If you’ve ever heard someone say they’d need to take out a second mortgage to cover a major expense, they were talking about a home equity loan. A home equity loan is sometimes referred to as a second mortgage because they’re both secured loans that use property as collateral, allowing you to borrow funds based on the property's value.

But whereas a mortgage lets you purchase a home, a home equity loan helps you use the equity you already have in your home to cover other expenses.

For example, a fixed-rate home equity loan can help you access cash relatively quickly if you need to cover a large or unexpected expense. However, it’s not right for everyone. Keep reading to learn more about the pros and cons of these installment loans, how they work, and how you can tap the equity you have in your home.

What is a home equity loan?

A home equity loan is when a borrower uses the equity in their home as collateral to borrow a lump sum. Most lenders allow borrowers to take out up to 80% of their home’s equity, but some will go over 90%. Then, when it’s time for the borrower to return the amount they withdrew, they make fixed monthly payments for a predetermined number of months.

A home equity loan is a useful benefit for property owners. Unfortunately, home title theft and other fraud involving home equity loans are still a problem. According to the FBI, there were over 9,000 real estate fraud complaints in 2023. So, ensure to protect your deeds and shred any papers with personal information before you throw them away.

What can you use a home equity loan for?

You can borrow against the equity in your home to help cover life’s larger expenses. Here are some of the ways you can use a home equity loan:

- Fund a startup

- Consolidate debt

- Pay for school tuition

- Make home improvements

- Pay medical bills

- Fund a wedding

- Make up for temporary cash flow issues

Typically, you wouldn’t use a home equity loan for smaller purchases under $10,000. In fact, most lenders won’t let you borrow less than that amount.

Home equity loan requirements

Lenders must determine if you are a high- or low-risk borrower before they can approve you for a loan or settle on borrowing terms like interest rates or term lengths.

Here are a few examples of considerations home equity lenders factor in:

- Credit score: Your credit score should at least be in the “Fair” range. However, the higher your credit score, the better loan terms you’ll secure. The same is true for buying your first home, though there are ways to buy a house with a low credit score too.

- Credit history: Most lenders will check your credit report to see that you’ve had at least a few years of experience with responsibly managing your debt.

- Home equity: You can only borrow against the part of your home that you own. Most lenders require borrowers to have at least 20% equity in their homes.

- Income: Lenders will check your debt-to-income (DTI) ratio to confirm your income is high enough to pay off a second mortgage.

How do home equity loans work?

Home equity loans are fairly straightforward—it all comes down to application approval, funds withdrawal, and repayment. Here’s what that process looks like:

- Equity assessment: After you submit your application, the lender will compare your mortgage balance against the property’s current market value to determine how much you’re qualified to borrow.

- Borrower evaluation: Next, they will look at factors like your income, credit history, and DTI ratio to determine how likely you are to make on-time payments.

- Payment: If approved, you will receive a lump sum payment via deposit, check, or through a third party.

- Draw period: Then, you can withdraw as much as you want (up to the credit limit) during the set draw period, which is the preset time frame when you can withdraw money before the repayment process begins.

- Monthly payments: After the draw period, you must start repaying the loan. This is a fixed amount you will pay monthly until you repay the full amount.

