Responding to identity theft isn’t just about filing reports and changing passwords—it’s about shifting into a mindset of calm, control, and action. This guide focuses on helping you think strategically when your identity has been compromised.

Whether the breach is small or life-disrupting, these steps can help you take back control one move at a time.

1. Assess the situation

Your first instinct might be to panic. That’s normal—but not helpful. Instead, take a breath and start gathering information.

Did you spot unfamiliar charges on your credit card? Get a weird notification from your bank? Maybe you received an unexpected collection notice or a credit denial for a loan you never applied for. Start documenting everything:

- Screenshot suspicious emails or texts

- Save any letters or voicemails

- Note dates and times of questionable transactions

Every detail you gather now will help you later.

2. Notify your financial institutions

Your money could still be on the move—so act fast. Contact your banks, credit card companies and lenders. Ask to freeze your accounts, dispute unauthorized charges, and add fraud alerts if available. Most institutions have dedicated fraud departments for exactly this reason—use them.

3. Report the theft to the authorities

The next step? Make it official. File a report with the Federal Trade Commission (FTC) at IdentityTheft.gov. This report serves as a formal record of the theft and can help support your case with banks, credit bureaus, or even the police.

Depending on the extent of the theft, you may also want to file a police report—especially if your identity is being used in criminal activity.

4. Secure your digital accounts

If someone has your personal info, they may have access to your digital life too.

There are several things you can do to protect your personal information online. Change passwords on all important accounts—email, social media, banking, shopping—and use strong, unique passwords for each. Even better, enable two-factor authentication wherever possible to add an extra layer of protection.

5. Monitor and lock your credit

Now’s the time to shut the credit door. Freeze your credit with all three major bureaus including Equifax, Experian, and TransUnion. This makes it harder for anyone to open new accounts in your name.

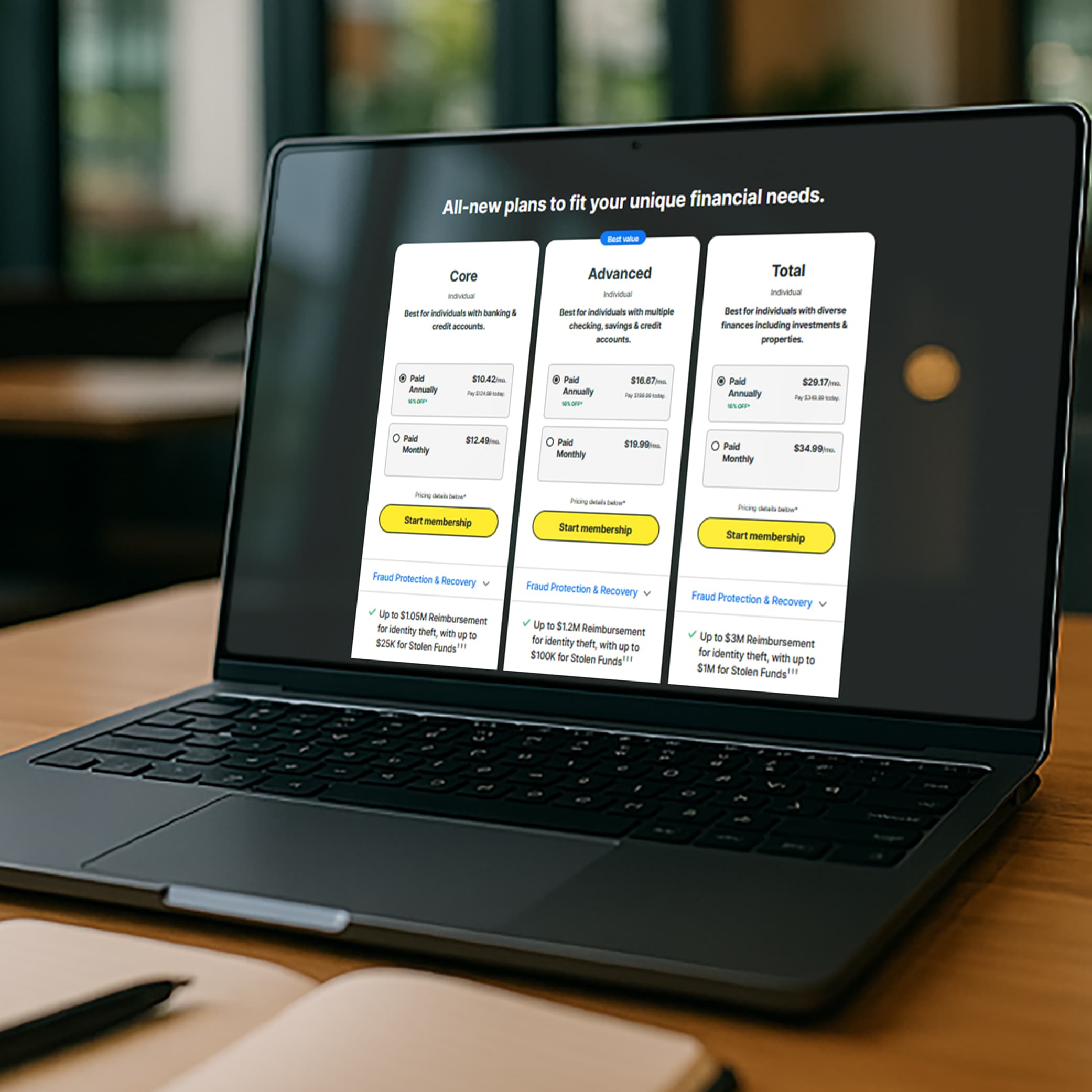

And don’t stop there—credit monitoring can help you stay ahead of future threats. LifeLock offers robust identity and credit monitoring tools to alert you to suspicious activity and freeze your credit.

6. Watch out for phishing attempts

Once you’ve been compromised, your information may be circulating on the dark web—which means you’re at greater risk of phishing attacks.

These can come in the form of emails, texts, or even phone calls pretending to be your bank, your employer, or even the government. Be wary of:

- Spelling errors or strange email addresses

- Unsolicited requests for personal info

- Urgent language like “Act now or your account will be closed!”

If it feels off, it probably is. Don’t click—delete.

7. Seek guidance from professionals

If the situation is messy—say, someone bought a car or committed tax fraud in your name—it’s smart to bring in the pros.

A legal or financial advisor can help you:

- Navigate fraud recovery

- Protect your assets

- Deal with credit repair or insurance claims

- Don’t try to go it alone if the stakes are high.

Stay one step ahead of identity thieves

Recovering from identity theft is about more than reacting—it’s about reclaiming control and staying vigilant. Once you’ve stabilized the situation, your next step is prevention.

Want an extra set of eyes on your personal info? LifeLock has your back by alerting you of suspicious activity and can help restore your identity if identity theft occurs.

FAQs

What is identity theft?

Identity theft is when someone uses your personal information—like your Social Security number, credit card number, or login credentials—without permission to commit fraud or other crimes.

How can you protect yourself from identity theft?

Use strong passwords, monitor your financial accounts, freeze your credit, and be cautious with personal information—especially online or over the phone.

If you fear you’ve been the victim of identity fraud, who do you contact to freeze your credit?

Reach out to each of the three major credit bureaus: Equifax, Experian, and TransUnion. You can request a credit freeze online or by phone.

How can I check if someone is using my identity?

Look for unexplained transactions, accounts you didn’t open, or debt collectors calling about unfamiliar accounts. Regular credit monitoring can also help detect fraud early.

How can I report identity theft?

Start by filing a report with the FTC at IdentityTheft.gov. For more serious cases, contact local law enforcement as well.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.