Pro tip: Applying for new cards or requesting increases can lead to a hard inquiry on your credit report. This can lower your credit score for up to two years.

A strong credit score can open doors — from better interest rates to smoother mortgage approvals. That’s why it’s crucial to understand how even small financial moves, like closing a credit card, can have a big impact.

Keep reading to discover the right time to cancel a card, what it could mean for your credit score, how to do it the smart way, and what other options you might want to consider instead.

When will closing a credit card hurt your credit score?

Closing a credit card can negatively impact your credit score by increasing your credit utilization ratio, lowering your average account age, and reducing your credit mix — all key factors credit bureaus consider when assessing your creditworthiness.

When it increases your credit utilization

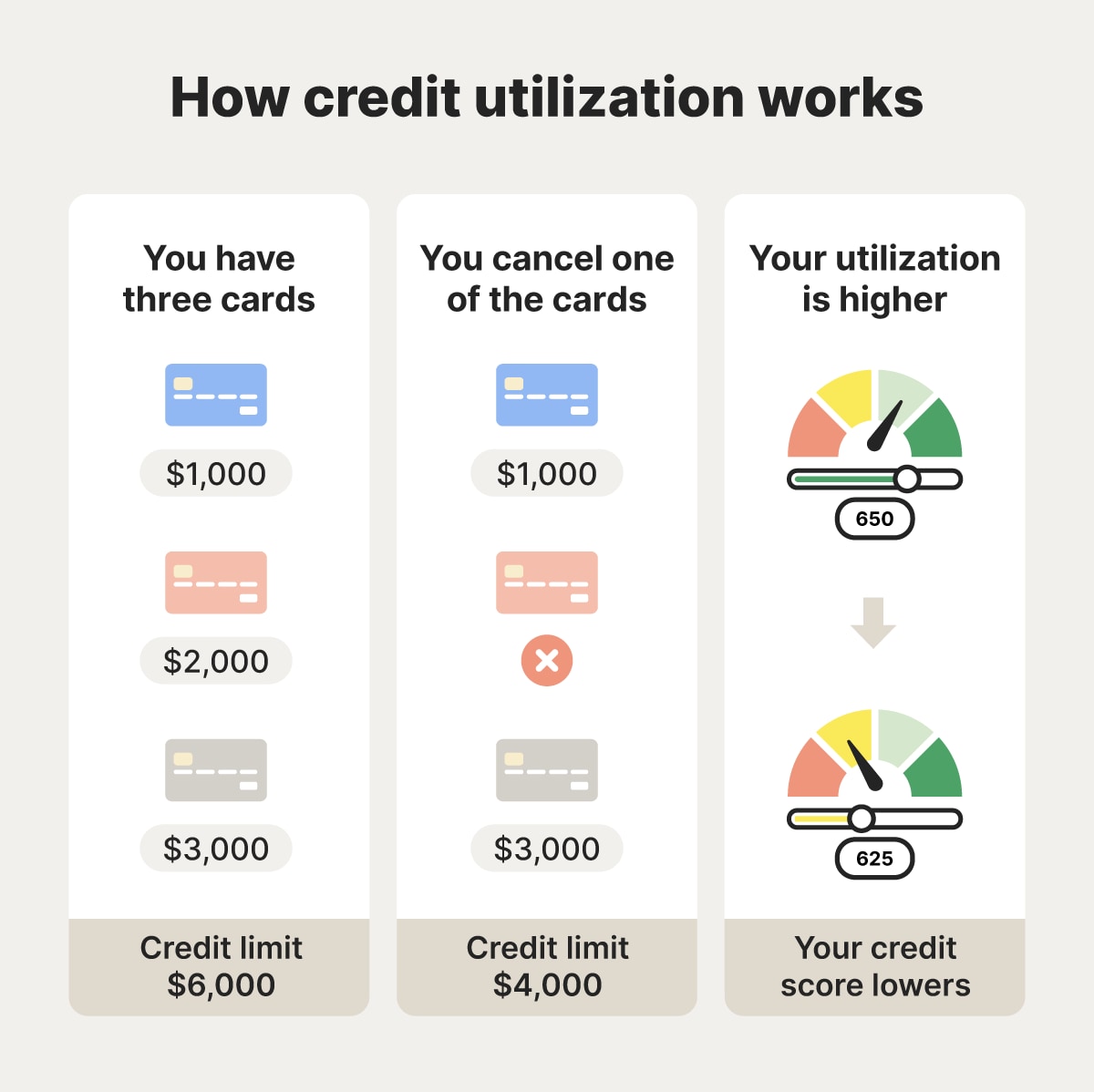

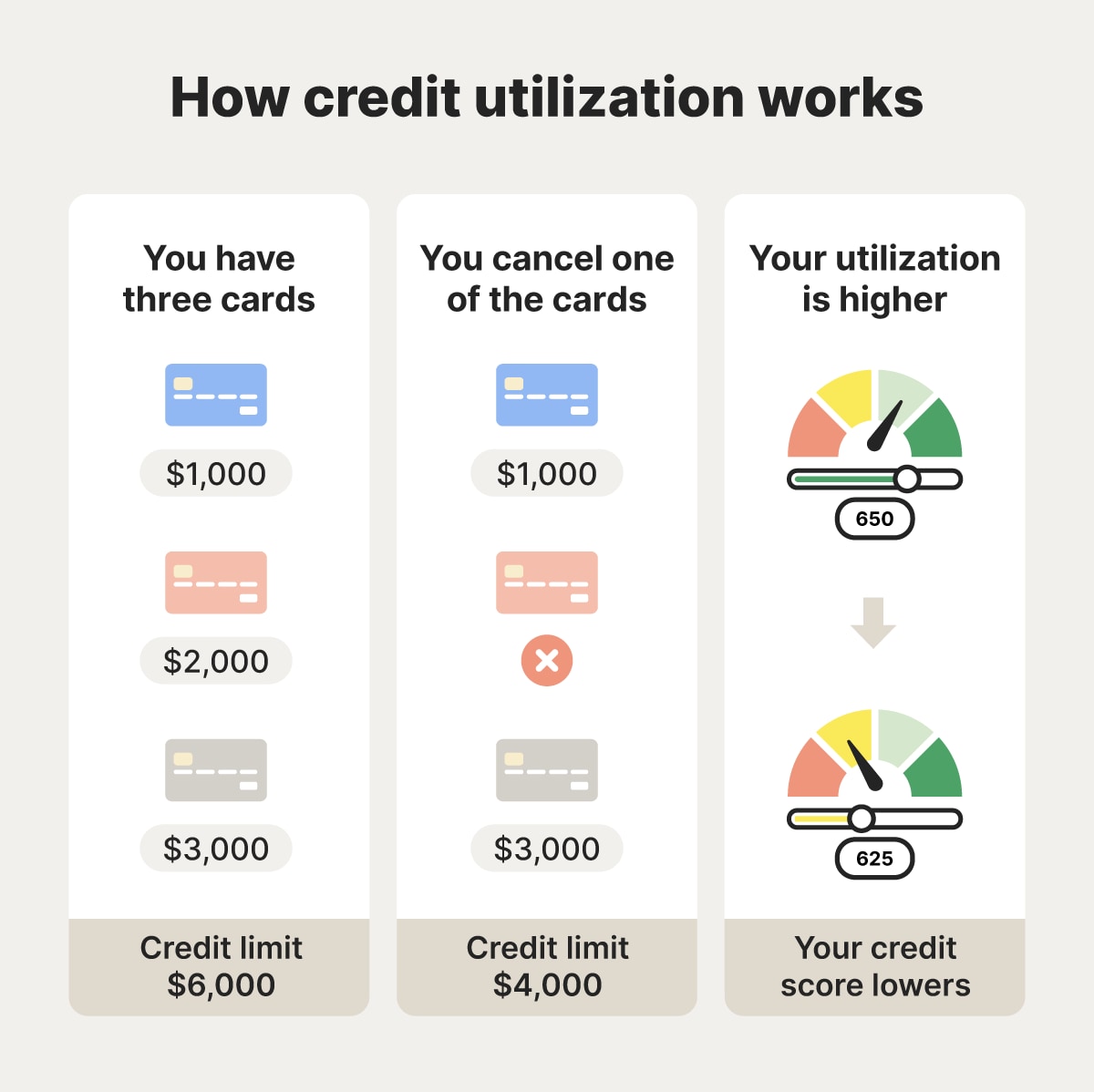

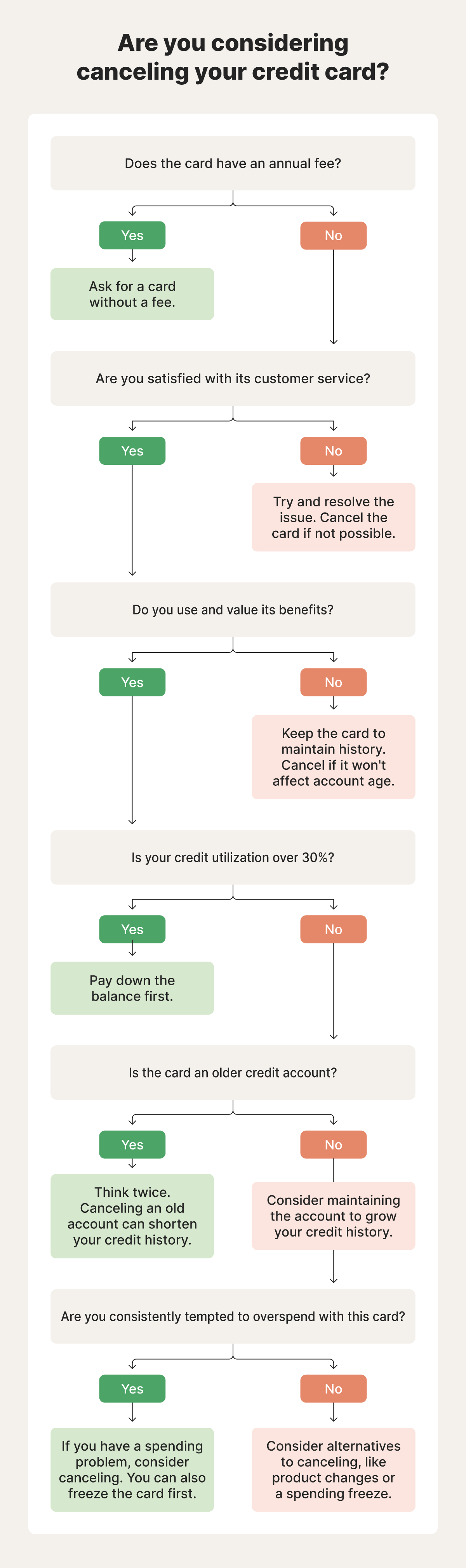

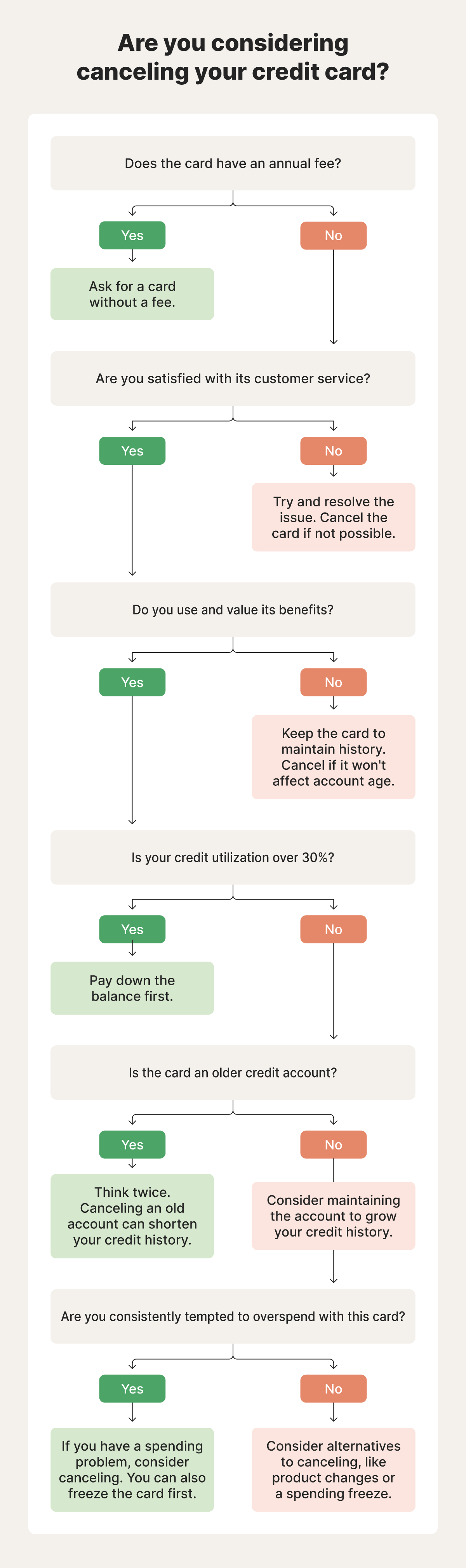

Closing a credit card reduces your total available credit, which can raise your credit utilization ratio. This ratio, which shows the amount of credit you’re using compared to your total available credit, can impact your credit score by 20% to 30%, shaping how lenders evaluate your creditworthiness.

