Tip: Set up the autopay feature on your credit cards so you don’t have to make manual payments or risk forgetting to pay a bill on time.

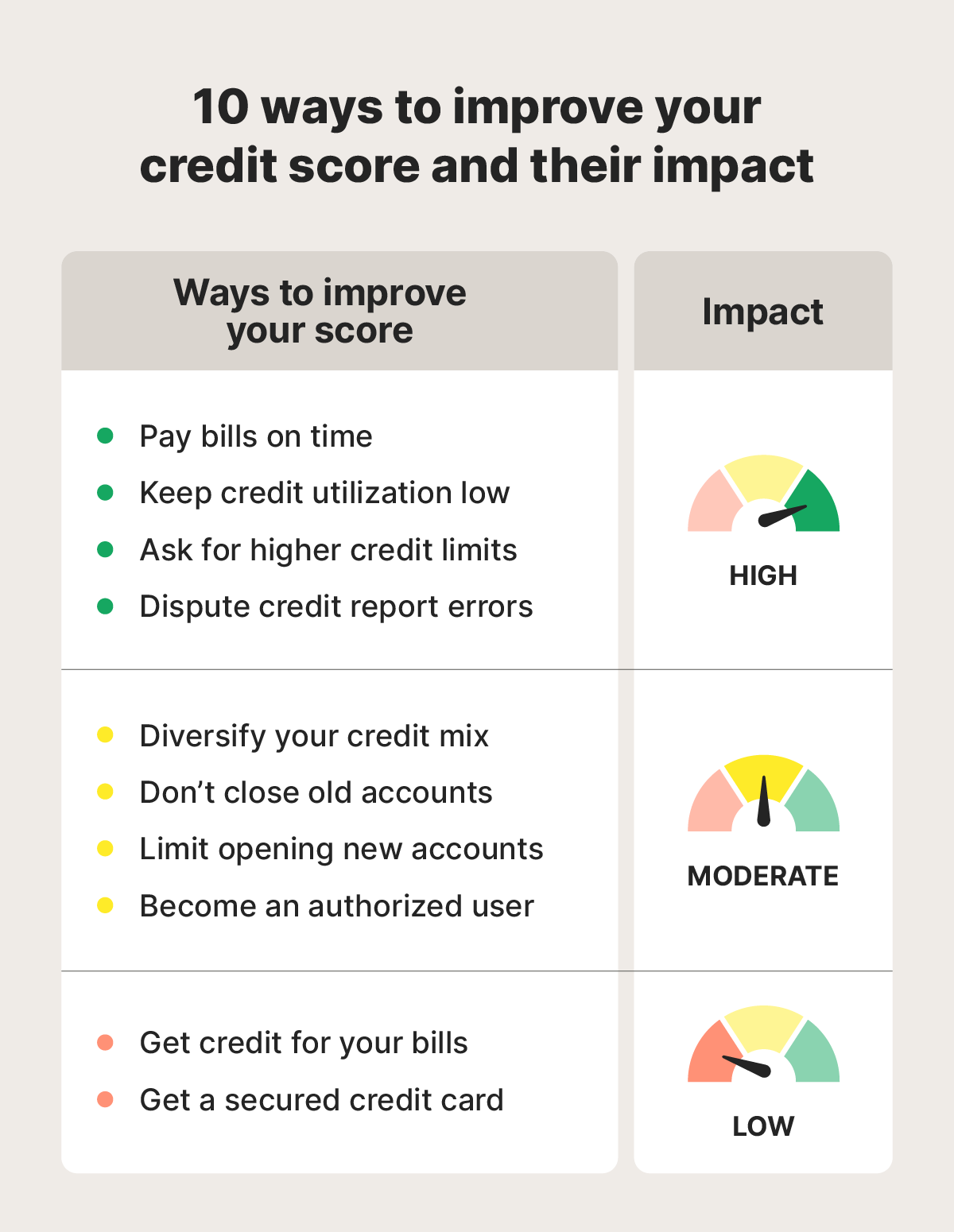

Improving your credit score might feel overwhelming, but you can get relatively quick boosts and work towards real long-term growth by adopting good habits. While these tactics won’t add hundreds of points to your credit score overnight, they can make a meaningful difference, helping you reach your financial goals sooner.

Read on to learn what you can do to improve your credit score fast and build a strong foundation for further growth.

