ready to take out a loan or open a new account.

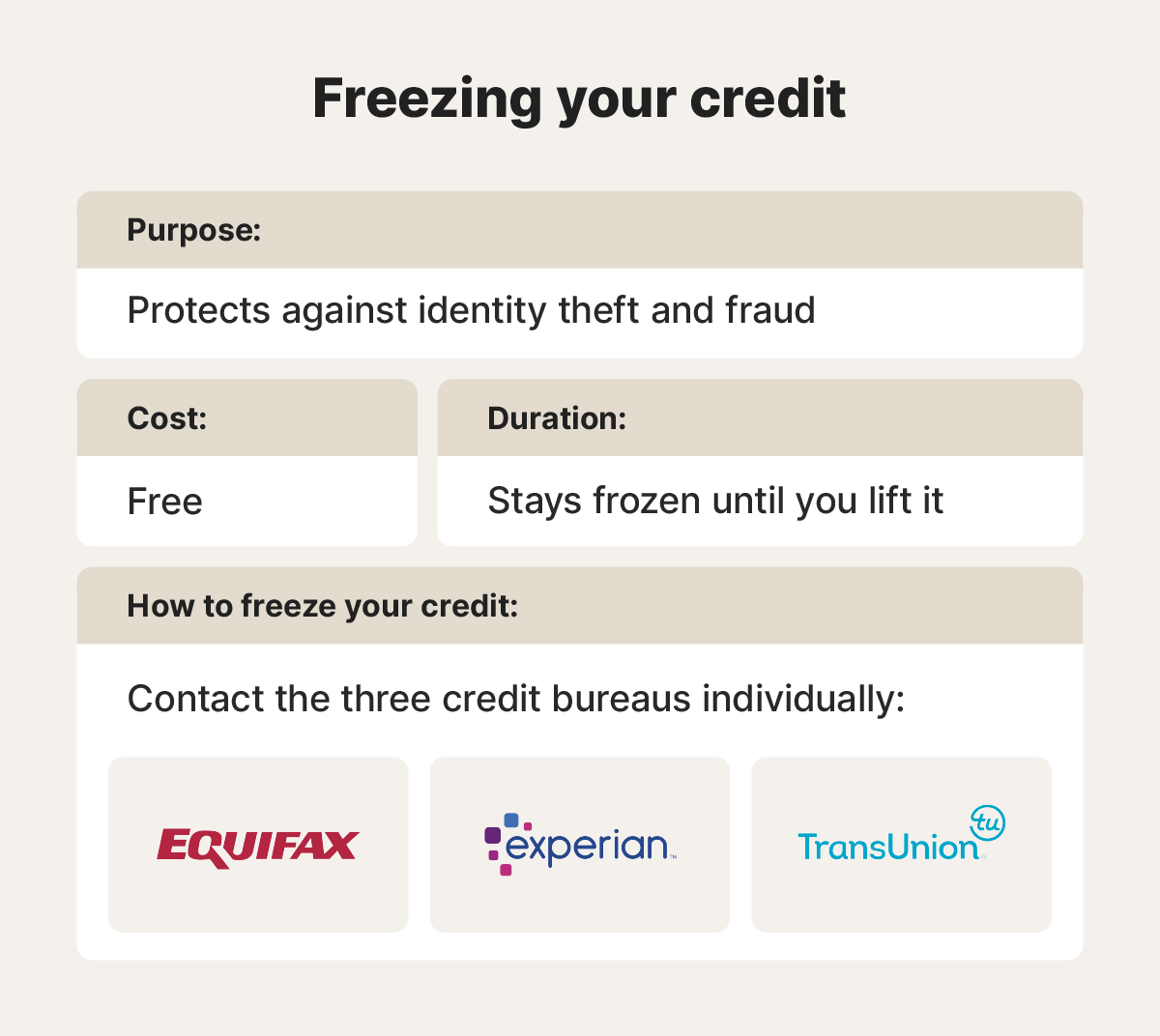

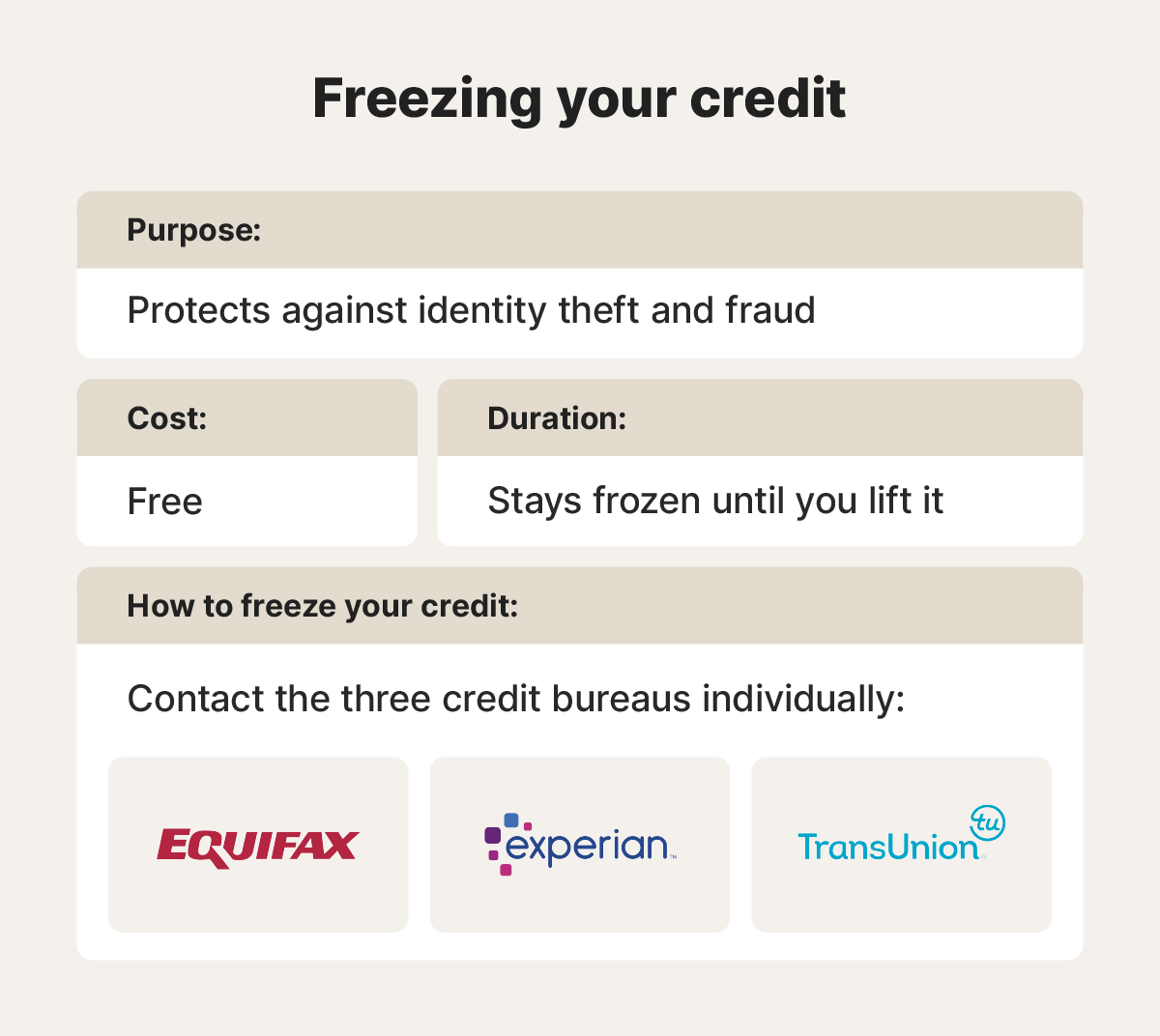

If your personal information has been compromised, freezing your credit may help protect you from fraud. A credit freeze restricts access to your credit report, making it much harder for criminals to open new accounts in your name.

To freeze your credit, you need to contact Equifax, Experian, and TransUnion individually — either online, by phone, or by mail — and request a credit freeze.

