Will I get my refund back if it’s stolen? In most cases, yes. The IRS doesn’t outright guarantee you’ll get a replacement refund if yours is stolen. But, if their investigation confirms that you were at no fault in the theft, they should reissue your paper check or direct deposit, ensuring you get the money you’re due.

Tax identity theft typically happens when a scammer files a fraudulent tax return using your Social Security number (SSN) and other personal information, claiming the refund you were owed. You probably won’t even realize it’s happened until you try to file your taxes, when you’ll receive an IRS notice that your return has already been submitted.

And it’s more common than you might think. In fact, in 2024, the IRS flagged $16.5 billion in refunds for possible identity fraud, according to the National Taxpayer Advocate mid-year report to Congress. But there’s a clear pathway to recovering a stolen refund. Follow these steps to get on your way.

How to check if your tax refund has been stolen

If a fraudster files a return in your name using stolen information, you’ll discover the tax refund theft when you try to submit your own return. It’ll be rejected immediately because the IRS system recognizes a tax return has already been filed under your SSN. At this point, you should contact the IRS and follow their recommendations, which will involve completing an Identity Theft Affidavit.

If you’ve successfully submitted your tax return and your refund hasn’t arrived, it could simply be delayed, or worst case scenario, lost in the mail. The IRS processes millions of returns each tax season, and various factors can slow things down, including errors on your return, incomplete information, or an influx of filings during peak times. Additionally, if the IRS suspects fraud, they may hold your refund for further review, which can add weeks or even months to the process.

To check the status of your tax refund, use the Where’s My Refund? tool. Enter your SSN or individual taxpayer ID number (ITIN) and it’ll tell you whether your refund has been approved and sent. If the IRS says your refund has been sent but you haven’t received it (and it’s been longer than five days since your return was sent for direct deposits or several weeks for mailed checks), it could have been stolen.

