Pro tip: Make sure your PIN isn’t the default code. Default PINs are often “1234” or “0000” — a scammer could easily guess these.

Getting swamped with spam texts because scammers know your number is bad enough. But if a scammer gains control of your phone number by hacking your SIM, the consequences could be far more serious.

Here are eight tips for what to do if a scammer has your phone number. The first six focus on the worst-case scenario: the scammer isn’t just aware of your number — they’re actively using it to break into your accounts, steal your identity, or scam others. The final two tips cover what to do when a scammer simply knows your number and is bombarding you with spam or scam attempts.

1. Lock your SIM card

If you’re afraid a scammer might be misusing your phone number, lock your SIM card to help prevent SIM swaps, where cybercriminals move your phone number to their device. By locking your SIM card, scammers can’t move your phone number without your PIN, providing you with more security.

If a scammer has already performed a SIM swap, it’s too late to lock your SIM, so contact your cell phone carrier immediately to reclaim your number.

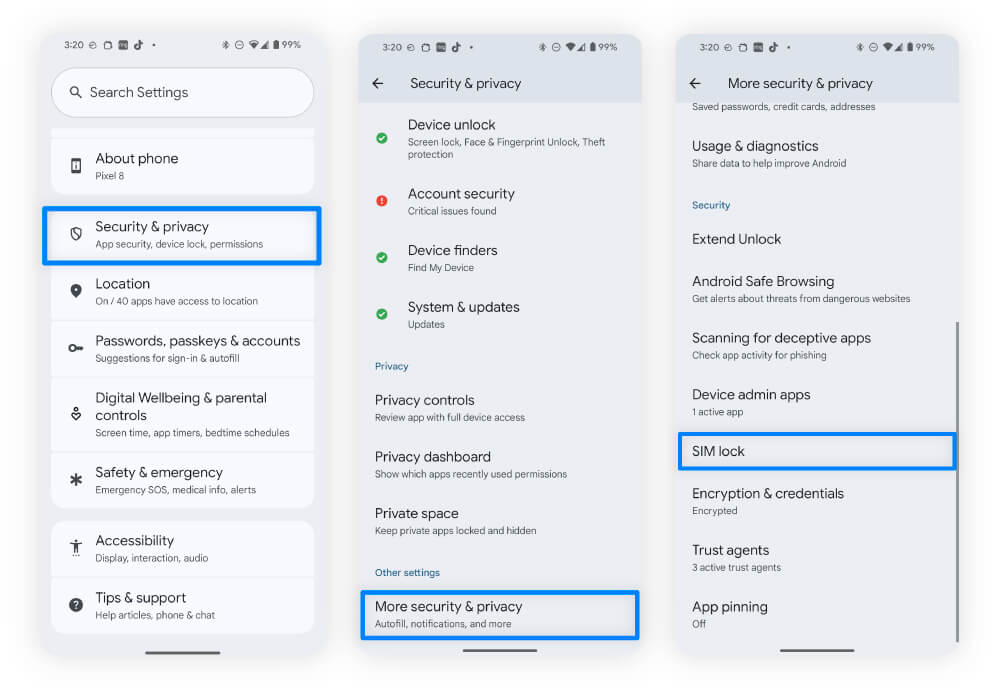

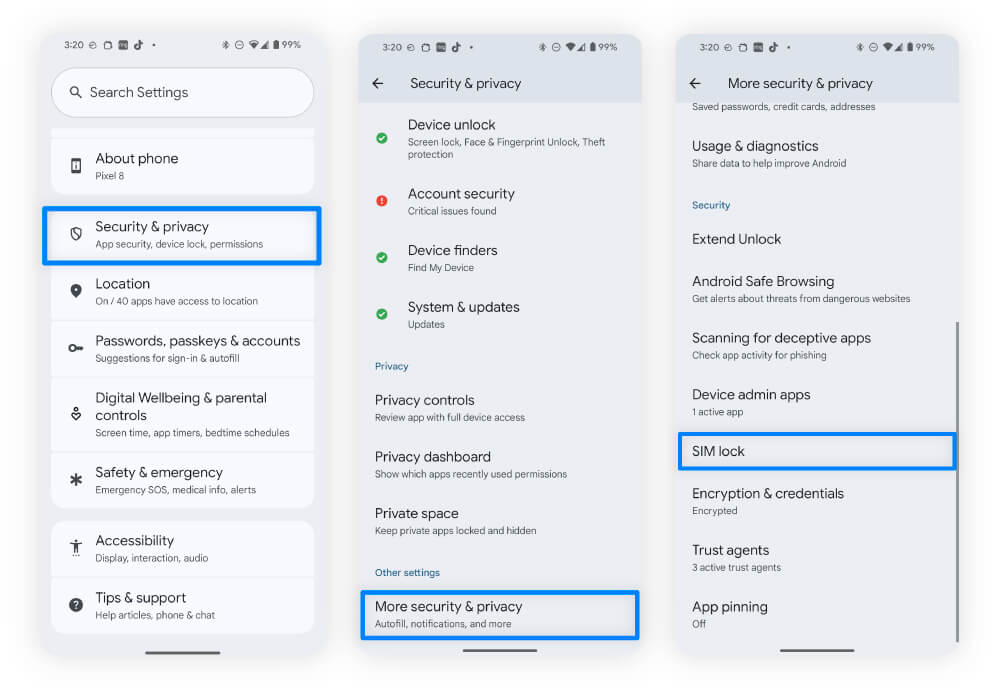

Here’s how to lock your SIM card on an Android phone (steps may vary by device):

- Open Settings and tap Security & privacy.

- Scroll down and tap More security & privacy.

- Find and tap SIM lock and toggle on Lock SIM. If you’ve never set one, enter the default PIN provided by your carrier, then change it to something unique.

