ATM skimmers, also known as credit card skimmers, are illegal devices that criminals attach to ATMs to fraudulently collect bank card data. They’re typically in the shape of an overlay installed on top of the existing ATM card reader, which collects data from your card when you insert it. But, they can also take the form of hidden cameras or false PIN pads.

These skimmers are built to look like the ATMs they’re connected to, making them hard to identify. However, knowing what to look out for can help you spot ATM skimmers in the wild, giving you a better chance of protecting your finances.

What does an ATM skimmer look like?

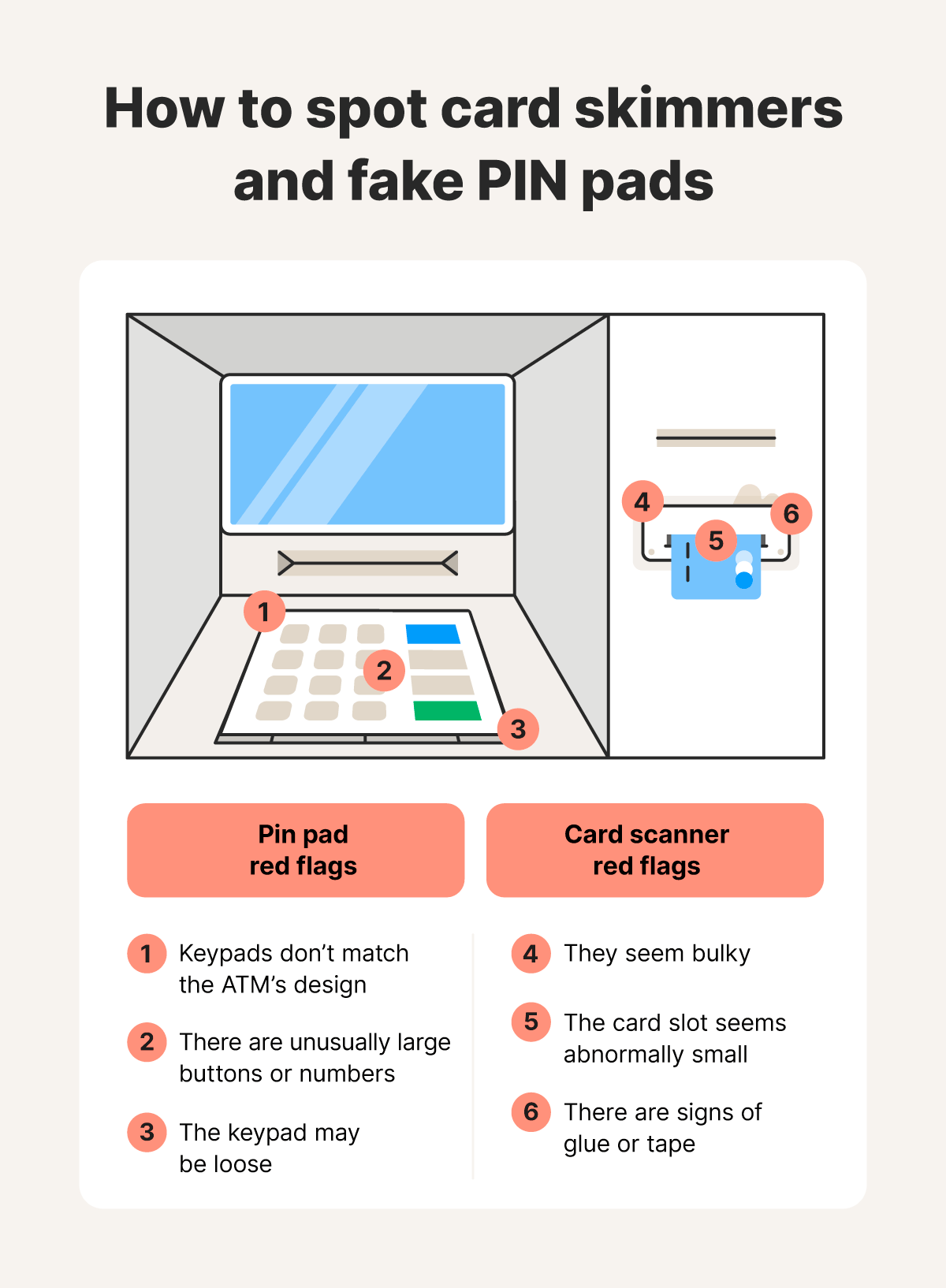

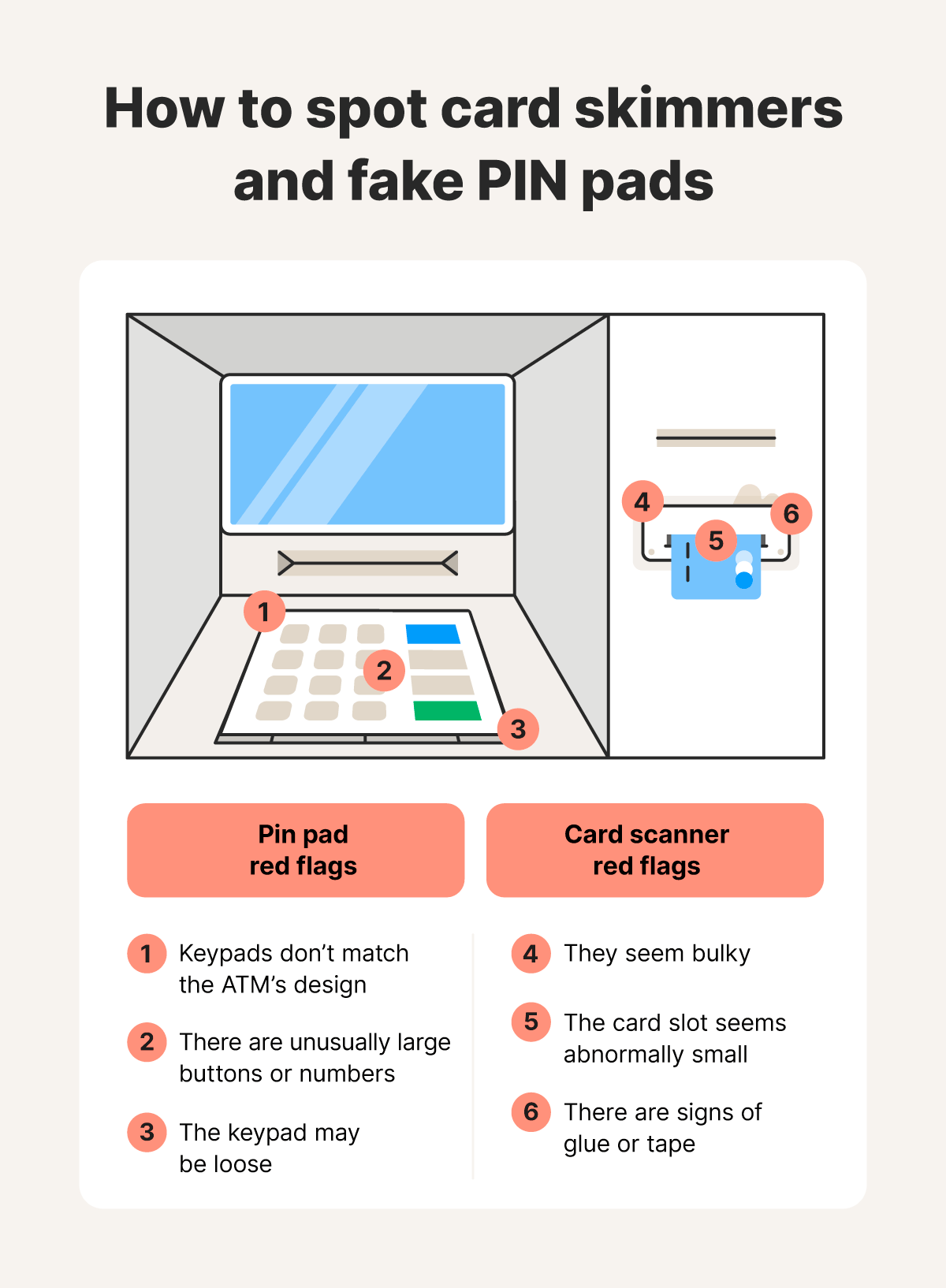

ATM skimmers are designed to blend in and look like they’re a regular part of the ATM they’re installed on, so they’ll often look like a card scanner or PIN pad. However, closer inspection may reveal glue, tape, and bulky or loose parts. You’ll typically find these signs of tampering on the card reader, PIN pad, or near the top of the machine.

Here’s what different types of ATM skimmers look like:

- Card scanners: Fake card scanner attachments can add bulk to the scanner element of an ATM or make the slot you insert your card into noticeably smaller. If your card gets stuck when you try to pull it out, that’s a sign that a criminal may have added something to the machine.

- Hidden cameras: Extra plastic that seems unnecessary could be hiding a pinhole camera. Look for these attachments above the PIN pad or on the side of the ATM, paying attention to subtle differences to the material the ATM is made from.

