LifeLock identity theft protection Ultimate Plus

Sign up safely and securely in a few easy steps.

Select plan and billing.

Select a plan and a billing option and go to our secure checkout.

Log in.

Create an account or log in to keep your information secure.

Add family.

Enroll the whole family, including children, in our hassle-free checkout. This option is available on individual plans.

Set up payment.

Use your preferred payment method. We accept major credit cards and other popular methods.

Activate monitoring.

Activate your plan’s monitoring and alerts by entering your Social Security number and date of birth.

Trusted by millions of customers

Trusted by millions of customers

Frequently asked questions

Frequently asked questions

LifeLock Ultimate Plus is the most comprehensive identity theft protection plan offered by LifeLock. It includes:

Identity & Social Security Number Alerts – Notifies you if your personal information is misused.

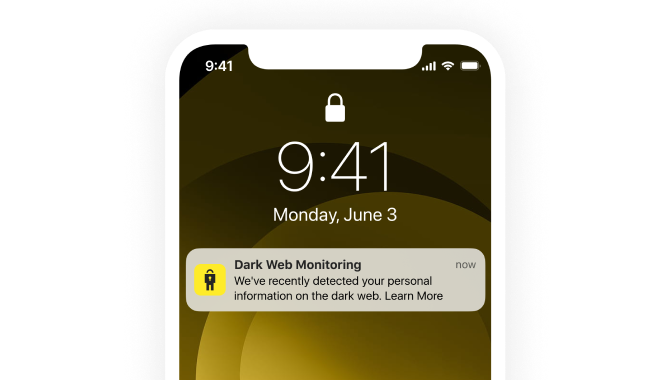

Dark Web Monitoring – Scans hidden marketplaces for your stolen data.

Bank & Credit Card Activity Alerts – Get notified of suspicious transactions.

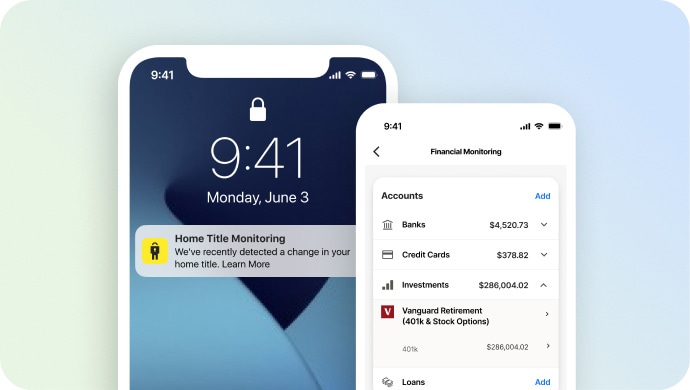

Home Title Monitoring – Helps protect against fraudulent home title transfers.

401(k) & Investment Account Alerts – Monitors unauthorized activity in your retirement and investment accounts.

Social Media Monitoring – Alerts you to privacy risks on social platforms.

$1 million Stolen Funds Reimbursement – Covers financial loss due to identity theft.

$1 million Coverage for Lawyers and Experts – Helps cover legal fees if fraud occurs.

LifeLock Ultimate Plus includes all features of LifeLock Advantage, plus:

Higher Stolen Funds Reimbursement – Up to $1 million (vs. $100,000 in Advantage).

401(k) & Investment Account Alerts – Helps protect retirement savings.

Home Title Monitoring – Detects fraudulent title transfers.

Social Media Monitoring – Alerts you to privacy risks and impersonation attempts.

Three-Bureau Credit Monitoring – Monitors all three major credit bureaus.

LifeLock Ultimate Plus provides advanced financial and home title monitoring to help detect unauthorized activity before it leads to identity fraud. Key protections include:

401(k) & Investment Account Alerts – Monitors for unusual activity in your retirement and brokerage accounts, helping to safeguard your long-term savings.

Bank & Credit Card Activity Alerts – Notifies you of suspicious cash withdrawals, balance transfers, or large purchases on your financial accounts.

Home Title Monitoring – Alerts you if someone fraudulently transfers or modifies your home’s title or deed, helping to prevent home title theft.

If suspicious activity is detected, you’ll receive real-time alerts via text, email, or mobile app, allowing you to take quick action. Plus, if fraud occurs, a U.S.-Based Personal Restoration Specialist will help you recover your assets and secure your identity.

LifeLock Ultimate Plus provides real-time alerts across multiple channels to notify you of potential identity threats. In addition to the alerts included in LifeLock Advantage, Ultimate Plus offers:

Three-bureau credit monitoring alerts – Notifies you of changes across all major credit bureaus.

401(k) & Investment Account Alerts – Warns you of suspicious activity in retirement and brokerage accounts.

Home Title Monitoring Alerts – Alerts you if there are unauthorized changes to your property records.

Bank & Credit Card Activity Alerts – Helps detect unusual withdrawals, balance transfers, or large purchases.

You’ll receive alerts via text, email, phone, or mobile app, allowing you to respond quickly to potential fraud.