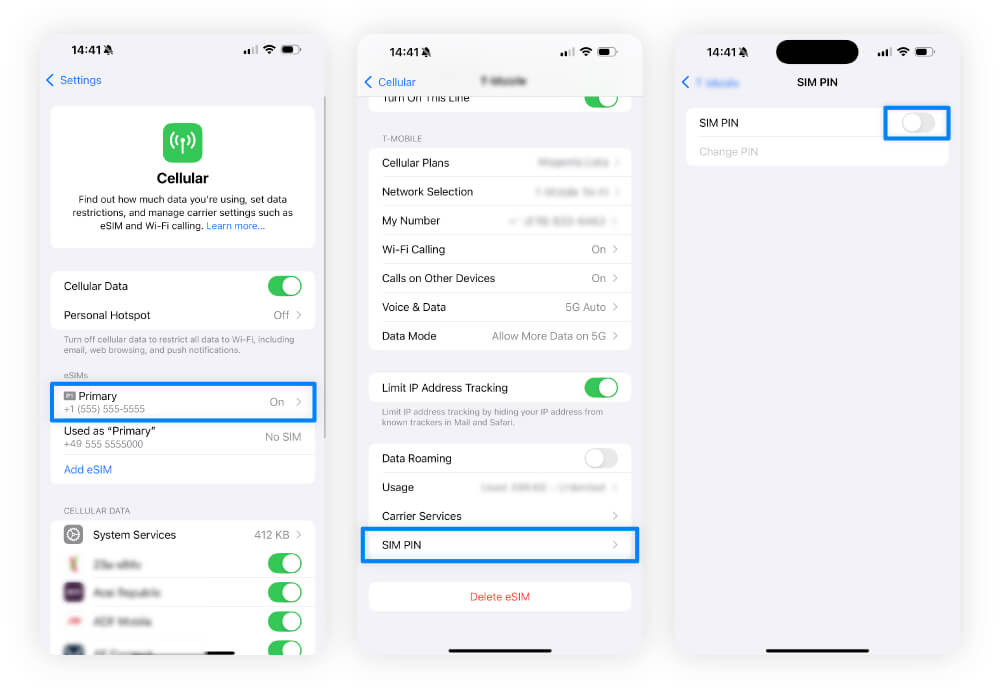

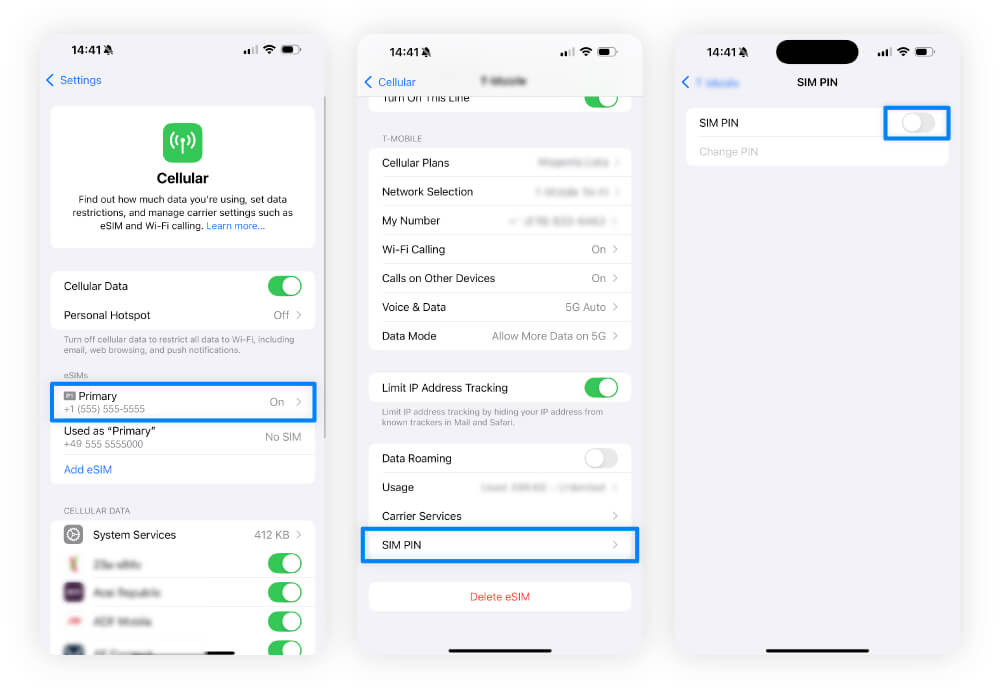

You can lock your SIM card on an iPhone through these steps:

- Open your phone Settings and tap Cellular. If you have a dual SIM or eSIM, choose the number you want to modify.

- Scroll down and tap SIM PIN.

- Toggle on SIM PIN. If you’ve never set one, enter the default PIN provided by your carrier, then change it to something unique.

2. Contact your cell phone carrier

If you believe your phone number has been compromised, let your cell phone carrier know right away. They’ll be able to give you advice on how to secure your phone and regain access if someone has hacked your SIM card.

Here’s a list of contact numbers for several major cell phone providers:

Cellular provider |

Customer service phone number |

|---|---|

Verizon |

1-800-922-0204 |

AT&T |

1-800-331-0500 |

Mint Mobile |

1-800-683-7392 |

T-Mobile |

1-800-937-8997 |

Xfinity Mobile |

1-800-934-6489 |

Once you reclaim your number, follow the instructions to lock your SIM card to help stop this from recurring.

Pro tip: When you contact your carrier, ask them to enable a port freeze or no port option. This means your phone number can’t be “ported” to another carrier without your authorization, adding an extra layer of security.

3. Secure your accounts and change 2FA settings

It can take anywhere from a few minutes to a few days to get your number back, depending on how simple your case is and how busy the customer service team is. Whether a scammer had or still has your number, secure your sensitive accounts, such as banking, email, and social media accounts.

Update your passwords so they’re all unique and have a minimum of 15 characters. You may also want to change the phone number associated with your accounts.