But since credit utilization is calculated based on your total available credit, not individual cards, the overall impact on your score is likely to be minor if you already have other high-limit cards.

To lessen the impact of closed cards on your score, you could request a credit limit increase on your remaining cards. However, there’s no guarantee your request will be approved. Another option is to apply for a new credit card with a similar credit limit to help maintain your credit utilization.

When it lowers your average account age

Closing older credit cards can reduce your average account age, which may negatively affect your credit scores. Both Vantage and FICO consider how long your credit accounts have been open: account age contributes 10% to your VantageScore® and 15% to your FICO score. In general, keeping accounts open and in good standing helps maintain or improve your score.

However, even if you close an account, its positive payment history can still help your credit score. Closed accounts in good standing typically remain on your credit report for up to 10 years, and on-time payments play a major role in your score — payment history makes up 35% to 40% of your total credit score. This means that even if you close an account, the record of your responsible payments can continue to benefit your credit.

Pro tip: Creditors might close long-standing cards if you don’t use them occasionally. Review your credit card’s terms of service to see how often you need to use the card to maintain your history.

When the card still has a balance

If you close a credit card with a balance, you get hit with a double whammy: the debt owed on the card still accrues interest, but you lose all of the credit utilization and account age benefits of leaving the card open.

If you don't make payments, or if you frequently exceed your credit limit, your creditor may close the card with an outstanding balance, eventually resulting in a charge-off. After six months of missed payments, the creditor might sell the debt to a collection agency, which can harm your credit history and stay on your credit report for up to seven years.

Pro tip: Instead of closing a credit card with a balance to prevent further spending, try hiding the card out of sight to help avoid the temptation to use it.

When it reduces your credit mix

A diverse mix of credit types, such as credit cards, personal or auto loans, and a mortgage, shows lenders you can manage different types of debt responsibly. This is why your credit mix contributes about 10% to your credit score. Closing a credit card can limit this diversity, potentially lowering your score, especially if it’s your only card.

If you have multiple credit cards, closing one might not significantly affect your credit mix. However, it could still lower your average account age and credit utilization, so carefully consider the implications before closing any of your cards.

Pro tip: Payday and "buy now, pay later" loans do not impact your credit mix. But they do negatively affect your credit score if you fail to make payments and the debt is sent to collections.

When should you consider closing your credit card?

Closing a credit card may be the right move if you're facing high fees, getting poor customer service, or navigating a separation or divorce. Although closing an account can lower your credit score, these circumstances often make cancellation the best option.

You’re paying high fees

Some cards charge annual fees to keep the account open, so closing them could be a savvy financial decision, especially if you open a new card to help offset the impact on your credit utilization and credit mix. Opting for cards without these fees can save you money, allowing you to apply your credit card payments directly to your balance.

Pro tip: Before canceling a credit card to avoid an annual fee, consider whether the card’s rewards and benefits are worth the cost. In some cases, the perks you earn may more than make up for the fee — but it’s also worth checking if there are no-fee cards that offer similar advantages.

