*Trustpilot ratings are accurate as of June 2025.

LifeLock vs. Aura: Overview

LifeLock Ultimate Plus |

Aura |

|

|---|---|---|

Identity verification monitoring |

|

|

Credit monitoring4 |

Equifax TransUnion Experian |

Equifax TransUnion Experian |

Payday loan lock |

|

|

Bank account application alerts2 |

|

|

Social media account monitoring |

|

|

Child monitoring with cyberbullying protection |

|

|

Phone takeover monitoring |

|

|

Utility account creation monitoring |

|

|

Buy Now Pay Later monitoring |

|

|

Criminal record monitoring |

|

|

Flexible identity theft reimbursement parameters††† |

|

|

Family plans |

|

|

Trustpilot rating |

4.8 [*] |

4.3 [*] |

LifeLock vs. Aura: Third-party reviews

LifeLock has consistently received outstanding reviews for its identity protection services. PC Mag called LifeLock's identity theft protection “comprehensive and time-tested” when they gave the prestigious Editors’ Choice award to the Norton and LifeLock bundled product. This comprehensive product was also named Best Overall Identity Protection in PC Mag’s summary of the best identity theft protection tools for 2025.

Tom’s Guide gave LifeLock its coveted “Best for all around protection” award based on the powerful suite of identity protection features. With hundreds of millions of data points monitored each second, LifeLock is an established leader in the field. And LifeLock is currently the #1 customer rated identity theft protection brand on Trustpilot.

Meanwhile, when PC Mag’s expert on security, privacy, and identity protection Neil J. Rubenking reviewed Aura, he stated that the local device protection element of Aura’s combined suite of security and identity tools “doesn’t make the grade.” This may be in part because Aura’s identity theft protection features are automatically bundled with their security tools. Many customers looking for identity protection may not want a service that bundles device-level security. Unfortunately, Aura doesn’t offer a standalone identity theft protection tool.

Here's a breakdown of how LifeLock compares to Aura in other third-party ratings:

LifeLock |

Aura |

|

|---|---|---|

Trustpilot |

4.8 (7K+ ratings) |

4.3 (700+ ratings) |

Apple App Store |

4.8 stars (140K+ ratings) |

4.7 stars (60K ratings) |

Google Play |

5M+ downloads |

500K+ downloads |

* Google Play downloads, Apple App Store ratings, and Trustpilot ratings are accurate as of June 2025.

LifeLock at a glance

LifeLock is the originator of identity theft protection and continues to be the sector leader today. In 2024 alone, LifeLock sent more than 81 million LifeLock Identity Theft Protection alerts to customers. And our dedicated U.S.-based Identity Restoration Specialists are available to provide personal recovery support, from start to finish, to any members who have their identity stolen — guaranteed — or your money back. In addition, LifeLock provides up to $3 million of potential coverage to help you restore your identity and get back on your feet.3

The bedrock of LifeLock’s protection is a sophisticated personal information monitoring feature that alerts you if someone fraudulently tries to use your Social Security number, name, address, birth date, or other personally identifiable information (PII).

Some companies tasked with protecting your identity automatically bundle device protection features into their tools — even if you don’t actually need them. LifeLock gives you the choice. You can either get simple-to-use, effective identity theft protection by itself, or if you want to level up your protection, you can easily add to your devices the suite of powerful security and privacy features offered by LifeLock’s partner, Norton.

But don’t just take our word for it. LifeLock has more than 7,000 reviews on Trustpilot and an average rating of 4.8.

Here are just some of the benefits (along with a few limitations) of LifeLock:

Pros |

Cons |

|---|---|

Subscribe and get 30 days free to test the product. |

The free trial requires pre-authorization with a valid payment card. |

We’ll send you 401(k) & investment account activity alerts2 if fraud is detected. |

The comprehensive level of protection may not fit every budget. |

Get reimbursement coverage of up to $3 million3 if you become the victim of identity theft. |

No credit simulator to check how projected transactions will impact your credit. |

Receive support from a U.S.-based Restoration Specialist, should the worst happen. |

|

Priority member support is available with our highest-tier product. |

LifeLock Ultimate Plus combines industry-leading identity theft protection with personalized customer support to help keep your data and identity more secure. With LifeLock, if you ever fall victim to identity theft, you'll get expert assistance from an individual U.S.-based Restoration Specialist to help you resolve your case and get your life back on track. Start your membership with a 30-day free trial.

