Know your rights: The Fair Debt Collection Practices Act prohibits threatening or aggressive behavior by debt collectors or calling before 8 a.m. or after 9 p.m. And debt collection agencies must provide written proof of the debt if you request it.

Threatening calls from account services claiming you owe $64,000 in vague fees, an automatic voice named “Heather” offering you lower credit card rates… sound familiar? These are some common tricks scammers use to lure victims into revealing sensitive personal information.

Calls like these may seem like nothing more than annoying spam, but phone scams have a big economic impact, costing Americans more than $25.4 billion in 2023.

Protect your financial information by learning to recognize account services scam calls and find out what you can do right now to lessen your chances of getting defrauded.

What is the account services call scam?

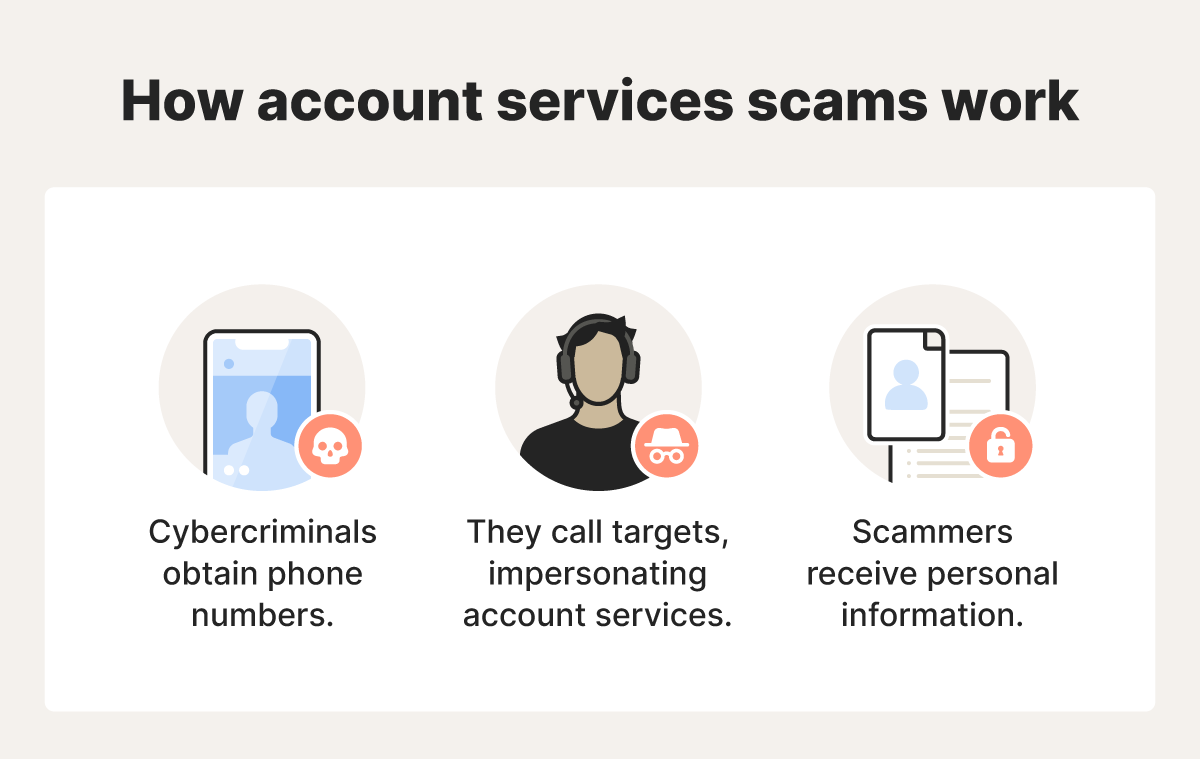

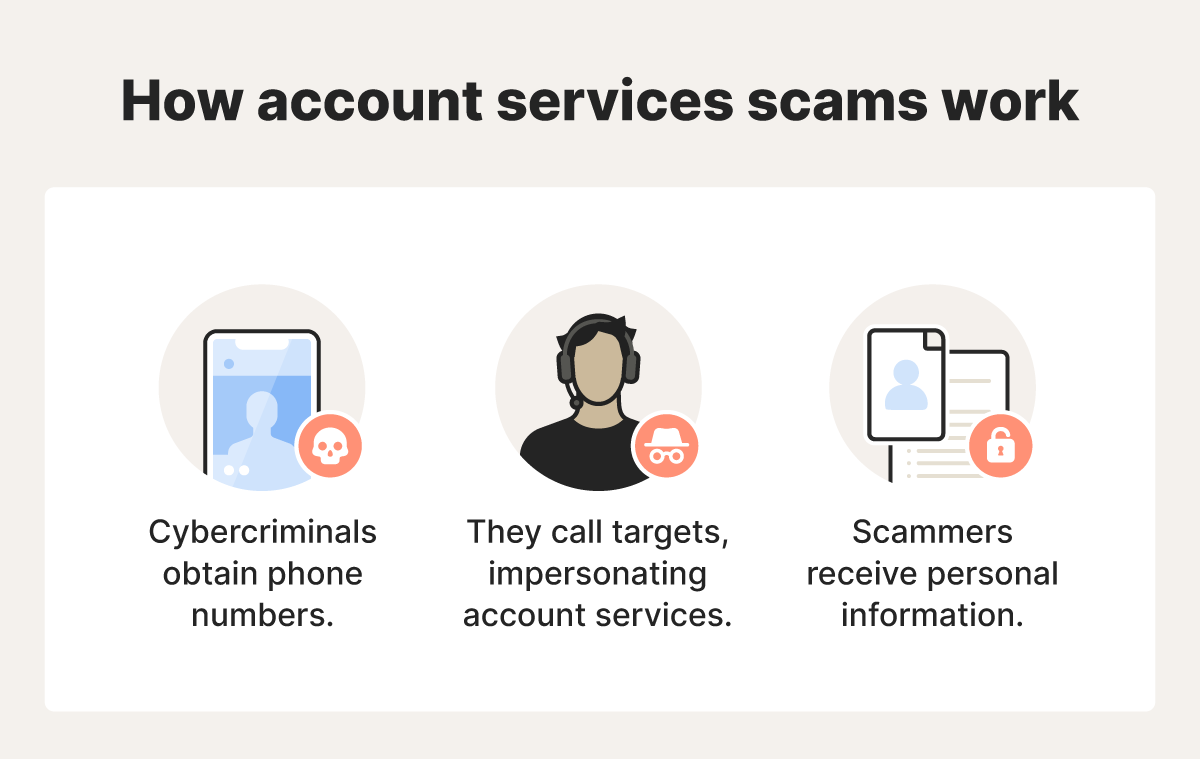

The account services scam call is a fraud scheme in which scammers use spoofed caller IDs pretending to represent the IRS account services team, card services, or consumer services departments of banks, debt collection agencies, or credit card companies to trick people into exposing sensitive information.

The goal of an account services call scam is to get people to provide personal information, which fraudsters can then sell on the dark web or use to commit identity theft.

Some scammers may claim you have debt that you need to pay soon or risk serious consequences, such as legal action, being arrested, or damage to your credit score. They often try to persuade you to act fast, before you have time to verify the call’s legitimacy.