Types of home equity loans

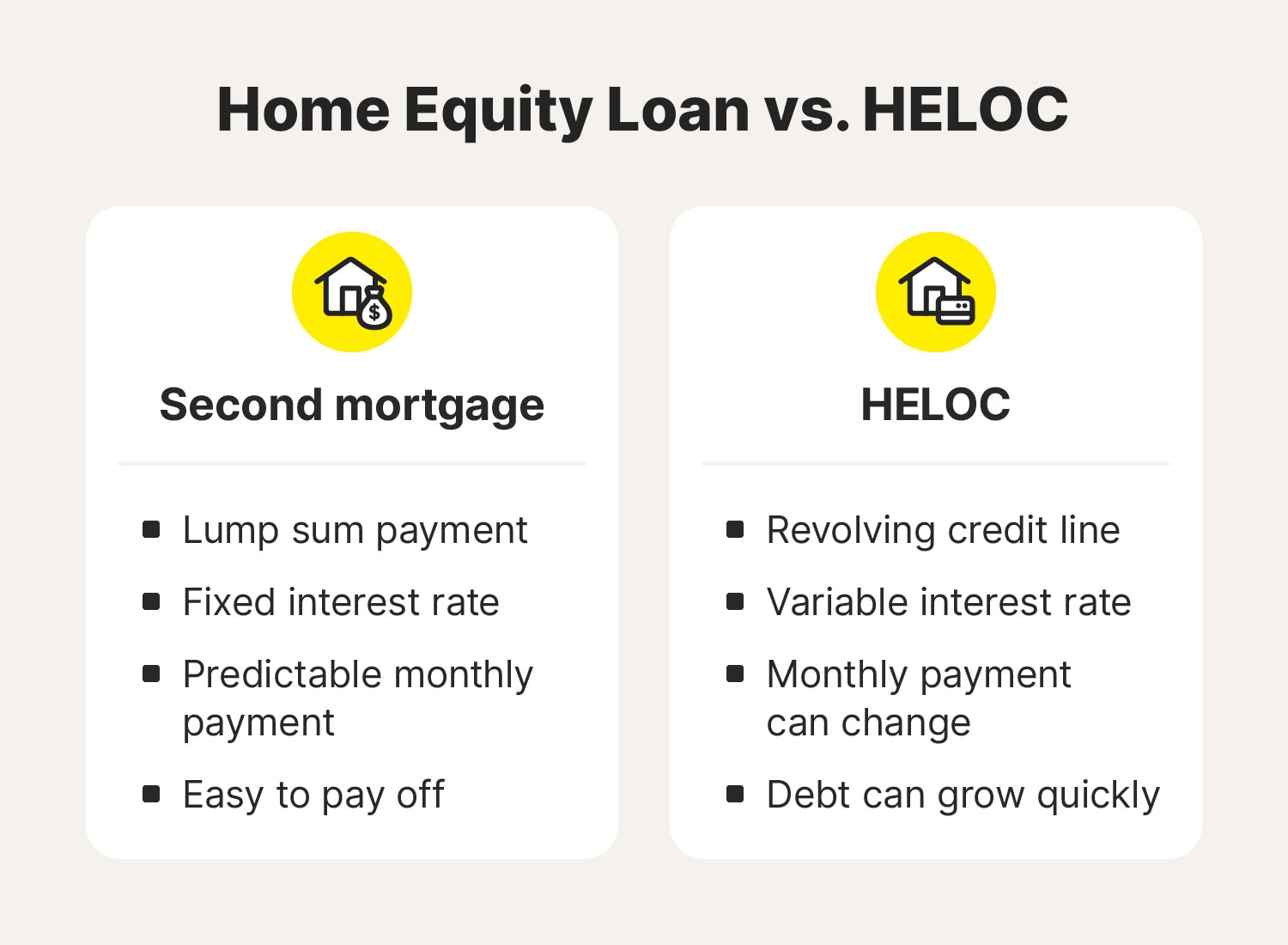

There are two main types of home equity loans: a second mortgage and a home equity line of credit (HELOC). However, depending on the lender, there can be slightly different variations of what each offers. Often, the terms “home equity loan” and “second mortgage” are used interchangeably, even though there are some slight differences.

Second mortgage

A second mortgage is a loan taken against the equity a homeowner has in their property. You might choose a home equity loan over a HELOC if you’re experiencing temporary cash flow problems or need to cover a large, one-time expense.

Here are some facts about second mortgages that you can use to determine if they’re the right fit for you:

- You can only get a one-time lump sum payment.

- The lender charges a fixed interest rate for the entire loan term unless you refinance, making it easier to pay off.