Aura at a glance

Founded in 2017, Aura is a younger company in the identity protection space. Aura has one identity theft protection product that’s bundled with cybersecurity features and available in multiple packages, including individual, couple, and family plans. It offers anti-malware capabilities, a VPN, and identity theft protection features. Aura also has a separate product for parents, which includes parental control features.

Here are some pros and cons of Aura’s main product:

Pros |

Cons |

|---|---|

Aura offers a 14-day free trial before you’re charged for the first time. |

Cybersecurity features are built in, so you can’t just get identity theft protection. |

Choose from family, couple, or individual plans. |

There's no credit simulator to check how projected transactions will impact your credit. |

Keep digital files in the Vault, a digital lockbox for your most important and sensitive files. |

Anti-malware features aren’t available for iOS. |

Offers financial account monitoring for multiple account types. |

How to cancel your Aura subscription

If you aren't satisfied with your Aura subscription and want to become a LifeLock member instead, here’s how to cancel your Aura membership:

- Log in to your Aura account.

- Hover over the cog icon and click Membership.

- Click Cancel membership, then Cancel online.

- Click Cancel membership (again), then Continue cancellation.

Choosing the right identity theft protection is an important decision, and the solution has to suit your needs. If you’re still not sure which option is the best, keep reading.

LifeLock vs. Aura: Features

LifeLock’s feature set is laser-focused on identity theft protection, while Aura bundles device-security tools that you may not need.

Brimming with identity protection features, LifeLock helps you monitor your personal information and get automatic alerts if it detects an identity thief trying to use your personal details fraudulently.

And LifeLock’s protection doesn’t stop there. Dedicated customer support is one of LifeLock’s most valued features, with U.S.-based Restoration Specialists standing by to provide dedicated help when you need it.

Here’s an in-depth feature comparison of LifeLock vs. Aura:

Identity monitoring

As a leader in the identity protection sphere, LifeLock front-loads features that can help you detect, monitor, and protect against identity theft risks. The reviewers at Tom’s Guide agree that LifeLock has the best identity protection features in 2025.

Here are LifeLock’s main identity monitoring features:

- LifeLock Identity Alert System: Sends alerts if your Social Security number (SSN), name, address, or date of birth (DOB) are used in applications for credit or services. This is a patented feature that sends alerts via text, phone, email, or even through the mobile app.

- Privacy Monitor: Scans common public people-search websites that collect your personal information and guides you through removing it or opting out.

- Dark Web Monitoring§: Scours the dark web and notifies you if it finds your personal information — such as your email, name, DOB, address, SSN, credit card numbers, or even your mom’s maiden name. If your data is found, LifeLock will guide you through the cleanup effort, helping you change your passwords or place credit freezes to protect your financial accounts.

- Identity Lock: Identity Lock6 allows you to lock your TransUnion credit file or payday loan accounts and unlock them again when you want to apply for a loan or new account.

- Stolen Wallet Protection: If your wallet is stolen, LifeLock can help you cancel and replace Social Security cards, insurance cards, driver’s licenses, and other important items.

Aura also offers a range of identity monitoring features, depending on the plan. Here are a few:

- Account Breach Monitoring: Aura will notify you if your email address, SSN, passport numbers, or other personal data are found on the dark web. A notification can be an indication that you should check if someone is using your identity and change your passwords for any affected accounts.

- ID Verification Monitoring: If your identity is used in a payday loan application or similar type of transaction, you’ll receive a notification.

- Lost Wallet Remediation: Aura can help with a remediation plan if your wallet is lost or stolen.