You’re tempted to overspend

Overspending on a card can lead to carrying a balance or exceeding your credit limit, resulting in interest charges or fees. If you find it difficult to resist the temptation to spend, canceling the card might be a smart move.

If this sounds familiar, you’re not alone — around 46% of Americans earning between $50,000 and $99,999 carry credit card balances. If you're one of them, consider paying off high-interest cards first to lower monthly payments and fix your credit.

Pro tip: Look at your budget to decide how much you can afford to spend with a credit card, and set a rule to never exceed that limit.

You’re unhappy with the service

Closing your card might be wise if you encounter repeated customer service problems, like long wait times or unresponsive support after a data breach. While a single service issue is often forgivable, multiple ongoing concerns can indicate deeper problems.

For instance, some cardholders get frustrated with a confusing or unhelpful credit card dispute process. If you're dealing with unauthorized charges or errors in transaction details, like the wrong date or amount, you should expect clear support from your creditor. If that’s lacking, it might be worth closing the card and looking elsewhere.

Pro tip: If you’ve faced repeated customer service issues, let your creditor know you’re thinking about closing your account. This may prompt them to take your concerns more seriously.

You’re going through a separation or divorce

Closing shared credit card accounts during a separation or divorce could protect you from being held responsible for your former spouse’s charges. Even in amicable situations, it’s safer to close joint accounts than risk unexpected debt.

Divorce proceedings may also involve legal name changes, so it’s important to update your name on financial accounts, including credit cards, and replace your Social Security card to reflect the change.

Pro tip: Seek legal advice when canceling shared accounts like credit cards and insurance policies. Be sure to follow all state and federal guidelines when going through a separation.

There’s a potential security risk

Canceling your card can help eliminate the risk of unauthorized use. In 2023, more than 64,000 cases of credit card fraud were reported to the United States Sentencing Commission. The risk is even higher if your accounts have weak passwords or if you have trouble keeping track of your cards.

While canceling a card prevents further use, it doesn't protect against the threat of data leaks, as credit card companies often retain customer information for years. To address this, ask your creditor if they can remove your information from their records after the account is closed.

Pro tip: If you’re having trouble keeping track of multiple credit cards, consider canceling one and increasing your credit limit on other cards to maintain your credit mix and utilization.

Pros and cons of closing a credit card

Before closing a credit card, weigh the potential benefits, such as eliminating high fees, against the possible drawbacks, like a reduced credit score. Carefully evaluating both sides can help you make the best decision for your financial health.

Here’s a list of potential pros and cons to consider:

|

|

|

|---|---|

Ends high fees. |

Lowers your credit score. |

Reduces the temptation to overspend. |

Reduces your credit utilization. |

Terminates poor customer service. |

Reduces your average age of credit. |

Reduces exposure to fraud, data breaches, and identity theft. |

New cards may have worse terms. |

How to cancel your card while minimizing credit impact

You can avoid some of the negative impact that canceling your card has on your credit score by first paying off the balance in full, canceling automatic payments, and taking other steps to safeguard your credit.

Follow these steps to cancel your credit card while minimizing the impact on your credit score:

- Pay off your card: Ensure your balance is down to zero and wait a few days for the payment to clear before requesting cancellation.

- Cancel automatic payments: Cancel all automatic payments linked to the card to avoid additional charges.

- Redeem unused rewards: Use any remaining rewards before canceling to avoid losing them. This gives you the most benefit from the card before giving it up forever.

- Call your creditor: Inform them of your intent to cancel. Be open to hearing any solutions they may offer, as they could resolve your problems and maintain your credit age.

- Check your report: After 45 days, review your free credit report at AnnualCreditReport.com to confirm the card is listed as closed.

- Dispute any incorrect information: If the card still appears open, dispute this error and provide documentation of your cancellation request.

Some lenders require a certified letter for cancellation. In this case, send a tracked letter, like through USPS First-Class Mail, and follow up a few days after delivery to confirm receipt and cancellation.

What to do instead of canceling your credit card

As an alternative to canceling your credit card, consider asking your creditor about other card options that better suit your needs. If your current card has an annual fee, they may even grant a waiver request. Wherever possible, try to resolve the issues you’re facing while maintaining your account and preserving your credit score.