In addition, if the scammer still has control of your phone number, change your two-factor verification methods so that they don’t rely on an SMS. If a hacker can bypass your 2FA security because they have access to your SIM, you are at high risk of identity theft.

Pro tip: Choose an authenticator app to provide your 2FA security. That way, even if a scammer has your phone number, they can’t access the codes without your physical device.

4. Freeze your credit

Freezing your credit can help stop scammers from opening new lines of credit in your name if you suspect they have access to your personal information.

You must contact each of the three major credit bureaus separately. Credit freezes are free, and you can unfreeze your credit whenever you like.

Here are the links and phone numbers of the three main credit reporting agencies:

- Equifax: 1-800-349-9660

- Experian: 1-888-397-3742

- TransUnion: 1-800-680-7289

Pro tip: Placing a fraud alert, which warns creditors that you may be a victim of identity theft, is also a good idea. Doing so is free, and you only have to contact one bureau; it is then obliged to inform the others. This is a good option if you need to apply for credit soon.

5. Warn your contacts

Warn your contacts that somebody has your phone number to help protect them from malicious calls or messages. Even if you’ve already regained your phone number, a phishing text with a malicious link — apparently from you — could still be on their phone.

Pro tip: Send a text to all your contacts as a quick way to warn everyone. If you don’t have access to your number yet, turn to social media.

6. Report it to the FTC

Report the incident and scammer to the Federal Trade Commission (FTC). To report an issue to the FTC, go to their official reporting website or call 1-877-382-4357.

