If a scammer tricks you into sharing your home address, you might immediately start worrying about the worst-case scenario. But due to voter registration and property records, nearly every adult’s address is a matter of public record, and most places won’t accept only an address as a primary piece of personally identifiable information.

In short, an address alone generally isn’t enough to put you at risk of identity theft or financial fraud. However, scammers might use your address to send phishing mail, intercept packages and mail, or even show up at your home.

Read on to learn how bad actors could target you using your address, and get tips to help keep your address private and protect your personal information.

Scammers can use your address to target you with phishing scams through physical mail. They might claim you’ve won a grand prize, send fake bills, pretend to be a government agency and demand money, urge you to call a phony customer service line, or devise other scenarios to trick you into sending money or information.

- Warning signs: You receive mail that creates a sense of urgency, requests personal information, doesn’t look official, or asks you to make a payment through an unsecured method.

- How to help protect yourself: Be wary of urgent requests for personal information or money arriving in the mail, and always verify their legitimacy with the supposed sender directly through a trusted channel.

- Tips to recover after a scam: Report the scam to the United States Postal Inspection Service (USPIS).

Scammers can file a Change-of-Address Form with the United States Postal Service in an attempt to divert your mail, allowing them to steal sensitive information from documents like bank statements or credit card bills. If successful, the fraudster may be able to commit identity theft and cash your checks or get a driver’s license in your name.

In 2023, the USPS started requiring identity verification through a valid debit or credit card (online) or a valid ID (at the post office) to help end Change-of-Address Form scams. However, this isn’t foolproof—especially if the scammer manages to steal your wallet and completes the online verification process.

- Warning signs: You suddenly stop receiving mail or get a Change-of-Address confirmation notification from the postal service.

- How to help protect yourself: If you lose your wallet, report the loss of any cards to your bank right away so they can help you set up fraud protection; this can help stop the Change-of-Address verification process.

- Tips for recovering after a scam: Contact USPIS to report the fraud and monitor your credit report.

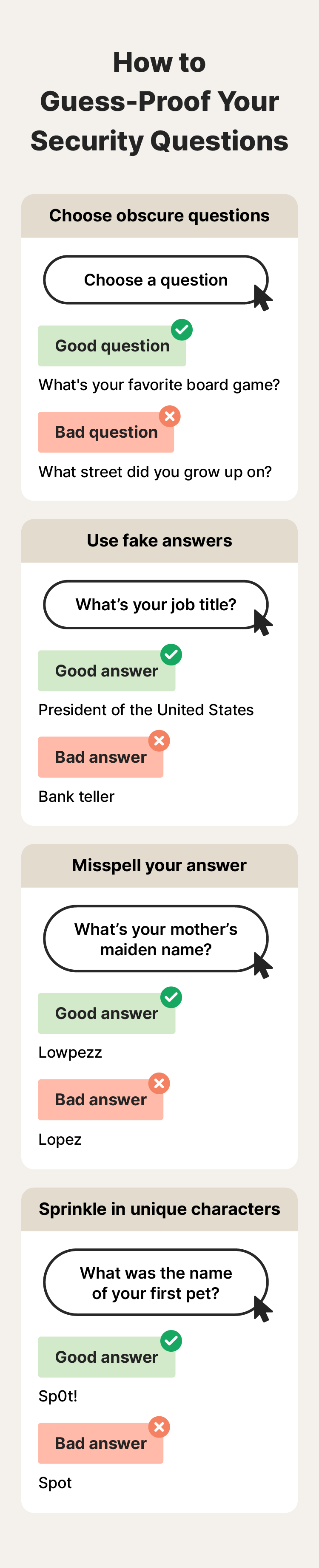

Security questions are useful for verifying identities, but some answers are too easy for scammers to guess. For example, a scammer could easily answer questions like “What street did you grow up on?” by finding old posts on social media or property records online.

Meanwhile, more complex answers about your personal life, experiences, and beliefs that have never been shared online are harder to guess. For instance, “Who is your favorite client?” or “What is your mom allergic to?” are questions that would be harder for strangers to answer.

- Warning signs: You receive a suspicious login alert or see unauthorized changes to your account.

- How to help protect yourself: Throw scammers off by listing fake or misspelled answers to security questions that only you would know.

- Tips to recover after a scam: Create new passwords, log out of all your accounts, and set up two-factor authentication (2FA).

