You probably know Social Security fraud costs taxpayers billions of dollars, but how does all that money get swiped? There are lots of ways criminals can commit this type of fraud, but it almost always starts with a stolen Social Security number (SSN), often obtained through physical theft of a Social Security card, a phishing attack, or a data breach.

With access to your personal information, a cybercriminal — or even a rogue Social Security Administration (SSA) employee — could attempt to steal your benefits by filing false claims or redirecting payments to their own accounts. You can also be found liable for Social Security fraud if you purposefully omit or falsify key details to qualify for government benefits.

Learn more about the different types of Social Security fraud and what you can do to protect your SSN from misuse, helping ensure your benefits are available when you need them.

What is Social Security fraud?

Social Security fraud occurs when someone who isn’t eligible for government benefits uses stolen or falsified information to obtain them. While often linked to career cybercriminals, SSA employees have been known to commit fraud by creating false records, issuing improper payments, or diverting benefits for personal gain.

Types of Social Security fraud

Social Security fraud comes in many forms, including lying on benefits applications, misusing another person’s identity, redirecting legitimate payments, and more. Here are some of the most common ways Social Security fraud plays out:

- Identity theft or impersonation: Fraudsters often attempt to steal SSNs through cyberattacks, data breaches, or phishing schemes where they pose as SSA employees. Once stolen, SSNs can be used to commit identity theft by fraudulently applying for benefits, credit, or services in the victim’s name.

- Buying or selling SSNs: Criminals with access to stolen SSNs may aim to sell them on the dark web or other illicit online marketplaces, enabling the buyers to commit Social Security fraud in the future.

- Making false claims: Applying for Social Security benefits using untrue information is a form of fraud. This includes misrepresenting age, marital status, work history, income, disabilities, dependents, living arrangements, or relationship to a deceased person.

- Concealing circumstances: Certain situations can disqualify applicants from collecting benefits or reduce their payout. Manipulating the truth to get around this — by failing to report medical improvements or living situation changes, for example — is a form of fraud.

- Misuse of benefits by a representative: Anyone managing benefits on behalf of a family member or friend is legally and ethically obligated to act in the beneficiary’s best interests. Using those funds for personal gain or purposes unrelated to the beneficiary’s needs is illegal.

- Insider fraud: Fraudulent SSA employees could potentially use their inside access to divert funds, approve inaccurate claim applications, or intentionally manipulate records to benefit themselves or a collaborating fraudster.

How to check if someone is using your Social Security number

Signs that someone has stolen your SSN for use in Social Security fraud should appear on your Social Security statements. Additionally, monitoring your credit reports for suspicious activity like changes to your personal information or new accounts you didn’t open can reveal that your SSN is compromised, potentially also leaving you vulnerable to Social Security fraud.

Alternatively, you can take a more proactive approach by signing up for an identity theft monitoring service that automatically alerts you to unauthorized SSN activity, including applications for credit or services.

Here’s a more detailed breakdown of the best ways to monitor your SSN:

