Protecting veterans from scams: why it matters

Veterans have given so much in service, yet too often, they’re the targets of scams aiming to steal their hard-earned benefits. Scammers leverage veterans' unique vulnerabilities—such as trust in government entities or a desire for community support—and use emotional manipulation to gain access to their personal information. From United States Department of Veterans Affairs benefits to exclusive grants, the stakes are high, and it is necessary to take steps to help prevent identity theft.

1. Fake government agency phishing attempts

Scammers often pose as representatives from the VA, the Department of Defense, or other government agencies, reaching out to veterans under the guise of verifying personal details. These phishing attempts usually involve phone calls or emails claiming “urgent action” is required, such as reactivating benefits. Falling for these scams can lead to serious financial and identity theft issues, as scammers often seek Social Security numbers or VA login credentials.

2. Posing as family or friends

Another common tactic is impersonating close family or friends to create a sense of urgency. Scammers might claim they’re in distress, in need of immediate financial help, or dealing with an emergency only the veteran can resolve. By leveraging personal details that may be available online, fraudsters make their claims seem believable, leading many veterans to unknowingly send funds or disclose sensitive information.

3. Fake government grants and programs

Scammers will frequently promote fake government grants or special veteran programs that promise quick financial relief or exclusive benefits. They lure veterans into providing personal information and, often, a “processing fee” to access these nonexistent programs. The risk? Personal details like Social Security numbers and bank account information can be stolen in seconds, used for financial fraud, or sold on the dark web.

4. Fraudulent job offers or education programs

Some scams specifically target veterans looking for career opportunities or educational benefits. Fraudsters pose as potential employers, offering veterans well-paying jobs or educational programs that cater to their experience and skills. Once they have the veteran’s personal information for a “background check” or “tuition payment,” they disappear. This scam preys on veterans eager to transition into civilian careers and education, leaving them vulnerable to data theft.

5. Healthcare and insurance fraud

Healthcare scams, including fake insurance plans, target veterans who may be unsure about healthcare coverage after leaving the service. Fraudsters may claim to represent health insurance providers or even VA hospitals, asking veterans to update their insurance information or pay fees for enhanced coverage. These scams often result in compromised data, stolen financial information or false billing.

6. Charging for free veteran services

Fraudsters sometimes charge for services that veterans are entitled to for free, like benefits assistance or claim support. By posing as “specialists” or “veteran advocates,” scammers promise quicker benefits processing for a fee, leading veterans to pay for services that the VA provides at no cost.

7. Exploiting veterans’ PACT Act benefits

With the PACT Act expanding benefits for veterans exposed to toxins, scammers see an opportunity. They may pretend to help veterans navigate the application process, promising fast-track benefits. In reality, they collect personal and medical details that can be used for identity theft or insurance fraud.

8. Housing and rental scams

Veterans are also targeted with housing scams, where scammers advertise rentals or home loans specifically for veterans at unbeatable rates. Once the veteran shares personal details or makes a down payment, the scammers vanish, often leaving the veteran without recourse and with financial or personal data compromised.

How veterans can protect themselves and respond to scams

Taking action to secure personal information is the best line of defense against veteran scams. Here’s how veterans and their families can stay protected:

- Safeguard VA login credentials and never share them over the phone or email.

- Regularly monitor your credit report to catch suspicious activity early.

- Set up fraud alerts or credit freezes through major credit bureaus.

- Use two-factor authentication for extra security on financial and personal accounts.

- Only use verified channels to contact the VA or other veteran organizations.

Resources for veterans to report scams

If you or a veteran you know encounters a scam, reach out to these agencies:

- Veterans Affairs (VA) – Report scams directly through the VA’s Office of the Inspector General.

- Federal Trade Commission (FTC) – File complaints related to fraud and deceptive practices.

- State Veterans Affairs Offices – Many states offer fraud prevention resources tailored for veterans.

