You may be wondering if you’re a victim of identity fraud or credit card fraud. Here’s a quick overview of what each entails:

- Identity fraud: Typically involves the misuse of your personally identifiable information, like your Social Security number, to open accounts or take out loans in your name.

- Credit card fraud: A specific type of identity theft that targets your credit card number to make unauthorized purchases.

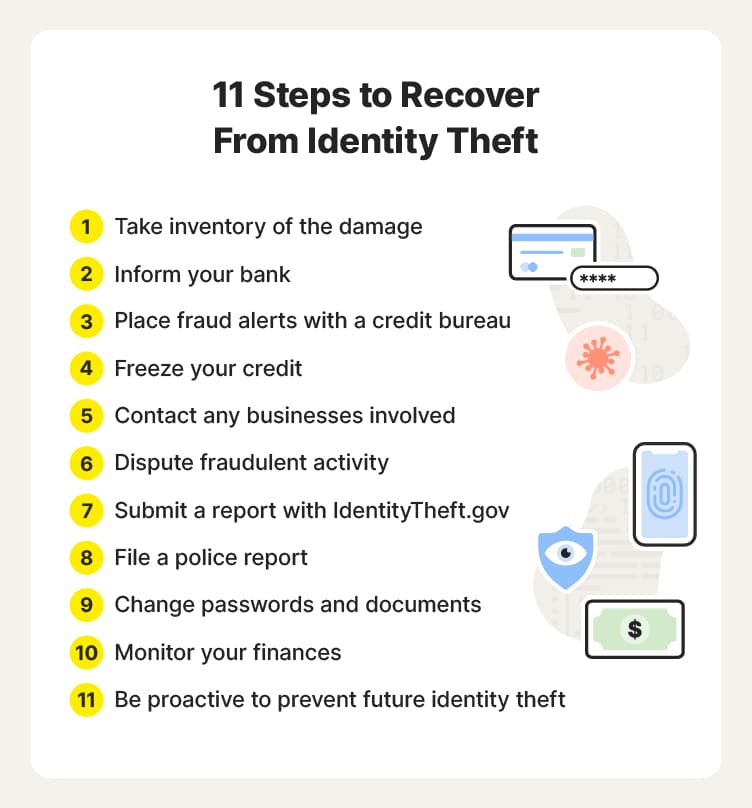

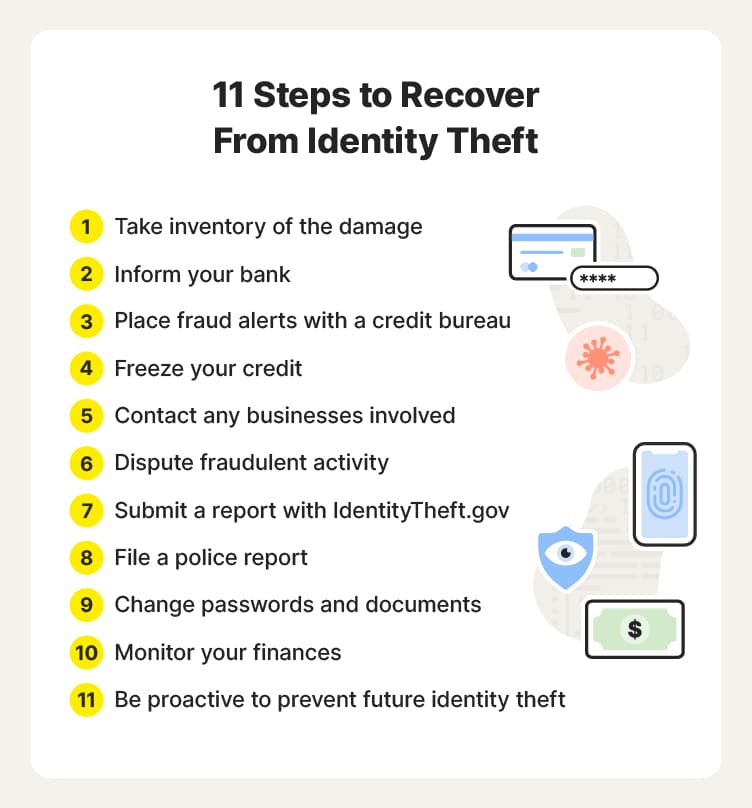

Are you one of the 1.1 million Americans affected by identity theft in 2023? We’ll show you how to recover from identity theft in 11 simple steps.

1. Take inventory of the damage

If you suspect you’re a victim of identity theft, review the following items for suspicious activity to begin the identity theft recovery process:

- Credit card statements: Review your credit card statements for any unfamiliar or unauthorized transactions.

- Bank statements: Ensure that you made all transactions to validate their legitimacy.

- Tax returns: Examine your tax returns for inconsistencies, such as multiple filings under your name.

- Medical bills: Confirm that the billed services reflect your previous appointments.

If there’s been suspicious activity, the next step is to report identity theft to the credit bureaus and your financial institutions.

2. Inform your bank

Whether you’re a victim of Social Security identity theft or credit fraud, it’s important to let your bank know as soon as possible.

The sooner your financial institutions are aware of a suspected identity thief, the sooner they can enable identity theft protection services like fraud alerts and account freezes.