Reporting fraud to the FTC is important, as it helps law enforcement build cases against scammers and protect future victims. It’s also an important step for you, because it creates an official record of the incident and crime. This can help you dispute fraudulent charges and recover from identity theft.

Pro tip: After you file a report with the FTC you’ll get a step-by-step recovery plan based on your situation. This includes sample letters to send to creditors and other entities, which can save you time and guesswork.

7. Ignore and block unknown callers

According to a Hiya report, 9% of unknown calls in the final months of 2024 were fraud attempts. Ignoring and blocking potential spam and scam numbers can help keep you safer.

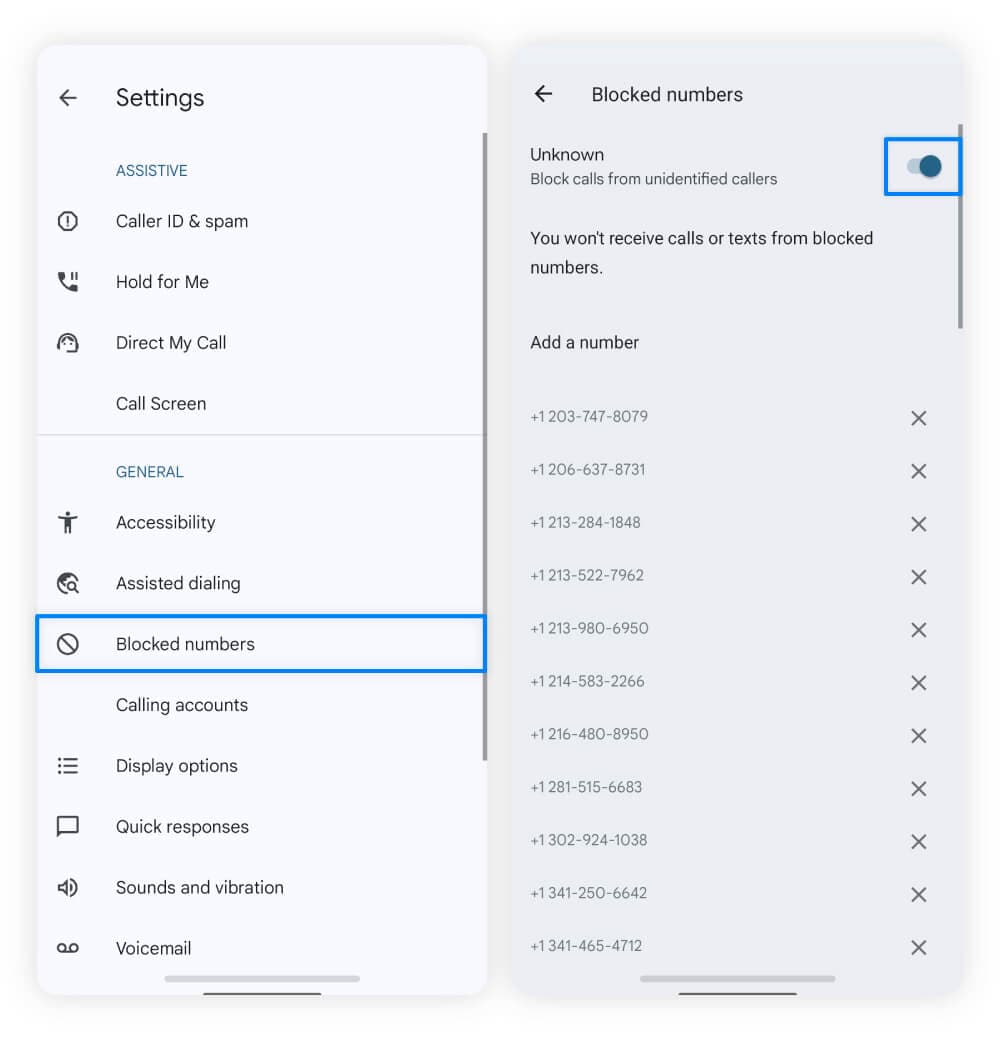

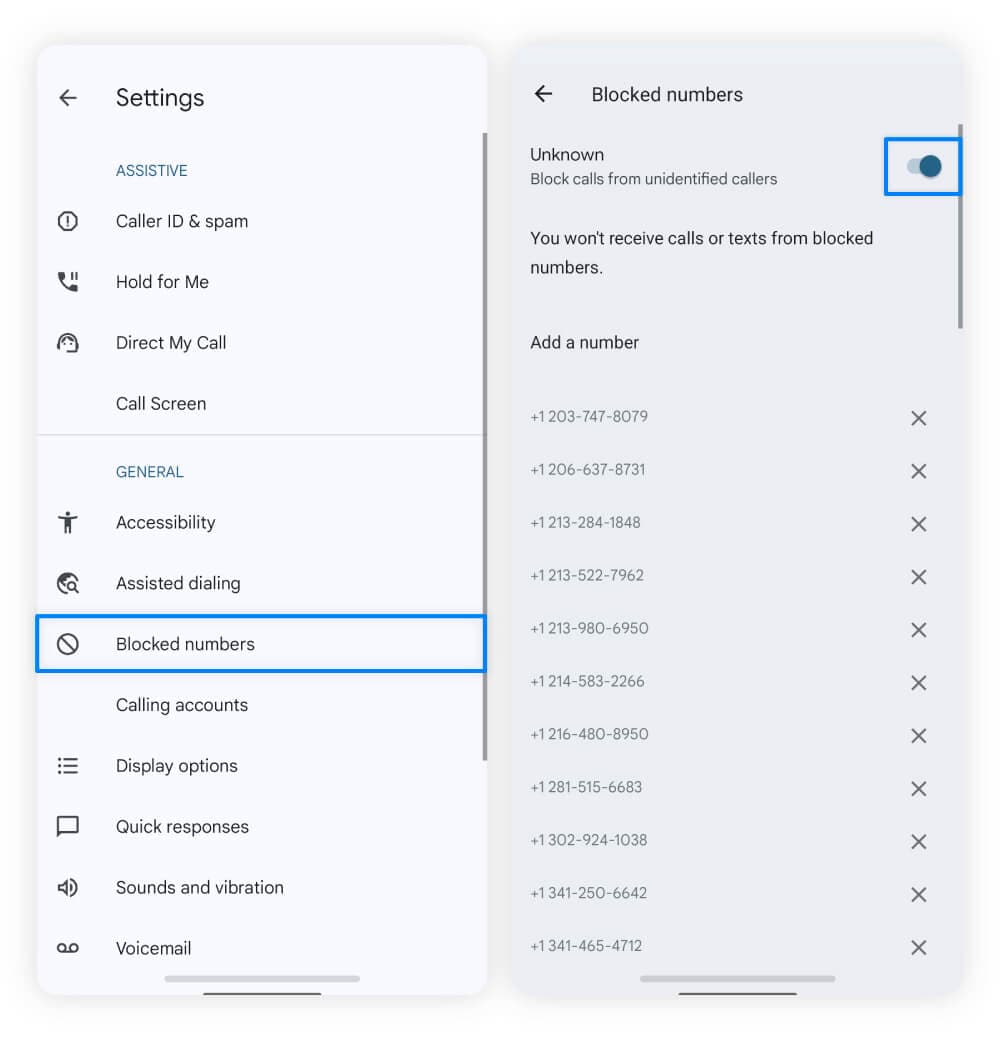

Here’s how to block unknown callers on Android (steps may vary depending on your phone and Android version):

- Open the Phone app and tap the three-dot menu in the upper-right corner.

- Select Settings and then Blocked numbers.

- Toggle on Block calls from unidentified callers.

