Someone in the U.S. falls victim to identity theft every five seconds. This post explains what identity thieves do once they get your information—and more importantly, how you can help stop them before they do serious damage.

1. Open financial accounts

Once cybercriminals have access to key personal data—like your name, address, Social Security number, and date of birth—they can impersonate you to open new credit cards, bank accounts, or loans. With some smooth social engineering, they might even talk their way into bypassing security questions with your bank.

These fraudulent accounts can go unnoticed for months, potentially damaging your credit and finances.

Tip: Check your credit report regularly for unfamiliar accounts and use a credit monitoring service that alerts you to new activity.

2. Make unauthorized purchase

If thieves get your credit or debit card details, they can quickly rack up charges—often on big-ticket items like electronics, designer goods, or prepaid gift cards. These transactions might seem small at first, but they add up fast.

Tip: Dispute any charges you don’t recognize immediately with your bank and set up real-time alerts for your financial accounts.

3. Take over existing accounts

With a combination of leaked passwords, security questions, and email access, cybercriminals can hijack your bank, email, or social media accounts. Once inside, they may drain funds, change account details, or use your platform to scam others.

Tip: Enable two-factor authentication (2FA) on all sensitive accounts and use a password manager to create and store strong, unique passwords.

4. Sell it

One of the most common things identity thieves do with your information is sell it—often in bulk—on the dark web. The dark web is a hidden corner of the internet where stolen data is bought and sold like currency.

Tip: Use a dark web monitoring tool to scan for your personal information and change compromised passwords immediately.

5. Use your health insurance

Medical identity theft occurs when someone uses your information to receive medical care or fill prescriptions under your name. This can result in false entries in your medical records and surprise bills.

Tip: Shred old medical statements and insurance documents and review your Explanation of Benefits (EOB) statements for unfamiliar services.

6. Apply for federal or state benefits

Fraudsters can use your identity to apply for unemployment, Social Security, or other government benefits. These scams often divert your benefits into their own accounts, leaving you empty-handed when you actually need help.

Tip: Contact your state’s unemployment office if you suspect fraud and set up online accounts for government benefits yourself to claim them securely.

7. Carry out phishing attacks

Armed with your name and email address, scammers can launch phishing attacks on your contacts— pretending to be you to trick your friends or family into handing over information or money.

Tip: Warn your contacts if you see duplicate or suspicious accounts using your name and keep your social profiles private and secure.

8. Submit your taxes

Tax identity theft happens when someone files a fraudulent return in your name to claim your refund. By the time you go to file your taxes, the IRS may already think it’s been done.

Tip: File your taxes as early as possible and use strong security practices for your online tax accounts.

How can you keep your information in your hands?

You can reduce your risk of identity theft by adopting a few simple but powerful habits. Start by avoiding calls from unknown numbers and never sharing personal information unless it’s absolutely necessary. Make sure to enable two-factor authentication (2FA) whenever possible, and always keep your software and devices updated. It’s also wise to shred any sensitive documents before you dispose of them. Finally, consider locking or freezing your Social Security number with the appropriate agencies to keep others from using it if it falls into the wrong hands.

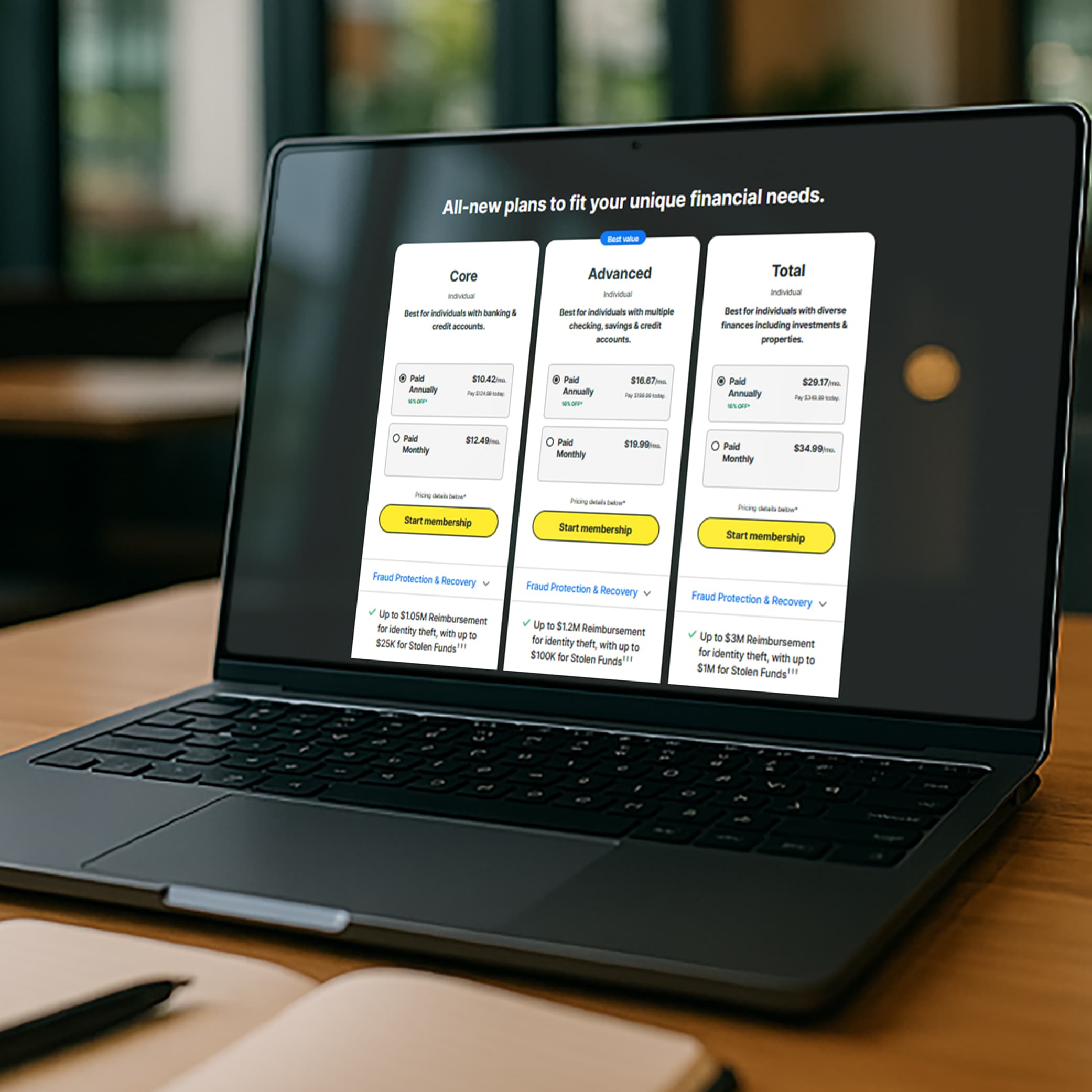

LifeLock is here to help you stay a step ahead by continuously monitoring millions of data points and alerting you if something should happen.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.