No, LifeLock Ultimate Plus focuses on identity theft protection and does not include Norton antivirus or VPN services. However, Norton offers all-in-one plans that combine LifeLock protection with Norton security features.

Not sure which product is right for you?

Take quiz

Finding your match...

10 cents

If your information is exposed or stolen in a data breach, it can end up on the dark web where it can be sold for as little as 10 cents.

100M+

LifeLock monitors hundreds of millions of data points a second.

Million Dollar Protection™ Package†††

- $25,000 in Personal Expense Reimbursement

- $1 million for Lawyers & Experts

- $25,000 in Stolen Funds Reimbursement

Million Dollar Protection™ Package†††

- $100,000 in Personal Expense Reimbursement per adult

- $1 million for Lawyers & Experts per adult

- $100,000 in Stolen Funds Reimbursement per adult

Million Dollar Protection™ Package†††

- $1 million in Personal Expense Reimbursement per adult ($25,000 per child)

- $1 million for Lawyers & Experts for each family member

- $1 million in Stolen Funds Reimbursement per adult ($25,000 per child)

Million Dollar Protection™ Package†††

- $25,000 in Personal Expense Reimbursement

- $1 million for Lawyers & Experts

- $25,000 in Stolen Funds Reimbursement

Million Dollar Protection™ Package†††

- $100,000 in Personal Expense Reimbursement per adult

- $1 million for Lawyers & Experts per adult

- $100,000 in Stolen Funds Reimbursement per adult

Million Dollar Protection™ Package†††

- $1 million in Personal Expense Reimbursement per adult ($25,000 per child)

- $1 million for Lawyers & Experts for each family member

- $1 million in Stolen Funds Reimbursement per adult ($25,000 per child)

Million Dollar Protection™ Package†††

- $25,000 in Personal Expense Reimbursement

- $1 million for Lawyers & Experts

- $25,000 in Stolen Funds Reimbursement

Million Dollar Protection™ Package†††

- $100,000 in Personal Expense Reimbursement per adult

- $1 million for Lawyers & Experts per adult

- $100,000 in Stolen Funds Reimbursement per adult

Million Dollar Protection™ Package†††

- $1 million in Personal Expense Reimbursement per adult ($25,000 per child)

- $1 million for Lawyers & Experts for each family member

- $1 million in Stolen Funds Reimbursement per adult ($25,000 per child)

401(k) & Investment Alerts†

Social Media Monitoring

Bank & Credit Card Activity Alerts†

Credit Scores & Credit Reports

Buy Now Pay Later Alerts

Recurring and Unusual Charge Alerts

Credit Monitoring Coverage3

Dark Web Monitoring

Stolen Funds Reimbursement†††

Lawyers & Experts†††

- Price valid for introductory term, after that your price will renew at the standard price.

- Your subscription begins immediately after payment automatically renews unless canceled. Prices subject to change and may be charged up to 35 days before current term ends. Cancel here or contact Member Services.

††† Up to $1 million for coverage for lawyers and experts included on all plans. Reimbursement and Expense Compensation varies according to plan, up to $1 million each for LifeLock Ultimate Plus.

Insurance benefits are issued by third parties.

See GenDigital.com/legal for policy info.

† LifeLock does not monitor all transactions at all businesses.

3 Credit features require successful setup, identity verification, and sufficient credit history by the appropriate credit bureau. Credit monitoring features may take several days to activate after enrollment.

Why do we ask?

Identifying your concerns gives us the ability to recommend the right plan for your needs.

Why do we ask?

Knowing this number helps us recommend coverage that fits your needs.

Why do we ask?

Providing your email address makes you eligible for notifications of potential identity threats.

You may also like:

You may also like:

No one can prevent all cybercrime or prevent all identity theft.

- Price valid for introductory term. After that, your price will renew at the standard price.

- Your subscription begins immediately after your transaction is complete. A payment method is required at sign-up for trials, and you will be charged at the end of your trial, unless canceled first.

Prices are subject to change and may be charged up to 35 days prior to renewal. Cancel here or contact Member Services. - Restrictions apply. Automatically renewing subscription required. If you're a victim of identity theft and not satisfied with our resolution, you may receive a refund for the current term of your subscription. See LifeLock.com/guarantee for complete details.

1 Credit features require successful setup, identity verification, and sufficient credit history by the appropriate credit bureau. Credit monitoring features may take several days to activate after enrollment.

2 Identity Lock cannot prevent all account takeovers, unauthorized account openings, or credit file inquiries. Deactivates if you downgrade or cancel your subscription.

††† Up to $1 million for coverage for Lawyers and Experts included on all plans. Reimbursement and expense compensation varies according to plan—up to $1 million each for LifeLock Ultimate Plus. Insurance benefits are issued by third parties. See us.norton.com/legal for policy info.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.

-and-prevention-tips-thumb.jpg)

TrustScore {trustScore} | {trustReviews} reviews

Award Winner

Award Winner