Shield our veterans from identity fraud

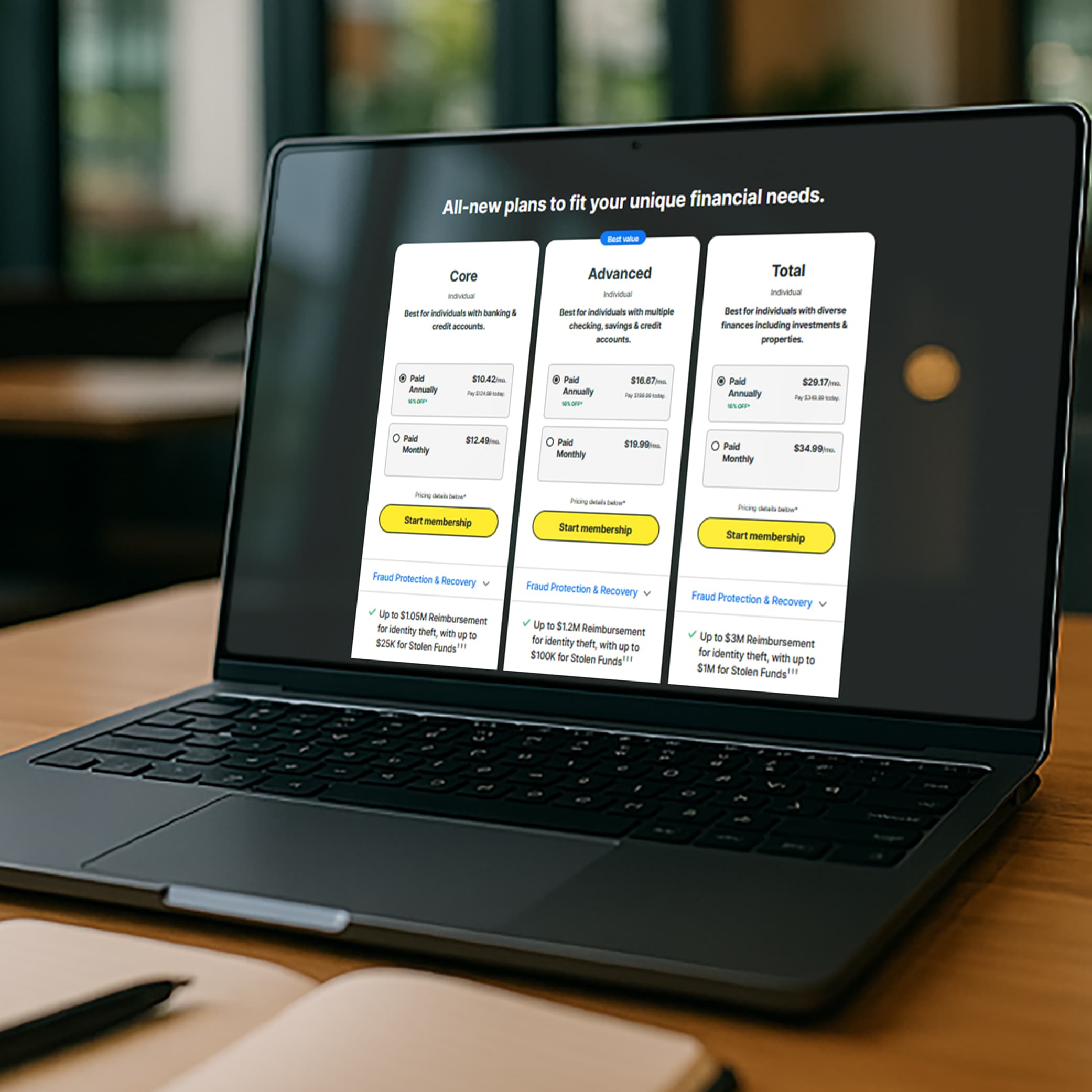

Veterans deserve peace of mind knowing their information and benefits are protected. LifeLock offers tools to safeguard their identities, helping veterans regain control. Our identity protection services provide monitoring, alerts, and recovery support for added assurance.

FAQs about veteran scams

How common are veteran scams?

Veteran scams are sadly common, as scammers exploit veterans’ trust in government entities and benefits programs. Awareness is crucial in preventing these types of fraud.

How can I spot a veteran scam?

Watch out for unusual requests for personal information or payments, especially if someone claims to be from a government agency. Suspicious urgency and unverified contact methods are red flags.

What should I do if I’m contacted by a suspected scammer?

If contacted by someone you suspect is a scammer, hang up or delete the message. Contact the agency they claim to represent using official channels and report the scam to the Federal Trade Commission or your local veterans’ affairs office.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- Protecting veterans from scams: why it matters

- 1. Fake government agency phishing attempts

- 2. Posing as family or friends

- 3. Fake government grants and programs

- 4. Fraudulent job offers or education programs

- 5. Healthcare and insurance fraud

- 6. Charging for free veteran services

- 7. Exploiting veterans’ PACT Act benefits

- 8. Housing and rental scams

- Shield our veterans from identity fraud

- FAQs about veteran scams

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.