Why checking your child’s credit score matters

Your child’s social security number might be the key to a fraudster’s next payday. Identity theft among minors often goes unnoticed until it’s too late—like when they apply for their first credit card or student loan. By learning how to check your child’s credit score, you can catch red flags early and take action to prevent long-term financial harm.

A child typically shouldn’t have a credit file unless they’ve been added as an authorized user on a credit account or have had their identity misused. That’s why a proactive check is essential.

Steps for checking your child’s credit score

If you're ready to check your child's credit report, follow these steps with the three major credit bureaus: Equifax, Experian, and TransUnion.

Here’s the improved version with proper indentation for lists:

1. Gather Required Documents

a. A copy of your government-issued ID.

b. Your child’s birth certificate and Social Security card.

c. Proof of your relationship to the child, like a utility bill showing shared address.

2. Contact the Credit Bureaus

a. Visit each bureau’s website or call them directly to initiate the request.

b. Submit your request along with all required documentation.

3. What to Expect

a. The bureau will confirm whether a file exists for your child.

b. If a report exists, review it carefully for unauthorized accounts or unusual activity.

c. Learn more about protecting identity theft victims.

Signs it’s time to check your child’s credit report

How can you tell if your child’s identity might be compromised? Here are common warning signs of identity theft:

- Receiving bills or credit offers in their name.

- Being denied government benefits due to "existing accounts" or errors.

- Notices or calls from creditors about debts under their name.

- If you notice any of these red flags, it’s time to take immediate action.

What to do if your child is a victim of identity theft

If you suspect or confirm that your child is the victim of child identity theft, here’s what to do:

- Contact the credit bureaus: Place a fraud alert or request a credit freeze on your child’s report to prevent further misuse.

- File an identity theft report: Submit a report with the Federal Trade Commission (FTC) at IdentityTheft.gov.

- Work with creditors: If fraudulent accounts exist, contact the lenders to dispute charges and close unauthorized accounts.

Taking these steps can help recover your child’s credit and prevent further fraud.

Shield your child’s credit from fraud

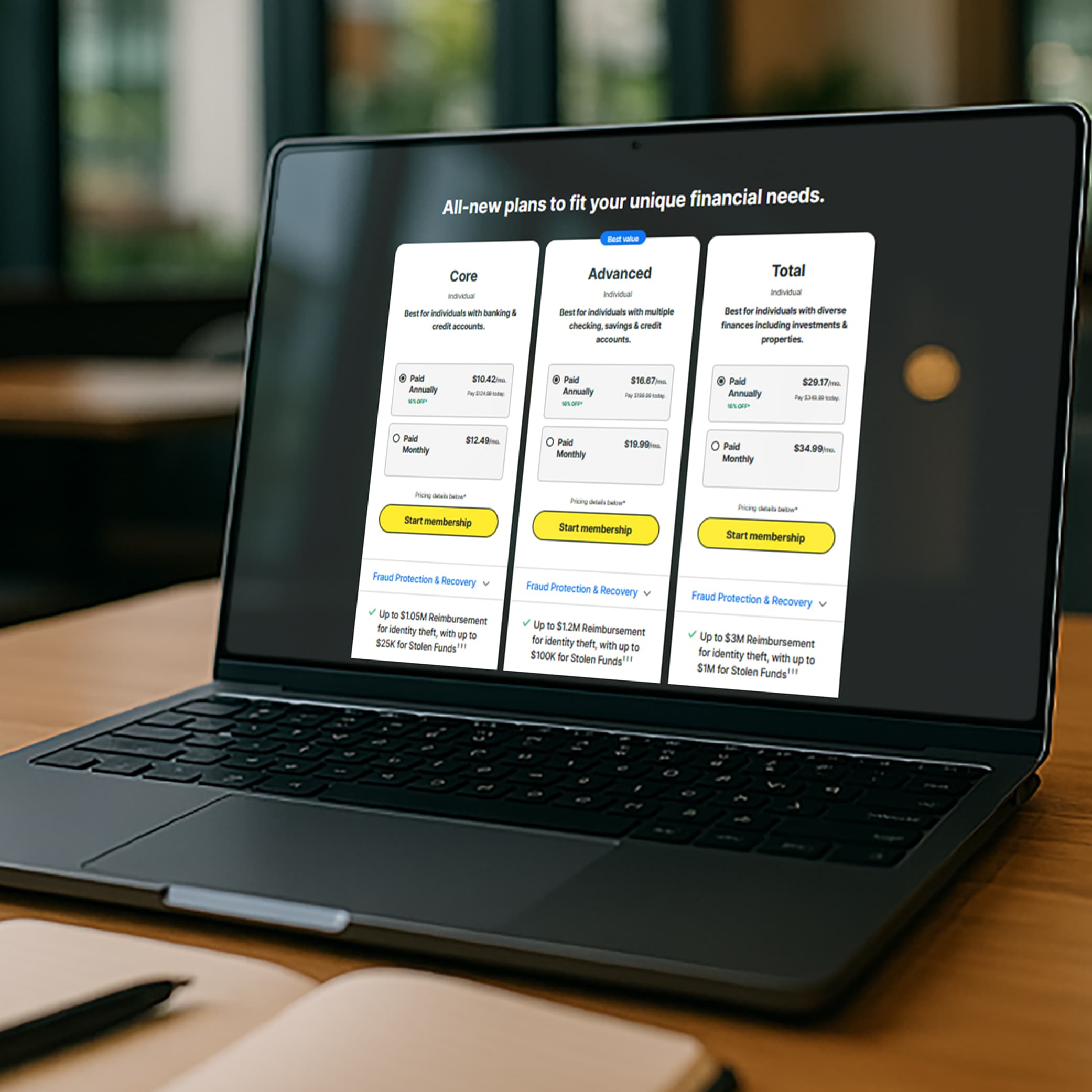

Securing your child’s credit is a two-step process: staying vigilant and utilizing services designed to protect personal information. LifeLock’s advanced monitoring tools can help safeguard your family’s identity before fraud occurs.

FAQs about checking your child’s credit score

Can I check my child’s credit score for free?

Yes! Contact the credit bureaus directly to request a free credit report if you suspect identity theft. There are no fees for inquiries related to fraud.

At what age can a child have a credit score?

A child typically doesn’t have a credit score unless they’ve been added to a credit account, or their identity has been stolen.

How can I protect my child's credit?

Monitor their credit activity regularly, avoid sharing their Social Security number unnecessarily, and consider professional identity protection services like LifeLock.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.