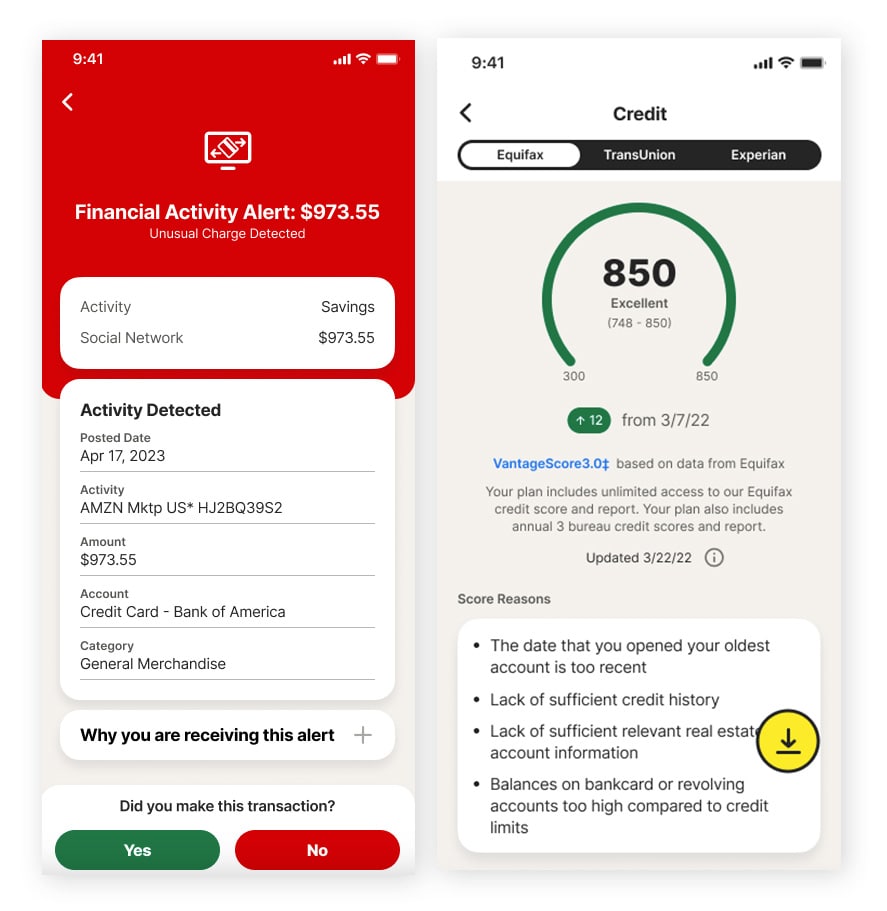

Financial account monitoring

LifeLock and Aura both offer financial account monitoring features. LifeLock Ultimate Plus will alert you about potentially fraudulent activity on your investment and 401(k) accounts, while Aura will notify you if it finds your registered investment accounts on the dark web.

LifeLock also alerts you of new, potentially fraudulent buy-now-pay-later accounts or utility accounts created in your name. If a new account isn’t yours, you can take quick action to report it.

Here’s a breakdown comparing the financial monitoring features of LifeLock and Aura:

LifeLock Ultimate Plus |

Aura |

|

|---|---|---|

Account types monitored |

Bank accounts (checking and saving), credit accounts, and 401(k) and investment accounts. |

Bank accounts, credit cards, and 401(k) and investment accounts. |

Stolen wallet assistance |

Helps you cancel or replace payment cards, IDs, insurance cards, Social Security cards, and other important cards. |

Offers remediation plans via customer support in case of a lost wallet. |

Payment monitoring2 |

Monitors and detects unusual activity from your bank or credit cards, as well as buy-now-pay-later purchases and utility accounts. |

Monitor credit card transactions, bank accounts and details, and investment accounts from a central dashboard. |

401(k) investment protection2 |

Alerts you to suspicious cash withdrawals and balance transfers regarding your 401(k) and investment accounts. |

Notifies you if your investment accounts are found on the dark web. |

While both LifeLock and Aura monitor a variety of account types, LifeLock stands out with comprehensive recovery support if your wallet is stolen and advanced detection of suspicious account behavior, including buy-now-pay-later transactions.