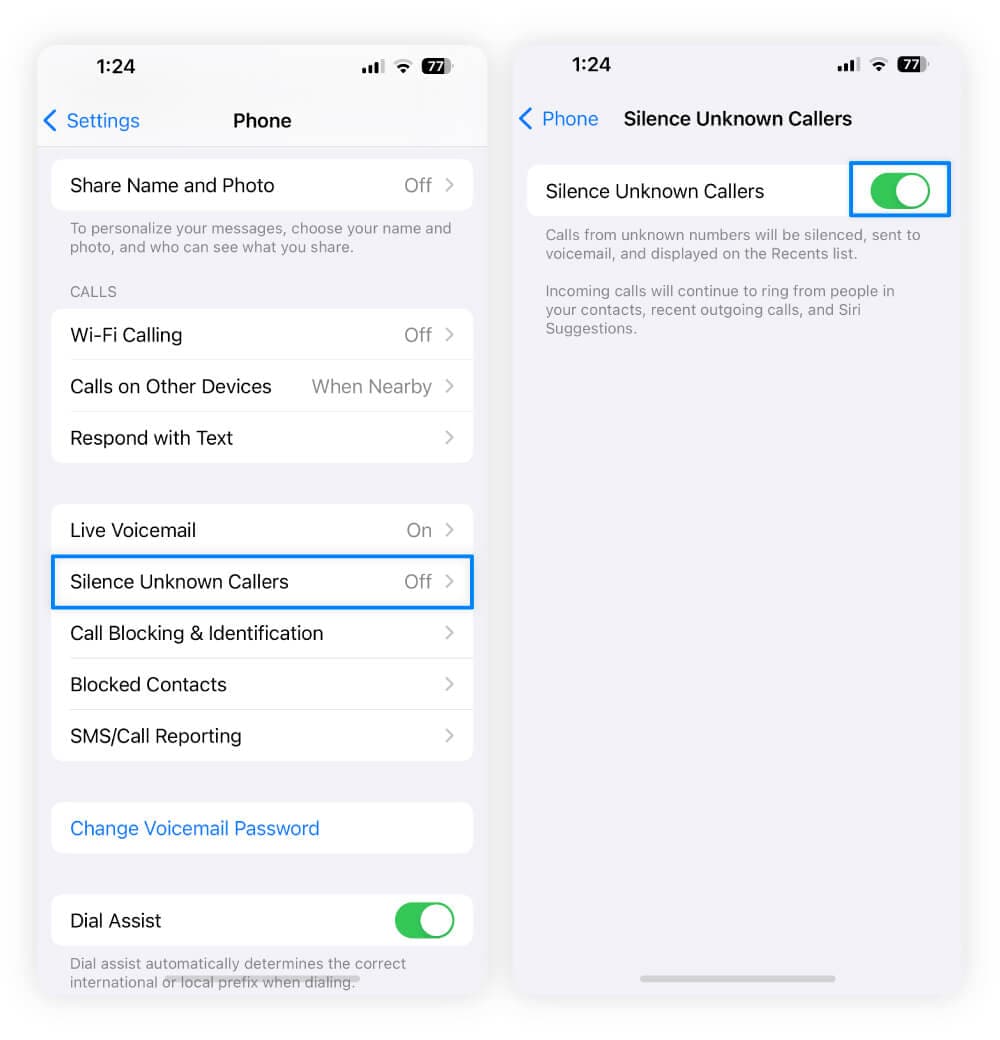

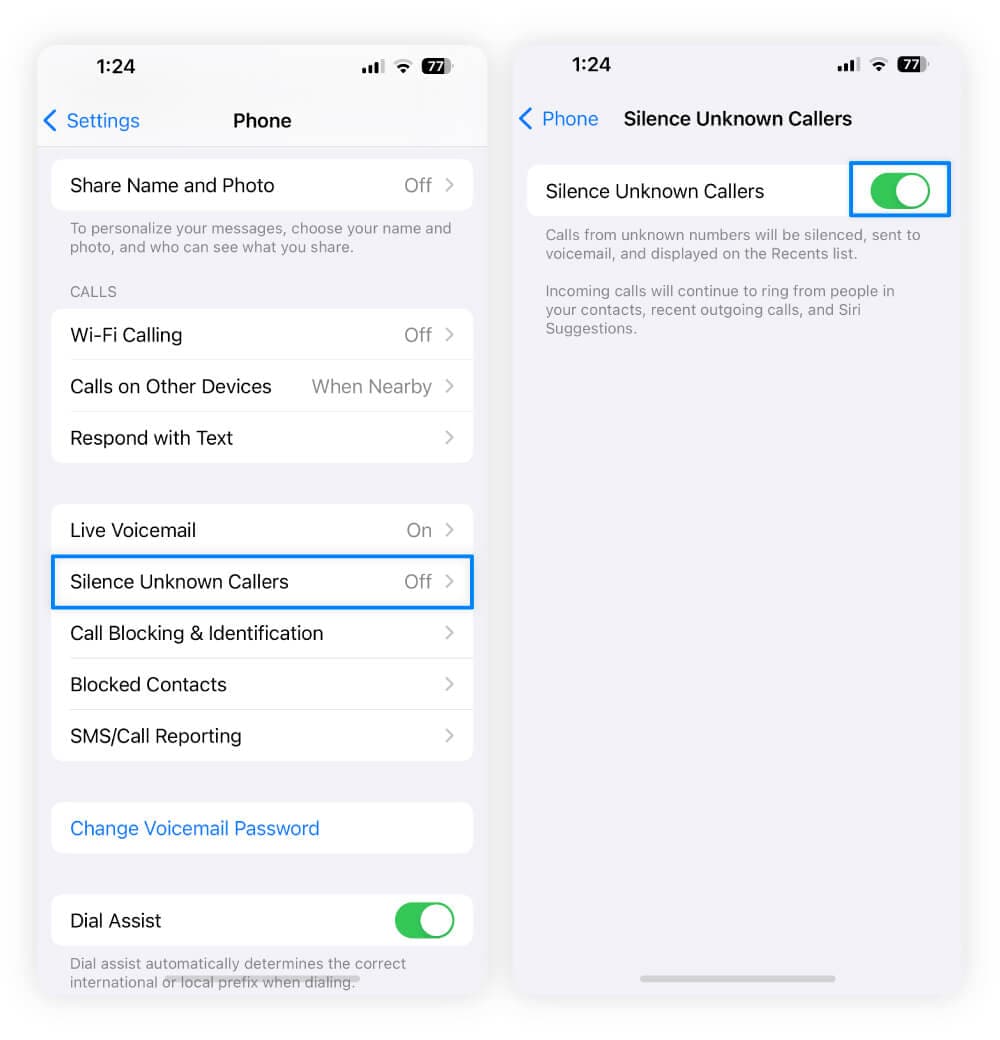

If you have an iPhone, you can silence unknown callers:

- Open Settings, then Phone.

- Scroll down and select Silence Unknown Callers.

- Toggle on Silence Unknown Callers.

Pro tip: Requests for personal or financial information from unsolicited callers are usually scams. Legitimate companies and organizations will never pressure you to provide sensitive details over the phone.

8. Don’t interact with unknown texts

Unsolicited messages could be fake texts and should be ignored, blocked, and deleted. If you accidentally open one, don’t click any links or download any attachments.

Here’s how to block unknown texts on your Android:

- Open Google Messages, tap your profile picture in the upper-right corner, and select Messages settings.

- Scroll down and tap Spam protection.

- Toggle on Enable spam protection.

Here’s how to enable unknown sender filtering on your iPhone:

- Open Settings, tap Apps, and select Messages.

- Scroll down until you see Message Filtering.

- Toggle on Filter Unknown Senders.

Pro tip: Smishing texts often contain strange links, deals that seem too good to be true, and urgent language to pressure you into acting quickly.

What can someone do with your phone number?

Scammers who know your phone number can text or call you, share your number publicly, or sell it on the dark web. If they have access to your SIM alongside other personal information, like your email or passwords, they could transfer your phone number to their device and commit identity theft.

- Call or text you: Scammers can call or text you pretending to be a friend or trusted organization. They use this false identity to fool you into providing sensitive information like your Social Security number.

- Spoof you: Scammers can manipulate caller ID systems to display your phone number. Posing as you, they could deceive your loved ones. For example, they might claim you’re in a fake emergency, such as being stranded in another country, and trick your contacts into sending money.

