* Automatically renews annually after the trial period ends, unless canceled. The price quoted in the cart today is valid for the introductory term after the trial, after which your subscription will be billed at renewal pricing. Renewal pricing is subject to change and may be charged up to 35 days before the active term ends. For support or to cancel automatic renewal, log into your account or contact support.

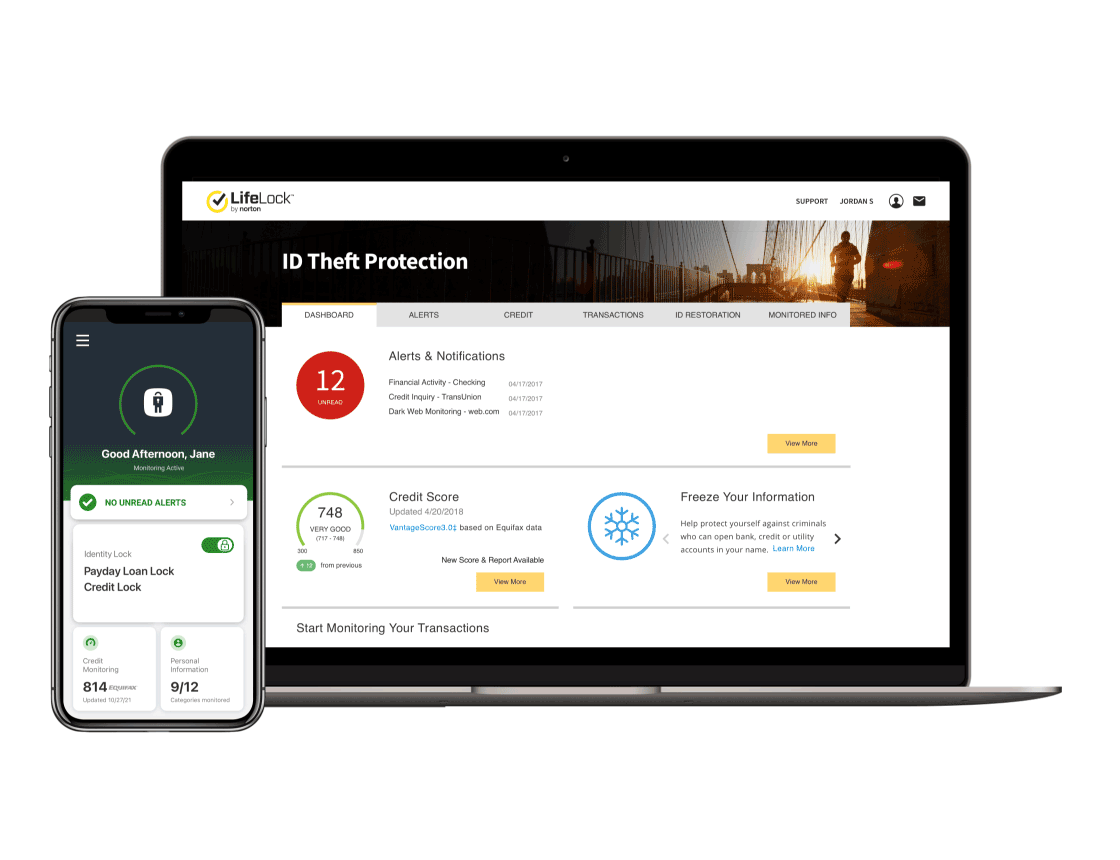

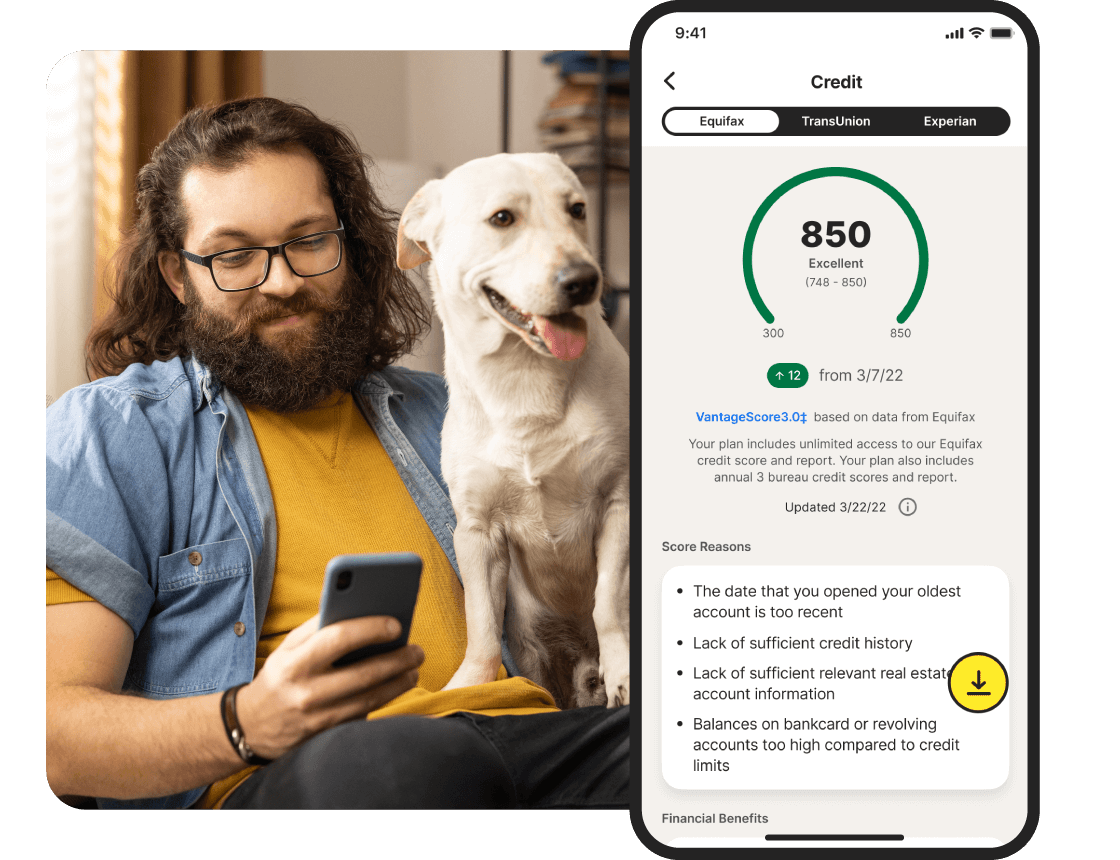

1 The credit score provided is a VantageScore 3.0 credit score based on Equifax data. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness.

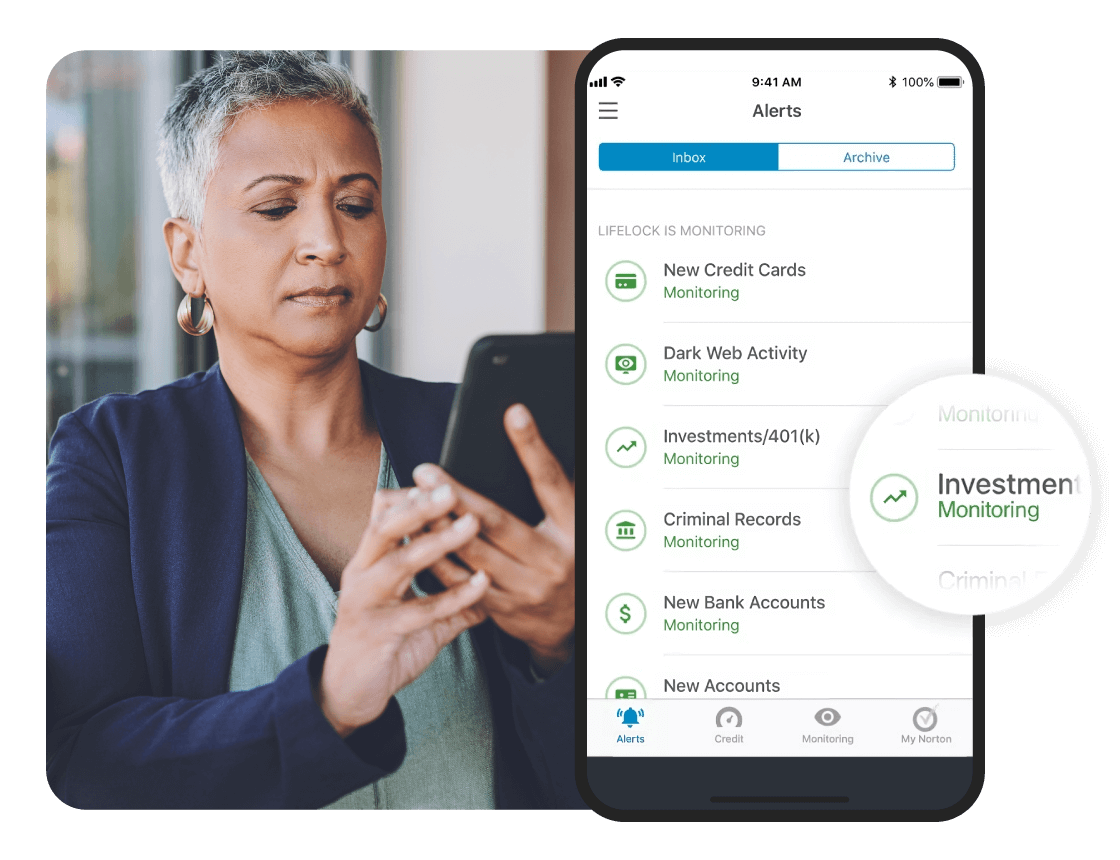

2 We do not monitor all transactions at all businesses.

3 Phone alerts made during normal local business hours.

4 Reimbursement and Expense Compensation, each with limits of up to $25,000 for Core, up to $100,000 for Advanced, and up to $1 million for Total. And up to $1 million for coverage for lawyers and experts if needed, for all plans. Benefits provided by Master Policy issued by United Specialty Insurance Company, Inc. (State National Insurance Company, Inc. for NY State members). Policy terms, conditions and exclusions at: NortonLifeLock.com/legal. Global Privacy Statement | Legal

** Credit features require setup, identity verification, and sufficient credit history by TransUnion and/or Equifax. Credit monitoring features may take several days to activate after enrollment.