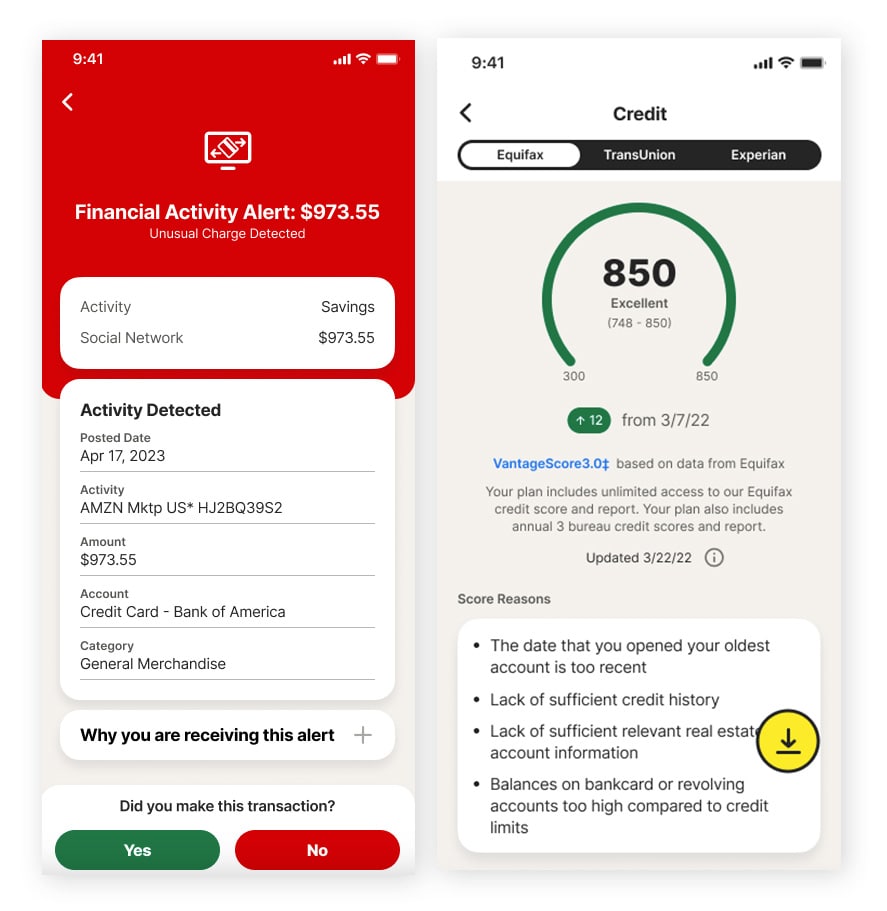

Credit monitoring

Here’s a comparison of LifeLock and Aura’s credit monitoring4 features:

LifeLock |

Aura |

|

|---|---|---|

Credit bureaus monitored |

Equifax, Experian, and TransUnion. |

Equifax, Experian, and TransUnion. |

Credit score monitoring |

Unlimited daily one-bureau credit scores and annual three-bureau scores. |

Monthly and annual credit score updates based on Equifax files. |

Credit report monitoring |

Monitors changes to your credit report at all three major bureaus. |

Sends alerts when credit report inquiries are made at all three major bureaus. |

Credit freeze |

Puts an instant credit lock on your TransUnion file to help block unauthorized account openings, and helps you request a freeze on your child’s credit. |

The family plan allows you to submit a child credit freeze request to all three bureaus. |

With frequent credit score tracking, granular report monitoring, and instant credit-locking capabilities, LifeLock provides a powerful defense for those seeking active credit protection.