- Fake PIN faceplates: PIN faceplates can look out of place, with abnormally large numbers or surfaces raised off the ATM. Look for scratches, tape, or glue around PIN pads as an indicator that a fake overlay might have been installed.

Look closely at ATMs that you use regularly. If something feels even slightly wrong, like a loose part or signs of glue, don’t use it. Instead, report it to the owner of the ATM to alert them of potential skimming. Ignoring your suspicion could leave you vulnerable to carding, where cybercriminals steal your card information and drain your funds.

How to spot ATM skimming devices

You may be able to spot ATM skimming devices by looking for unusually bulky or loose parts, tape, glue, or misaligned graphics. These are often on the card scanner itself, but you can also find them on PIN pads or the ATM’s surface.

Here’s a step-by-step guide to help you spot ATM skimmers when you’re withdrawing money, checking your balance, or paying for gas:

- Start with a visual overview: Step back and inspect the ATM as a whole. Note any obvious bulkiness, mismatched colors, or unusual attachments. A criminal may have installed the skimmer hastily, leaving uneven or sloppy results.

- Closely examine the card reader: Check if the card reader appears bulky, feels loose after wiggling, or has an abnormally small card slot. Cards may be difficult to insert into ATMs with skimmers.

- Inspect the PIN pad: Check the PIN pad to see if it looks raised or if there are signs of damage or scratches, misalignments, or suspicious texture differences compared to the rest of the ATM. Fake PIN pads may also be fastened by glue or tape, and will likely come off if you try to pry them away from the ATM.

