The data gold rush of cybercrime

Cybercrime has grown into a booming industry, and personal data is its most valuable commodity. According to the Q1 Gen Threat Report, data breaches skyrocketed by 36% at the beginning of 2025, while breached personal information records surged by a staggering 186%. This isn’t just about numbers on a page. Behind each hacked account or exposed record lies a real person whose privacy and financial security are at risk.

Here’s what makes your data so valuable to cybercriminals:

- Email addresses: These are gateways to your online accounts, making them vital for phishing schemes or password reset exploits.

- Passwords: If your password is compromised in plaintext, hackers essentially get your digital master key.

- Personal data: Names, addresses, and even Social Security Numbers are perfect for perpetrating identity fraud.

- Financial information: Credit card numbers and transaction details are goldmines for would-be thieves.

Real-life examples of breaches

Here are some shocking example breaches from recent times:

- USOSGM: Exposed the full names and addresses of U.S. shoppers, handing attackers highly sensitive data on a silver platter.

- ALIEN TXTBASE: A mind-boggling 493 million stolen user credentials were published online, impacting 284 million unique email addresses globally.

These breaches show just how severe a stolen piece of information can be. But how do cybercriminals go about their attacks?

How cybercriminals steal your data

It’s not just the large-scale hacks of companies that we hear about in the news. Cybercriminals leverage multiple digital avenues to get into your accounts and devices. Here are just a few popular methods:

1. Phishing attacks

Phishing emails and text messages that appear genuine are a leading cause of data theft. Cybercriminals use these to trick victims into revealing sensitive information like login credentials or payment details. A recent trend involves attackers hosting phishing scams on legitimate platforms, making detection even harder.

2. Information-stealing malware

Information Stealers – often called Infostealers – are sneaky software that invade your phone or computer to siphon information. These programs quietly harvest email credentials, cryptocurrency wallets, and even two-factor authentication tokens. Once planted, they give attackers full access to your personal world.

3. Ransomware

Ransomware works by locking or encrypting files on a person’s or company’s device, making the data completely inaccessible. The attackers then demand a cryptocurrency payment in exchange for the possibility of restoring access - though there’s no guarantee the files will ever be recovered.

4. Social media exploits

Think twice before clicking that flashy link on Twitter or Instagram. Cybercriminals often use social platforms not only to distribute malicious links, but also to impersonate trusted individuals or brands, or promote fake apps and giveaways.

The risks for consumers

When your data is stolen, the fallout can span years. Here’s how it impacts you:

- Financial fraud: Stolen payment details can result in fraudulent purchases or payday loans being taken out in your name.

- Identity theft: Hackers can use your Social Security Number and personal details to open unauthorized accounts or commit crimes under your identity.

- Loss of digital accounts: If a hacker gains access to your email or social media, you may completely lose control of those accounts.

The good news? You’re not powerless. By adopting a few proactive measures, you can significantly reduce your risk.

How to protect yourself from data theft

1. Enable two-factor authentication

Always activate two-factor authentication (2FA) for your online accounts. It adds an extra layer of security by requiring you to verify your login via a code sent to your phone or email.

2. Use strong, unique passwords

Avoid reusing passwords across multiple sites. A password manager can help you create and securely store complex passwords.

3. Stay alert to phishing attempts

Be cautious when clicking on emails or text message links, especially if they ask for personal information. Legitimate companies will never ask you to share sensitive data via email.

4. Keep your software updated

Outdated software can become a critical vulnerability. Always keep your operating system, apps, and antivirus software updated to the latest version.

5. Monitor your financial accounts

Review your bank statements, credit card transactions, and credit reports regularly. If you notice any suspicious activity, alert your financial institution immediately.

6. Set up data-breach alerts

Use alert services to get notified instantly if your data has been exposed in a breach. Some cybersecurity tools also offer credit monitoring and alerts, so you can act quickly in case of unauthorized activity.

7. Avoid oversharing online

Posting too much information on social media—including your travel plans, address, or even pet names (common password choices)—can make you a target.