Other account services scam calls may present deals that sound too good to be true, offering to lower your interest rates, reduce your debt, waive fees, or provide exclusive upgrades, all while pressuring you to provide sensitive account information or make an immediate payment to secure the offer.

These calls can feel relentless, with some Reddit users reporting they receive multiple calls a day. Adding to the frustration, account call scams often come from different numbers, making them nearly impossible to block.

Is an account services call ever legitimate?

While calls pretending to be account services are scams, some legitimate organizations may use similar-sounding terms when they contact you.

Let’s look at a few scenarios where you may receive a call from account services. Then, we’ll teach you some tell-tale signs of fraud so you can spot the difference between the real deal and a dangerous scam call.

Calls from debt collections agencies

Debt collection agencies specialize in recovering unpaid debts by contacting individuals or businesses to arrange repayment. Some debt collectors may use a name similar to “account services” in their caller ID.

Businesses that are owed money may sell their debt to debt collection agencies because the businesses don’t want to pursue non-paying customers themselves. For example, your credit card company might sell your overdue accounts, leaving it to a debt collector to contact you and recover the funds.

However, calls from debt collectors are unlikely to be totally out of the blue. Most organizations will make attempts to contact you via email or snail mail before passing the debt on to a collections agency.

If you’re unsure whether you owe a debt, you should check your credit report. Check your report at each of the three major bureaus because they may have different information regarding your accounts. Reports are available at AnnualCreditReport.com.

