LifeLock Ultimate Plus is the most comprehensive identity theft protection plan offered by LifeLock. It includes:

Identity & Social Security Number Alerts – Notifies you if your personal information is misused.

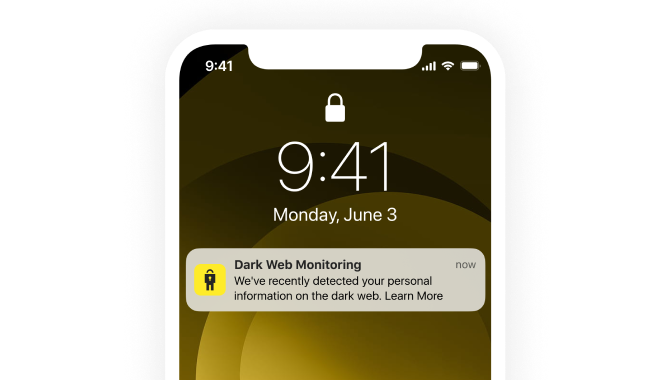

Dark Web Monitoring – Scans hidden marketplaces for your stolen data.

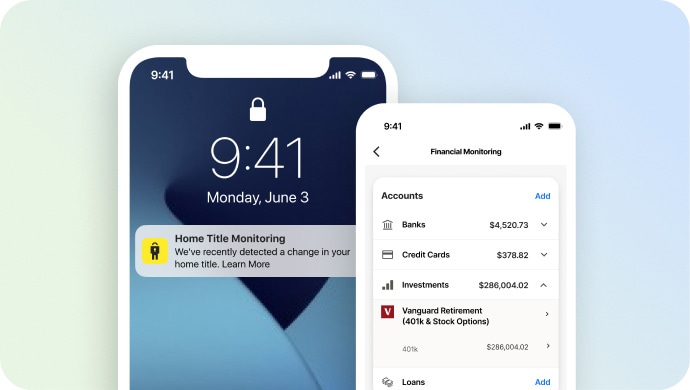

Bank & Credit Card Activity Alerts – Get notified of suspicious transactions.

Home Title Monitoring – Helps protect against fraudulent home title transfers.

401(k) & Investment Account Alerts – Monitors unauthorized activity in your retirement and investment accounts.

Social Media Monitoring – Alerts you to privacy risks on social platforms.

$1 million Stolen Funds Reimbursement – Covers financial loss due to identity theft.

$1 million Coverage for Lawyers and Experts – Helps cover legal fees if fraud occurs.

-and-prevention-tips-thumb.jpg)

TrustScore {trustScore} | {trustReviews} reviews

Award Winner

Award Winner