What is spousal identity theft?

Spousal identity theft occurs when a spouse uses your personal information—such as your Social Security number, credit card, or bank account details—without your consent to open new lines of credit, rack up debt, or commit fraud. Imagine finding out your spouse has opened several credit cards in your name, maxed them out, and left you to deal with the damage. Unfortunately, this scenario isn’t as rare as it should be.

Many victims of spousal identity theft face a unique dilemma: while they want to stop the fraud, they may hesitate to take legal action against someone they love. This reluctance can make it harder to recover from the financial and emotional turmoil.

What to do if your spouse stole your identity

If you suspect or know that your spouse has stolen your identity, it’s important to act quickly to protect your financial well-being. The good news is that there are concrete steps you can take to regain control:

1. Freeze your credit: Contact the major credit bureaus (Equifax, Experian, and TransUnion) and request a credit freeze. This prevents anyone from opening new lines of credit in your name without your authorization.

2. Set up fraud alerts: Place a fraud alert on your credit report. This alerts creditors that they should take extra steps to verify your identity before approving new credit.

3. Report fraud to the FTC: File an identity theft report with the Federal Trade Commission (FTC). The FTC will guide you through creating a recovery plan, which is an essential step in documenting the fraud.

4. Review your credit report: Go through your credit reports carefully to spot any unauthorized accounts or activity. You’re entitled to a free report from each credit bureau once a year at AnnualCreditReport.com.

5. File a police report: While it may be difficult to report a loved one, filing a police report creates an official record of the crime, which you may need when working with creditors or legal representatives.

6. Get legal counsel: Seek advice from a lawyer who specializes in financial or family law. They can help you understand your legal options, whether you choose to pursue charges or seek other forms of resolution.