Criminal record monitoring

LifeLock Ultimate Plus helps protect against criminal identity theft by monitoring for falsified court records containing your personal information. The court records scan feature checks for your name and date of birth to help detect falsely linked convictions, helping protect you against being associated with crimes you didn’t commit.

Similarly, Aura’s criminal and court records monitoring feature notifies you if it discovers that criminals used your identity.

Identity theft reimbursement

LifeLock provides dollar-for-dollar expense and loss reimbursement for each covered family member in the case of qualifying identity theft. There are no out-of-pocket expenses for lawyers, no limit on the number of annual claims, and no sub-limits on reimbursement for wages or other expenses — with a reimbursement total of up to $3 million3 in our LifeLock Ultimate Plus plan.

Here’s a breakdown of how the $3 million is split:

- Up to $1 million reimbursement for lawyers and experts that were consulted during the identity theft recovery process.

- Up to $1 million reimbursement for stolen funds that were lost due to identity theft.

- Up to $1 million compensation for personal expenses incurred during the identity theft recovery process.

Aura works a little differently: Each membership plan is covered by general identity theft insurance of between $1 million and $5 million per membership — not per individual family member. This amount helps cover overall reimbursement for expenses incurred during the identity theft recovery process.

LifeLock vs. Aura: Plans and pricing

LifeLock offers multiple identity protection plans to choose from for both individuals and families. Opt for an individual LifeLock Standard plan to get the most budget-friendly option, including identity theft protection, financial reimbursement,††† one-bureau credit monitoring,†† and Social Security number alerts.

A LifeLock Advantage membership offers extra identity protection features, such as phone takeover monitoring, buy-now-pay-later alerts, and Identity Lock, which allows you to lock your credit with TransUnion in case of fraudulent activity.

For premium protection, try LifeLock Ultimate Plus and get all of the features included in Standard and Advantage plus a range of additional tools like 401(k) alerts, home title monitoring, social media monitoring, and up to $1 million in stolen funds reimbursement††† should the worst happen.

For its part, Aura’s protection plans fall into three tiers: Family (5 adults + unlimited kids), Couple (2 adults), and Individual (1 adult). With each plan, you get a collection of identity protection features alongside bundled cybersecurity tools for the stated number of family members.

With the Aura Family plan, you also get Child Identity Protection with Social Security number alerts, which can help a parent or guardian detect if their child has fallen victim to child identity theft by a parent or stranger. However, only children included on the plan benefit from these features.

Here’s an overview of LifeLock plans compared with Aura plans:

Individual plans

Plan |

Adults |

Kids |

Monthly Price |

Annual Price |

Notes |

|---|---|---|---|---|---|

LifeLock Standard |

1 |

0 |

$11.99 |

$89.99 (1st year), renews at $124.99 |

Includes over $1 million in potential coverage in case you need it.††† |

LifeLock Advantage |

1 |

0 |

$22.99 |

$179.88 (1st year), renews at $239.99 |

Includes up to $1.2 million in potential coverage in case you need it. |

LifeLock Ultimate Plus |

1 |

0 |

$34.99 |

$239.88 (1st year), renews at $339.99 |

Includes up to $3 million in potential coverage in case you need it. |

Aura Individual |

1 |

0 |

$15.00 |

$144.00 |

Includes $1 million in identity theft insurance. |

Family plans (adults only)

Plan |

Adults |

Kids |

Monthly Price |

Annual Price |

Notes |

|---|---|---|---|---|---|

LifeLock Standard |

2 |

0 |

$23.99 |

$149.87 (1st year), renews at $249.99 |

Includes over $1 million in potential coverage per adult, in case you need it. |

LifeLock Advantage |

2 |

0 |

$45.99 |

$287.88 (1st year), renews at $479.99 |

Includes up to $1.2 million in potential coverage per adult, in case you need it. |

LifeLock Ultimate Plus |

2 |

0 |

$69.99 |

$395.88 (1st year), renews at $679.99 |

Includes up to $3 million in potential coverage per adult, in case you need it. |

