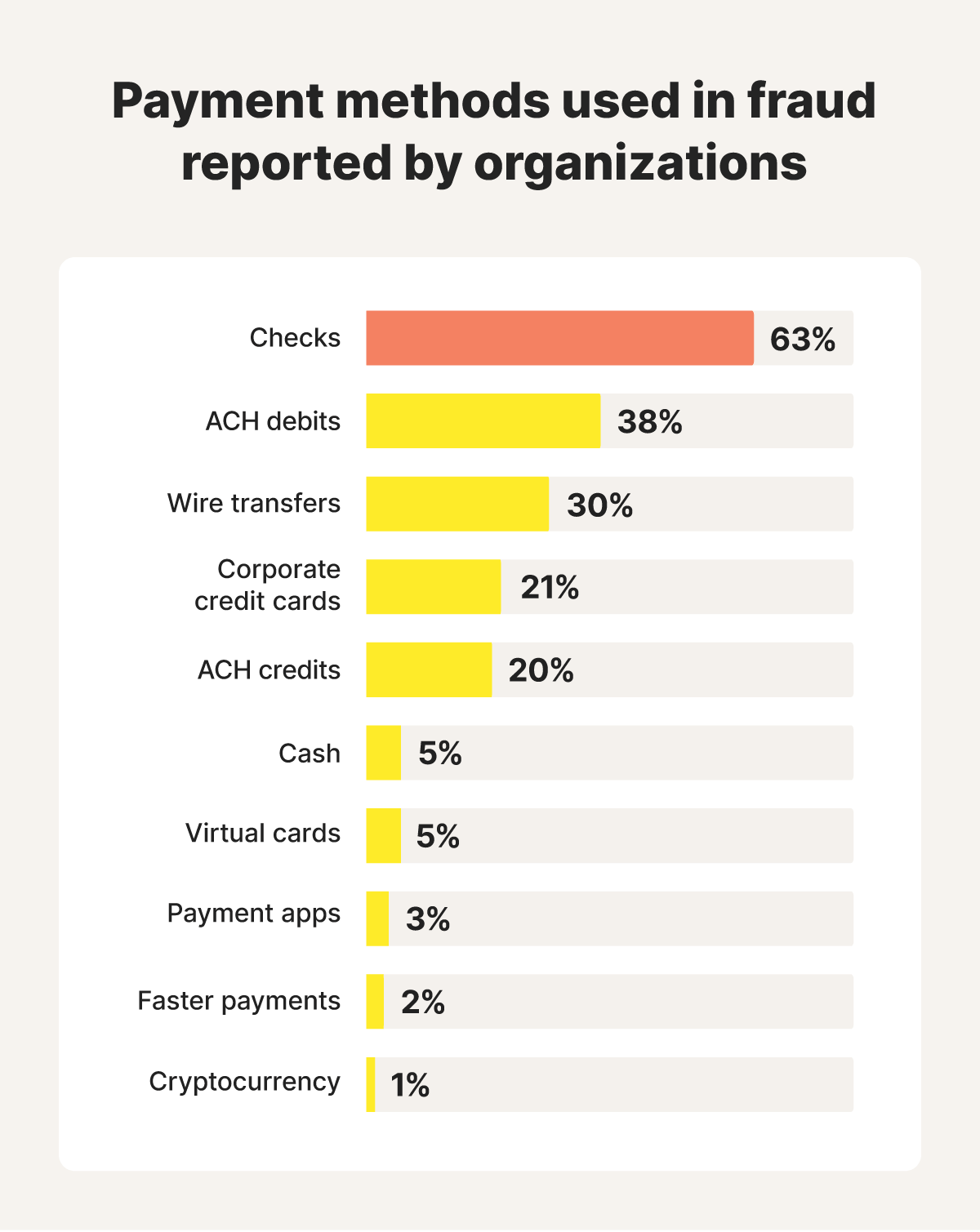

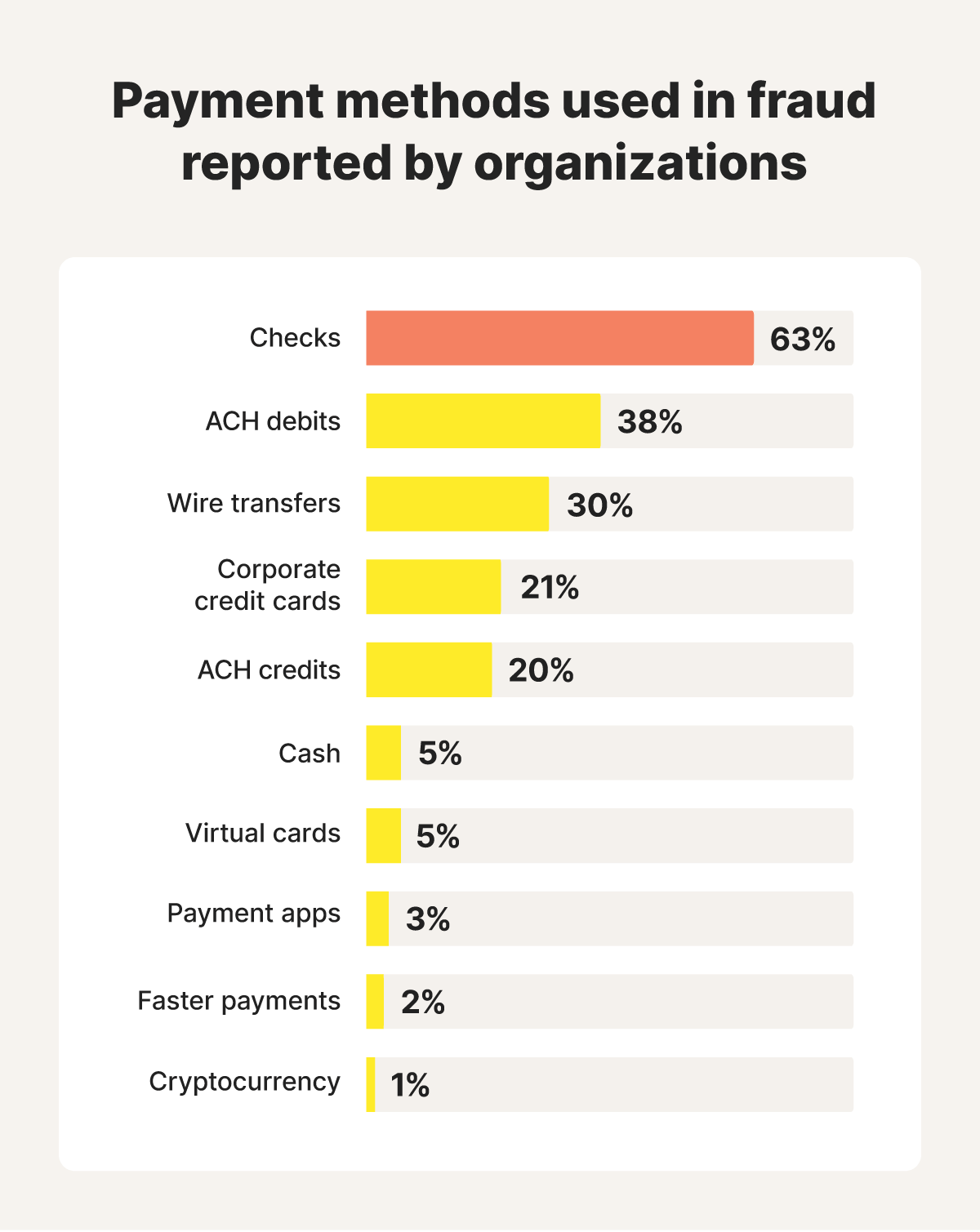

While more consumers and businesses are shifting to digital payment methods like credit and debit cards, check usage continues to decline. But that hasn’t stopped fraudsters. According to a recent Association for Financial Professionals survey, checks remain the most common target for payment fraud in businesses, with 63% of organizations reportedly facing check fraud in 2024.