1. Make payments on time

Making consistent, on-time payments across all of your credit accounts, including credit cards, loans, and mortgages, will help strengthen your credit score over time. Payment history is the most impactful factor in most credit score models, making up 35-40% of the overall weighting for both FICO Score and VantageScore calculations.

Paying your bills on time helps demonstrate to the credit bureaus that you’re a trustworthy borrower. In contrast, making repayments late or missing them altogether could indicate poor creditworthiness and may negatively impact your credit score.

A late payment generally won’t show up on your credit report until it’s 30 days overdue. If you don’t make the payment in that window, it could linger on your report for up to seven years.

If you know you won’t be able to make a credit payment on time, contact your creditor to see if they can extend the due date or create a more forgiving repayment plan.

- Impact: High.

- How fast it works: Making consistent on-time payments will gradually increase your score.

2. Keep credit utilization low

Decreasing your credit utilization — the percentage of your total credit limit that you’re using — can help boost your credit score. Credit utilization accounts for 20-30% of your total credit score, depending on the specific credit scoring model. Reducing your utilization may result in quick gains, and keeping it low should fuel long-term growth.

Lower credit utilization indicates to credit bureaus that you’re not reliant on debt to meet your daily financial needs. Many sources claim that keeping your credit utilization under 30% is enough to positively influence your credit score, but Experian suggests that maintaining single-digit utilization (1-10%) is ideal. However, you ideally want to avoid 0% utilization (meaning you don’t use credit at all), because this will prevent you from making regular payments.

Keeping your credit utilization low can also help you build better financial habits. According to a CNBC interview with debt-relief attorney Leslie Tayne, it’s best to “treat your credit card the same as your debit card,” meaning you shouldn’t spend more than what you can pay off at the end of the month.

If you have high credit utilization that you want to work on decreasing, consider these debt repayment methods:

- Avalanche method: Focus on repaying high-interest debt first, minimizing the amount of interest you have to pay in total.

- Snowball method: Focus on repaying your smallest debts first, leaving larger ones till later, to get a quick sense of achievement that keeps you encouraged.

- Debt consolidation: Combine multiple debt obligations into a single monthly payment to simplify your debt management. You can do this with a balance transfer card or a debt consolidation loan.

In certain circumstances, it may also make sense to seek alternative financing methods to pay off high-interest debt, like drawing on a home equity loan. Whatever method you choose, try to avoid building the debt up again, as this can drop your credit score back to where it was.

- Impact: High.

- How fast it works: It can take anywhere from a few months to several years to get your credit utilization below 30%, depending on how much debt you have. However, your score should gradually grow as your utilization ratio decreases.

Tip: Try to pay off your credit card balance in full each month before your next statement arrives. This will help keep your utilization low while also avoiding interest payments.

3. Increase your credit limit

Increasing your total credit limit is an effective tactic that may help boost your credit score relatively quickly. It affects your score by decreasing your credit utilization ratio, provided you don’t scale up your credit spending in line with the credit limit increase.

There are two main ways to increase your credit limit: request a higher limit on an existing credit card or apply for a new credit card.

- Increase existing credit limits: You can request a credit limit increase over the phone or using your card issuer’s mobile app. Doing so over the phone might help your cause, as you’ll have the opportunity to explain your situation in more detail and provide good reasons for the increase.

- Apply for a new card: If you’re unable to increase the limits on your existing cards, consider whether applying for a new card is worthwhile. While it’ll help drop your credit utilization, you’ll have to face a hard credit check that might temporarily affect your score.

In either case, bear in mind that you’re more likely to get approved if you have a history of good credit habits, like a strong track record of on-time payments and maintaining manageable balances. You’re also more likely to be successful in your application if you’ve recently increased your income or reduced your bills.

If you don’t qualify for either option, consider applying for a secured credit card. These tend to have lower requirements because you use your own money as collateral.

- Impact: High.

- How fast it works: You may see a credit score increase in as little as 30 days after your credit utilization reduces, with further benefits as you continue to decrease it.

Tip: If you’re requesting a credit limit increase through a credit app, make sure you update the income information and monthly expenses on your profile.

4. Dispute credit report errors

Credit report errors are incorrect items on your credit report — like debts that aren’t yours or on-time payments labeled as late — that can negatively affect your credit score. They might be the result of innocent errors made by creditors or bureaus, but they could also be a sign of credit fraud. Disputing these errors can result in their removal from your file, potentially improving your score.