During booking, criminals could give your name, address, and birth date to the police to mask their true identity. They may do this to protect themselves if there’s a warrant out for their arrest or if they have prior convictions. Unfortunately, this deception can tie you to crimes you know nothing about, potentially causing legal and reputational harm.

- Warning signs: You receive legal documents, summons, or calls from law enforcement about crimes you didn’t commit.

- How to help protect yourself: Limit how much information you share online and with strangers.

- Tips to recover after a scam: Report the identity theft to the police and the FTC.

Want to get notified directly if someone’s committing crimes in your name? LifeLock Ultimate Plus scans court records to find matches of your name and date of birth to help protect you from being falsely linked to arrests and crimes you have no connection to

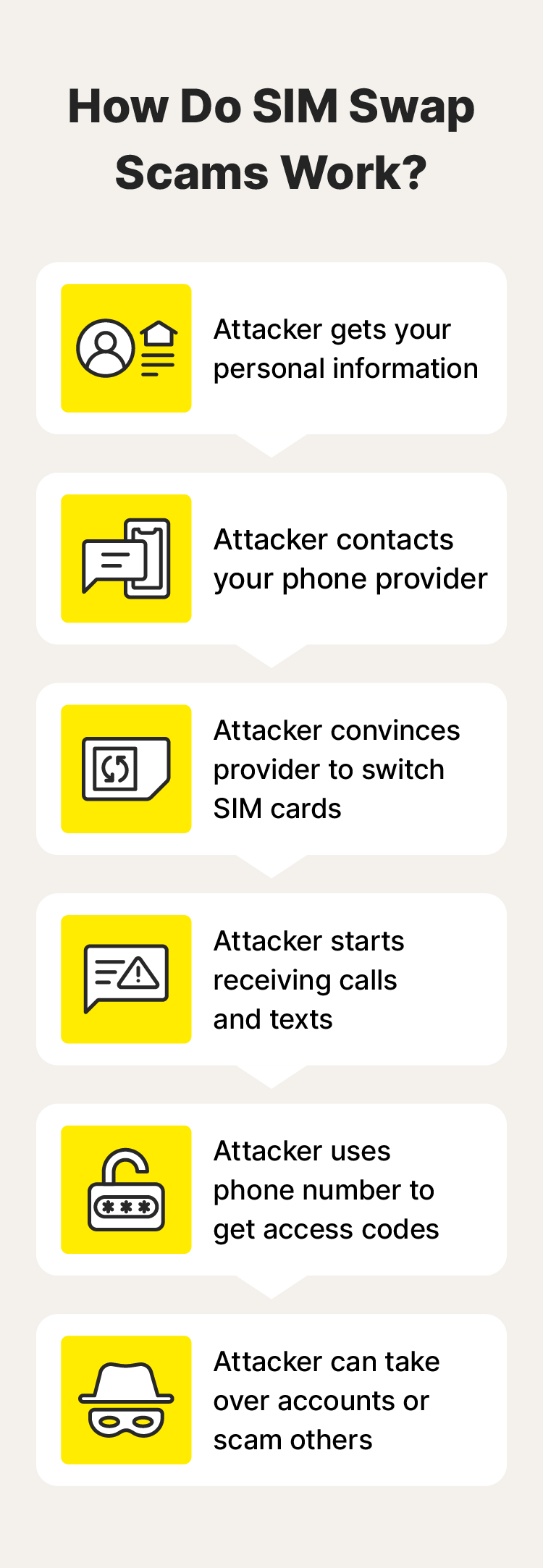

Scammers can use personal information like your name, address, and birth date to impersonate you when contacting your mobile carrier. By claiming they lost their phone and providing your address for verification, they may be able to persuade the carrier to activate a new SIM card for your account.

That lets the scammer take control of your phone number, access your calls and texts, and potentially even obtain your two-factor authentication codes. It also means your name will appear on caller ID when they make outgoing calls, which can help them trick and scam people you know.

- Warning signs: You suddenly lose cell service and can’t access accounts linked to your phone number.

- How to help protect yourself: Enable the Number Transfer PIN feature with your carrier and create a passcode or PIN for your mobile account.

- Tips to recover after a scam: Contact your mobile carrier to deactivate the bogus SIM and regain control of your phone number.