And as mobile banking grows, so does mobile-based check fraud. People are depositing checks through their smartphones, and scammers are finding new ways to exploit this process, too.

Read on to learn how check fraud works, which fake check scams to watch for, and how to protect yourself, or your business, from falling victim.

What is check fraud?

Check fraud occurs when someone uses another person’s checks without permission to make purchases or withdraw money. Like loan fraud or credit card fraud, it involves using checks as a tool to commit financial fraud, often leading to major losses for both individuals and businesses.

How does check fraud work?

Check fraud can occur in many ways. One of the most common methods works by stealing a legitimate check from someone’s mailbox, erasing the original ink, and rewriting the check with their information to cash it and steal the funds.

In addition to altering real checks, fraudsters have developed various fake check scams designed to trick unsuspecting victims and take advantage of organizations.

Many of these schemes work by exploiting “float time” — the time between when someone deposits a check and when the bank verifies the check’s legitimacy and clears the funds. Banks often mark deposited funds “available” in your account within a day or two, but that doesn’t mean the check has actually cleared. Scammers exploit the common misconception that “funds available” means a check is good when, in reality, it may bounce days later.

Types of fake check scams

Fake check scams come in many forms, each designed to trick victims into handing over money or personal information. Here are some common tactics scammers use to carry out check fraud:

Counterfeiting

Counterfeiting involves criminals creating fake checks to steal money. Sometimes, the entire check, including the account and routing numbers, is fabricated. Other times, scammers use stolen banking information from a real person’s account to make the counterfeit check appear legitimate. These checks are often deposited via mobile apps or ATMs, allowing the scammer to withdraw funds before the bank detects the fraud.

Fraudsters target a wide range of financial institutions with this type of check fraud. While large banks falling victim to counterfeiting tend to be more widely reported, community banks and credit unions are more vulnerable due to their less robust fraud detection systems.

In some cases, criminals use counterfeit checks in larger scams, too. Sometimes, victims are tricked into depositing a fake check and immediately pressured to send a portion of the funds back to the scammer through other methods like wire transfers or gift cards.

Forgery

Forgery occurs when a bad actor signs a legitimate check without the account holder’s permission or endorses a check that wasn’t made out to them. The scammer then attempts to cash the check and pocket the money illegally.

Check washing

Check washing involves stealing a legitimate check and altering the information. Often, fraudsters will use chemicals to wash off the original ink, rewrite the check to change the payee’s name to their own, then alter the amount to steal more money.

In a recent check washing scheme, a Chicago business owner lost $30,000 after someone intercepted checks she mailed to vendors and altered them using whiteout. The fraudsters replaced the original amounts with much larger sums, then used mobile deposit to cash the checks.

Duplicate checks

Duplicate check fraud occurs when a scammer deliberately deposits the same check more than once. To carry out this scheme, the fraudster exploits gaps in the check processing system by depositing the same check at two different financial institutions.

If the timing is just right, a scammer could deposit it once through a mobile banking app, then exploit the float time before the issuing bank clears the funds. During that time, the fraudster could then try to deposit it in person or wash the check and use it as payment.

Check kiting

Check kiting is a general type of check fraud that occurs when a fraudster intentionally accesses funds from a deposited check before the bank collects the money from the issuing account. They exploit the float time between when a check is deposited at one bank and when it clears at another, creating the illusion of available funds.

In one recent example of check kiting, TikTok users found a glitch in Chase Bank’s ATMs, which allowed people to withdraw funds from fraudulent checks, often ones they wrote themselves, before the checks bounced. This glitch led to significant losses for the bank and prompted lawsuits against several participants.

Paperhanging

Paperhanging is a form of fraud that involves deliberately writing bad checks to pay for goods or services, knowing the account either has insufficient funds or is completely closed. The scammer typically vanishes once the check is handed over, leaving the victim without payment.

Mobile deposit scams

As mobile banking grows in popularity, scammers are finding new ways to exploit it with mobile deposit bank scams.

