As tax season rolls around, the maze of forms and regulations sends many scurrying for professional assistance. This surge in demand for tax preparers, however, has opened the door for scammers to exploit unsuspecting taxpayers. These fraudsters masquerade as qualified professionals, offering to ease your tax burdens, only to steal sensitive personal and financial information.

So let’s take a look at fake tax preparer scams and equip you with the knowledge to identify genuine tax help, spot potential red flags, and take decisive action if you suspect foul play.

Understanding tax preparer scams

Tax preparer scams take various forms, but their end goal is always the same: to swindle you out of your hard-earned money or steal your identity. Fraudulent tax preparers might attract victims with the promise of inflated refunds, only to disappear with their personal information and money. These scams not only jeopardize your financial security but can also lead to serious legal consequences if false information is filed in your name.

Fraudulent preparers typically use deceptive tactics, such as advertising guaranteed larger refunds than competitors or offering services without proper credentials. They prey on the taxpayer's lack of knowledge about tax laws and the genuine complexity of the tax system. Falling victim to such scams can result in identity theft, loss of your tax refund, and potential legal issues due to incorrect or fraudulent tax filings.

How to identify legitimate tax preparers

Legitimate tax preparers come equipped with verifiable credentials and transparent practices. Every authorized tax professional must have a Preparer Tax Identification Number (PTIN) issued by the IRS. This number is a tax preparer's legal identification for filing purposes and is the first thing you should ask for when vetting a tax help professional.

Moreover, genuine tax professionals often have additional qualifications, such as being Certified Public Accountants (CPAs), Enrolled Agents (EAs), or attorneys specializing in tax law. These credentials can usually be verified through respective professional bodies or state boards. Taking the time to check references and online reviews can also provide insight into the preparer's reliability and track record.

Red flags of fake tax preparer scams

Here are some of the warning signs that can alert you to a potentially fraudulent tax preparer.

- Big promises: Be wary of anyone promising unusually large refunds without first reviewing your financial information. This is a common lure used by scammers.

- Refund-based payment: A reputable tax preparer should never ask for payment based on the size of your refund.

- Refusal to provide your return: A real tax preparer will never refuse to provide a copy of your return.

- Doesn’t ask for receipts: Another red flag is a preparer who does not ask for receipts or question deductions and credits you're entitled to, as legitimate professionals will always ensure your return complies with tax laws.

- Won’t share their credentials: If a tax preparer is reluctant to share their credentials or contact information, it's a strong indication that something is amiss.

Steps to take if you suspect a scam

If you suspect that you've encountered a fraudulent tax preparer, act immediately to mitigate potential damage. First, report the incident to the IRS using Form 14157, Complaint: Tax Return Preparer. This helps the authorities investigate the preparer and prevent further scams.

Next, protect your personal information by alerting credit bureaus and monitoring your credit reports and financial accounts for unusual activity. If fraudulent tax returns were filed in your name, you might need to file an Identity Theft Affidavit (Form 14039) with the IRS. While resolving tax fraud can be a daunting process, acting swiftly can help limit the scam's impact on your financial life.

How to safely file your taxes

Here are a few best practices to avoid falling prey to tax scams.

- Utilize reputable tax filing software or seek out well-established tax preparation services with good reviews and solid reputations.

- When choosing tax help, opt for professionals recommended by trusted sources.

- Ensure they're willing to sign the tax returns they prepare, as required by law.

- Filing taxes electronically and opting for direct deposit for refunds can reduce the risk of mail fraud.

- Always use secure, private internet connections when submitting sensitive information online to prevent data theft.