To find credit report errors, you’ll first need to review your credit report. You can get a free copy of your credit report every week from AnnualCreditReport.com, or use a credit monitoring service like LifeLock Ultimate Plus for more regular reports.

Any time you spot something that doesn’t look right, file a dispute using each bureau’s online form:

You can also dispute your credit report in writing by mailing a physical copy of your credit report to each bureau alongside a letter stating your dispute claims and providing any relevant evidence.

- Impact: High.

- How fast it works: The credit bureaus may take up to 45 days to investigate your dispute claim and update your credit report. Any credit score improvements will happen soon after the dispute is approved.

Tip: If you’ve received a letter claiming one of your debts has been sent to collections, you can request a debt validation notice. This helps you learn more about whether the debt is yours, providing information that can help you file a dispute if the details are incorrect.

Get a free trial of LifeLock Ultimate Plus for daily credit reports and credit score updates so you can catch potential errors early. You’ll also benefit from credit monitoring features that alert you to potential signs of fraud, like new applications made in your name.

5. Diversify your credit mix

Credit mix is a measure of how diverse your overall credit file is. It makes up around 10-20% of your credit score, depending on the model, showing bureaus that you can handle a range of different debt types. A strong credit mix generally includes credit cards, loans, and mortgages. On the other hand, someone with multiple credit cards but no loans might be seen to have a weaker credit mix.

Here are the two main types of credit you might consider if you’re trying to diversify your credit mix:

- Revolving credit: Accounts that allow you to repeatedly access funds up to a set limit, repay the balance, and borrow again, like credit cards.

- Installment credit: Accounts where you borrow a lump sum that’s repaid over a set term in fixed monthly payments, like auto loans.

Having one revolving and one installment account is a good start, but if you already have a healthy mix of credit, opening new accounts might not help you improve your score.

It’s also important to note that you shouldn’t force yourself to take on new credit accounts at all costs, as your needs may vary depending on your situation. Instead, ask yourself if you could make use of different types of credit, focusing on instruments that can contribute to your financial health.

- Impact: High.

- How fast it works: You may see your credit score increase as soon as 30 days after you diversify your credit mix, when credit bureaus are made aware of the new accounts.

Tip: Don’t open new credit accounts unless you’re confident you can manage the repayments — missed payments can hurt your score more than a limited credit mix.

6. Avoid closing old accounts

Closing old credit accounts can affect the length of your credit history, which makes up around 15% of your credit score. Credit history length measures a few factors, including the age of your oldest account and the average age of all your accounts. Accordingly, maintaining aged credit accounts is one of the best ways to build credit over time.

If you’re set on closing accounts, focus on newer ones that don’t meet your needs, particularly those that have unnecessary fees or high interest rates. You might also consider closing accounts if you’re prone to overspending or there’s a risk of identity theft.

Avoid closing your older accounts wherever possible, as this may result in a credit score drop. Maintaining old accounts as long as possible helps show creditors you’re responsible over the long term, so try to keep them as long as you can benefit from them.

Bear in mind that some accounts will close automatically if you don’t use them regularly. Make minor payments each month to demonstrate they’re still active, or contact your creditor to see how often you need to use the card to maintain it.

- Impact: Moderate.

- How fast it works: Provided you’re also keeping up with payments and maintaining healthy credit utilization, your credit accounts getting older should gradually increase your score over time.

Tip: If you have old, delinquent debts, try to pay them instead of letting them get charged off. Ignoring them can have a massive negative impact on your credit score, leaving a long-lasting derogatory mark on your credit report.

7. Limit hard credit inquiries

Hard credit inquiries, also known as hard credit checks, happen whenever you formally apply for a new credit account, whether you’re approved or not. They typically cause a small dip in your credit score. Although a few hard credit inquiries won’t have a huge impact on your credit score, they can add up if you make lots of new applications.

You can limit the impact of hard credit inquiries by requesting a pre-approval check when you’re considering applying for a new account. Pre-approval uses soft checks instead of hard checks, which won’t impact your credit score. If you aren’t eligible for the new credit account, you’ll avoid the impact of a hard check.

You can also take advantage of the rate shopping window that bureaus grant customers shopping around for new credit accounts. This feature treats several hard credit checks made within a small window, typically 14 days, as a single inquiry, saving your credit score from the impact of lots of credit checks.

- Impact: Moderate.