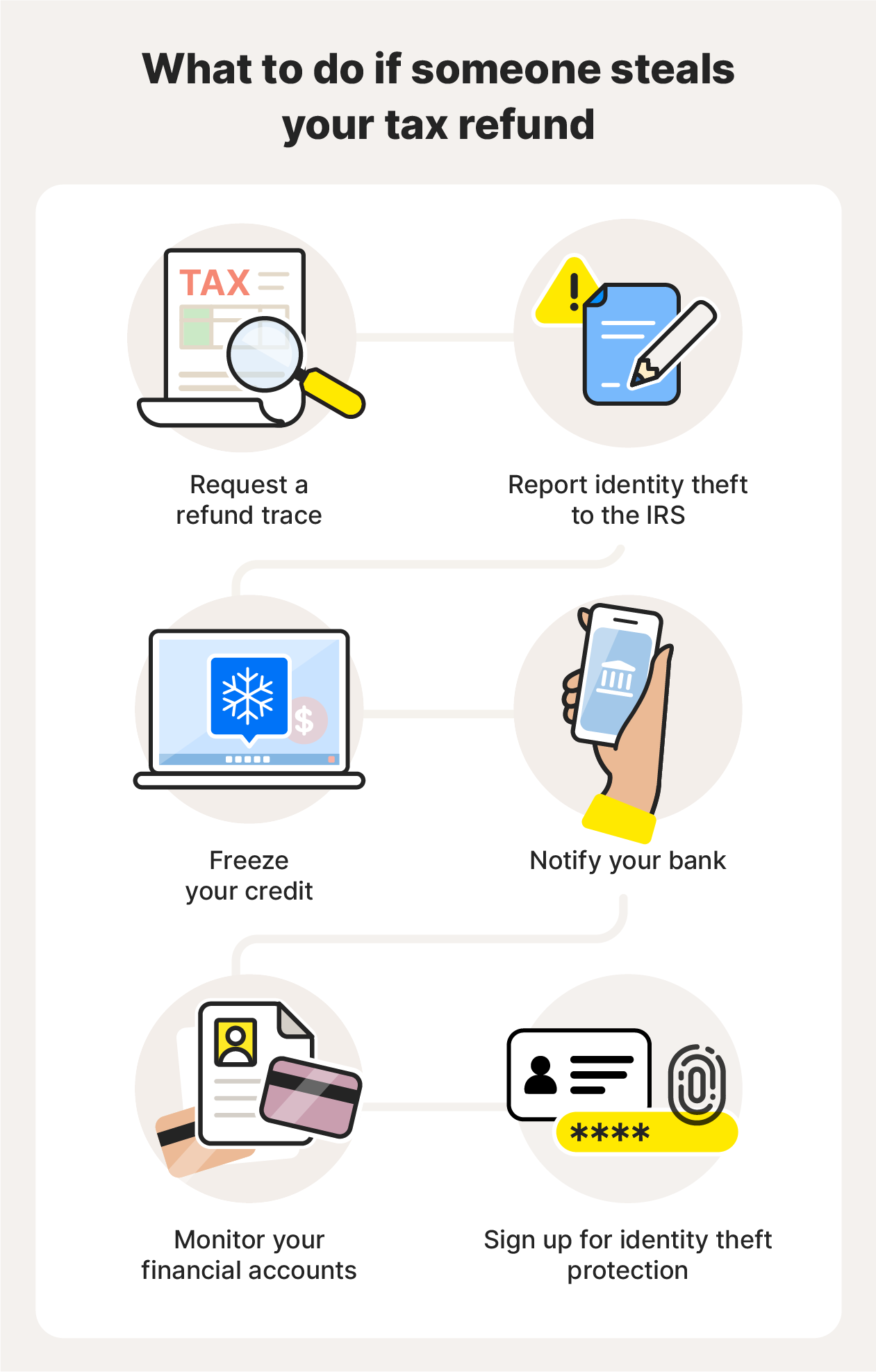

What to do if someone steals your tax refund

If you can confirm that your refund has been stolen, whether it’s due to receiving an error message when you try to submit your return or tracking the status of your refund on the IRS website, acting fast can help increase the chances of you recovering the money you’re owed. It’ll also help limit the potential risk of subsequent identity theft or fraud.

Here are the key steps to follow if someone has stolen your tax refund:

- Request a refund trace: Contact the IRS to initiate a refund trace, which helps determine whether your refund was issued, intercepted, or cashed fraudulently. You can only do this after five days have passed since your refund was issued via direct deposit or several weeks if your refund was issued via paper check.

- Report identity theft to the IRS: Follow the IRS reporting guidance for what to do if you fall victim to tax fraud and file the IRS Form 14039 (Identity Theft Affidavit) to formally notify them that your identity has been compromised. You should also file an identity theft report with the Federal Trade Commission (FTC) for additional advice.

- Freeze your credit: Place a free credit freeze with all three major credit bureaus (Experian, Equifax, and TransUnion) to help reduce the risk of further fraud, like criminals opening credit accounts in your name.

- Notify your bank: If your refund was supposed to be issued via direct deposit but never made it to your account, contact your bank as soon as possible. They may be able to help you track down where it went or help you recover it.

- Monitor your financial accounts: Look out for suspicious activity on your bank statements, credit card statements, and credit reports, which may signal other identity theft issues.

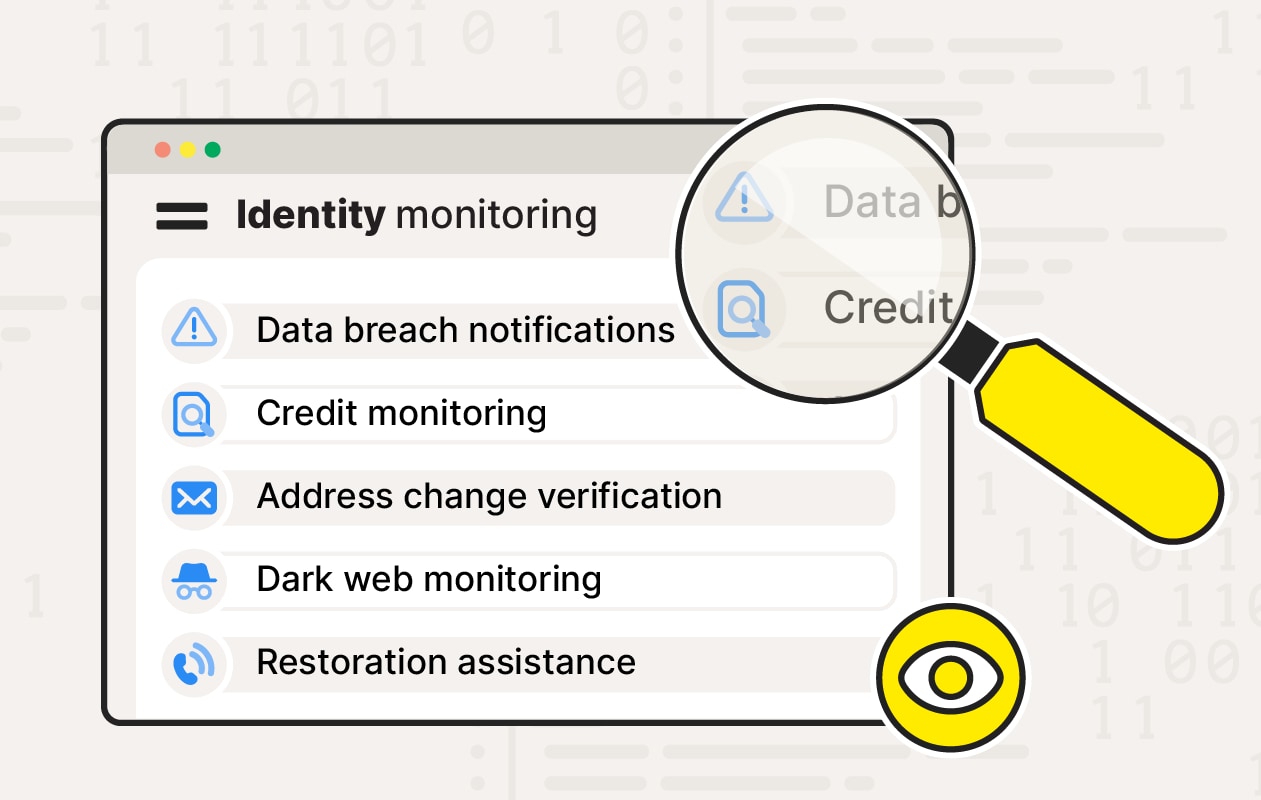

- Sign up for identity theft protection: An identity theft protection service can help you monitor your credit, alert you to suspicious financial activity, and give you the safety net of a reimbursement allowance if you lose money to identity theft.