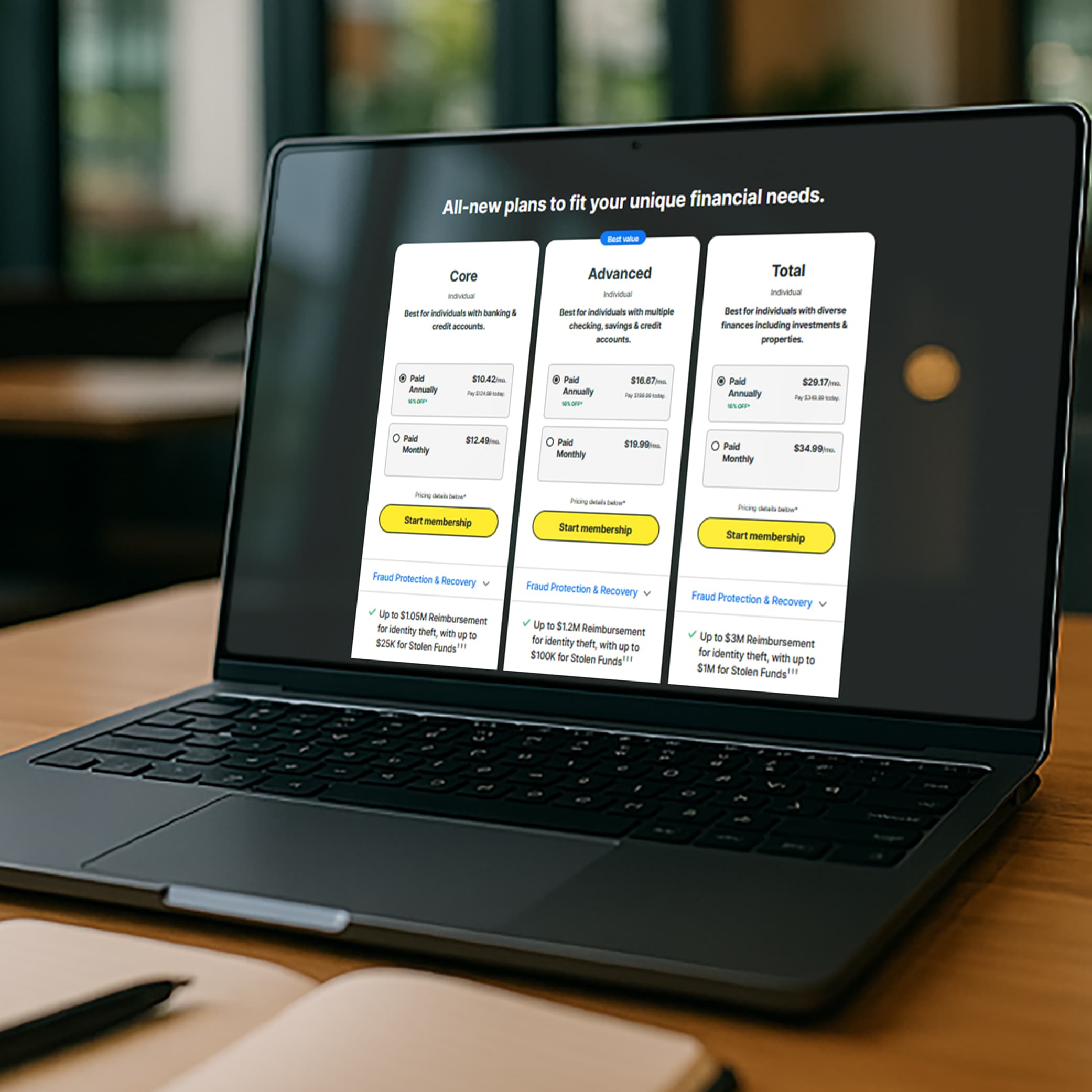

7. Use identity theft protection services: Consider signing up for an identity theft protection service like LifeLock. These services monitor your information, alert you to suspicious activity, and assist with recovery if fraud occurs.

Signs your spouse stole your identity

Spousal identity theft can be hard to detect, especially if you share financial accounts. However, certain red flags can signal something’s wrong:

- Unexplained account activity: You notice charges or withdrawals from your account that you didn’t authorize.

- New lines of credit: Unexpected credit card or loan accounts appear on your credit report.

- Debt collector calls: You start receiving calls from debt collectors about accounts you didn’t open.

- Changes in account information: Your bank or credit card account details are updated without your knowledge.

- Unfamiliar deliveries in your name: Packages or bills for purchases you didn’t make start showing up at your doorstep.

- Declined credit applications: You’re denied credit because of debts you weren’t aware of, or your credit score suddenly drops.

How to protect yourself from spousal identity theft

While you can’t always prevent someone close to you from betraying your trust, there are steps you can take to minimize your risk of spousal identity theft:

- Monitor your financial accounts: Regularly review your bank and credit card statements for unauthorized activity.

- Keep an eye on your credit: Check your credit reports frequently and look for unfamiliar accounts or changes.

- Create account alerts: Set up alerts for your financial accounts to be notified of large transactions or changes in personal details.

- Maintain financial independence: Keep separate bank accounts and credit cards, even if you share some joint accounts.

- Limit sharing of personal information: Be cautious about sharing sensitive details, even with a spouse. Ensure that your personal documents are securely stored.

- Invest in identity theft protection: A trusted identity theft protection service can offer an extra layer of defense by helping you monitor your information.

Reclaiming your financial security

Discovering spousal identity theft can feel overwhelming, but with the right steps, you can start to rebuild your financial stability and regain your peace of mind. If you’re ready to take control, consider investing in an identity theft protection service like LifeLock. With advanced monitoring and restoration support, LifeLock can help ensure that your future is safer and more secure.

FAQs About Spousal Identity Theft

Is spousal identity theft a crime?

Yes, spousal identity theft is illegal, even though it involves a close personal relationship. Victims have the right to report the crime and seek restitution.

What is the punishment for spousal identity theft?

Penalties vary by jurisdiction, but spousal identity theft can result in fines, restitution, and even imprisonment, depending on the severity of the fraud.

Can my spouse use my credit card without my permission?

No, using your credit card without your permission is considered fraud, even if you’re married.

What happens if my spouse steals my identity?

If your spouse steals your identity, you may face financial loss, damaged credit, and emotional distress. Taking swift action to report the fraud and protect your accounts is essential.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.