- How fast it works: Hard inquiries can impact your score within days, and it takes two years for them to fall off your credit report. Avoiding them doesn’t boost your score, but protects it from minor decreases.

Tip: If you see hard inquiries on your credit report that you don’t recall making, it might be a sign of fraud. Take steps to secure your accounts and then contact the bureaus to remove inaccurate hard inquiries from your credit report.

8. Become an authorized user

If you’re trying to increase your credit score from a relatively low starting point, becoming an authorized user on someone else’s credit card can help you make early gains. When you become an authorized user, the credit bureaus will factor the main cardholder’s credit history into your credit score calculation, meaning you may benefit from their good habits.

If a friend, family member, or partner with good credit is willing to take you on as an authorized user, they will need to contact their card issuer and make the request. It’s usually possible to do this over the phone, by mail, or using a mobile app.

As an authorized user, you’re allowed to use their card as your own, but you don’t necessarily have to. Just be sure that payments are made on time, regardless of your agreement, because if the primary borrower makes late payments or closes the account, your credit score may be negatively impacted, too.

- Impact: Moderate.

- How fast it works: You may see a credit score increase as soon as 30 days after becoming an authorized user on a credit card owned by someone with good credit.

Tip: Avoid becoming an authorized user if the primary cardholder has a history of irresponsible credit use, such as late payments or exceeding their credit limit.

9. Get credit for your bills

Using a service to report your payments of recurring bills like utilities and rent can help you build a strong payment history. This may raise your credit score in both the short and long term. Just like making credit payments on time, meeting these financial obligations consistently demonstrates to the credit bureaus that you’re responsible.

Standard credit reporting models don’t report bills automatically, but there are several tools you can use to report your payment history for utilities and rent. These are some of the most popular:

- Experian Boost: A free tool that tracks your payment record with internet providers, subscription services, and utility companies.

- eCredible: A paid tool that tracks your payment history for eligible expenses going back 24 months.

- KikOff: A paid rent reporting tool that exports future rent payments to Equifax.

- UltraFICO: A paid tool that tracks your positive account balances, cash on hand, and payment history to help improve your score.

While setting up an additional credit reporting tool might not massively impact your score, the small boosts they can provide may add up to major growth over time.

- Impact: Low.

- How fast it works: After setting up a credit boosting service, you could see an impact on your credit score in as little as 30 days.

Tip: Not all credit-building tools apply to all three major credit bureaus, so keep this in mind as you search for the right choice if you want to report your bills to a specific bureau.

10. Get a secured card

If you can’t get a regular credit card due to a low credit score, consider getting a secured credit card instead. This can help you start to build credit history, providing an early boost to your credit score.

Secured cards can be a great tool for those new to credit. They feature lower eligibility requirements than a regular credit card because you provide cash as collateral for your debt, meaning your creditor is protected from risk.

If you miss payments, the cash you provided to open the card will be used to pay it off, saving you from the credit score impact of a debt going to collections or being charged off.

- Impact: Low.

- How fast it works: Your credit score may see a small boost in the first 30 days after opening a secured credit card, and it should continue to grow as you make consistent, on-time payments.

Tip: Treat your secured credit card just like a regular credit card, paying your bills on time to avoid penalties and the potential loss of your invested collateral.

How long does it take to improve your credit score?

You may see improvements to your credit score 30-45 days (or when creditors notify the bureaus) after you perform a credit-boosting activity, like increasing your credit limit or diversifying your credit mix. However, it can take years of consistent payments and good credit habits to improve your credit score significantly.