In this guide, we’ll break down when to freeze your credit, how it works, and the exact steps to take with each major credit bureau.

What is a credit freeze?

A credit freeze, also known as a security freeze, restricts access to your credit report, meaning creditors and lenders can’t access your file and assess your creditworthiness. When you freeze your credit, you essentially lock it down, preventing anyone from completing new credit applications in your name.

If you suspect or detect suspicious activity on your credit report, placing a credit freeze adds an extra layer of security, blocking potential identity thieves from taking out loans or new cards in your name. However, keep in mind that a freeze also means you won’t be able to apply for new credit.

There are a few actions you can take when managing a credit freeze, including:

- Adding the initial credit freeze: This locks your credit report to prevent anyone from opening new accounts, including you.

- Lifting a credit freeze: A credit freeze lift temporarily thaws your report long enough for you to apply for new credit lines.

- Removing a credit freeze: Removing your credit freeze permanently lifts the restriction, restoring full access to your report.

How to freeze your credit with all three bureaus

To freeze your credit, you’ll need to contact each bureau directly and provide the required personal information. The three major U.S. credit bureaus — Equifax, Experian, and TransUnion — manage your credit data and provide reports to lenders and other institutions.

A credit freeze is not automatically applied across all three bureaus, so you’ll need to request a freeze from each one individually to fully protect your credit.

Here’s how to contact each bureau to place a freeze on your credit files:

What information do you need to freeze your credit?

To place a credit freeze, you'll need to provide the credit bureau with your:

- Full name

- Address

- Date of birth

- Social Security number (SSN)

- Government-issued identification (driver’s license or passport)

Some bureaus may also ask for additional verification — such as a copy of a utility bill or pay stub — if you request a credit freeze by phone or mail. However, be cautious of fraudulent schemes like Equifax scams, where scammers contact you impersonating a bureau.

Credit bureaus will never call, email, or text you to request sensitive information or identity verification, so only provide it if you initiate contact directly.

Key considerations before freezing your credit

Here are a few key things to know about credit freezes before you request one:

- Cost: Federal law allows you to freeze your credit report free of charge, and there’s no limit on how many times you can do so. You can also temporarily lift or remove the freeze for free at any point.

- Timing: By law, credit bureaus must freeze your report within one business day of your request if you submit it online or by phone, although it typically goes into effect immediately. If you request a credit freeze by mail, it may take up to three business days. The reverse is also true: unfreezing may not happen immediately. If you need to thaw your credit to apply for new lines, plan ahead.

- PIN: Previously, credit bureaus provided a personal identification number (PIN) to manage credit freezes. However, none of the three major credit bureaus requires a PIN anymore. Instead, you can log into your online account to manage your freeze. If you request a freeze by phone or mail, they may ask you to provide your SSN or a code sent via text to verify your identity.

When should you freeze your credit?