Navigating tax season requires vigilance to avoid falling victim to scams. By understanding how to identify legitimate tax help, recognizing the red flags of fraudulent preparers, and knowing what steps to take if you encounter a scam, you can protect yourself from potential financial and legal hardships. Remember, when it comes to tax preparation, transparency, credentials, and a good track record are your best allies. Stay informed, stay skeptical, and ensure your tax filing process is as secure as possible.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

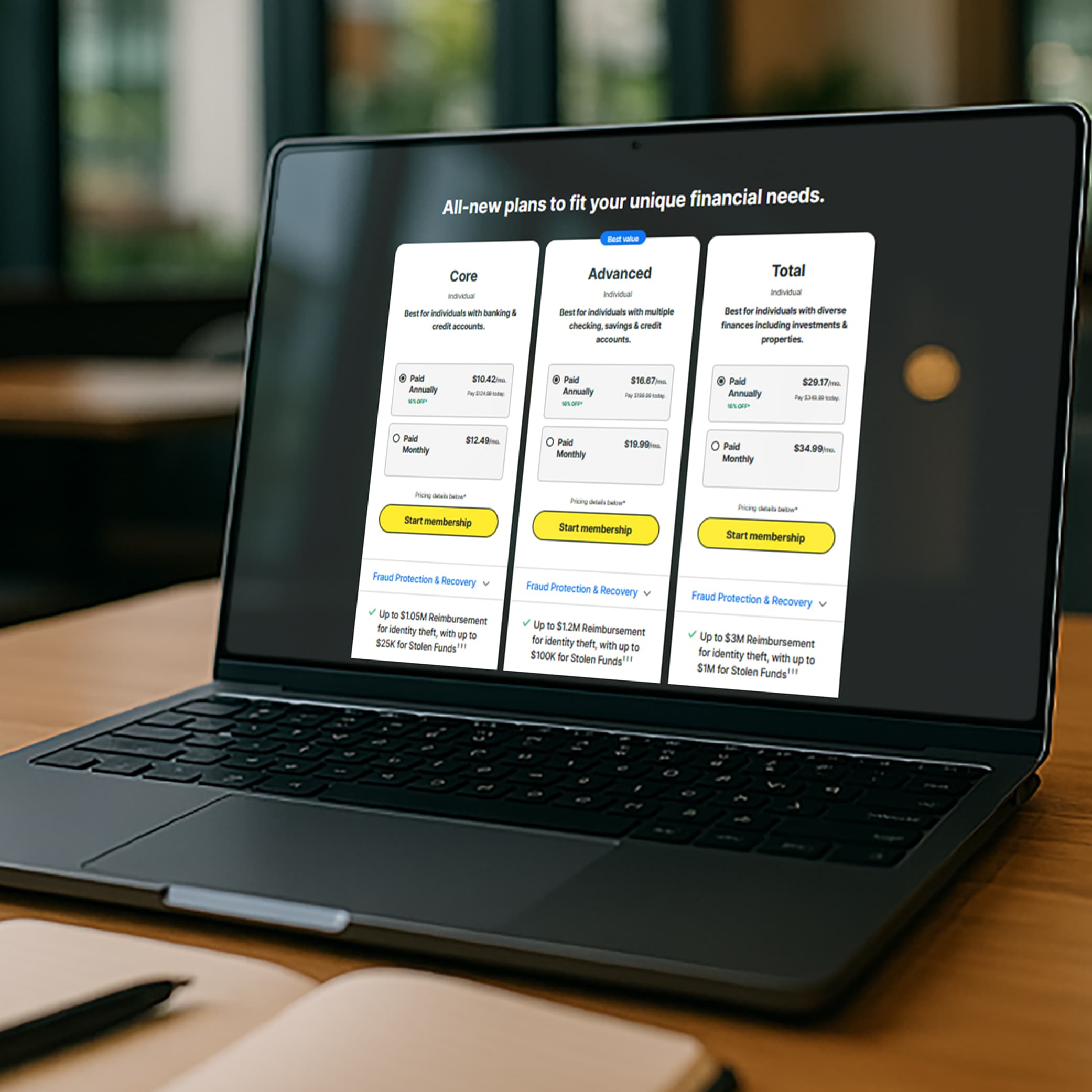

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.