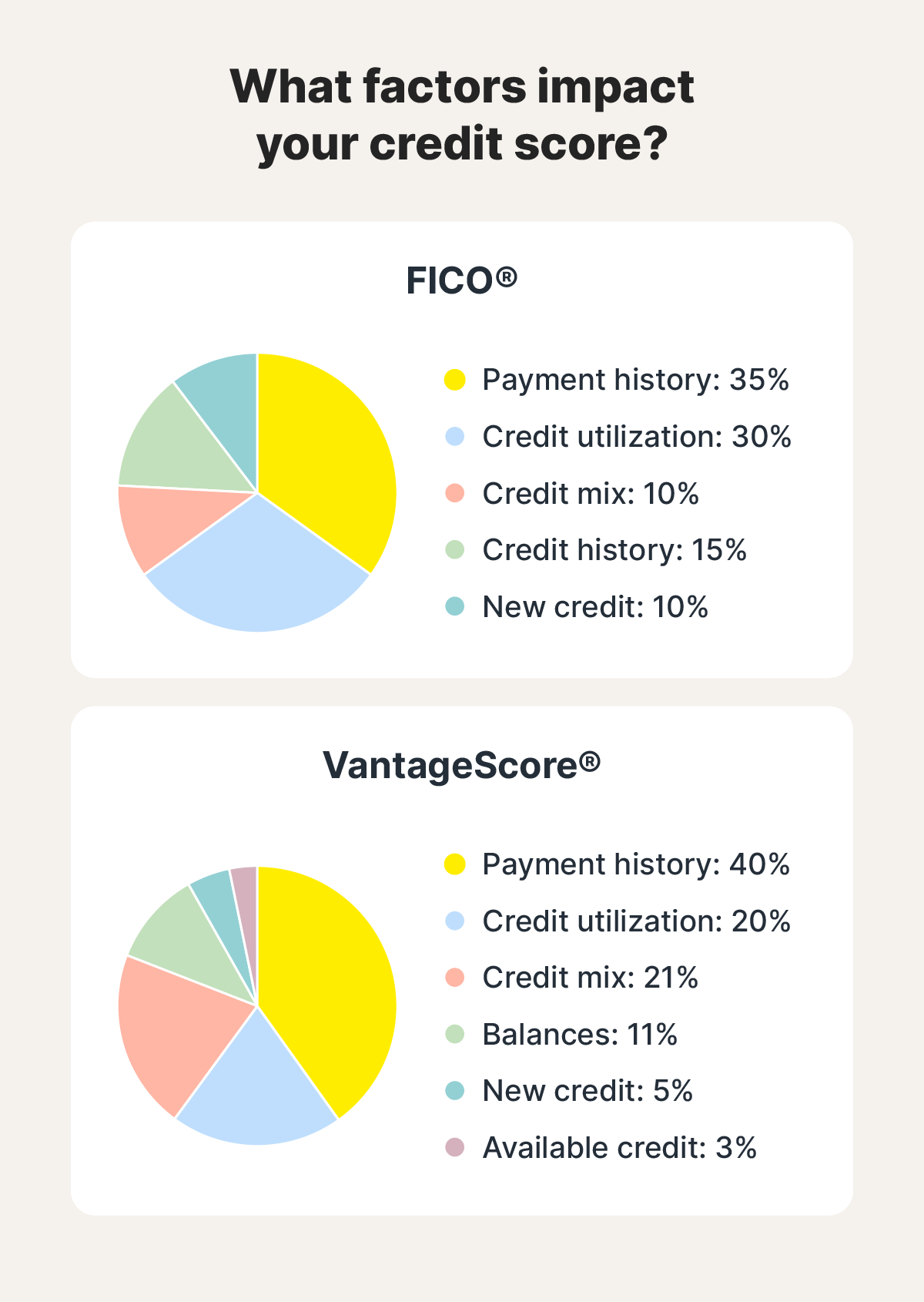

To understand how to improve your credit, and how long it may take, it’s important to know the different factors that impact credit scores:

- Payment history: Your track record of making on-time payments across all credit accounts, with missed or late payments having the highest potential negative impact on your score.

- Credit utilization: What percentage of your total available credit balance you use, with lower credit utilization generally helping improve your credit score.

- Credit mix: How many different types of credit you use, with higher scores generally provided to those managing mortgages, auto loans, and credit cards without falling behind.

- Credit history: The length of your credit history, including the age of your oldest account and the average age of all your accounts, with a longer history generally meaning a higher credit score.

- New credit: The number of new credit accounts in your recent credit history, with hard inquiries made in the past two years negatively impacting your credit.

- Available credit: An assessment of your total available credit across all accounts, and whether you have more available than you might need.

- Balances: A TransUnion-specific factor that tracks your current and delinquent credit balances, with higher scores generally given to those who maintain lower balances.

Each of these factors is an opportunity to demonstrate your creditworthiness and earn a credit score boost. Whether you’re hoping to grow your credit score quickly or you’re pursuing a long-term goal, maintaining good credit habits is the best way to get there.

What to avoid when building your credit score

The key things to avoid when trying to increase your credit score include missing payments, only making minimum payments, and maxing out your credit cards. The goal is to maintain regular payments that decrease your overall utilization, so taking on more debt is only likely to slow you down.