- Move your number: Hackers could hijack your number in a SIM-swap attack. Once they gain control, they could exploit your number to carry out account takeovers.

- Steal your identity: With your number and other identifying information, scammers can eventually steal your identity. Consequences of identity theft could include credit cards opened and maxed out in your name, leaving you to pick up the pieces.

Can someone hack your account with just your phone number?

A phone number alone isn’t enough to hack your account directly, but it can serve as a gateway for cybercriminals with access to other personal information.

If they have the right data, they could launch a SIM-swap attack and take control of your phone number. If successful, this could allow them to access accounts linked to your number and intercept two-factor authentication (2FA) codes, putting your online security at risk.

Signs that scammers have your phone number

An increase in spam calls, suspicious text messages, or unexpected password reset attempts are some red flags that scammers know your phone number.

- Surges in spam calls or texts: A sudden increase in spam calls or texts suggests scammers are targeting your number, often to steal more information through phishing.

- Phone losing service: If your phone suddenly loses service, it could indicate a SIM swapping attack. Check your phone settings to confirm your number is still listed under the “About” section.

- Unexpected verification codes: Receiving random verification codes could indicate that someone who knows your passwords might be trying to intercept authentication codes. Change your passwords within these accounts to keep them safe.

If you notice any of these signs, contact your mobile carrier to verify any recent account login attempts or suspicious calls.

How can scammers get your phone number?