It’s worth noting that debt collectors are exempt from the National Do Not Call Registry. And shady debt collectors may employ deceptive or abusive practices to get you to pay more than you actually owe. If debt collectors contact you, it’s important to understand what they can and cannot do when attempting to reach you.

Calls from Account Services Collections, Inc.

Account Services Collections, Inc. is a legitimate debt collection agency based in San Antonio, Texas.

You may receive a call from them if you have an outstanding debt. If you’re unsure whether you owe them money, check the collections section of your credit report to see if Account Services Collections, Inc. is listed. You can also contact Account Services Collections directly via their official website.

Tip: Account Services Collections, Inc. never makes calls offering to lower credit card interest rates.

Calls from an organization’s account services department

Some companies have an account services department responsible for managing financial accounts, building relations with clients, or recovering debts owed by customers. These departments may display “account services” or a similar name in their caller ID.

Calls from a company’s account services department are rarely unexpected. To be safe, rather than answering directly, let the caller leave you a message and contact the organization using the phone number provided on their official website.

Calls from scammers impersonating account services

If you don’t owe any debts or aren’t expecting a call from a company’s account services department, a scammer is likely trying to reach you.

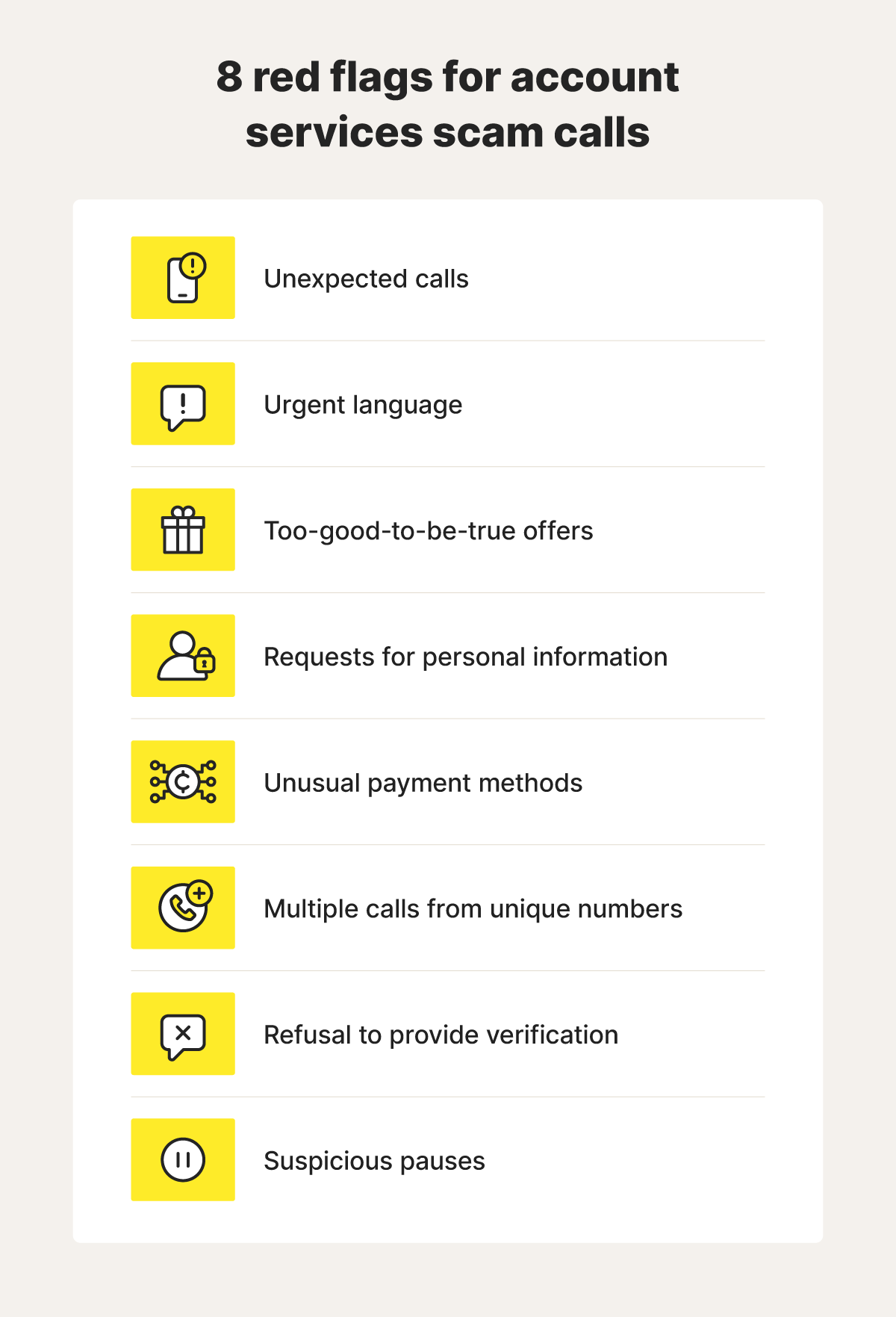

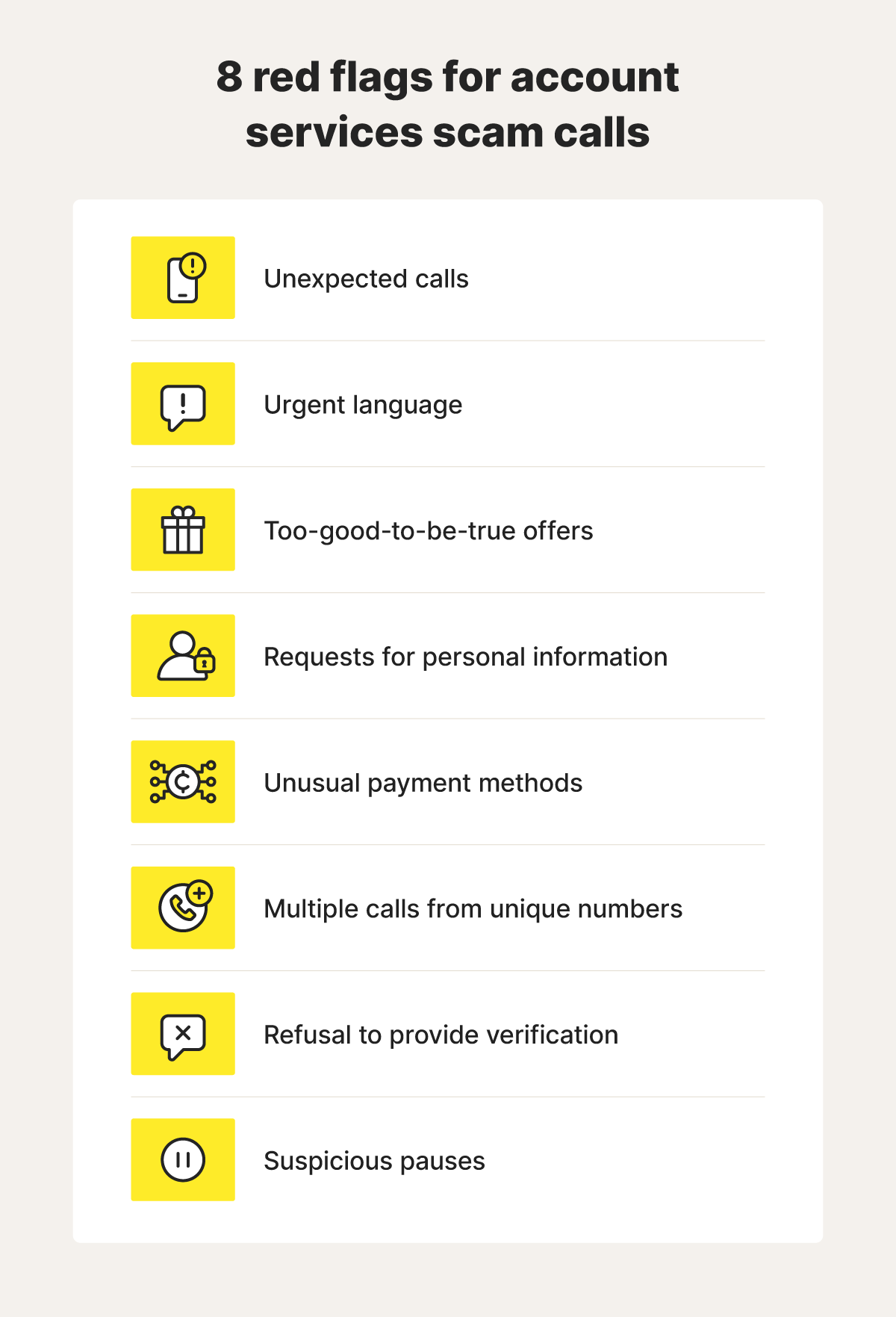

Here are 8 common signs that an account services call is fraudulent:

- Unexpected calls: Be suspicious of any call you weren’t expecting, especially if you have no outstanding debts with the supposed company. Legitimate debt collectors will often try to contact you by email or with physical letters first.

