Ever wondered what someone can do with your Social Security number? You’re not alone. Many people don't realize just how dangerous it can be if this sensitive number falls into the wrong hands. In this post, we’ll walk through the unsettling possibilities of what scammers can do with your Social Security number when combined with other personal information and, more importantly, how you can protect yourself.

1. Open bank accounts and credit cards in your name

Scammers can use your SSN and information to open bank accounts or apply for credit cards without your knowledge. These accounts can be used to take out loans or rack up massive debts—all under your name. Eighty percent of U.S. identity theft victims who had accounts opened in their name did not find out from their bank or credit card company - and by the time you find out, your credit score could already be damaged.

2. Drain your bank account

With your Social Security number, thieves might gain access to your existing bank accounts. They could drain your hard-earned savings or conduct fraudulent transactions, leaving you scrambling to recover lost funds and secure your accounts.

3. Rent apartments or vehicles

If an identity thief has your SSN, they can use it on applications to rent apartments or even vehicles in your name. This not only leads to unpaid bills in your name but could also affect your credit score and your ability to rent or lease in the future.

4. Make fraudulent purchases

Your SSN, combined with other personal information, can be used to make large fraudulent purchases. It could lead to piles of debt being built in your name, which is difficult to untangle once discovered.

5. Get a fake ID or driver’s license

One frightening possibility is that thieves could use your SSN to create a fake ID or driver’s license. With this new identity, they could commit further fraud and crimes, all linked back to you.

6. File a tax return

Fraudsters can file a tax return in your name and claim your refund before you even know what happened. By the time you file your taxes, the IRS might flag it as a duplicate, leaving you in a mess that could take months to resolve.

7. Steal your medical benefits and social security checks

Identity thieves can steal your medical benefits, racking up bills for treatments you never received. They can even divert your Social Security checks, leaving you without your rightful payments.

8. Commit crimes on your record

Criminals can use your identity to commit crimes, which could leave you with a record of offenses you didn’t commit. Trying to prove your innocence in such cases can be a long and stressful ordeal.

How can scammers steal your Social Security number?

There are many ways one’s Social Security number can be compromised.

- Phishing attacks: Scammers trick you into revealing personal details through fake emails or websites.

- Data breaches: Hackers steal personal data, including Social Security numbers, from businesses that are poorly secured.

- Stolen Social Security cards or other sensitive documents: Physical theft of documents is another common way SSNs get stolen.

What to do if your SSN gets stolen?

If your Social Security number is stolen, it is important to act quickly to protect your identity. The longer you wait, the more opportunity an identity thief has to cause more problems.

- Freeze your credit: This prevents any new accounts from being opened in your name.

- File a police report: Document the theft with law enforcement for future reference.

- Create fraud alerts: Notify credit agencies so they can monitor unusual activity on your accounts.

- Report the incident to the Social Security Administration: They can help you safeguard your number.

- File a complaint with the Federal Trade Commission (FTC): This adds an official record of the theft.

- Monitor your accounts: Keep a close eye on bank accounts and credit reports for suspicious activity.