3. Place fraud alerts with a credit bureau

Choose one of the following credit card bureaus to place a fraud alert with by contacting them through their website, phone number, or mailing address:

- Equifax®: 800-685-1111, Equifax P.O. Box 105069 Atlanta, GA 30348-5069

- Experian®: 888-397-3742, Experian P.O. Box 9554 Allen, TX 75013

- TransUnion®: 888-909-8872, TransUnion – Fraud Victim Assistance Department P.O. Box 2000 Chester, PA 19016

According to the Federal Trade Commission, fraud alerts typically last for one year. You can also extend them if necessary.

4. Freeze your credit

In addition to placing fraud alerts, freezing your credit is also one of the most important identity theft recovery steps. A credit freeze protects you from identity theft by making it harder to use your credit or open new accounts under your name.

Visit these websites to establish a credit freeze with one of the three main credit bureaus:

Similar to a fraud alert, you only have to choose one credit bureau for the credit freeze. You should also let any businesses involved know about your stolen identity.

5. Contact any businesses involved

Let any business entities who may be affected by your identity theft or credit card fraud know your identity has been stolen. Not only does this help them avoid accepting fraudulent payments, but they can potentially alert you to additional charges you didn’t make. You can also dispute any charges you didn’t make at this time.

6. Dispute fraudulent activity

Again, acting quickly is the best way to recover from identity theft. This includes disputing charges as soon as you know you didn’t make them. Once your credit accounts are frozen and a fraud alert is active, new charges will be prevented from surfacing on your account. Now’s the time to take action on fraudulent charges and attempt to return stolen funds.

7. Submit a report with IdentityTheft.gov

After you have a firm grasp on the damage done by the identity thief, it’s time to fill out a Federal Trade Commission Identity Theft Report. The report will also provide you with a recovery plan and advise you on ways to rebuild your credit. Alerting the government about your stolen identity can ensure you have a report on file if they detect suspicious activity on your tax return or other federal documents.

8. File a police report

You should also file an identity theft police report. A police report can help extend your fraud protection for up to seven years. This step is especially important for in-person identity theft cases such as a stolen wallet or purse.

Contact your local police office’s non-emergency line to report your identity theft. Have your identification number ready to verify your identity and make sure to get a copy of the report for your records.

9. Change passwords and replace documents

After you contact the official organizations that can help alleviate the damage of identity theft, you can begin to take back control of your accounts. Start by replacing stolen passwords and documents:

- Ensure all passwords are unique: Create new, strong passwords. Don’t reuse passwords across multiple accounts and avoid using your name, date of birth, or other obvious information within your password.

- Replace stolen documents: This can include, but is not limited to, your Social Security card, driver’s license, passport, and credit card.

Regardless of whether your documents were stolen virtually or in person, replacing them is a key step toward preventing repeat attacks.

10. Monitor your finances

Regularly monitoring your financial statements by reviewing your bank statements every month can help you stay abreast of possible fraudulent activity in the future. Although you don’t want to jeopardize your financial security with the overuse of fraud alerts and credit freezes, use your discretion to know when to use the resources at your disposal.

11. Be proactive to prevent future identity theft

Here are a few potential ways you can proactively prevent cases of identity theft from happening in the future.

Let’s dive into the details of how to mitigate identity theft as best as possible:

- Don't click suspicious links: Attachments or links in emails or text messages could be infected with malicious software.

- Limit the info you share: Be mindful of the personal information you share online or over the phone.

- Password protect your devices: Whenever possible, add passwords and 2FA identity protection to your devices.

- Properly discard your documents: Shred legal or other official documents instead of recycling them whole.

- Update your software: Outdated software is more vulnerable to malware and hackers.

Stay updated on the latest identity theft protection tips to avoid repeat cases of a stolen identity as much as possible.

Help keep your identity safe

Now that you know how to recover from identity theft successfully, consider brushing up on new ways of keeping your identity safe online.

If peace of mind is your priority, LifeLock can help detect and notify you about suspicious activity regarding your personal information on the dark web, help you opt out of public-facing sites run by data brokers, and provide you with expert help from identity restoration experts. Sign up today.

FAQs about how to recover from identity theft

Still have questions about how to recover from identity theft? We’ve got answers.

What happens if identity theft happens to you?

If you become a victim of identity theft, you may see charges on your accounts that you didn’t make or unfamiliar accounts open under your name. The consequences of identity theft can include fraudulent spending, being locked out of your accounts, and being unable to access your funds.

What should you do if you are a victim of identity theft?

If you’re impacted by identity theft, you should alert your bank, credit bureau, local law enforcement, and any affected businesses as soon as possible. This can help prevent further fraudulent activity from occurring.

Why is it important to act so fast?

The faster you act, the less time the identity thieves have to damage your credit score or spend your money. Acting quickly may also reduce the number of tasks to complete during the identity recovery process.

Is identity theft reversible?

In general, you can rectify much of the damage caused by identity theft. The key is to communicate quickly and transparently with your bank, credit bureau, and relevant businesses.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- 1. Take inventory of the damage

- 2. Inform your bank

- 3. Place fraud alerts with a credit bureau

- 4. Freeze your credit

- 5. Contact any businesses involved

- 6. Dispute fraudulent activity

- 7. Submit a report with IdentityTheft.gov

- 8. File a police report

- 9. Change passwords and replace documents

- 10. Monitor your finances

- 11. Be proactive to prevent future identity theft

- Help keep your identity safe

- FAQs about how to recover from identity theft

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.