- Look for hidden cameras: Check the area around the PIN pad for small holes that may hide a camera or extra plastic indicating attachments. Hidden cameras can generally be found above the keypad or on the side of the ATM.

- Feel the ATM’s surface: Run your fingers along the ATM’s surface to feel for any sudden changes in texture. If the ATM is mostly smooth and suddenly feels rough, it could be a sign that a skimmer has been attached.

Be extra cautious when using ATMs in isolated areas. ATMs in the back of gas stations, at hotels, or anywhere away from cameras or monitoring are prime targets for skimming. Trying to stick to using bank ATMs, especially those inside, can limit your risk of falling for a potential ATM scam.

Tips to protect against ATM skimming

You can help protect yourself from falling victim to an ATM skimmer by wiggling different parts of the machine, shielding your PIN with your hand as you enter it, and only ever using ATMs at trusted locations, such as those on your bank’s premises.

Here’s a better look at what to do to protect yourself against ATM skimming attacks:

- The wiggle test: Grab any suspicious-looking parts on an ATM and tug or wiggle them. Loose parts that come off effortlessly are a red flag that the ATM has been compromised.

- Hide your PIN: As you enter your PIN, cover the PIN pad with your free hand to hide your sensitive information from hidden cameras that may be hidden somewhere in the ATM.