In a typical scheme, a fraudster deposits a fake check into the victim’s account, often claiming it’s for a job, purchase, or repayment. They then ask the victim to return some or all of the funds using a third-party payment app like Cash App.

Eventually, the check bounces, and the victim is left responsible for the withdrawn money, essentially handing their own money over to the scammer.

How to detect check fraud

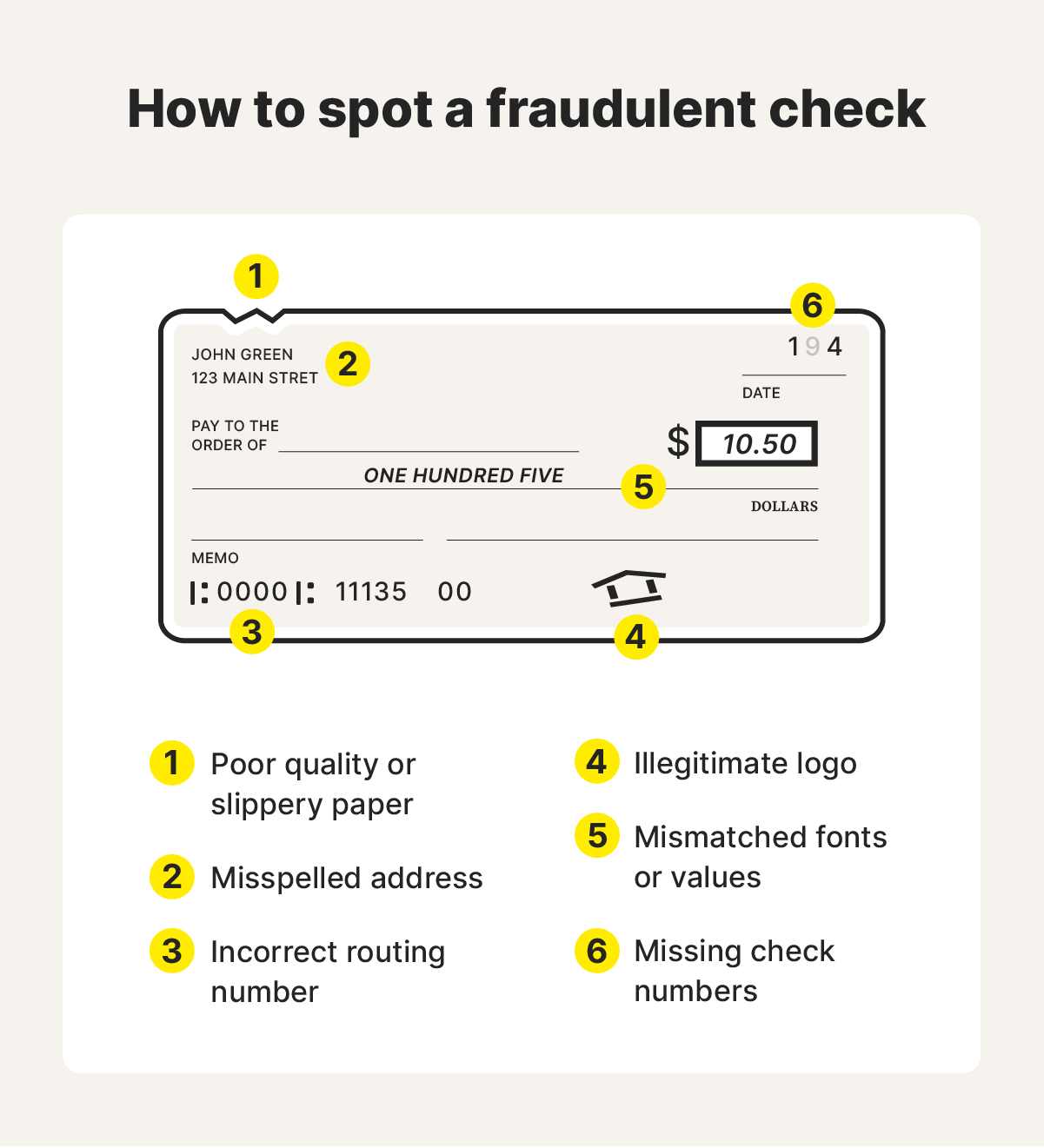

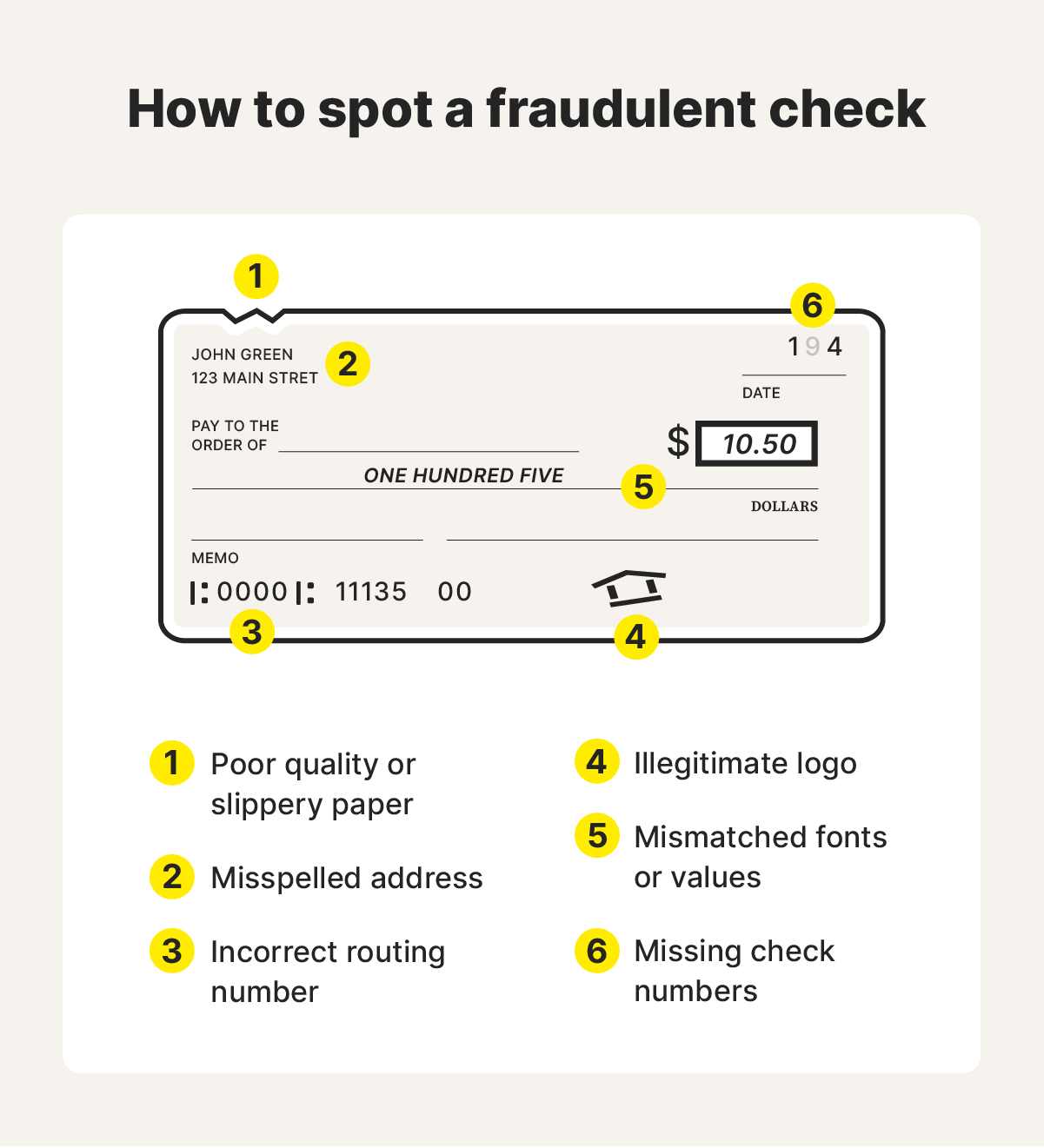

Inspect physical checks carefully, and monitor your bank accounts to help you spot potential check fraud. Effective check fraud detection starts with looking for physical signs that a paper check is fake, such as:

- Poor-quality or unusually slippery paper

- Mismatched fonts or dollar amounts

- Spelling errors or missing information

- Illegitimate logos

- Signs that previous ink was rubbed out

If you’re ever unsure whether a check is legitimate, visit your bank and ask them to verify it.