- Your monthly payment will be the same amount each month.

- These loans are easier to qualify for than other types of loans.

- You can lose your home if you miss payments since you place your equity as collateral.

HELOC

A Home Equity Line of Credit (HELOC) is a revolving credit line that allows homeowners to borrow against their property’s equity. This credit line is available as needed and is ideal for ongoing expenses such as extensive home renovations, recurring healthcare expenses, or high-interest debt consolidation.

Here are some HELOC highlights to consider:

- They function like a credit card with a revolving credit line.

- Interest rates will change over time.

- You can make interest-only payments to prevent your debt from snowballing.

- You can access money over time, as needed, rather than receiving a lump sum payout.

- It’s easy to fall into a debt vortex if you overborrow or repeatedly take out money.

- You can lose your home if you miss payments since you place your equity as collateral.

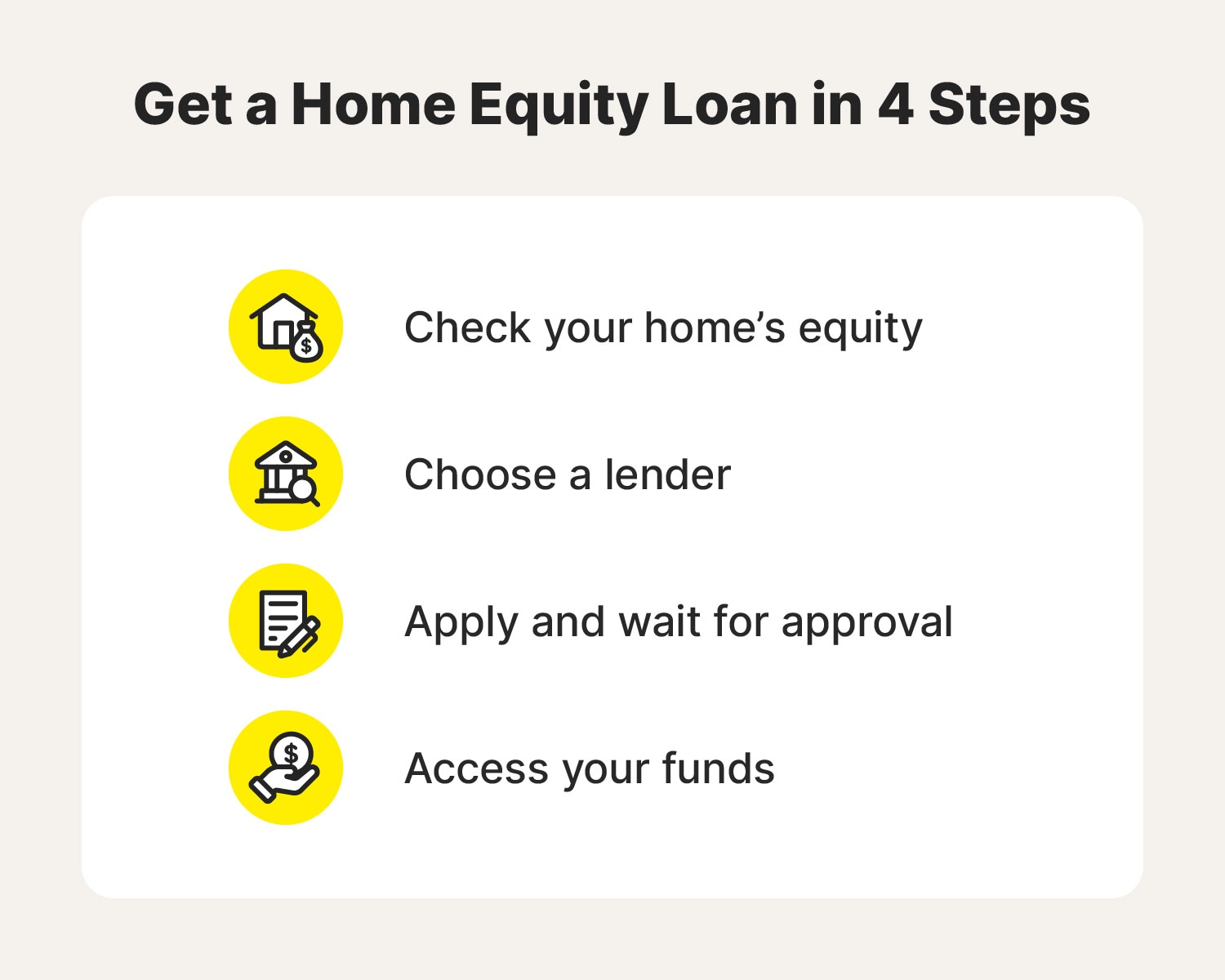

How to get a home equity loan in 4 steps

Most homeowners find that a home equity loan is one of the easiest types of loans to get approved for. Here’s how you do it:

1. Check your home’s equity

The first step is deciding if a home equity loan is a valid option and a good fit for you. So, before approaching a lender, calculate your home equity and get a ballpark figure of how much your home is worth. That helps give you an idea of your financial standing so you can get a better deal at the bank or explore alternative financing options.

For some extra help with the calculations, try using a home equity loan calculator. That can help you gauge what offers you qualify for—including loan term lengths, APR, and borrowing limits—and give you an estimate of how much your monthly payment would be.

2. Choose a lender

Then, if you decide to borrow against the equity in your home, you can start researching lenders. During this process, you should look for a lender that:

- Offers competitive interest rates

- Provides transparent loan terms

- Responds quickly via customer service channels

- Promises low fees

- Offers flexible repayment options

Once you find a few options that check your boxes, call the company and talk to a loan officer until you settle on the best option.

3. Apply and wait for approval

Most lenders allow borrowers to apply online, in person, or over the phone. Applying online is typically the fastest and easiest option.