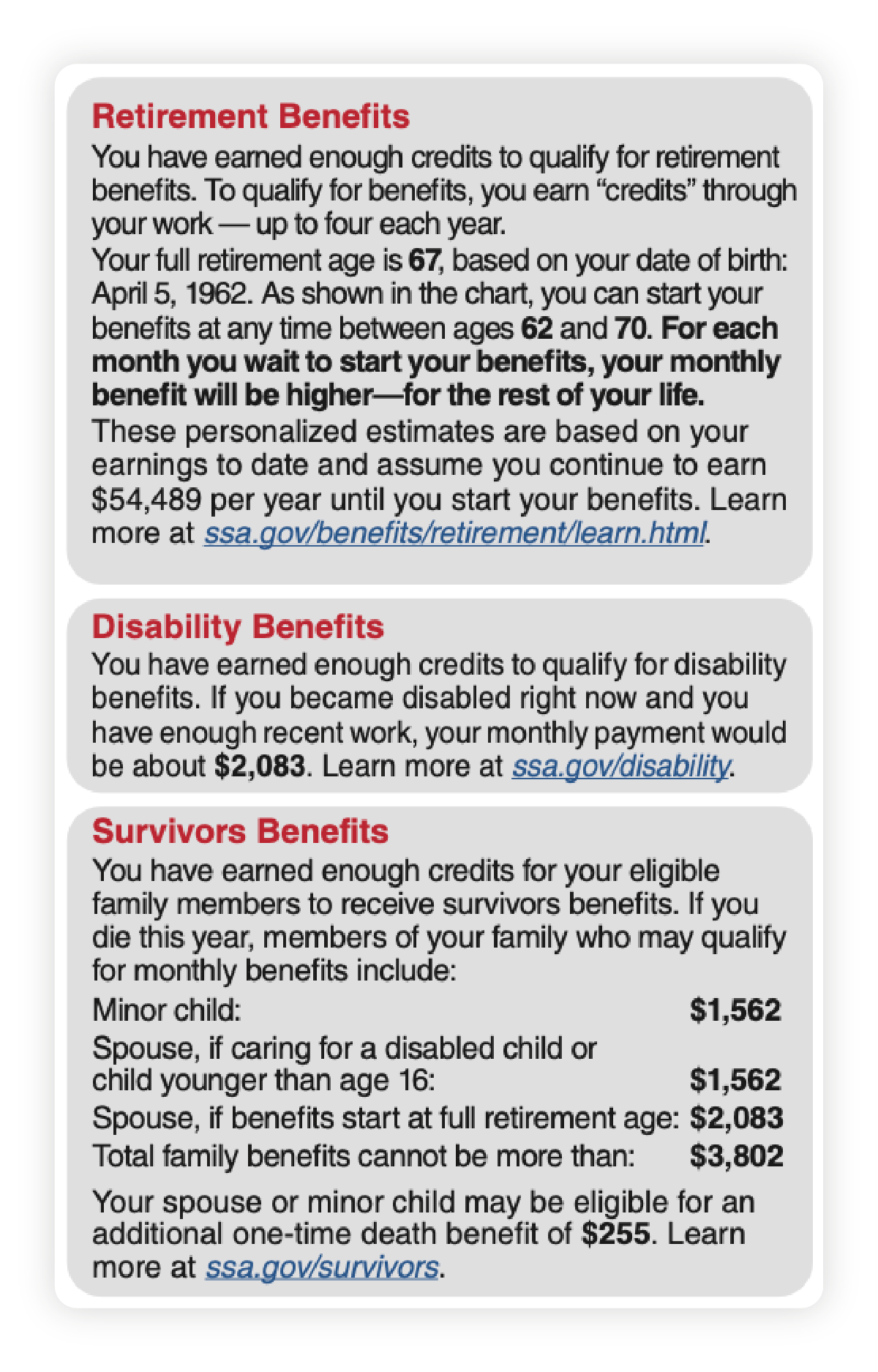

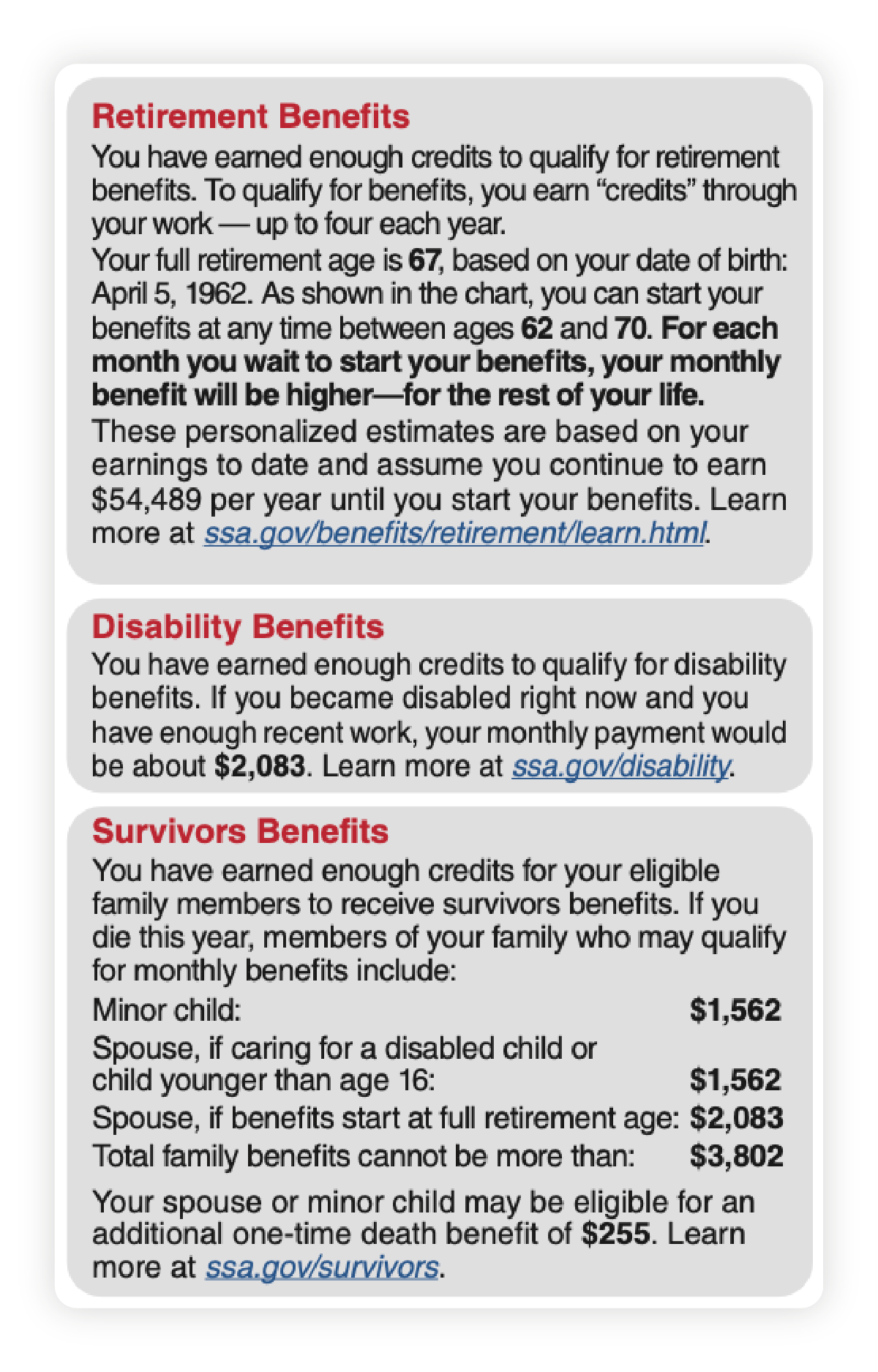

Social Security statements

Review your Social Security statement online to check for unauthorized benefit claims. If someone uses your SSN to commit employment fraud or tax fraud, you should see discrepancies in your statement's “Earnings” section.

Also, if you notice that your benefits estimates aren’t tracking with your expectations, the problem could be that someone is fraudulently claiming benefits with your SSN, impacting the overall calculations.