It’s also important to regularly review your bank statements. Report any unfamiliar or suspicious transactions to your bank immediately, as they could be signs of check fraud.

How to prevent check fraud

The best defense against check fraud is staying vigilant. Since checks contain sensitive financial and personal information, they’re a common target for scammers. Here’s how to strengthen your check fraud prevention efforts:

- Store checks securely: Keep your checkbook locked in a safe or secure drawer at home. Never leave it in your car, bag, or out in the open.

- Make checks harder to alter: Use a black gel pen to write checks since it’s harder to wash off. Fill out all fields completely and draw lines through any unused space.

- Avoid mailing checks from a mailbox: Thieves can steal checks from personal mailboxes. Instead, drop them off at the post office or a secure USPS box just before the last pickup time.

- Opt for electronic payments when possible: Consider making payments online or using payment apps such as Venmo, since they’re harder for criminals to intercept than paper checks. However, watch for Venmo scams and similar schemes on other platforms.

- Monitor your accounts: Check your bank activity regularly and set up alerts for large transactions or any checks over a certain amount.

- Don’t deposit checks for strangers: If someone you don’t know asks you to deposit a check and send them money, it’s likely a scam.

- Limit personal information: Only include required details on your checks, and avoid adding personally identifiable information (PII) such as your Social Security number.

- Destroy unused checks: Shred or cut up old and unused checks to prevent fraudsters from obtaining sensitive information.

What to do if you’re a victim of check fraud

If you’ve fallen victim to check fraud, acting fast is key to protecting your finances and identity. Here’s what to do:

- Contact your bank immediately: Notify your bank as soon as you notice any suspicious activity. They can close your account to help prevent further unauthorized transactions and begin an investigation.

- Place a fraud alert on your credit file: Reach out to one of the three major credit bureaus to request a fraud alert on your credit report. That bureau will notify the others, making it harder for identity thieves to open new accounts in your name.

- File a report: Report the incident to the Federal Trade Commission (FTC) and your local police department. If the fraud involved a check stolen or altered through the U.S. Mail, also report it to the U.S. Postal Inspection Service (USPIS).

Get help detecting financial fraud

The consequences of fraud can be serious. That’s why taking proactive steps to protect your finances is essential. Ignoring the risk leaves you wide open to fraud and the headaches that come with it.

Thankfully, LifeLock lets you easily link your financial accounts so you can set up alerts to help detect suspicious activity or unauthorized transactions in your bank or credit accounts. And if your wallet is lost or stolen, LifeLock can help cancel and replace your sensitive documents quickly.

FAQs

What happens if a fake check is deposited?

If you accidentally deposit a fake check, your bank may initially make the funds available, but once they identify the check as fraudulent, they’ll remove the money from your account. This can lead to overdraft fees if you’ve already spent the money, and you may be held responsible for repaying the full amount.

How do I reverse a fraudulent check?

If you realize you deposited a fraudulent check, contact your bank immediately. They may be able to stop the check from being cashed or reverse it completely.

Do banks refund fraudulent checks?

In some cases, banks will refund money from fraudulent checks, but it’s not always guaranteed. For example, if you deposit a fake check and spend the money before it’s flagged as fraudulent, you’ll likely be responsible for repaying the funds.

Is check fraud a federal crime?

Yes, check fraud is a crime in the U.S. and can be prosecuted at either the state or federal level, depending on the severity of the charges. It can come with hefty penalties, including fines and imprisonment.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.