Aura Couple |

2 |

0 |

$29.00 |

$264.00 |

Includes $2 million in identity theft insurance per couple. |

Family plans (adults + kids)

Plan |

Adults |

Kids |

Monthly Price |

Annual Price |

Notes |

|---|---|---|---|---|---|

LifeLock Standard |

2 |

Up to 5 |

$35.99 |

$221.87 (1st year), renews at $359.99 |

Includes over $1 million in potential coverage per family member. |

LifeLock Advantage |

2 |

Up to 5 |

$57.99 |

$359.88 (1st year), renews at $579.99 |

Includes up to $1.2 million in potential coverage per adult and over $1 million in potential coverage per child. |

LifeLock Ultimate Plus |

2 |

Up to 5 |

$79.99 |

$467.88 (1st year), renews at $799.99 |

Includes up to $3 million in potential coverage per adult and over $1 million in potential coverage per child. |

Aura Family |

Up to 5 |

Unlimited |

$50.00 |

$384.00 |

Includes $5 million identity theft insurance per family. |

All pricing valid as of May 2025.

Identity theft can have long-lasting effects on the financial health of you and your family members. That’s why we’re offering a free trial of LifeLock Ultimate Plus — so you can take proactive steps to help safeguard your identity. LifeLock Ultimate Plus offers a full spectrum of identity protection features that help you monitor for fraudulent use of your personal information so you can take action to protect yourself.

LifeLock vs. Aura: Ease of use

Setting up LifeLock is easy. In just a few minutes, you’ll have full access to a dashboard detailing your accounts, known data breaches, and any alerts you need to be aware of. All features are marked clearly in an easy-to-use interface so you can finish setup quickly and leave the protection to the experts. You can even set up ID protection alerts to be sent to your mobile phone for immediate access.

Aura’s products include a modern design with items and features marked appropriately for easy use. According to TechRadar, one drawback to Aura’s interface is the position of alerts, which are hidden in sub-menus and not given prime real estate on the main product dashboard.

Remember, any software that’s difficult to use or set up can get in the way of your protection, potentially compromising the security of your personally identifiable information and, ultimately, your identity.

LifeLock vs. Aura: Customer support

Both LifeLock and Aura have an online help center where you can troubleshoot product activation and read about common support topics. Each company provides multiple ways for customers to get in touch with customer support representatives beyond that, including email, phone, and live chat — you may just need to be a subscriber to initiate contact.

An important difference is that LifeLock’s exceptional level of customer support is backed by its outstanding 4.8 Trustpilot score. Here’s what one customer recently wrote in a five-star review:

“With all the identity theft, cyber information theft from corporations, I feel much safer with LifeLock. I have had LifeLock for 15+ years and my identity has always been secure. I have called in a couple of times regarding strange emails, the LifeLock team was on top of it and I received updates regarding the situation and what I needed to do. The LifeLock team has ALWAYS been very very nice, knowledgeable and helpful. Thank you LifeLock!”

Compare that to a recent one-star review of Aura, where a customer allegedly could not connect to a customer service agent who could help and ended up cancelling their Aura subscription after just two days. If their customer service really is that questionable, it’s understandable that Aura’s Trustpilot rating is so much lower than LifeLock’s.

What’s special about LifeLock’s customer support is that all personal restoration specialists are U.S.-based. As a LifeLock member, you’ll be able to contact an individual restoration specialist near your own time zone who will help guide you from start to finish through the most important steps to take after identity theft occurs. And, if you’re on a LifeLock Ultimate Plus plan, your case can be prioritized to help you connect to a restoration specialist even faster.

Plus, LifeLock offers a money-back guarantee. So if you fall victim to identity theft and a U.S.-based restoration specialist can’t restore your identity, you’ll get your subscription money back through LifeLock’s Restoration Guarantee.

Protect your identity with LifeLock

Securing your identity is a team effort and, with support from LifeLock, you’ll have peace of mind that someone’s always on your side. LifeLock has decades of experience helping people keep their private information safer and more secure, and our protection just keeps getting better with age.