Scammers can get your phone number through people search sites, social media, data breaches, the dark web, or social engineering.

Here’s how scammers can get your phone number:

- Social media: You might be oversharing on social media by including a phone number on your public profile.

- People search sites: Data broker sites share your personal information for free or for a fee to anyone, including potential scammers.

- Data leaks: Data leaks occur when sensitive information is accidentally exposed, usually through human error.

- Data breaches: Data breaches happen when cybercriminals steal information by breaking into a website or an organization’s information database.

- Social engineering: Scammers use social engineering tactics like phishing to extract phone numbers and other information from victims.

How to protect your phone number from hackers

To help protect yourself from hackers who want to use your phone number maliciously, you should hide it wherever possible, be wary of scams, limit who you share it with, and use an alternative number for business purposes.

Here’s how you can help protect your phone number from hackers:

- Hide it online: Remove your phone number from public-facing websites. Start by removing it from data broker sites — you’ll need to find each site where your number is exposed and complete their opt-out form. Or, LifeLock Advantage will scan common public people-search websites for your personal information and help you opt out, saving you a ton of time and hassle.

- Get identity theft protection: Identity theft protection services, like LifeLock Advantage, can help mitigate the fallout if you fall victim to identity theft. LifeLock Advantage offers up to $100,000 in personal expense reimbursement and stolen funds reimbursement, as well as coverage for lawyers and experts.*

- Know how to spot scams: You can identify a scammer by paying attention to unusual information requests and phishing tactics. Be on the lookout for everything from Facebook scams to fake UPS messages.

- Keep your social media private: If your social media profiles are public, you could be sharing a wealth of information and are more likely to have your social media hijacked or other accounts hacked.

- Limit where you share your number: You can’t avoid what a hacker does with your number after a data breach, so aim to avoid sharing your number with companies with poor security.

- Use an alternative number: Get a separate number for your business and personal activities. That way, if a scammer steals one of these numbers, it limits the damage they can do.

Protect your information from scammers

If they take over your SIM and gain control of your phone number, they could steal your identity and turn your life upside down. LifeLock Advantage can help protect you.

Its Phone Takeover Monitoring keeps an eye on your SIM for suspicious activity, while Privacy Monitor helps limit how much of your personal data is exposed — all from the most reputable brand in identity theft protection.**

FAQs

What should I do if a scammer has my address?

If a scammer has your address alone, they can’t do much. But if you know a scammer has stolen other sensitive information too, then you need to secure your accounts, freeze or lock your credit, and monitor your financial accounts.

Should you change your phone number if a scammer has it?

If a scammer is using your phone number, you should contact your mobile carrier to reclaim it, and then secure your linked accounts. In most cases, changing your phone number isn’t necessary, but some people may take this step if they’re relentlessly targeted by scammers.

Is there any way to hide your phone number?

You can help hide your phone number by making your social media profiles private and requesting information be removed from data broker sites.

Can a scammer access my bank with my phone number?

Yes, if a scammer successfully performs a SIM swap, they could potentially access your bank account. With SIM swap fraud, they can intercept two-factor authentication (2FA) codes sent via text message, allowing them to bypass other security measures and gain access to your account.

*Up to $1 million for coverage for Lawyers and Experts, collectively, if needed, for all plans. Reimbursement and expense compensation goes up to $100,000 for LifeLock Advantage subscribers. Benefits under the Master Policy are issued and covered by third-party insurance companies. See GenDigital.com/Legal for policy info.

**Data based on an online survey of 3000 adults in the US conducted by Walnut Unlimited on behalf of Gen™, October 2024 - January 2025.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- 1. Lock your SIM card

- 2. Contact your cell phone carrier

- 3. Secure your accounts and change 2FA settings

- 4. Freeze your credit

- 5. Warn your contacts

- 6. Report it to the FTC

- 7. Ignore and block unknown callers

- 8. Don’t interact with unknown texts

- What can someone do with your phone number?

- Signs that scammers have your phone number

- How can scammers get your phone number?

- How to protect your phone number from hackers

- Protect your information from scammers

- FAQs

Start your protection,

enroll in minutes.

Copyright © 2025 Gen Digital Inc. All rights reserved. All trademarks, service marks, and tradenames (collectively, the "Marks") are trademarks or registered trademarks of Gen Digital Inc. or its affiliates ("Gen") or other respective owners that have granted Gen the right to use such Marks. For a list of Gen Marks please see GenDigital.com/trademarks.