You can sometimes receive your notification in minutes, but the underwriting (risk analysis) process can take up to two months. That’s because they have to:

- Review your application

- Verify documentation

- Run a credit check

- Complete a debt-to-income (DTI) ratio analysis

- Check the home’s market value and your equity in the home

- Verify that you legally own the property

If approved, the lender will prepare loan documents for you to sign.

4. Access your funds

After you sign the loan documents, the draw period (usually 5–10 years) begins.

You can withdraw any amount up to the maximum loan amount during this time. Once the draw period ends, the homeowner must pay fixed monthly payments until you pay off the loan. However, in most cases, you can start paying off the loan before the draw period ends.

Most times, you can choose between a 15- or 30-year repayment term. Just keep in mind that the shorter period typically comes with higher monthly payments, and choosing the longer repayment period means you’ll likely pay more in interest over time.

Keep your credit report clean

A home equity loan can be a useful financial tool. The real trouble is when a cybercriminal gets hold of your personal information and takes out an unauthorized loan. Help protect your critical investments with LifeLock Total, which includes built-in identity theft protection features like credit and home title monitoring to help you detect credit or other financial fraud early and minimize lasting damage.

FAQs about home equity loans

Still have questions about home equity loans? Here’s what you need to know.

Can I get a home equity loan with bad credit?

You can usually get a home equity loan with a 620+ credit score, but it might be more difficult if yours drops below that. However, you might get a second mortgage approved with bad credit if you meet the home equity and income requirements.

Can you refinance a home equity loan?

Yes, you can refinance a home equity loan to lower your interest rate or extend the loan repayment period.

What are current home equity loan rates?

As of early 2024, the average average home equity loan interest rate is 8.91%, but that will vary depending on the length of the loan and other factors.

How much can I borrow with a home equity loan?

There isn’t a set maximum. However, you can usually borrow about 80% – 90% of your home’s equity.

Are home equity loans tax deductible?

It depends on what you use the home equity loan money for. According to the IRS, expenses like home building and renovations usually qualify for tax breaks.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.