Start your LifeLock membership today with a free trial of LifeLock Ultimate Plus and enjoy comprehensive, free identity protection for 30 days before you commit.

FAQs

Is Aura legit?

Yes. Aura is a legitimate service that offers capable identity and credit monitoring, plus basic antivirus protection. But, if you’re after a tool that’s laser-focused on giving you the best possible identity protection without all the extra fuss, choose a plan from a brand you can trust to do it — LifeLock.

Is LifeLock or Aura better?

LifeLock has a 4.8 rating on Trustpilot, and its service is focused on quality identity theft protection. Aura has only a 4.3 Trustpilot rating and bundles antivirus protection into their product, without offering customers the choice to separate the two functionalities. PC Mag reviewed Aura and stated, “Aura’s security suite offers uneven protection” — so which is better? It depends on the features you need, and how well they need to work.

How can I choose the right identity theft protection service for me?

To start your search for the right identity protection service, choose a trusted brand like LifeLock so you feel more secure knowing your identity is in good hands. Then, consider which plan offers the protection you need, with features like SSN monitoring for all family members and credit monitoring covering the major credit bureaus. Ideally, your plan should also include identity theft reimbursement for losses or costs associated with identity theft.

Disclosures

2 We do not monitor all transactions at all businesses. No one can prevent all cybercrime or identity theft.

3 $3 million coverage in our Ultimate Plus plan consists of up to $1 million each for Reimbursement, Expense Compensation, and Lawyers and Experts. Total coverage and category limits vary depending on plan chosen. Benefits under the Master Policy are issued and covered by United Specialty Insurance Company (State National Insurance Company, Inc. for NY State members). Policy terms, conditions and exclusions at: LifeLock.com/legal.

4 If your plan includes credit reports, scores, and/or credit monitoring features ("Credit Features"), two requirements must be met to receive said features: (i) your identity must be successfully verified with Equifax; and (ii) Equifax must be able to locate your credit file and it must contain sufficient credit history information. IF EITHER OF THE FOREGOING REQUIREMENTS ARE NOT MET YOU WILL NOT RECEIVE CREDIT FEATURES FROM ANY BUREAU. If your plan also includes Credit Features from Experian and/or TransUnion, the above verification process must also be successfully completed with Experian and/or TransUnion, as applicable. If verification is successfully completed with Equifax, but not with Experian and/or TransUnion, as applicable, you will not receive Credit Features from such bureau(s) until the verification process is successfully completed and until then you will only receive Credit Features from Equifax. Any credit monitoring from Experian and TransUnion will take several days to begin after your successful plan enrollment.

†† Credit reports, scores and credit monitoring may require an additional verification process and credit services will be withheld until such process is complete.

††† Up to $1 million for coverage for Lawyers and Experts included on all plans, plus reimbursement and expense compensation up to $25,000 each with Standard, $100,000 each with Advantage, and $1 million each with Ultimate Plus. Insurance benefits are issued by third parties. See GenDigital.com/legal for policy info.

Δ LifeLock/Norton 24/7 Support is available in English only. See https://www.norton.com/globalsupport.

§ Dark Web Monitoring is not available in all countries. Monitored information varies based on country of residence or choice of plan. It defaults to monitor your email address and begins immediately. Sign in to your account to enter more information for monitoring.

6 Identity Lock cannot prevent all account takeovers, unauthorized account openings, or stop all credit file inquiries. The credit lock on your TransUnion credit file and the Payday Loan Lock will be unlocked if your subscription is downgraded or canceled.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

Copyright © 2025 Gen Digital Inc. All rights reserved. All trademarks, service marks, and tradenames (collectively, the "Marks") are trademarks or registered trademarks of Gen Digital Inc. or its affiliates ("Gen") or other respective owners that have granted Gen the right to use such Marks. For a list of Gen Marks please see GenDigital.com/trademarks.