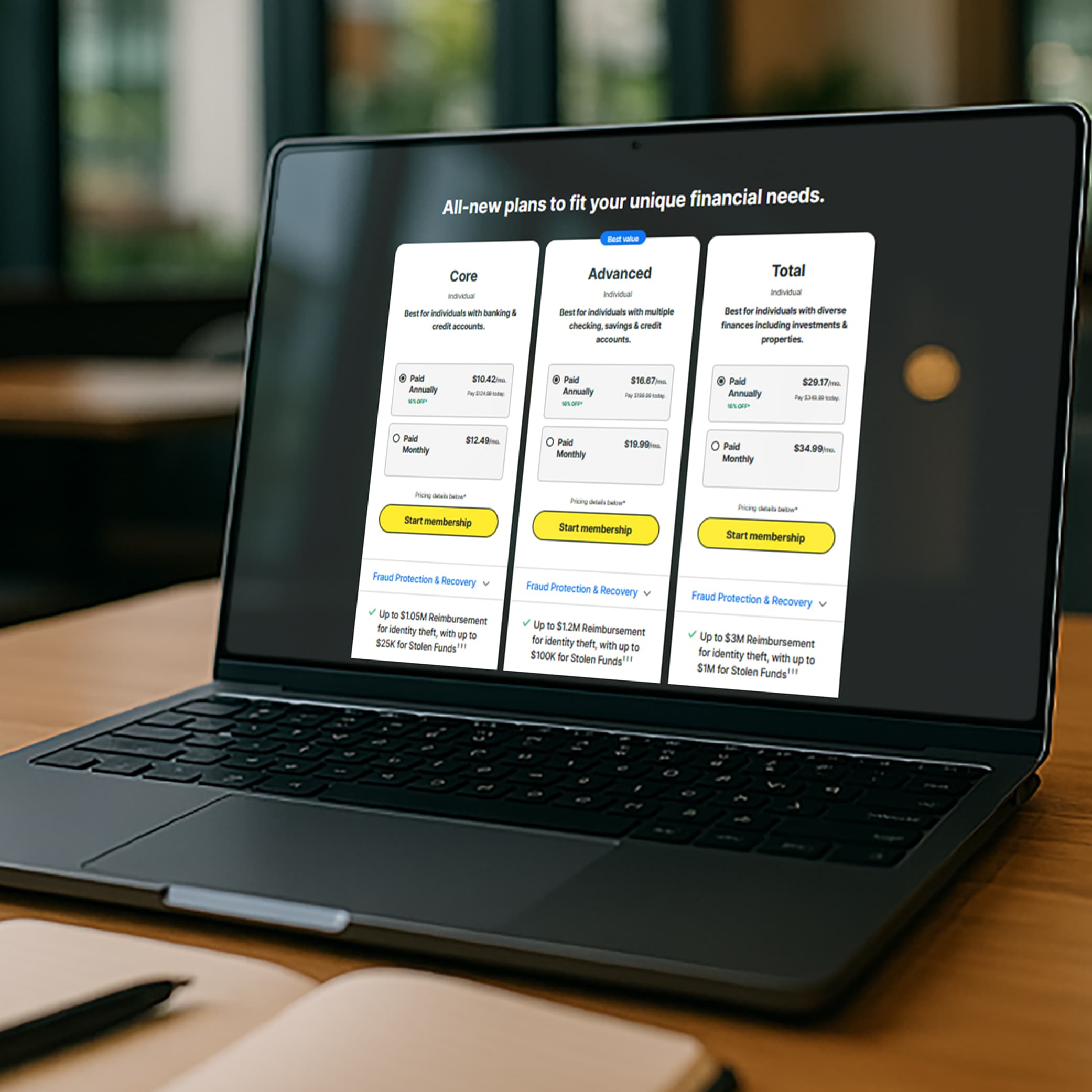

- Add identity theft protection: Consider LifeLock to help protect yourself and to be alerted of potential threats.

Boost your protection against identity thieves

Taking proactive steps is key to staying safe. LifeLock offers comprehensive protection and monitoring to help protect your identity and personal information.

FAQs about stolen Social Security numbers

Can you change your SSN if it gets stolen?

Yes, in some extreme cases you can change your Social Security number, but it’s a lengthy and difficult process.. You’ll need to contact your local Social Security office and provide evidence that your identity is being misused and that the misuse is causing significant damage.

How easy is it for someone to obtain your Social Security number?

While you might think it is impossible for someone to guess your number. Someone could potentially figure out the first five digits of your Social Security number if they know the state and year you were born in. Since people are generally comfortable giving away their last four digits, it is easy for identity thieves to ask people for it.

By staying aware and taking action, you can protect your Social Security number and minimize the risk of identity theft. Be vigilant and consider adding layers of protection like LifeLock to shield your identity from potential threats.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- 1. Open bank accounts and credit cards in your name

- 2. Drain your bank account

- 3. Rent apartments or vehicles

- 4. Make fraudulent purchases

- 5. Get a fake ID or driver’s license

- 6. File a tax return

- 7. Steal your medical benefits and social security checks

- 8. Commit crimes on your record

- How can scammers steal your Social Security number?

- What to do if your SSN gets stolen?

- Boost your protection against identity thieves

- FAQs about stolen Social Security numbers

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.