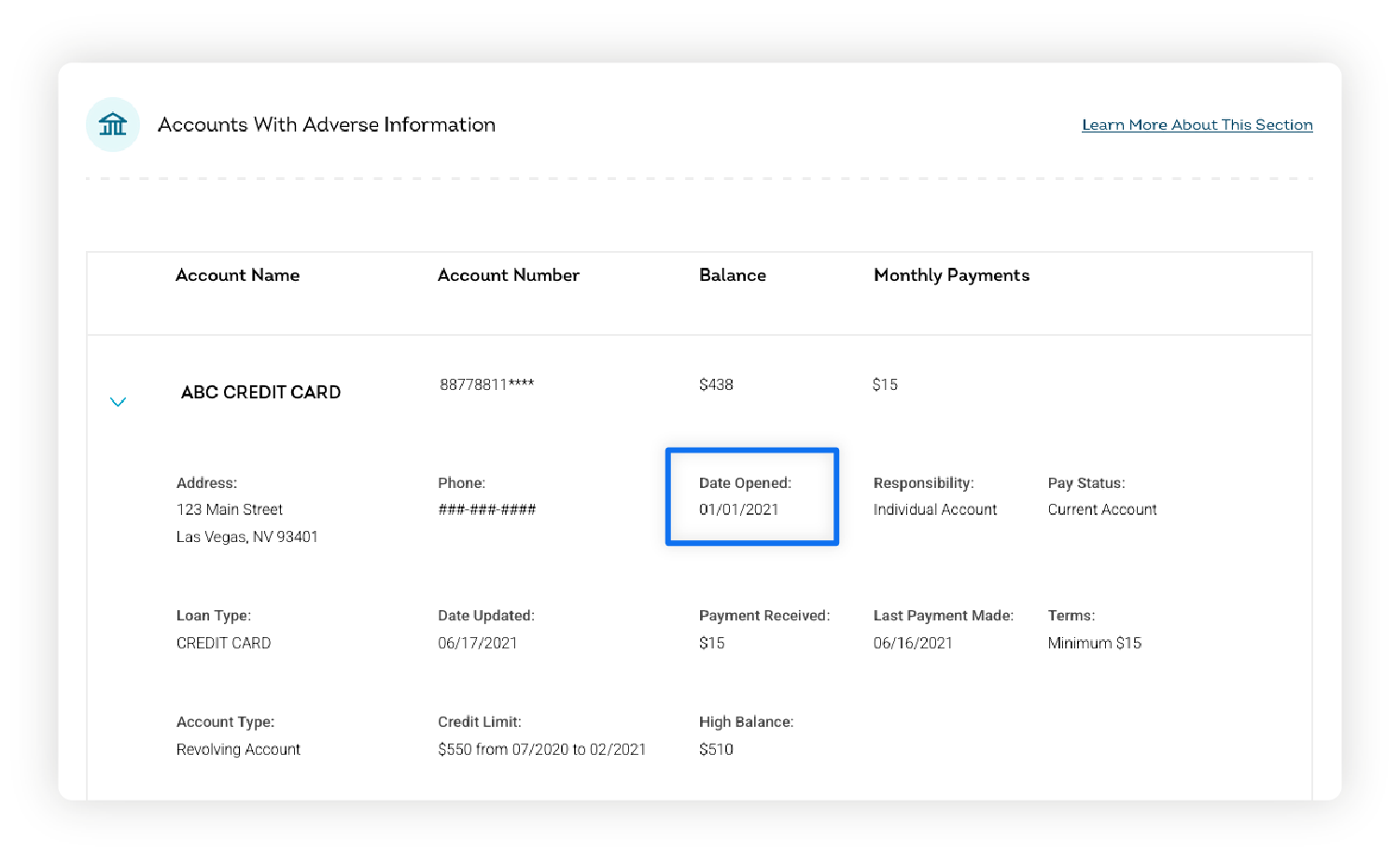

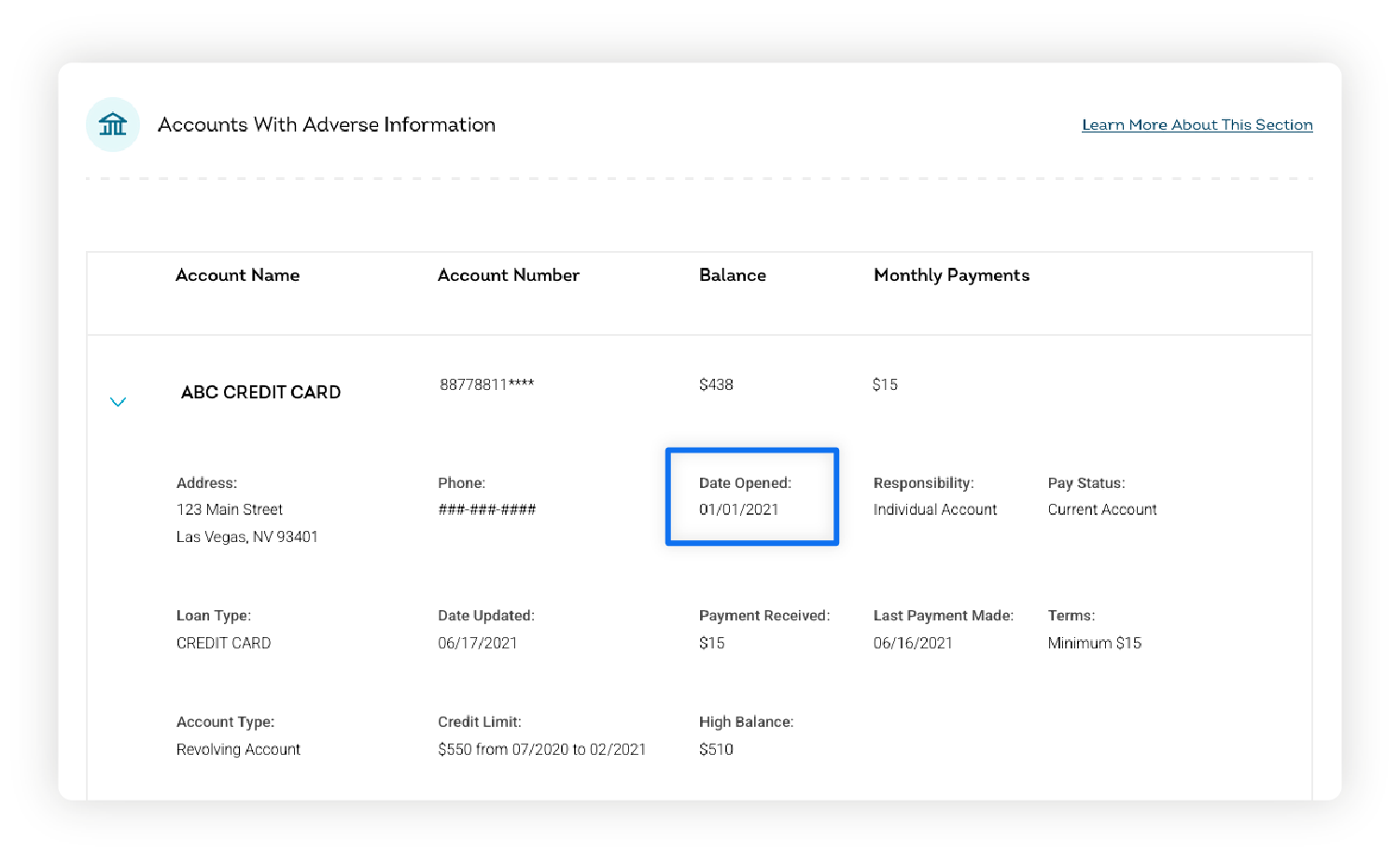

Credit reports

Check your Equifax, Experian, and TransUnion credit reports for recent accounts and inquiries, unexpected delinquencies, and changes to personal information and public records. AnnualCreditReport.com allows you to check your credit reports weekly, or you can check if your bank or credit card issuer offers credit report features.

Identity theft monitoring

Identity theft monitoring tools can help you monitor for fraudulent use of your SSN by scanning various public databases and the dark web for your details and alerting you to any suspicious activity or fraudulent applications in your name.

Join LifeLock Standard to set up identity and SSN alerts. You’ll get automatic notifications whenever we detect someone using your Social Security number or other personally identifiable information to apply for credit or services. And if you ever fall victim to identity theft, you’ll get personalized restoration support from U.S.-based specialists.

How to report Social Security fraud

You should report Social Security fraud to the Office of the Inspector General, a separate and independent unit within the SSA, to trigger an investigation and help protect against future legal or benefit issues. All you need to do is gather proof and submit an online form.

