Identity Theft

What is identity theft?

Identity theft is when thieves steal your personal information in order to take over or open new accounts, file fake tax returns, rent or buy properties, or do other criminal things in your name.

Identity theft is when thieves steal your personal information in order to take over or open new accounts, file fake tax returns, rent or buy properties, or do other criminal things in your name.

Children

Millennials

Recently separated

Newlywed

New parents

New homeowner

Kids’ clean credit histories make it easy for criminals to make new charges, open accounts and more.

Parents are proud of their kid’s accomplishments. But, sharing too many details about your children can cause more harm than good.

Unknown friend requests could open the door to criminals looking for personal information.

Sharing on social media is one thing. But sharing personal information like your birthday, address and phone number can lead to having your identity stolen.

Letting new people into your life can lead to unintentionally over-sharing personal details. Be careful what you put out there on both social and dating websites.

If the "ex" was the tech-savvy one in the home, online activity can get less safe when you're on your own.

Planning for the bright financial future can mean making changes to existing financial accounts or opening new ones. All of which can expose personal information.

Sharing where you're going to be and when and posting photos can expose details that make you vulnerable.

Sharing and storing photos online can make identity thieves aware of new additions to family.

New babies can mean less sleep. When parents let their guard down, they may not update security software and passwords.

New babies require forms that need to be filled out with personal information and routed through the system.

There is so much to do when you move, that giving out personal information can start to be routine.

Shopping online for new things for the home can expose personal details.

Buying or selling a home can bring unattended outsiders in.

How identity theft can happen

How your info can be used

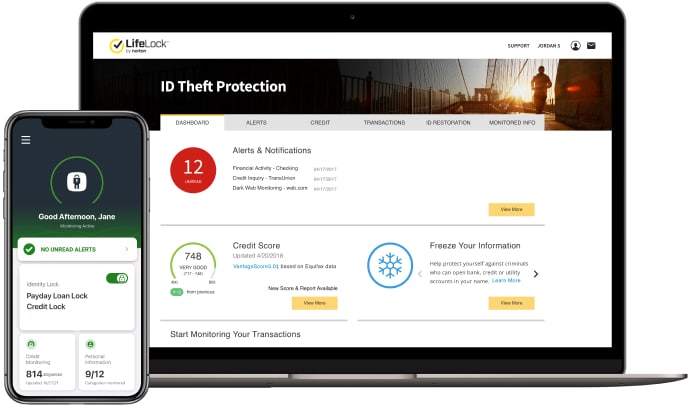

Detect & Alert

We can detect a wide range of threats and will alert you if we find potentially suspicious activities.†

Restore

A dedicated U.S-based Identity Restoration Specialist will work to resolve your identity theft problem.

Stolen funds reimbursement

We’ll reimburse up to $25,000 to $1 million to replace stolen funds depending on your level of your plan.‡

Alert screen modified for demonstration purposes.

Call Us 1‑800‑416‑0599

Identity theft is a crime in which someone accesses information to commit fraud, typically by getting false credentials, opening new accounts in someone else's name or using someone else's existing accounts.

You can take steps to help avoid having your identity stolen. First, you'll need to know how identity theft occurs and how to spot it.

There are a lot of ways identity theft can happen to you. Hackers may get your information from a data security breach. Or, you may unknowingly provide it on social media, during conversions others can hear or by leaving financial documents in unsafe places. That information may include:

With this information, criminals could impersonate you, max out your credit cards, rent an apartment, steal your frequent-flyer miles or act out a number of other bad-guy fantasies. Thieves can even access the Social Security number of a deceased person, commit fraud, and create problems for the estate.

You've probably heard about—or have experienced — thieves stealing credit card numbers or money from a bank account. To help catch this kind of identity theft, set up account alerts, scan your credit card and bank statements, and look for charges you don't recognize.

But there are other types of identity theft to look for.

And that doesn’t cover everything. You can read more about these and other types of identity theft, including employment identity theft and senior identity theft.

Criminals are itching to get their hands on your data everywhere, online and offline. That’s one of the basic facts about identity theft. So, it’s smart to understand how thieves steal your information and how to counter it.

What to look for? A fishy email may have bad spelling or grammar, an unofficial-looking email address, an urgent request for information, and an attachment or link.

If you get a suspicious email, contact the entity yourself and verify it's really an email from the person or company you trust.

Certain clues could indicate that you’re a victim of identity theft. It’s a good idea to watch for those indicators so you can act quickly and take action to help minimize the damage. The FTC cites some of the common warning signs:

That’s just a sample. Check out these tips on how to help prevent identity theft.

Identity theft happens. Reacting quickly may be the most important thing you can do. Here are steps you can take if you've been a victim of identity theft.

If you believe you’ve been a victim of identity theft, it’s important to report the crime to the Federal Trade Commission. Here’s where to start:

The website will guide you through the process. You will receive an identity theft report and a recovery plan. Creating an account on the website offers these benefits:

If you report identity theft to the FTC by phone, the agency will collect details related to the theft. It won't provide you with an ID theft report or recovery plan.

In some cases, you may also choose to report your identity theft to your local police station. According to the FTC, it could be necessary in these circumstances:

No one can prevent all identity theft. But there are things you can do to help protect yourself from it. You can read about ways to help protect yourself from identity theft in more detail, but USA.gov notes some basic precautions:

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.