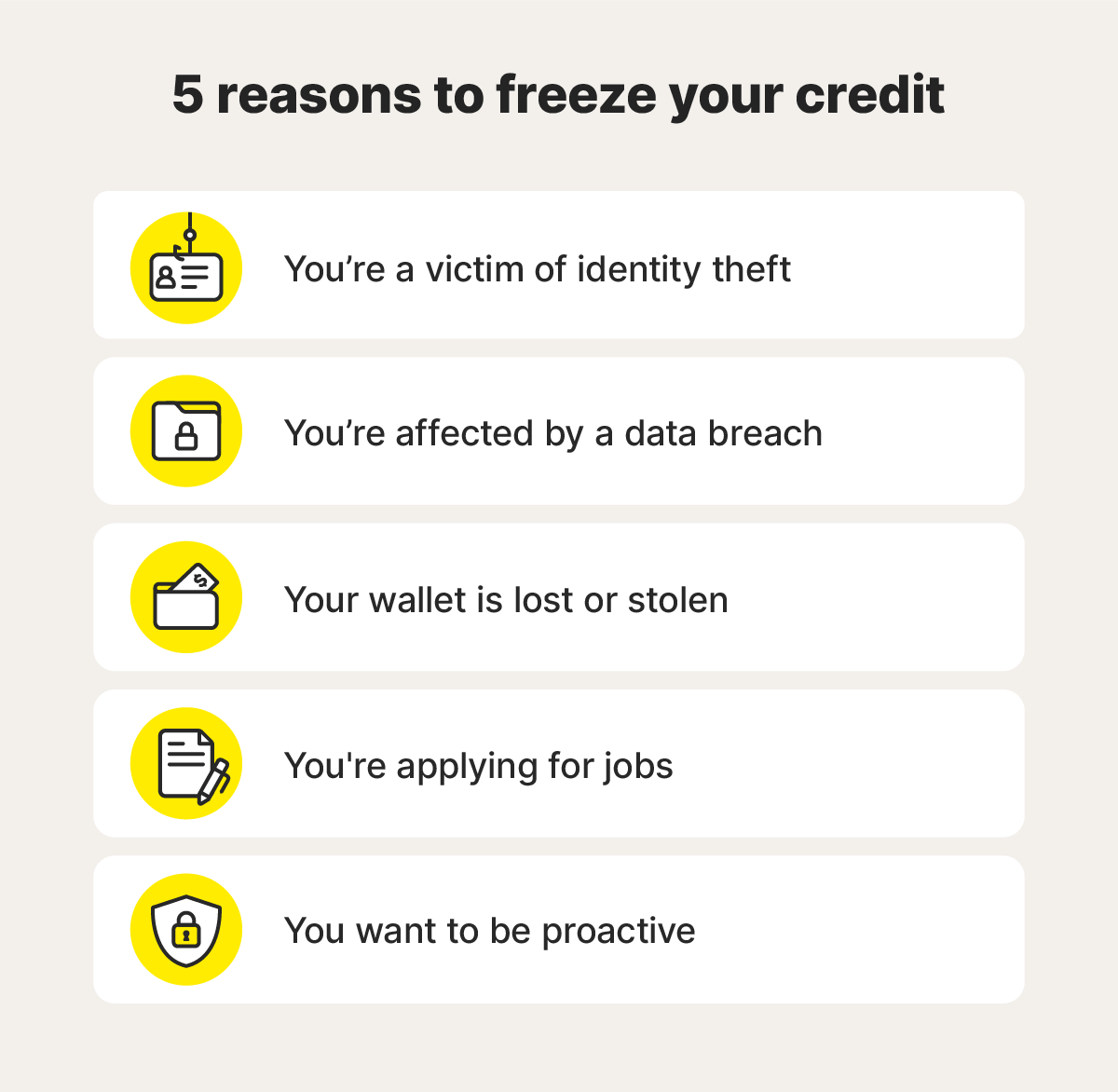

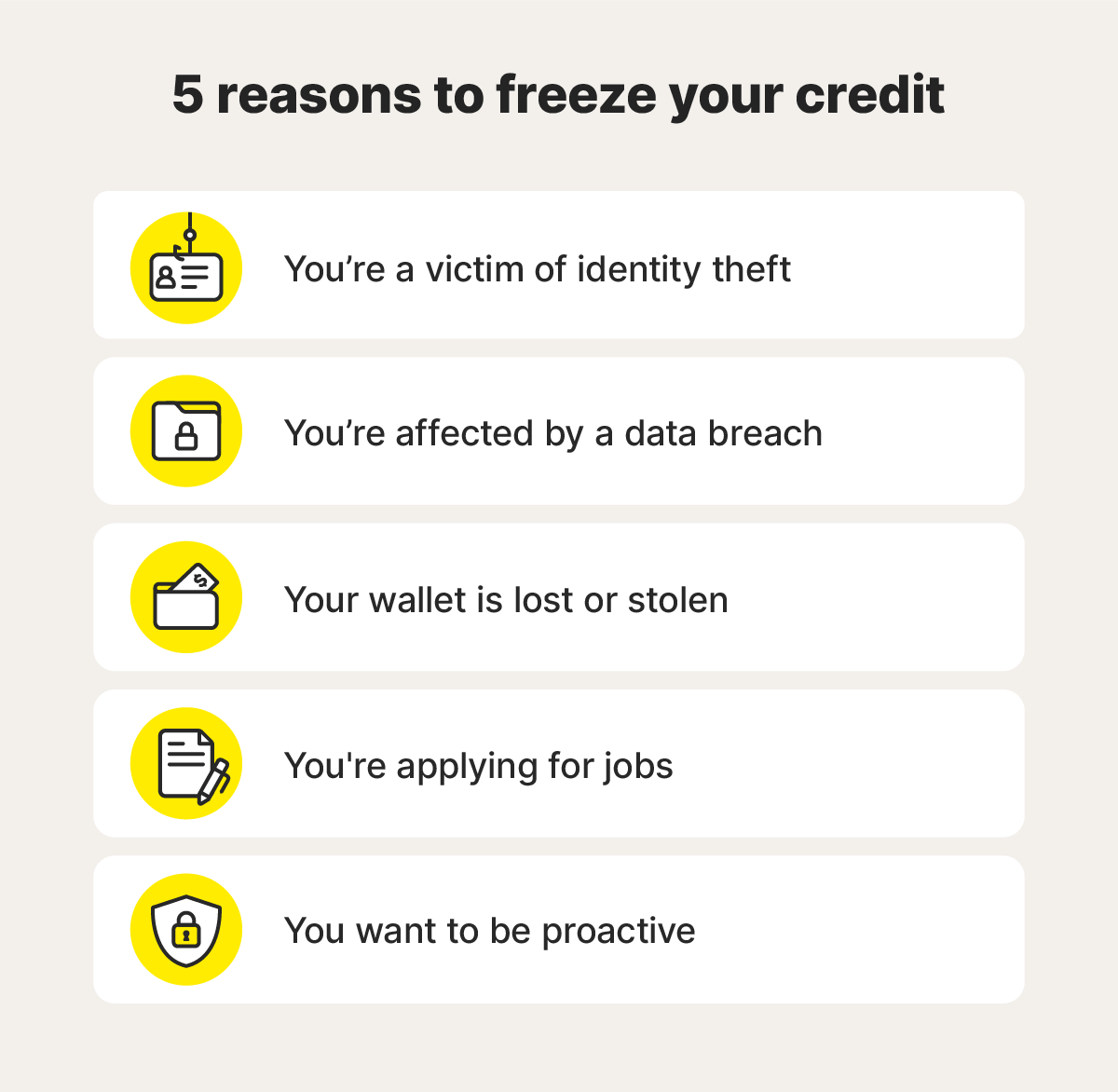

You should freeze your credit to protect your credit score, especially after events that may have exposed your personal information to cybercriminals.

Here are some scenarios in which you may want to freeze your credit to help protect your finances and personal information:

- Following identity theft: If you've been a victim of identity theft or suspect fraudulent activity, a credit freeze is crucial to help limit further damage.

- After a data breach: If your personal information has been compromised in a data breach or leak, freezing your credit can help stop criminals from exploiting it for fraud.

- If you lost your wallet: If your purse or wallet is lost or stolen with identifying documents inside (e.g., you lost your Social Security card), a credit freeze can offer peace of mind while you recover them.

- When applying for jobs: Employers may perform credit checks to assess whether or not you pose a risk of theft or embezzlement, especially in some professions that require you to handle customer data or funds. A freeze allows you to control when your credit report is accessed.

Tip: Don’t wait until somebody steals your identity to freeze your credit. Even if you don’t have reason to be concerned, freezing your credit is a proactive way to minimize the risk of identity theft.

Who can access your frozen credit reports?

While a credit freeze blocks most people from accessing your credit report, certain parties (including you and your current lenders) may still be able to view it under certain conditions.

Here’s who can still access your frozen credit reports:

- You can still check your credit scores and view your credit reports (you just won’t be able to apply for new lines of credit unless you thaw the freeze.)

- Government agencies, including federal, state, and local employees and courts, may be able to view your credit report in certain circumstances, such as when running federal government background checks or collecting child support.

