Did you know that 1 in 3 consumers have experienced identity theft? While technology continues to evolve, so do the tactics used by cybercriminals to steal sensitive information. April 8, 2025, marks Identity Management Day, a global initiative established in 2021 in partnership with the National Cybersecurity Alliance to raise awareness about safeguarding personal and digital identities.

What is identity theft?

Identity theft occurs when someone unlawfully uses your personal or financial information without consent. This can include accessing Social Security numbers, bank account details, email credentials, or other private information to commit fraud or other crimes. Identity theft is not only a significant invasion of privacy but also a costly and emotionally draining ordeal for victims, often requiring months (or years) of effort to resolve.

For businesses and individuals alike, being proactive in identity management is no longer optional. It’s essential.

The different types of identity theft

Understanding how identity theft occurs can help you recognize vulnerabilities and take preventive measures. Here are some common forms of identity theft to watch out for:

- Financial identity theft: Criminals gain access to your bank accounts, credit cards, or other financial details. They may open new lines of credit, make unauthorized purchases, or even drain your accounts.

- Medical identity theft: Using someone’s identity to access medical services or file claims with insurance providers is an increasing concern. This type of identity theft can lead to inaccurate medical records, denied insurance claims, or surprise medical bills.

- Social Security identity theft: Identity thieves can use a stolen Social Security number to commit tax fraud, open fraudulent accounts, or impersonate you for government benefits.

- Online identity theft: Identity thieves often gain access to email credentials, social media accounts, or cloud storage, compromising sensitive photos, communications, or documents.

How to protect yourself from identity theft

Although identity theft is a growing concern, there are many steps you can take to safeguard your information. Here’s what you need to know to stay protected:

1. Use strong and unique passwords

Avoid using predictable passwords such as “12345” or your pet’s name. Instead, create passwords that include a combination of uppercase and lowercase letters, numbers, and symbols. Use a password manager to keep track of your credentials securely.

2. Monitor your accounts regularly

Review your bank statements, credit card history, and utility bills for any suspicious or unauthorized transactions. Early detection is key to minimizing damage.

3. Enable two-factor authentication (2FA)

Adding a layer of protection to your accounts with 2FA makes it significantly harder for a hacker to gain access. This often involves entering a unique verification code sent to your phone or email.

4. Protect your Social Security number

Never share your Social Security number unless absolutely necessary. Be cautious when providing it over the phone or online, and ensure any requests come from verified sources.

5. Be cautious with public Wi-Fi

Avoid accessing sensitive accounts (like banking or email) on public Wi-Fi networks, which are often unsecured. Use a Virtual Private Network (VPN) to keep your online activity encrypted and safe from prying eyes.

6. Keep software updated

Outdated software is one of the easiest entry points for hackers. Make sure your operating system, apps, and antivirus software are always up to date.

7. Check your credit report

Regularly request free credit reports from agencies like Experian, Equifax, or TransUnion to monitor unusual activity, such as new accounts or credit inquiries you didn’t initiate.

8. Invest in identity theft protection services

Identity theft protection services can monitor your personal information online, alert you to suspicious activity, and assist with recovery if your identity is compromised. Not all identity theft protection services are created equal, and you should look for a solution that provides monitoring, alerts, restoration, and reimbursement.