- Urgent or threatening language: Scammers will try to pressure you to act quickly by evoking a sense of urgency. This may include threats of legal action or financial penalties.

- Too-good-to-be-true offers: Fraudsters may lure you with unrealistic promises, such as drastically reduced interest rates, waived debts, or exclusive benefits, to convince you to share personal information or make a payment.

- Requests for personal information: Be cautious if the caller asks to “verify” sensitive details like your Social Security number, bank account information, or credit card numbers. Legitimate companies rarely request this information over the phone, and when they do, it should only occur after you initiate the call through a verified contact number.

- Demands for unusual payment methods: If you are asked to make a payment via an unusual method like wire transfer, Cash App, or gift cards, it’s almost certainly a scam. These payment methods are difficult to trace, and legitimate companies will never ask you to pay this way.

- Multiple calls from different numbers: Scammers often use different phone numbers to bypass call-blocking attempts and increase their chances of getting through.

- Refusal to provide verification: Scam callers cannot or will not provide clear details about their identity, the debt in question, or how they obtained your information. While they may know some basic information like your name, they often get defensive or use an aggressive tone when pressed.

- Suspicious pauses: Unnatural pauses are an indicator of robocalls, a beloved technology of phone scammers of all stripes. These automated systems take a few seconds to connect, making the conversation feel disjointed or robotic.

How to stay safe from account services scam calls

Scam calls aren't just annoying; they're also dangerous. If a scammer gets your personal information, they can use it to commit identity theft or sell it on the dark web to other cybercriminals. Take the following steps to help protect against fraud and reduce the likelihood of falling for a scam call.

Know your financial situation

Regularly monitor your accounts and credit card statements to stay on top of any outstanding debts. When you have a clear understanding of your personal finances, it becomes harder for scammers to deceive you.

Use call-blocking features

Call-blocking apps use data from users, the Federal Trade Commission (FTC), and other sources to identify and block potential scams before they reach you. Depending on the app, you can send these calls directly to voicemail, let them through without ringing your phone, or block them entirely.

Block scam numbers

Scam calls often come from different numbers, so blocking these numbers won't stop scam calls entirely. However, blocking known scam numbers can help reduce the frequency of unwanted calls and make it more difficult for scammers to reach you.

Avoid oversharing

Don't share your phone number on social media, as this could make it easier for scammers to reach you. Avoid providing your phone number to businesses or websites unless necessary. This reduces the likelihood of your number being exposed in a data breach.

Report scam calls

Use the FTC’s report fraud page to report scam calls. This helps authorities track and take action against scammers.

Get identity theft protection

Comprehensive identity theft protection tools help you monitor how others use your information online. Some will scan the dark web and other data points across the internet and let you know if they find your personal details exposed.

LifeLock Total helps you track your bank and credit info and view your linked financial accounts from an easy-to-use dashboard. And if you do get scammed by a fake account services call and your identity is stolen, LifeLock’s dedicated restoration specialists will help you recover your identity.

What to do if you gave a scammer your information

Fell for the account services scam? Use the following strategies to protect your personal information.

- Set up dark web monitoring: Once a scammer gets your personal information, their next move may be to sell it on the dark web. LifeLock comes with Dark Web Monitoring, and we’ll notify you if we find your information.

- Protect your credit: Prevent people from opening new accounts in your name by freezing your credit. Or, place a fraud alert on your credit report, which alerts lenders to take extra steps to verify your identity before extending credit.

- Monitor your financial accounts: Regularly monitor your credit, and check your bank and credit card statements for any suspicious transactions.

- Change your passwords: Update passwords for any accounts that may have been compromised, especially banking and email accounts.

Protect yourself from phone scammers

Even the savviest individuals can accidentally disclose sensitive information to a fraudster. For identity theft protection and peace of mind, get LifeLock Total. We’re here to help protect your identity and recover it if you become the victim of identity fraud.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.