Here’s a closer look at the process:

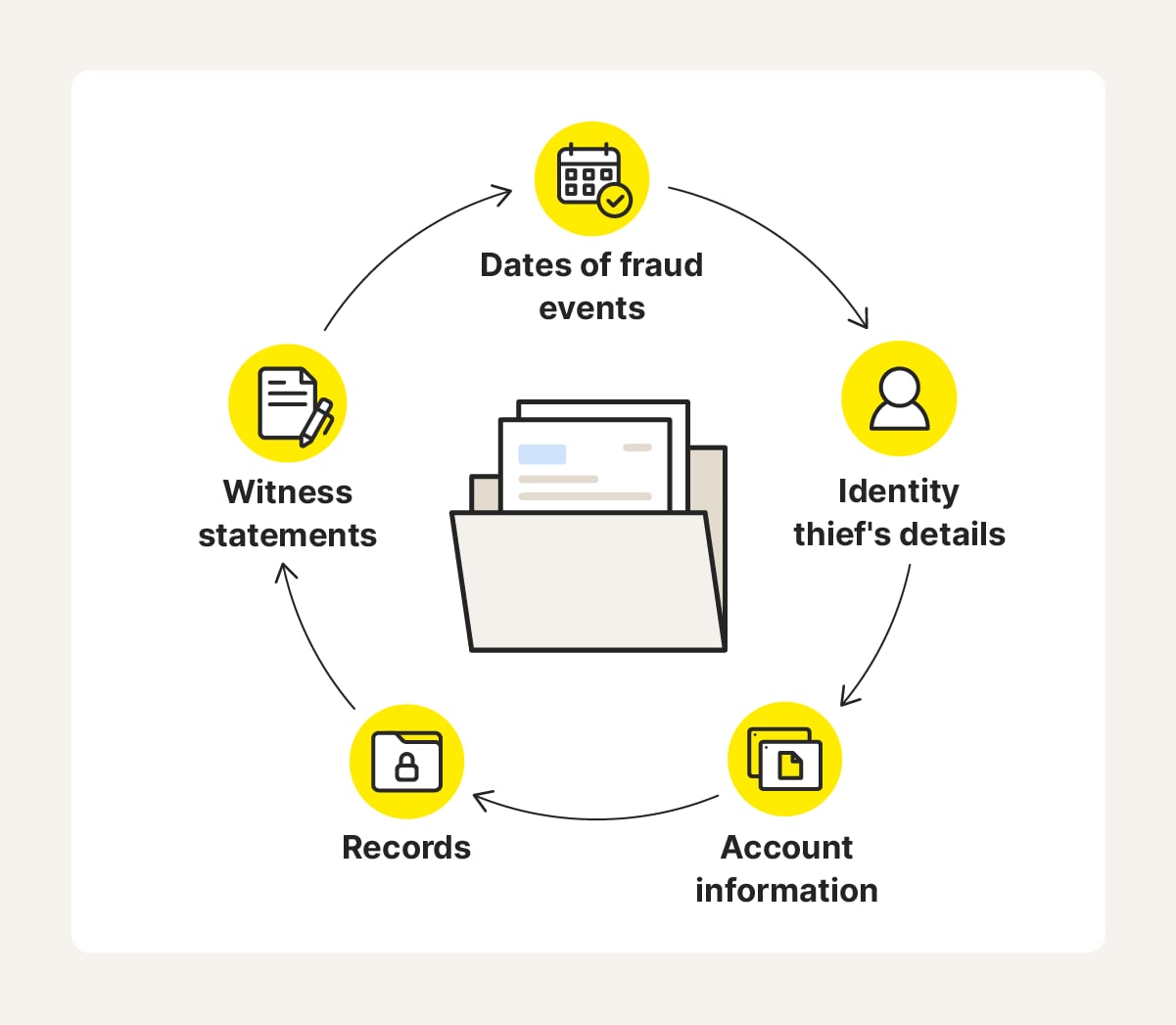

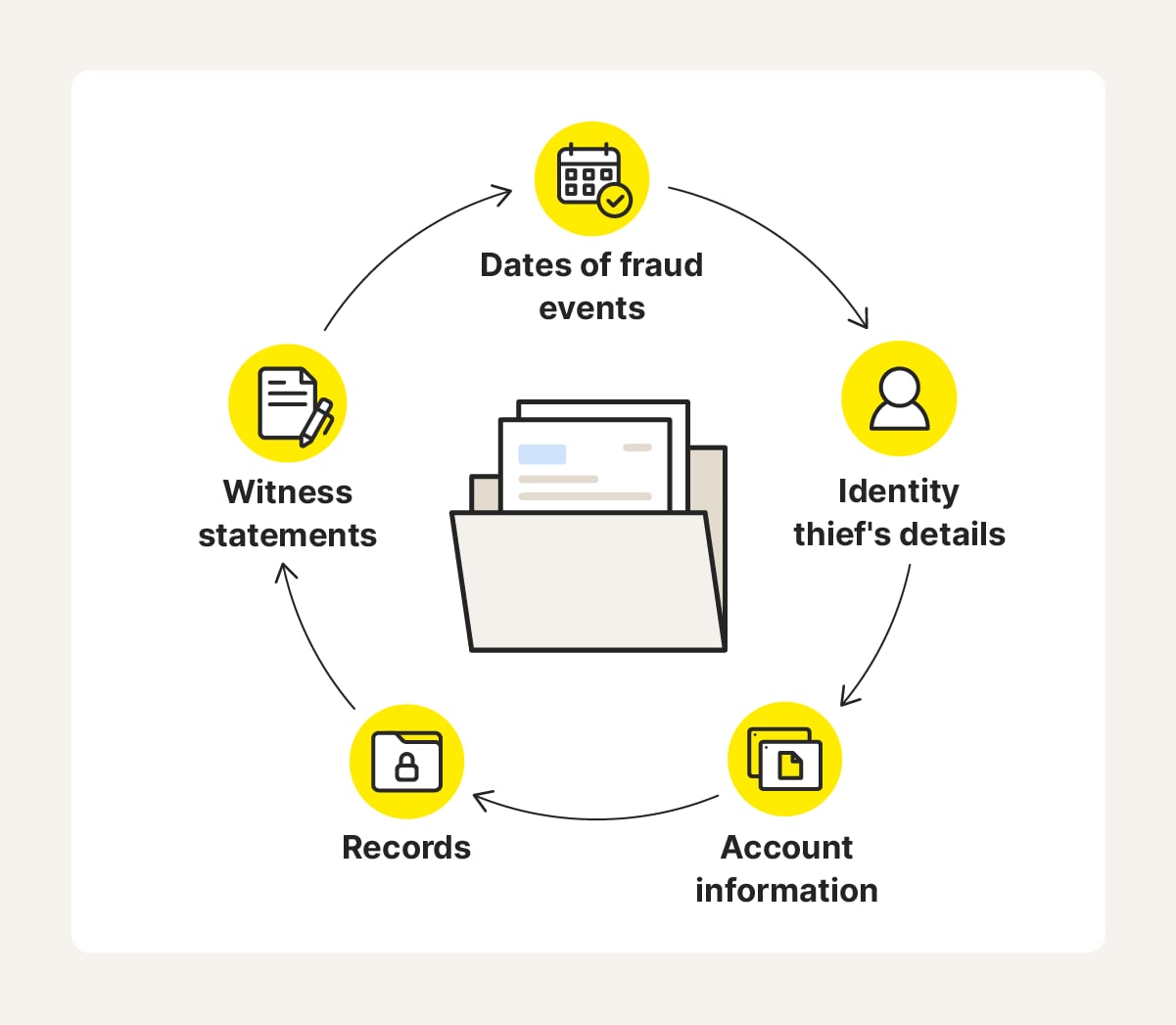

1. Gather proof: Collect as much relevant information as possible, including the identity thief’s name (if known), the dates when fraudulent accounts were opened or claims were submitted, correspondence between the fraudster and other involved parties, witness statements, financial records, and other supporting documents.

2. Report the fraud: File a report with the Office of the Inspector General by calling the OIG fraud hotline at (800) 447-8477 or submitting an online form.

3. Wait for the investigation to conclude: If your complaint is deemed valid, the OIG may launch an investigation or audit. However, OIG investigations aren’t bound by strict timelines and may face delays due to limited resources.