- Credit monitoring services, such as LifeLock, that you’ve permitted to view your credit reports will still be able to view changes, score updates, and potentially fraudulent use of your personal information.

- Current lenders can manage your existing credit accounts, even when your credit is frozen.

- Collection agencies can pursue debt payments you owe to existing creditors.

- Insurance companies can view your credit reports for underwriting purposes in some states.

Pros and cons of freezing credit

Though credit freezes can help protect against identity theft, there are also some downsides to consider, especially if you plan to apply for new credit in the near future. Here are some of the main pros and cons of placing a freeze on your credit files:

Pros of freezing your credit |

Cons of freezing your credit |

|---|---|

Reduces the risk of thieves applying for credit with your name. |

Requires extra steps when applying for new credit. |

Has no negative impact on your credit score. |

Requires contacting each credit bureau individually. |

Helps prevent credit bureaus from sharing your personal data. |

Doesn’t stop fraud on your existing accounts. |

Free, by federal law, with all major credit bureaus. |

Not foolproof against overall identity theft. |

What is the difference between a credit lock and a credit freeze?

A credit freeze is a federally mandated, free service that restricts access to your credit report, while a credit lock is an optional service that some services, like LifeLock, offer.

With a LifeLock Advantage subscription, you'll get access to credit locks and lock removals with TransUnion, preventing unauthorized access with just a few clicks. Both credit freezes and locks protect your credit, but a freeze involves more manual steps, while you can manage a lock within your product.

What is the difference between a fraud alert and a credit freeze?

Unlike credit freezes, fraud alerts don’t block creditors from accessing your credit report. Instead, placing a fraud alert requires lenders to contact you to confirm your identity before approving a credit application.

In some cases, using both a fraud alert and a credit freeze can be beneficial, since the fraud alert remains in place even if you temporarily lift the freeze to apply for a loan.

Protect your credit with LifeLock Ultimate Plus

While freezing your credit offers a robust layer of security, it's not a surefire way to protect against fraud — and it shouldn’t be your only line of defense.

LifeLock Ultimate Plus provides identity theft protection services like credit monitoring and fraud alerts. And if you ever become a victim of identity theft, LifeLock will help get you back on your feet with the white-glove support of expert U.S.-based restoration specialists.

FAQs

Does freezing your credit prevent identity theft?

Nothing can prevent identity theft completely, including a credit freeze. However, freezing your credit does make it significantly harder for fraudsters to open new accounts in your name, which can help reduce the risk of identity theft.

Does a credit freeze affect your credit score?

No, a credit freeze does not affect your credit score. On the contrary, it can help protect your credit score from harm caused by fraud or identity theft.

Can I freeze my child’s credit?

Yes, in most states, you can freeze your child's credit to help protect against child identity theft and other risks. Contact each of the credit bureaus for specific details and requirements.

How long does a credit freeze last?

A credit freeze lasts until you unfreeze it through the three credit bureaus. You can also temporarily unfreeze, or thaw, it if you need to make a new credit application.

How do I unfreeze my credit?

The process of unfreezing your credit is similar to placing a freeze, and you can do it online, by phone, or by mail through each credit bureau.

Does LifeLock freeze my credit?

No, LifeLock does not freeze your credit. However, some LifeLock products offer credit locks via TransUnion, as well as credit monitoring and identity theft protection.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- What is a credit freeze?

- How to freeze your credit with all three bureaus

- When should you freeze your credit?

- Who can access your frozen credit reports?

- Pros and cons of freezing credit

- What is the difference between a credit lock and a credit freeze?

- What is the difference between a fraud alert and a credit freeze?

- Protect your credit with LifeLock Ultimate Plus

- FAQs

Start your protection,

enroll in minutes.

Copyright © 2025 Gen Digital Inc. All rights reserved. All trademarks, service marks, and tradenames (collectively, the "Marks") are trademarks or registered trademarks of Gen Digital Inc. or its affiliates ("Gen") or other respective owners that have granted Gen the right to use such Marks. For a list of Gen Marks please see GenDigital.com/trademarks.