Scammers might use your address to build trust with other victims. They could claim to live nearby, creating a false sense of closeness. That can make their online persona seem more believable and encourage the victim to send money, aid, or personal information.

- Warning signs: People in your community contact you about interactions you don’t remember.

- How to help protect yourself: Be very careful sharing your address online, don’t share photos with obvious location markers, and consider using a post office box for online transactions.

- Tips to recover after a scam: Report fake profiles and alert the people in your community to the issue.

7 ways scammers might have found your address

With enough patience and technical know-how, scammers can find your address and piece together your identity using bits of information they find online or elsewhere. From public social media posts and unshredded mail to public records and hacking tactics, there are many ways for them to discover where you live.

Here are seven of the most common ways crooks find their targets’ addresses:

- Dark web: Criminals can find and sell personal information like your address on the dark web.

- People-search sites: People finder websites gather information from public records, social media, and data brokers. Then, they publish it online for anyone to access.

- Public records: Documents like voter registration and property records are accessible online and show your address.

- Data breach: Hackers may breach online databases and steal personal information, such as your address.

- Physical mail theft: Criminals living nearby can steal mail and packages from your home, linking your name to the address.

- Phishing: A fake link may take you to a spoofed website that prompts you to enter your address.

- Social media: You may inadvertently show where you live by posting media that shows your house, street signs and numbers, or obvious landmarks.

How to help keep your address private

If you’ve ever voted or bought property, keeping your address 100% private is virtually impossible. But that doesn’t mean you can’t make it harder to find. Here are a few ways you can help keep your address away from criminals who could use the information against you:

- Remove your personal information from people-search websites: Use a tool like LifeLock Advantage to help scan people-search sites to find out if your personal information is exposed. Then, get assistance contacting those sites to request they remove your information.

- Shred sensitive documents: Keep dumpster divers from stealing your name and address by carefully shredding sensitive papers.

- Go paperless: Consider signing up for paperless statements and correspondence. Not only does this help keep criminals from seeing your personal information, but it’s also good for the environment and decluttering your home.

- Avoid oversharing on social media: Be careful about what you post to avoid giving snoopers hints about where you live.

- Get a VPN: Use a VPN when sharing personal details online to help prevent packet sniffing—a hacking technique used to collect data traveling through unencrypted networks.

- Use a P.O. Box: Rent a post office box so mail will go to a secure location instead of the mailbox in front of your house.

What to do if someone uses your address to steal your identity or commit financial fraud

A stolen address can result in financial or legal trouble, mail fraud, identity theft, and worse credit scores. If you believe someone is using your address to commit fraud, you should:

- Report it: Report the ID theft to the Federal Trade Commission (FTC) and consider contacting your local police department. You should also report any mail fraud to the United States Postal Inspection Service (USPIS).

- Freeze your credit: Contact the three major credit bureaus (Equifax, Experian, and TransUnion) to freeze your credit or place a credit lock to help prevent criminals from opening new accounts in your name.

- Monitor your accounts: Keep tabs on all your existing accounts to monitor for unexpected changes and protect against account takeovers.

- Check your credit report: Get a copy of your credit report and look for unauthorized additions. If you find anything suspicious, dispute it immediately.

Stop people-search websites from sharing your personal information

In the wrong hands, your address is one of the pieces a criminal can use to try to steal your identity. That’s why services like LifeLock are so important. LifeLock gives you greater control over your online privacy by periodically scanning public people-search websites and other public records to help you find out if your personal information is being used against you.

We’ll also let you know about USPS address change requests linked to your identity and check court records for potentially fraudulent use of your name and date of birth. Try LifeLock free for 30 days to help protect against identity fraud and get expert support if it occurs.

FAQs about how scammers use stolen addresses

Still have questions about how scammers can use your stolen address? Here’s what you need to know.

Why do I need to protect my address if it’s a part of public records?

Even though your address is a public record, you should keep it as private as possible to help avoid misuse. Combined with other personal information, scammers can potentially use your address to manipulate others, redirect your mail, and commit other crimes.

Can someone steal my identity only using my address?

No, your address alone likely isn't enough for someone to commit identity theft, but it can be a valuable starting point upon which scammers may attempt to target you further and build a more convincing false identity.

What should I do if I notice someone is stealing my mail?

Report mail theft online or call the USPIS at 1-877-876-2455; you can also file a complaint with local police.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2025 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.