- Avoid certain ATMs: Avoid ATMs in sketchy spots, such as seedy hotels or run-down gas stations. Try to stick to ATMs in well-lit, populated locations with a strong police presence, using machines that are inside wherever possible.

- Try an ATM skimmer detector: Skimming detectors aim to detect if an extra device is scanning your card information. While expensive, these devices could be helpful if you use ATMs frequently and you’re particularly concerned about skimming.

Just like in other bank scams, fraudsters involved in skimming hope to collect your financial information so they can use it to steal your money. The best way to avoid accidentally revealing your information is to avoid situations where it might happen. If that’s not an option, just make sure you thoroughly check the ATM for signs of tampering before you use it.

What should I do if I fall for an ATM skimmer

If you fall for an ATM skimming scam, immediately contact your bank to report the incident and get a new card. Then, contact the ATM operator, open an investigation with your local law enforcement department, and monitor your accounts for suspicious activity.

Here are the steps you should take to recover from falling for an ATM skimming scam:

- Contact your bank: Call your bank to report the incident and any suspicious transactions. Some banks may refund scammed money and help you set up anti-fraud measures for better protection. You should also ask for a new card to make the stolen credit card numbers redundant.

- Report the skimmer: Most ATMs will have a contact number on them which you can use to report suspicious activity or ATM errors. If you notice a skimmer, contact the provider to report it.

- Open a police report: Contact your police’s non-emergency line to report the incident and make a police report. Keep this police report in case your bank needs more information before they agree to refund a charge.

- Protect your credit: A scammer with access to your card details may be able to commit credit fraud. You can use a fraud alert to inform creditors that you’re vulnerable, or a credit freeze to prevent new credit applications from being filed in your name. Both are an additional layer of protection if someone tries to use your details for fraud.

- Monitor accounts: Keep a close eye on your bank accounts in the weeks and months following the incident to check for unrecognized transactions. If you notice anything suspicious, contact your bank.

Check with your bank to see if they offer a mobile app that notifies you when transactions are made. This will save you some time when monitoring bank accounts, an important step to help prevent stolen cards from transforming into fraud that causes serious financial losses.

Mitigate the impact of skimming attacks

ATM skimmers can be difficult to spot, making it easier than you think to fall for these hidden attachments. Take the time to inspect every ATM you use to reduce the risk.

Then subscribe to LifeLock Standard, an award-winning identity theft protection service with built-in financial monitoring features that can help you detect potentially fraudulent use of your personal information. And if you ever fall victim to financial fraud as a result of identity theft, LifeLock’s U.S.-based restoration specialists are standing by to help you get back on your feet.

FAQs

Can a chip-enabled card protect me from skimming?

A chip-enabled card can protect you from skimmers that rely on magstrips, the long black strip on the back of your card. However, it won’t protect you from skimmers that can read information on your chips.

What should I do if I find an ATM skimmer?

Report ATM skimmers to the ATM owner, or to local law enforcement who will notify the owner. If you find a skimmer on a bank ATM, report it directly to them so they can handle the issue quickly and protect other customers.

Can ATM skimmers steal data from contactless payments?

Typical ATM skimmers can’t steal data from contactless payment methods like Apple Pay and Google Pay. However, some sophisticated criminals may have access to specialized RFID skimmers that can extract contactless payment details from your phone in specific circumstances.

Is there an app that detects ATM skimmers?

Some apps claim to detect ATM skimmers, but they tend to have mixed results. Trusted detection of well-hidden ATM skimmers often requires technical knowledge and specific tools.

Can ATM skimmers steal my PIN?

Hidden cameras and fake keypads, two forms of ATM skimmer, can record you typing in your PIN and send the number to cybercriminals. Traditional ATM skimmers, however, steal information like the card number, expiration date, and CVV number.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

Copyright © 2025 Gen Digital Inc. All rights reserved. All trademarks, service marks, and tradenames (collectively, the "Marks") are trademarks or registered trademarks of Gen Digital Inc. or its affiliates ("Gen") or other respective owners that have granted Gen the right to use such Marks. For a list of Gen Marks please see GenDigital.com/trademarks.