While waiting for a resolution, consider freezing your credit to help prevent identity thieves from opening new accounts in your name. You should also report fraudulent uses of your identity to the Federal Trade Commission (FTC). Doing so not only provides personalized recovery guidance but also supports the FTC’s efforts to investigate fraud, track trends, and inform the public.

How to prevent Social Security fraud

The most important steps to take to help prevent identity theft leading to Social Security fraud include keeping your SSN private, practicing good cybersecurity habits, and staying wary of scams and phishing schemes.

While the SSA takes preventive measures to help protect against fraud — including strict identity verification procedures and advanced data analytics to identify suspicious claims and limit unauthorized changes to direct deposit information — it’s ultimately your responsibility to protect your SSA.

Follow these tips to safeguard your SSN and protect against Social Security fraud:

- Don’t carry around your Social Security card: To avoid losing your Social Security card, store it in a lock box or filing cabinet and only take it out when you need it for a specific purpose.

- Be careful where you enter your SSN: You may need to provide your SSN for taxes, banking, or insurance, but always verify the request is legitimate and check whether the website is real to avoid phishing scams or identity theft.

- Verify caller identities: Before giving your SSN over the phone, ask for the caller’s name, agency, and a call-back number — then verify it on the agency’s official website. Remember, legitimate organizations won’t request your SSN by phone unless you contacted them first.

- Shred sensitive documents: Destroy documents containing personal information like your SSN, address, passport number, or banking details before discarding them to keep criminals from impersonating you and collecting benefits in your name.

- Use a password manager: Creating a strong password can help protect your “my Social Security" account from brute force, credential stuffing, and keylogging attacks. Using a password manager makes it easier to manage secure passwords.

- Enable two-factor authentication (2FA): This feature sends a login code to your email or phone, adding an extra layer of protection to your “my Social Security” account, helping to prevent unauthorized access even if someone has your password.

- Lock your SSN: The SSA offers a Self Lock feature designed to prevent other people from using your SSN for employment authorization. To lock your account, log into myE-Verify, answer three security questions, and enable Self Lock.

Social Security fraud statistics

Statistics show that despite numerous safeguards, Social Security fraud remains a widespread issue impacting both individual claimants and the Social Security Administration.

Here are some key figures that underscore the scale of the problem and why it’s so important to be alert to the risks:

- An OIG audit found that the Social Security Administration made $71.8 billion in improper payments over seven years.

- People aged 70 to 84 reported the greatest average Social Security fraud loss of any age group, with a reported average of $11,902.

- Government benefits fraud is most common in Florida, Alabama, California, Georgia, and Virginia.

- In 2024, Social Security scammers most commonly tricked targets by claiming there was a problem with their SSN, impersonating a government official, or using official-looking documents to sell their lie.

- The median loss of government benefits fraud is $170,613.

Protect your SSN and your identity

Taking proactive steps to protect against Social Security fraud can save you from benefits issues and ongoing financial, credit, or legal problems.

Subscribe to LifeLock Standard for SSN alerts that notify you of suspicious applications involving your details, along with a range of additional identity theft protection features like dark web and credit monitoring.

FAQs

How does Social Security notify you of suspicious activity?

A Social Security Administration employee may call or mail you a notice after detecting suspicious activity. But always verify messages are legitimate, as scammers sometimes impersonate the SSA to steal personal information or commit fraud. A legitimate representative will never ask for sensitive data or money.

Can I freeze my Social Security number?

You can’t “freeze” your SSN like you would a credit report, but you can lock it by creating and using a "my Social Security" account and enabling the Self Lock feature, which restricts electronic access to your Social Security record for employment checks.

How much does it cost to lock your Social Security number?

It’s free to lock your Social Security number to protect against employment fraud with the Self Lock feature within your "my Social Security" account, or by contacting the SSA.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

Copyright © 2025 Gen Digital Inc. All rights reserved. All trademarks, service marks, and tradenames (collectively, the "Marks") are trademarks or registered trademarks of Gen Digital Inc. or its affiliates ("Gen") or other respective owners that have granted Gen the right to use such Marks. For a list of Gen Marks please see GenDigital.com/trademarks.