Common tax scam tactics

Tax scams come in many forms, from IRS impersonation tactics designed to get you to give up your sensitive personal information to fraudulent tax preparers who steal your refund while pretending to help you. Understanding the most common strategies used by tax scammers can help you reduce your risk of becoming a victim of fraud this tax season.

These are some of the most common tax scams:

- IRS impersonation scams: Scammers pretending to be from the IRS may contact you via phone, email, or regular mail, hoping to trick you into sharing sensitive information they can use to steal your return. Stay wary of these impersonation scams around tax season and remember that the IRS will only ever initiate first contact with a letter.

- Fake tax preparers: While most tax preparers are perfectly legitimate, some fraudsters offer fake services designed to trick you into thinking you’re in safe hands. They might promise to maximize your refund, but will actually direct your refund to their account or cause you legal issues by filing your return inaccurately.

- Tax identity theft: Identity thieves with access to sensitive information like your SSN may submit a return in your name, stealing your refund before you even get a chance to file. They could get this information from data breaches, phishing scams, or even by hacking your phone or computer.

- W-2 form phishing scams: Phishing scammers may target organizations around tax season, impersonating a senior employee to request copies of W-2 forms that contain valuable sensitive information they can use in tax fraud or identity theft.

- Unclaimed refund scams: If you receive a letter or email suggesting you have an unclaimed tax refund, it may be part of a scam designed to get you to give up sensitive information that a fraudster can use to submit a return on your behalf and steal your refund.

A study commissioned by Gen* found that 17% of respondents encountered a tax-related scam in 2025, with 35% of those people falling victim and suffering an average loss of over $8,000. 79% of respondents said they were planning to take steps to protect against tax scams in 2026 — an important consideration to protect against potential financial losses and the serious risk of identity theft.

Tips to protect against tax fraud and identity theft

It can be tricky to prevent tax fraud if your sensitive personal information has been revealed in a data breach or hacking incident, but there are some protective steps you can take to reduce further identity theft and financial fraud.

- Request an Identity Protection (IP) PIN: An IP PIN is a short IRS-issued code that you’ll be asked to provide when you submit your return. It adds an extra layer of security to your account, helping prevent fraudsters from filing in your name.

- File your return as early as possible: Filing early in the tax season reduces the chance that a fraudster submits a fake return in your name before you get around to it.

- Opt for direct deposit refunds: Generally speaking, opting to get your refund sent via direct deposit is faster and more secure than receiving a paper check, which can be intercepted or stolen.

- Keep your SSN private: Limit when and where you share your Social Security number. Only provide it when you’re absolutely sure it’s needed and know that the requester is a legitimate and trustworthy organization.

- Beware of phishing scams: Be cautious of unsolicited emails, texts, calls, or messages on social media asking for sensitive information relating to your tax return. Scammers use phishing techniques to get access to details they can use in tax fraud.

- Sign up for identity theft protection: An identity theft protection service can help you monitor for warning signs of identity theft, like new credit accounts you didn’t open, which could mean you’re vulnerable to tax fraud.

Boost your protection this tax season

Tax refund fraud can leave you in a tricky financial situation, down money you were expecting to receive. But by following the steps above, you may be able to hunt down where your refund went and get back what you’re owed, while also helping boost your protection against tax scams in the future.

For additional protection, join LifeLock to get credit monitoring, identity theft alerts, and support from expert restoration specialists that can help you deal with tax-related identity theft if it happens.

FAQs

What happens if someone steals your IRS refund?

If a fraudster claims your refund, you’ll need to contact the IRS to report identity theft, file an Identity Theft Affidavit (Form 14039), and request a refund trace to discover where your money went and how to get it back.

How do you know if someone used your Social Security number (SSN) to file a tax return?

Your return being rejected and the IRS providing an error message that a return has already been filed in your name is the main way you’ll discover that someone has stolen your refund. However, other warning signs include the IRS sending you a notice about a suspicious return or an account created in your name.

What happens if you lose your tax refund check?

You can request a replacement check from the IRS by filing Form 3911 (Taxpayer Statement Regarding Refund). Just bear in mind that the IRS will likely only send a new check if the original one wasn’t cashed.

*The study was conducted online within the United States by Dynata on behalf of Gen from 20th November to 26th November 2025 among 1,000 adults ages 18 and older. Data are weighted where necessary by age, gender, and region, to be nationally representative.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.