Before closing your credit card, consider these alternatives to maintain your credit age:

- Ask for a different card: Ask your creditor about other cards they offer that align better with your current needs. For instance, if you don’t travel often, you might be able to switch from a travel rewards card to one that offers cash back on groceries.

- Ask for a fee waiver: Tell your creditor you’re considering switching to a card with no annual fee and ask them to match the offer. They may waive your current fee to retain your business.

- Use the card for gas: Use the card only for a specific, controlled expense, such as gas. This helps manage spending while keeping the account active.

- Hide the card: If you’re prone to overspending, protect your credit card by physically hiding it in a safe, inconvenient place, like a shoebox on a high shelf, to reduce the temptation to reach for it.

Common myths about closing credit cards

Some people believe that canceling unused credit cards will boost their credit scores, while others think having multiple cards or checking their credit frequently is harmful. In reality, these are common myths surrounding credit cards.

Here’s a closer look at some of the most prevalent credit card misconceptions:

Myth |

Reality |

|---|---|

Canceling unused cards improves your score. |

Canceling unused cards often lowers your score. |

Having multiple credit cards reduces your score. |

Having multiple credit cards can reduce credit utilization and increase your score if you manage them responsibly. |

Checking your credit score too often will reduce it. |

Checking your credit score does not affect it. |

Carrying a balance on your credit cards helps build credit. |

You don’t need to carry a balance to build credit — paying off your balance each month helps your score and avoids interest charges. |

A high credit card limit hurts your credit. |

A higher credit limit can help your score by lowering your credit utilization ratio, provided you keep your spending under control. |

Help monitor and protect your credit

It might feel stressful knowing that simply closing a credit card can affect your credit score, but staying on top of your credit health doesn’t have to be overwhelming.

LifeLock Ultimate Plus gives you the tools and confidence to safeguard and manage your financial future. In addition to a comprehensive identity theft protection suite, you’ll enjoy access to in-depth monitoring features, including daily credit score updates, helping you stay one step ahead of identity fraud and other threats to your credit.

FAQ

What happens when you close a credit card?

When you close a credit card, you’ll no longer be able to use it, and you may lose any rewards you’ve earned. If the card still has a balance, you’re still responsible for paying it off, usually at the same interest rate.

What happens if you don’t use your credit card?

If you don’t use your credit card for an extended period, your creditor may close the account. This can negatively affect your credit score by lowering your average account age and available credit. To avoid these consequences, make small purchases periodically and pay them off in full each month.

Can you reopen a closed credit card?

It’s sometimes possible to reopen a closed credit card, but it depends on the issuer’s policy and how long ago the account was closed. Accounts closed due to inactivity or at your request are more likely to be reopened than those closed for delinquency or other serious issues.

Does closing a charge card affect your credit score?

Yes, closing a charge card can affect your credit score. While most charge cards don’t impact your credit utilization ratio like credit cards do, closing one may still reduce your overall credit history length or mix of credit, both of which are factors in your credit score.

Does paying off a loan early hurt your credit score?

Paying off a loan early can hurt your credit score if it shortens your average credit age or disrupts your credit mix. Older loans contribute positively to your credit history, and if you don’t have other types of loans, closing one can reduce the variety in your credit profile.

Does refinancing hurt your credit score?

Refinancing can impact your credit score by triggering a hard inquiry and potentially lowering your average credit age. Hard inquiries can remain on your credit report for two years, and rebuilding your average credit age can take much longer.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- When will closing a credit card hurt your credit score?

- When should you consider closing your credit card?

- Pros and cons of closing a credit card

- How to cancel your card while minimizing credit impact

- What to do instead of canceling your credit card

- Common myths about closing credit cards

- Help monitor and protect your credit

- FAQ

Start your protection,

enroll in minutes.

Copyright © 2025 Gen Digital Inc. All rights reserved. All trademarks, service marks, and tradenames (collectively, the "Marks") are trademarks or registered trademarks of Gen Digital Inc. or its affiliates ("Gen") or other respective owners that have granted Gen the right to use such Marks. For a list of Gen Marks please see GenDigital.com/trademarks.