8. Use a trusted security tool

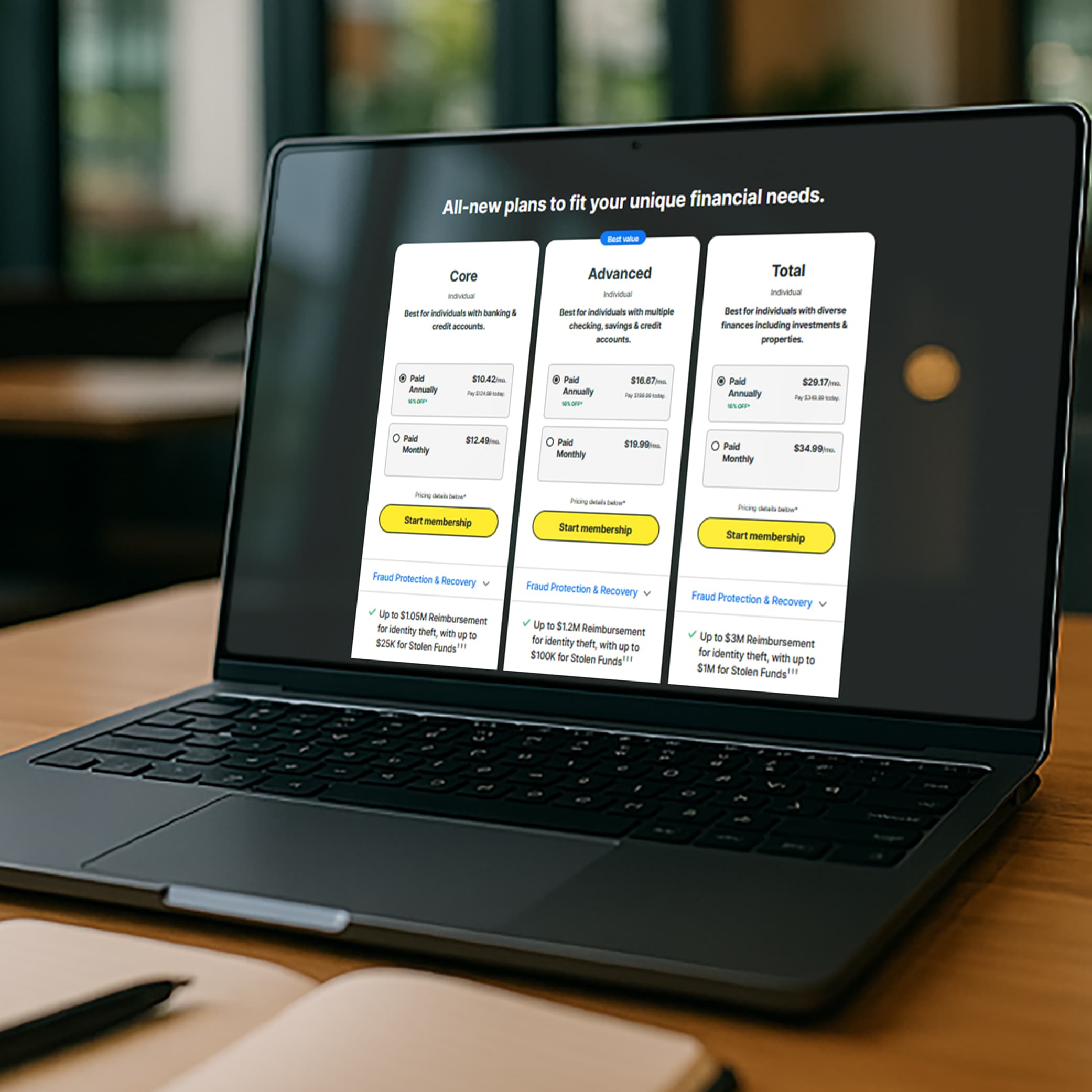

Protecting your personal information goes beyond antivirus software. Identity theft protection services like LifeLock monitor for suspicious activity involving your personal data—such as your Social Security number, bank accounts, or email addresses—and alert you to potential threats so you can act quickly.

What to do if your data is breached

If you suspect or are notified that your data has been compromised:

- Change your passwords immediately. Use a strong, unique password for every account.

- Enable 2FA for all accounts, even those that weren’t directly affected.

- Monitor your credit report for suspicious activity.

- Freeze your credit if you believe your Social Security Number has been compromised.

- Notify your bank and credit card companies to flag unauthorized transactions.

Remember, acting quickly is key to minimizing damage.

Stay secure, stay empowered

The reality of living in a digital world is that data theft will always be a potential threat. But you don’t need to live in fear. By staying vigilant and adopting smart cybersecurity practices, you can protect yourself and continue to enjoy the conveniences of today’s digital age.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.