Why identity theft protection matters

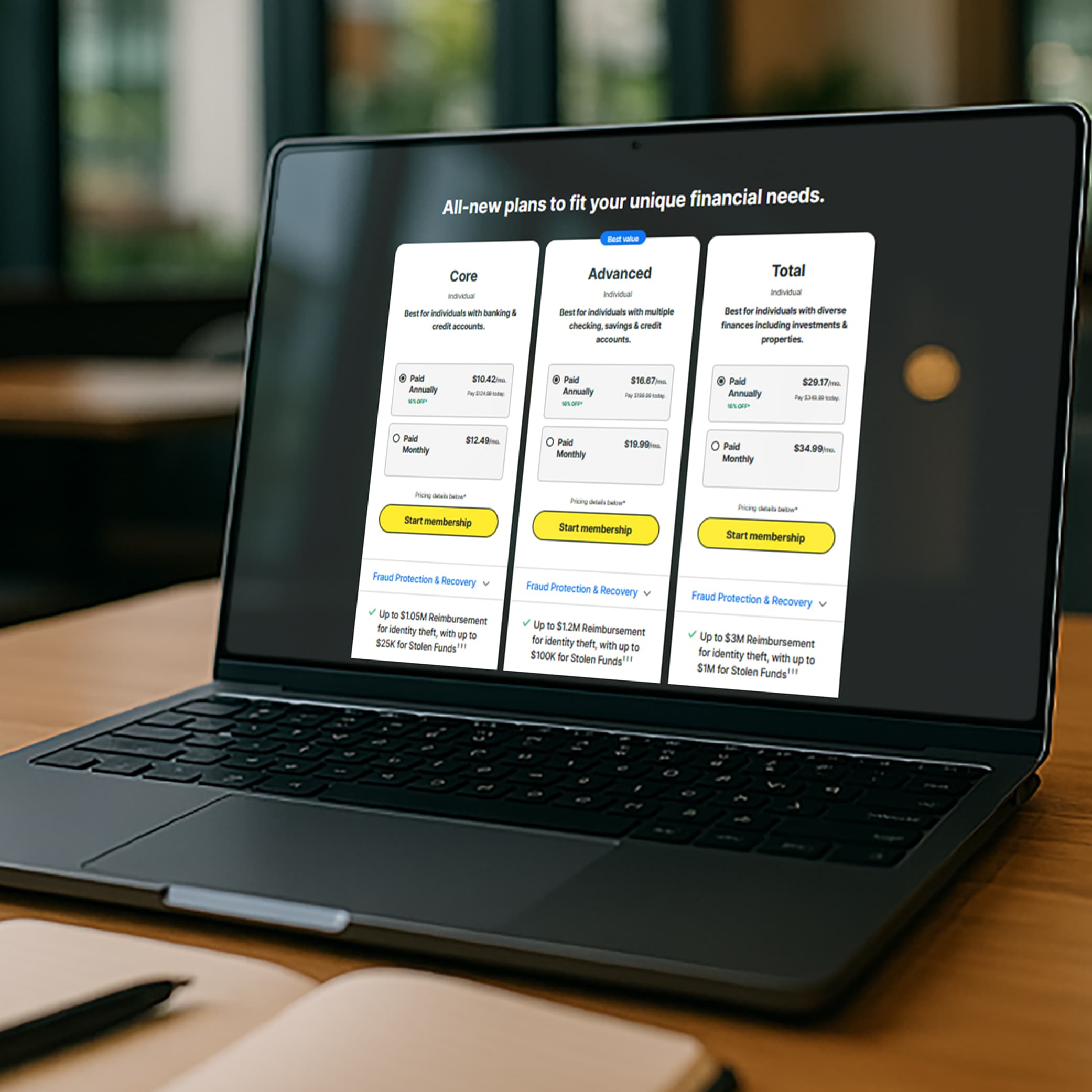

Identity theft is on the rise, but you don’t have to face the risk unprotected. LifeLock provides a comprehensive safety net, offering continuous monitoring and alerts to suspicious activity. If you are a victim of identity theft, LifeLock restores your identity, guaranteed, or your money back. *

LifeLock helps simplify the complex process of identity theft protection, so you can enjoy peace of mind knowing you’re covered. With its user-friendly dashboard and robust protection systems, it’s an excellent way to enhance your security efforts.

Take action to protect your identity

On Identity Management Day 2025, there’s no better time to take control of your personal and digital identity. By understanding different types of identity theft and taking the proper precautions, you can proactively safeguard against risks.

If you’re ready to elevate your security, consider investing in an identity protection service like LifeLock. Don’t wait until it’s too late—take action today.

*Restrictions apply. Automatically renewing subscription required. If you're a victim of identity theft and not satisfied with our resolution, you may receive a refund for the current term of your subscription. See LifeLock.com/Guarantee for complete details.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.