Here’s some more detail on what you should avoid when working on building your credit score:

- Making cash advances: Cash advances can have very high interest rates, making them difficult to pay off. This type of credit might cause more harm than good, as it’s short-term and can lead to a cycle of high-interest debt.

- Making payments late: Avoid missing payments or making them late whenever possible. If there’s a bill you can’t pay, try to get ahead of it by contacting your creditor to negotiate a postponement or payment plan.

- Making minimum payments: Minimum card payments generally only cover the interest on your debt, meaning the principal debt goes untouched. By paying above the monthly minimum, you can reduce your monthly interest while improving your credit utilization ratio.

- Maxing out cards: Bringing your credit card balances to their limit harms your credit utilization ratio, negatively impacting your credit score. By paying balances down instead, you can limit the interest you pay while improving your score.

- Not using your cards: Many credit card companies will close a card if you don’t use it for a certain time period. Try to use your cards, especially older ones, for small payments to prevent them from being closed. Just make sure to remember to settle the balance to avoid late payment penalties.

- Applying for too many new cards/loans: Applying for lots of cards and loans will incur numerous hard inquiries, which can linger on your credit report for two years. Limit your credit applications to just what you need and take advantage of the rate shopping window as you consider options to help preserve your credit score.

How to track your credit score

Tracking your credit score will help you keep up with your progress, letting you see the impact of your actions as they boost your credit. There are various ways to check your credit score, including using tools offered by your bank or credit card issuer, features offered by credit bureaus, and dedicated credit monitoring tools like those included with LifeLock.

Here’s a breakdown of some of the main ways to track your credit score:

- Bank or issuer: Some banks and credit card issuers offer free or paid credit score tools to customers, allowing you to check your score on a regular basis from within a mobile app.

- Credit bureaus: The major credit bureaus, Equifax, Experian, and TransUnion, offer paid tools for checking your credit score.

- Credit monitoring tools: LifeLock Ultimate Plus offers daily credit score updates and credit reports from one bureau, so you can stay up to date as you work on improving your credit.

Know your credit score

Improving your credit score takes hard work and dedication, but it can pay off by helping you reach your financial goals. LifeLock Ultimate Plus is an award-winning identity theft protection service with powerful financial monitoring features to support your credit-building journey, including daily credit reports and credit score updates.

Try LifeLock free for 30 days and benefit from credit monitoring that alerts you to signs of potential credit fraud, so you can take steps to protect yourself — and your credit score — from harm.

FAQs

What is a good credit score?

A good credit score is generally considered to be 670 or higher, with scores in the mid-700s and 800s considered very good and excellent, respectively. Reaching these scores often requires a long and consistent history of positive credit activity.

What brings your credit score up the fastest?

Paying off collections and past due amounts is the fastest way to bring up your credit score. These derogatory marks tend to have the highest negative impact, so removing them should be a priority when improving your score.

How can I build my credit with no credit history?

You can build your credit with no history by getting a secured card or becoming an authorized user on a card owned by someone with good credit. Both options require little to no credit.

Will paying off all of my debt make my credit score drop?

Paying off your credit cards shouldn’t affect your credit significantly as long as you don’t close the cards afterwards. However, maintaining 0% credit utilization might have a negative impact. Making regular purchases on credit cards and paying your balances off in full at the end of the month is one of the best ways to optimize your credit utilization.

What ruins credit scores?

Consistently making payments late, allowing debts to go to collections, or defaulting on a credit card or loan can all ruin your credit score. However, scores can be rebuilt in time with the right habits in place.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- 1. Make payments on time

- 2. Keep credit utilization low

- 3. Increase your credit limit

- 4. Dispute credit report errors

- 5. Diversify your credit mix

- 6. Avoid closing old accounts

- 7. Limit hard credit inquiries

- 8. Become an authorized user

- 9. Get credit for your bills

- 10. Get a secured card

- How long does it take to improve your credit score?

- What to avoid when building your credit score

- How to track your credit score

- Know your credit score

- FAQs

Start your protection,

enroll in minutes.

Copyright © 2025 Gen Digital Inc. All rights reserved. All trademarks, service marks, and tradenames (collectively, the "Marks") are trademarks or registered trademarks of Gen Digital Inc. or its affiliates ("Gen") or other respective owners that have granted Gen the right to use such Marks. For a list of Gen Marks please see GenDigital.com/trademarks.